William_Potter

Creator’s notice: This text was launched to CEF/ETF Revenue Laboratory members on February nineteenth.

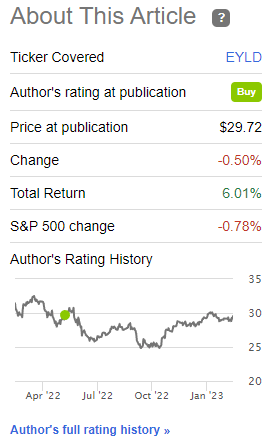

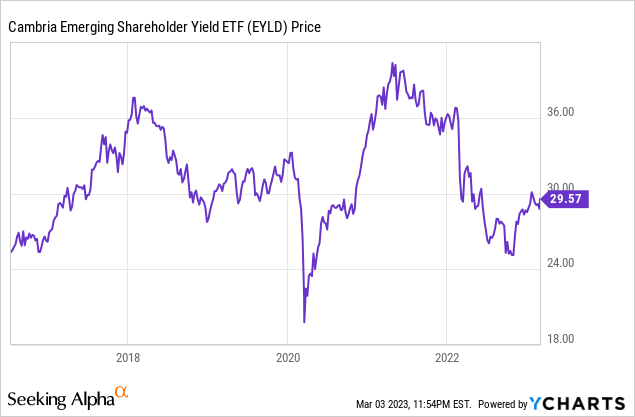

I final lined the Cambria Rising Shareholder Yield ETF (BATS:EYLD), which invests in rising market equities with robust shareholder yields, in mid-2022. In that article, I argued that EYLD’s robust dividend yield and low cost made the fund a purchase. The fund has outperformed since, in-line with expectations.

EYLD Earlier Article

Since my earlier article, EYLD’s earnings and efficiency track-record have each elevated, whereas its valuation has considerably decreased. Fund fundamentals stay roughly the identical, however barely stronger.

EYLD’s robust 6.8% dividend yield, low cost valuation, and improved fundamentals, make the fund a purchase.

EYLD – Fast Overview and Funding Thesis

A fast overview of the fund earlier than a extra in-depth take a look at the way it has carried out these previous few months, and at its improved fundamentals.

EYLD is an rising market fairness ETF. It’s actively-managed, however follows a well-defined funding course of, so capabilities as extra of a distinct segment, focused index fund in apply.

In easy phrases, EYDL invests in rising market equities with robust shareholder yields. Shares should meet liquidity, valuation, and high quality standards. Costly shares are excluded from the index, as are closely indebted ones. It’s an equal-weighted index, with 100 holdings.

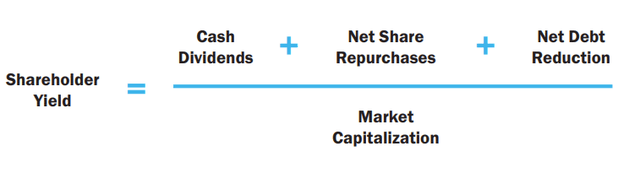

Shareholder yield is outlined as follows.

EYLD

EYLD’s precise, in-depth funding methodology is as follows.

EYLD

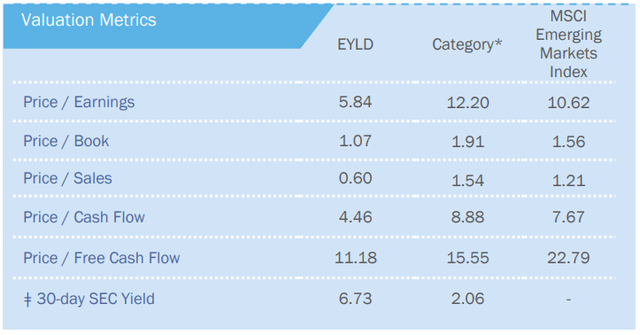

EYLD doesn’t appear to estimate or report a median shareholder yield for its portfolio, an necessary oversight for my part. The fund does report a number of valuation and cash-flow metrics, and does extraordinarily nicely on this regard. Fairly assured that the fund’s shareholder yield is kind of robust too.

EYLD

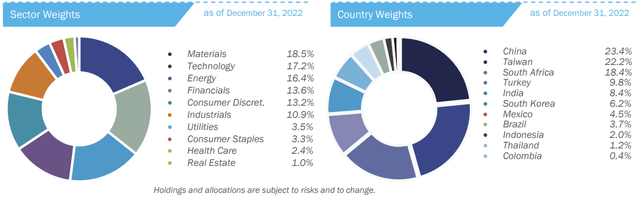

EYLD is kind of diversified inside its market area of interest, with investments in round a dozen international locations and 100 equities, and with publicity to most related business segments. As EYLD targets a small, area of interest market phase, it stays a dangerous funding, diversification however. Small place sizes are supreme, for my part at the very least.

EYLD

EYLD’s funding thesis is kind of easy. The fund presents buyers a robust 6.8% dividend yield and an inexpensive valuation, so earnings, capital good points, and complete returns are, probably, all fairly robust. Specializing in firms with robust shareholder yields helps too, as these firms are returning lots of money to buyers, which underpins returns and reduces danger (not rather a lot can go flawed with receiving a dividend or paying again debt).

EYLD’s fundamentals have at all times been roughly the identical, because the fund’s funding technique all however ensures robust yields and low cost valuations. Nonetheless, these do differ, and have improved as of late. Let’s take a look.

EYLD – Improved Fundamentals

Cheaper Valuations

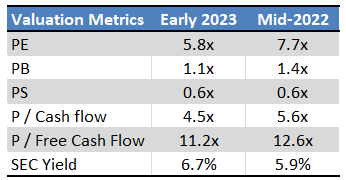

EYLD usually trades with a low worth and valuation, however the actual figures do differ, and generally for the higher. The fund’s valuation has decreased these previous few months, throughout most related metrics.

EYLD – Chart by Creator

EYLD’s cheaper valuation advantages buyers in two key methods.

First, cheaper valuations means potential capital good points are stronger, a big profit for shareholders.

On a extra unfavorable notice, good points are considerably contingent on valuations normalizing, which isn’t assured, and which has largely not occurred up to now. EYLD’s share worth is up from its mid-2022 lows, however the fund has nonetheless not totally recovered from the pandemic.

On a extra optimistic notice, specializing in firms with robust shareholder yields helps issues. Dividends, share buybacks, and debt discount all profit buyers even when valuations stay low cost, and the fund’s underlying holdings have interaction fairly strongly in these actions / initiatives.

Second, valuations rising cheaper implies robust development within the fund’s underlying holdings, at the very least assuming low portfolio turnover. Though I used to be unable to search out exact turnover figures, fund holdings haven’t considerably modified these previous few months, so robust underlying holding development appears possible.

EYLD’s improved valuation advantages the fund and its buyers, and makes the fund a stronger funding alternative now than up to now.

Stronger Revenue, However Unstable

EYLD’s underlying holdings generated 5.9% in earnings per yr in mid-2022, as per the fund’s SEC yield. Revenue has elevated to six.8% as of December 2022, a double-digit enhance. EYLD presently sports activities a TTM dividend yield of 6.8%, not too dissimilar from its SEC yield. It’s unclear to me how a lot of mentioned enhance was on account of dividend development within the fund’s underlying holdings, and the way a lot of it was on account of a (attainable) decline within the fund’s share worth, on account of peculiarities in how SEC yields are calculated.

In any case, EYLD’s increased earnings is a crucial profit for the fund and its shareholders. Revenue advantages buyers instantly: increased earnings means extra dividends to spend or re-invest.

Revenue additionally advantages buyers not directly, insofar because it makes complete returns much less depending on market whims or investor sentiment. CAPEX or buybacks ought to result in capital good points, however markets will not be completely rational, and there’s no assure that this would be the case. Traders obtain dividends no matter what the market thinks or does, and will help underpin returns throughout bear markets and different hostile market situations.

The excellence above issues, each in idea and apply. EYLD has seen no capital good points these previous few months, at the same time as its earnings enhance and its valuation plummets. EYLD’s buyers have acquired their dividends, and these led to outperformance at the same time as share costs stay low, and capital good points non-existent.

EYLD’s share worth might stay flat shifting ahead, no ensures there, however the dividends enhance returns regardless.

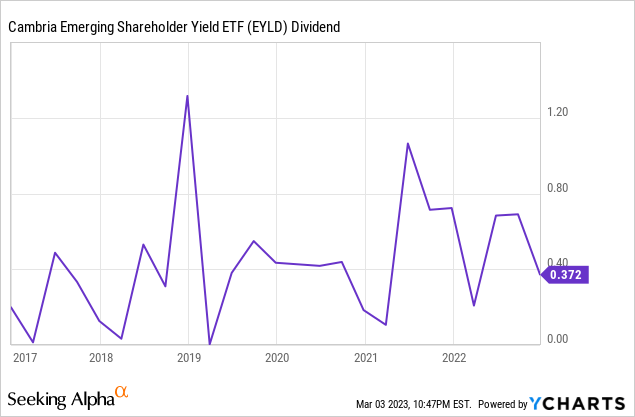

On a extra unfavorable notice, rising market equities generally have irregular dividend cost schedules, which leads to risky dividend funds for EYLD.

Unstable dividends are one thing of a unfavorable, particularly for retirees who would possibly rely on dividends for his or her bills and retirement.

Dividend volatility additionally makes it troublesome to research and forecast the fund’s anticipated dividends. For instance, the fund paid an uncharacteristically excessive dividend in 3Q2021. Mentioned dividend boosted the fund’s yield to 9.3% in mid-2021. Mentioned yield was technically correct, however a lot increased than the precise earnings generated by the fund, 5.9% as per its SEC yield. Mentioned yield was additionally not significantly indicative of the dividends buyers ought to have anticipated, with the fund yielding 6.8% proper now. As an apart, I ought to have seen these points in my final article, however I didn’t. The yield was correct, and it appeared nice to me, however the volatility was readily obvious regardless.

Though EYLD’s decrease TTM dividend yield may very well be construed as a unfavorable, because the discount was nearly fully on account of dividend volatility, I do not actually see it that method. EYLD is producing extra in earnings now than earlier than, so fundamentals have improved, even when the figures do not essentially replicate that. EYLD’s dividends are decrease than I believed, however that isn’t a unfavorable per se. The volatility itself stays a unfavorable, and does complicate issues for buyers.

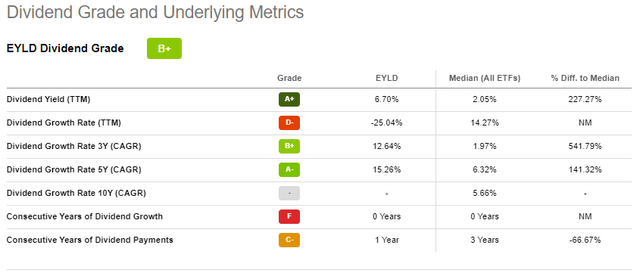

On a extra optimistic notice, EYLD’s dividends have seen very wholesome, double-digit development since inception. Dividend volatility does imply these figures are, nicely, risky, so take them with a grain of salt.

EYLD

EYLD’s robust 6.8% dividend yield and rising earnings are necessary advantages for the fund and its shareholders.

Stronger Efficiency

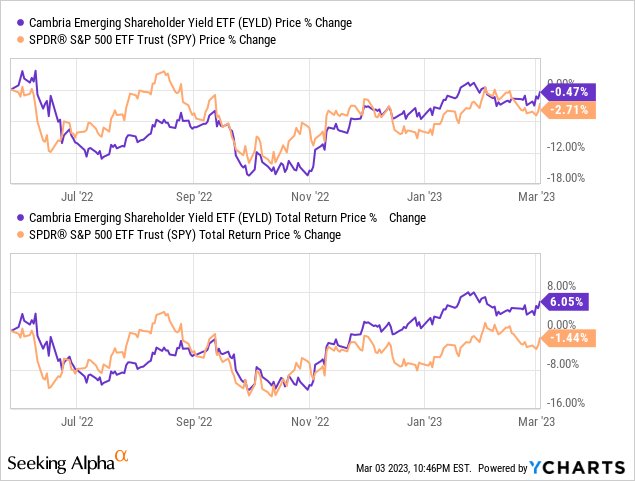

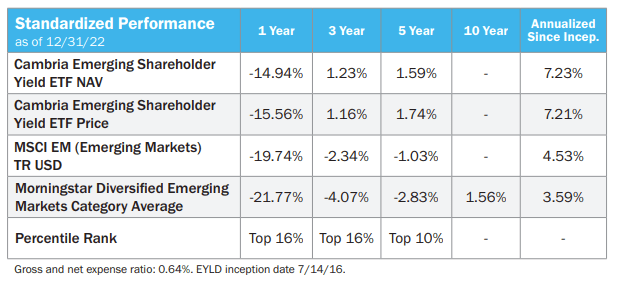

EYLD’s efficiency track-record is fairly good, with the fund outperforming relative to its index since inception, and for all related time durations.

EYLD

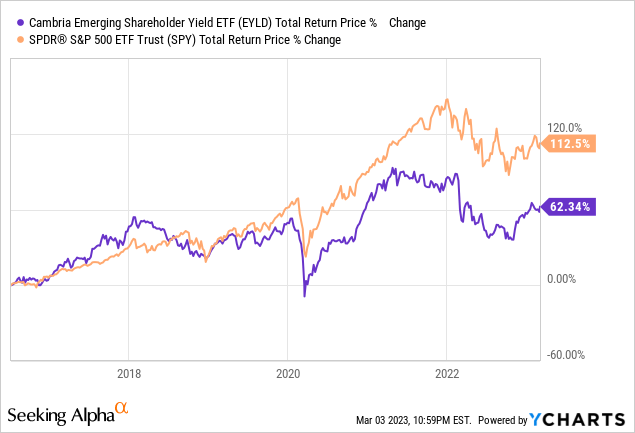

On a extra unfavorable notice, EYLD has considerably underperformed relative to the S&P 500 since inception. Underperformance was fully on account of subpar rising market fairness efficiency.

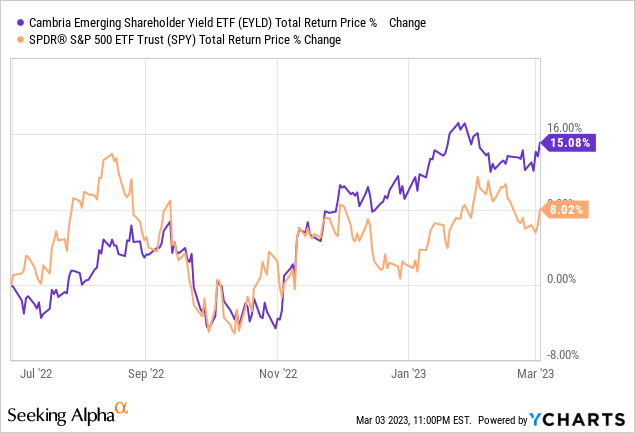

On a extra optimistic notice, EYLD’s has improved as of late, with the fund outperforming relative to the S&P 500 since round mid-2022. Efficiency may be very risky, considerably inconsistent, however the outperformance is certainly there. Outperformance was on account of stronger rising market fairness efficiency, and EYLD’s increased yield.

EYLD’s improved efficiency track-record was a direct profit for buyers up to now and is (partial) proof of the fund’s robust fundamentals and funding thesis. EYLD appeared like a robust funding in mid-2022, and the fund has outperformed since. EYLD seems to be like a robust funding alternative right this moment, and will outperform shifting ahead too. Though that is technically at all times the case, having proof is necessary, and might enhance an investor’s confidence, together with my very own.

Conclusion

EYLD’s robust 6.8% dividend yield, low cost valuation, and improved fundamentals, make the fund a purchase.