Liudmila Chernetska/iStock by way of Getty Pictures

Encore WIRE

Encore is a well-run wire and cable producer that lands within the prime 1% of firms ranked on top quality momentum and worth, the 2 metrics I (HIT Capital) use to discover cheap and rising firms. Encore initially popped up as an funding candidate 1.5 years in the past as a result of extra earnings in 2021 and constant inventory worth enhance.

That is my analysis abstract meant to reply the query if Encore remains to be a prime 20 inventory I wish to maintain out of our preliminary subset of 43,000.

Encore’s Historical past

I begin this analysis abstract off with Encore’s historical past as I consider it results in the aggressive benefit I point out afterward within the report and gives readability into their tradition and management.

Encore Wire was based by Vincent Rego and Donald Spurgin after they purchased a cell dwelling park in 1989. Their second vital milestone was hiring their now current day CEO, Daniel Jones. The three of them have since turned the rundown cell dwelling park right into a one campus 450 acre, 3 million sq. foot wire and cable producing juggernaut.

In 1990 they began producing residential (nonmetallic sheathed cable and underground feeder cable) wire. In 1992 they expanded into business THHN (thermoplastic excessive heat-resistant nylon) wire and in 1998 they constructed a copper rod mill and started to recycle copper scrap. One yr later they added a plastic mill and in 2001 they added circuit wire. In 2006 they added armored cable, 2008 industrial cable, and in 2012 aluminum constructing wire. Their whole historical past of progress was natural, they actually constructed Encore from the bottom up.

Administration

Daniel L Jones formally grew to become CEO in 2006 however carried out the duties beginning in 2005. Daniel started his profession because the director of gross sales with Encore as one in all their first hires in 1989. Much like Encore’s natural progress Daniel got here up by the ranks. Daniel stands out as somebody who stays inside his realm of confidence (wire centric), rewards shareholders effectively (buybacks), works to align pursuits (workforce incentive plans), and leads a wholesome and protected tradition.

Encore’s Rising

Market Progress

In response to Zion Market Analysis and Verified Market Analysis, world copper wire demand is predicted to develop at a 3.38% – 5.77% CAGR by 2028. For a complete copper wire endpoint, wire consumed 11% of complete copper produced (mine & recycle) within the USA (2.51Mt) in 2018. I consider the rise in wire demand and the general electrify all the pieces motion was the underlying driver behind Encore’s 2021/22 earnings enhance.

Demand and Margin Progress

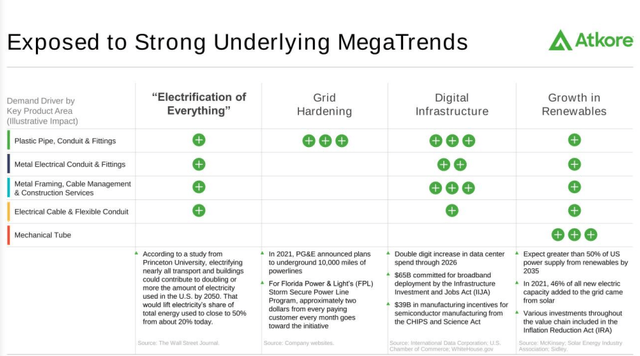

Encore grew their wire gross sales (by lbs) over the previous 2 years. In 2021 they grew 10.8% and in 2022 they grew 7.9%. Prysmian Group (OTCPK:PRYMF), one in all Encore’s rivals was additionally up 10.8% in 2021. This demand drove worth will increase and Encore’s margins expanded from 5.9% in 2019 to twenty.9% in 2021 and as much as 23.8% in 2022. Atkore (ATKR), one in all Encore’s different rivals discovered it vital sufficient to place in of their traders supplies and referred to as it “Electrification of The whole lot” demand.

Atkore

Competitor Evaluation

To be able to perceive if Encore may proceed on with increased margins it was vital to determine if that they had a aggressive benefit or if wire was a commodity. Encore constantly promotes that they’ve benefits over their friends in customer support, value, and product innovation.

Innovation

When Encore mentions innovation, the examples they provide are coloured wire and packaging (Reel Payoff, Reel Deal, Cyclone Barrel Packs, and Pull Professional). After I checked this towards their competitors I discovered everybody to have coloured wire and a number of other had related packaging merchandise.

Competitors

Ticker

Coloured Wire

Revolutionary Reel

Encore Wire

(WIRE)

Sure

Sure

(Basic Cable Company) Prysmian

(OTCPK:PRYMF)

Sure

No

Atkore

(ATKR)

Sure

Sure

Alan Wire Firm

Non-public

Sure

?

Sumitomo Electrical Industries Ltd.

(OTCPK:SMTOY)

Sure

?

Belden Inc.

(BDC)

Sure

?

Southwire

Non-public

Sure

Sure

Republic Wire

Non-public

Sure

No

Click on to enlarge

Buyer Service

From what I gathered from Encore’s publications is that customer support actually means order fill price. Encore particularly mentions having a 100% fill price inside 48 hours of their March 2022 traders presentation however they don’t usually share this metric aside from it being “excessive”. Encore’s primary clients are wholesalers and my present perception is that “customer support” is just not a aggressive benefit in itself however their skill to have wire obtainable at a aggressive value is.

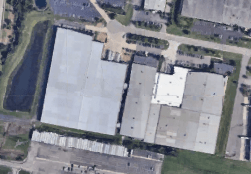

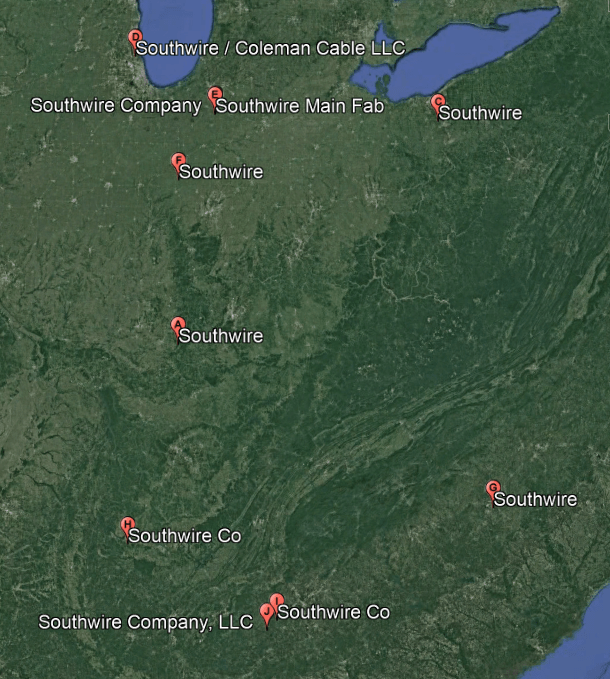

Low Value Producer

Encore has grown organically since 1989 and has expanded their campus to incorporate the entire capabilities I discussed above (Historical past). After reviewing their closest rivals I consider Encore does have a price benefit by their vertical integration setup. I can’t confirm this benefit by their funds attributable to their major rivals (Republic, Southwire, Alan) being personal however I can confirm if the others have one campus and the services to be as vertically built-in as Encore. What I discovered is that their rivals both didn’t have the identical capabilities attributable to (mills, recycle heart, and so on.) or if it was potential that they did have the capabilities they weren’t situated on the identical campus. The satellite tv for pc snapshots beneath are probably the most compelling piece of the information I used to make this conclusion. You’ll be able to see that Republic Wire and Alan Wire do not need the bodily dimension to function a copper mill, plastic mill, copper recycling, service, distribution heart and circuit wire, aluminum wire, industrial wire, armored wire and cable strains. In addition they do not need rail strains coming into and out of their services. Southwire, their different competitor, has grown through the years by acquisition and is unfold out all throughout North America.

Alan Wire

Google Earth

Republic Wire

Google Earth

Southwire

Google Earth

Encore

Google Earth

Benefits

Encore’s vertical integration and rail entry offers them an anticipated manufacturing value and suppleness benefit over their friends.

Dangers

Encore’s sole deal with cable and wire could give them a bonus at being a low value producer and positions themselves advantageously towards their sole wire rivals however it may be an obstacle as nicely. When there’s loads of wire to go round a wholesaler could select to make use of one provider that may provide extra than simply wire and cable. For instance, their competitor Atkore can provide wire, conduit, fittings, cable administration methods, and conduit. I tried to see if this performed out within the financials but it surely was foggy at greatest. For instance Atkore and Encore had related working margins in 2022 however to essentially lean on this pricing energy drawback I might have to do extra analysis.

Competitors

Ticker

Working Margin

Encore Wire

WIRE

30.32%

(Basic Cable Company) Prysmian

PRY

5.16%

Atkore Worldwide Group

ATKR

30.77%

Alan Wire Firm

Non-public

?

Southwire

Non-public

?

Republic Wire

Non-public

?

Click on to enlarge

One Location

Whereas there are a number of benefits of being on one campus there are additionally disadvantages. If there was a twister, earthquake or native political shift Encore may really feel it totally.

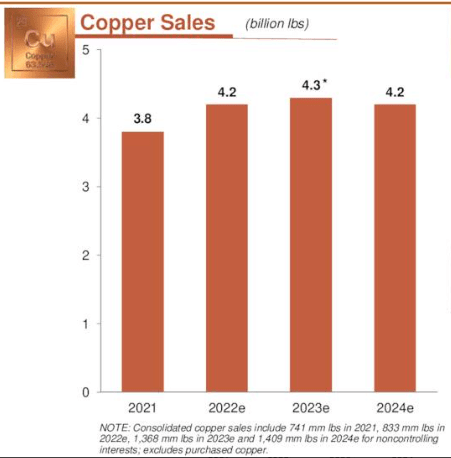

Copper Provide

If all copper costs spike increased it might damage Encore as 80% of Encore’s uncooked materials value is attributed to Copper (2022). Within the quick time period it’s tough / unimaginable to foretell what copper costs are going to do. This may be seen as current as Goldman Sachs predicting report costs in 2023 and Freeport-McMoRan (FCX) predicting flat to declining demand in 2023/24.

Freeport-McMoRan

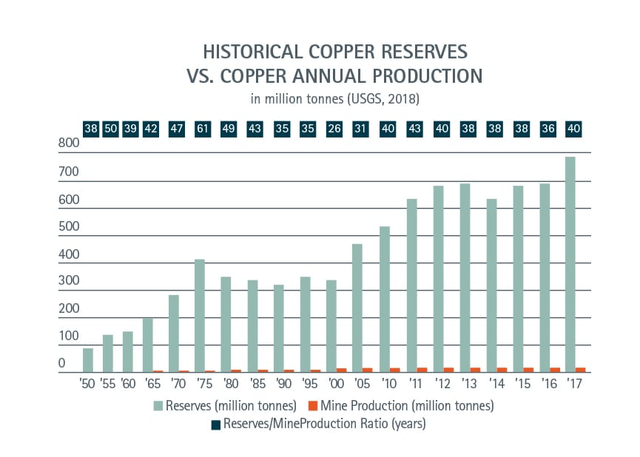

Over the long run copper reserves for the foreseeable future look to be plentiful.

Copper Alliance

Encore has labored to partially defend themselves from this danger and doubtlessly having a bonus in sure situations by their vertical integration. They’ve a copper recycling heart and their very own mill giving them extra optionality.

Margin Compression

That is the first close to time period and long run danger I foresee for Encore and its rivals. Since I didn’t discover Encore (nor their personal rivals) to have pricing energy via customer support, nor progressive and differentiated merchandise, I consider their wire and cable enterprise is a commodity. The 30% gross margins I calculated and the +20% margins Encore reported in 2021/22 don’t seem like sustainable for my part.

Valuations and Go Ahead Funding Choices

A fwd P/E of 9.52, and a trailing twelve month P/E of 6.79 mixed with a rising demand for wire (3.38% – 5.77% progress) initially alerts Encore to be an especially low cost enterprise however as a substitute of the fwd P/E rising like in 2020/21 it’s shrinking.

EV/OCF

4.14

EV/FCF

5.41

EV/EBITDA

3.34

P/E

6.79

P/S

1.19

Click on to enlarge

In Conclusion

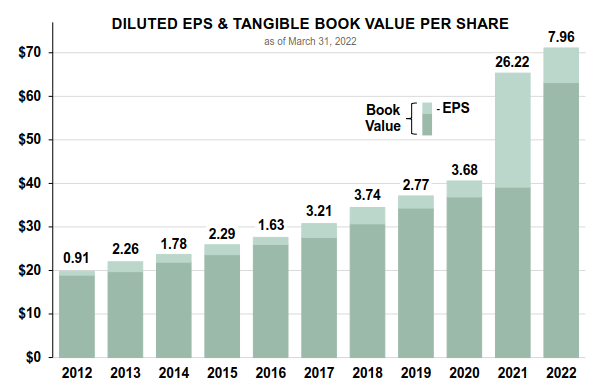

I consider Encore is a well-run enterprise that has steadily elevated their e-book worth by natural progress and a well-managed steadiness sheet (presently $586k = Money – All Debt).

Encore

Encore produces wire and cable, a aggressive and commoditized product and with out pricing energy I count on the margins to normalize.

After I cut back the margin again to the 2020 baseline and account for share discount, manufacturing progress, and future demand I get ~$5.45 EPS. I don’t consider the margins will come down that shortly in 2023 from what we noticed in This fall however I do consider the trajectory is to normalize.

As a consequence of this estimated margin compression, I give Encore a maintain ranking reasonably than a purchase. The long run positives are Encore is nicely run, has a powerful steadiness sheet, seems to have a price and suppleness benefit and is in a rising trade.

That stated, since it’s now not as cheap as beforehand thought when normalizing the margin Encore doesn’t meet my inner hurdle to remain within the prime 20. Encore seems to be a well-run enterprise, thus if the value adjusts decrease it may once more develop into a long run purchase however in the present day I price WIRE inventory a maintain.

2023+ EPS Calculations

2020 EPS = $3.68

2021 10.8% product progress (in lbs)

2022 9.1% share depend discount

2022 7.9% product progress

2023 est. 6% product progress

2023 est. 6% share depend discount

2023 normalized EPS = $5.45

Editor’s Word: This text discusses a number of securities that don’t commerce on a significant U.S. alternate. Please pay attention to the dangers related to these shares.