posteriori/iStock by way of Getty Photographs

Abstract

HelloFresh (OTCPK:HLFFF) delivers meal kits on a subscription foundation to customers. The information-driven method and distinctive expertise developed by the corporate are two of the foundational pillars on which the enterprise mannequin stands. It is a sport of optimizing CAC vs CLTV, as such it’s essential to safe optimized advertising spend. The subsequent step is distribution, the place the meal kits should be despatched from A to B in a well timed method whereas taking the shortest and best route attainable. Theoretically, the enterprise mannequin has rather a lot going for it, together with a big TAM, a transparent path to profitability, and extremely predictable income streams (subscription mannequin). Custom-made merchandise, recipes, menus, and so on. add lots of complexity to the enterprise mannequin, although. The core worth is that it gives clients a brand new, extra environment friendly mannequin that they will undertake to chop prices and enhance effectivity. In fact, the mannequin additionally advantages from the rising curiosity in wholesome consuming, the comfort of on-line meals ordering, and the rising expectations of discerning diners for trustworthy, clear labels.

Shares of HLFFF had been down after the corporate reported earnings on March seventh, which I attributed to the corporate’s very disappointing FY23 steering. Importantly, I believe one other punch to buyers was the 1Q23 information, that adjusted EBITDA for 1Q23 would fall by roughly half, to between €30 million and €40 million. The 1Q23 underperformance seems to be the results of each income and expense pressures. For 1Q23, energetic clients are anticipated to lower by the mid-single digits %, whereas order values are anticipated to extend by solely the low single digits %. Within the meantime, HLFFF can be accelerating its promoting efforts up entrance and its capital expenditures haven’t returned to their normalized ranges. Given these elements, it could imply that FCF in 1Q23 is predicted to be unfavorable. That is fairly a U-turn on profitability expectations in a way FCF turned optimistic to unfavorable (you may think about what number of buyers had been shocked by this as HLFFF was purported to be a worthwhile enterprise). This additionally signifies that 2H23 is carrying a hefty burden of danger if HLFFF is the case, as huge accelerations are required to fulfill these implied numbers.

HLFFF has lots of work to do within the second half of the yr to attain even the low finish of its FY23 steering vary, so I don’t assume it’s a good time to purchase the inventory. That is very true on condition that administration has guided predicted a lackluster 1Q23 and a unfavorable first half FCF.

4Q22 overview

HelloFresh’s quarterly buyer progress and 2023 forecast had been each decrease than anticipated. The one brilliant spot on this report was administration’s reiteration of FY25 steering for €10 billion in revenues and an adj EBITDA margin of 10-15%. Whereas this helped ease buyers’ issues about low buyer progress, I stay inquisitive about how long-term the HLFFF enterprise mannequin is sustainable by way of buyer retention (i.e., churn charges) and what the normalized CAC is.

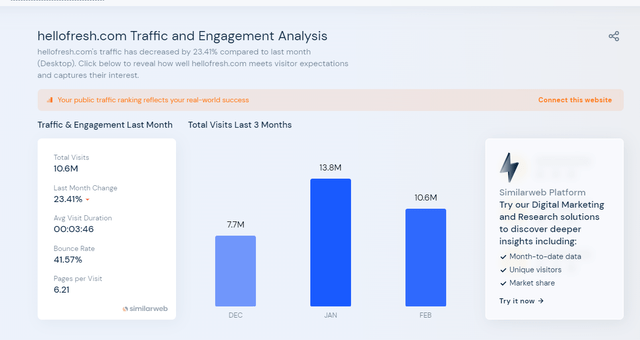

February net knowledge is look

In my view, the huge sequential drop in HLFFF’s Similarweb knowledge was one other issue that scared off buyers. Consensus are actually pricing within the weak 1Q23 that administration has been forecasting (and may additionally be extrapolating this ahead till finish of 1H23). Since January is historically the quarter’s strongest month for actives, this steering possible displays the noticeably weak month-over-month developments, indicating that top buyer churn is predicted to persist into March.

Similarweb

Extra knowledge wanted

I believe it could be useful for HLFFF in the event that they shared details about their cohorts. I am trying ahead to the CMD on March 23 and hope that there will probably be some dialogue of buyer retention charges. Regardless of HelloFresh already being a worthwhile enterprise, the corporate’s cohort and buyer retention ranges have been the topic of a lot debate for a lot of bulls and bears. If I’m the administration, within the upcoming CMD, I might shed extra gentle on bettering buyer retention, which may act as a catalyst if it causes the consensus to revise its earnings estimates upward from being too bearish on retention charges.

Conclusion

Whereas HLFFF enterprise mannequin has the potential to achieve success in the long run, there are some issues about its sustainability and profitability. The corporate’s disappointing FY23 steering and unfavorable FCF in 1Q23 are alarming, and administration has lots of work to do in 2H23 to attain even the low finish of its steering vary. Moreover, the drop in Similarweb knowledge and excessive buyer churn charges are regarding. It will be useful if HLFFF shared extra details about their cohorts and buyer retention charges on the upcoming CMD. Till then, it could be clever for buyers to attend and see how the corporate performs earlier than contemplating shopping for the inventory.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please concentrate on the dangers related to these shares.