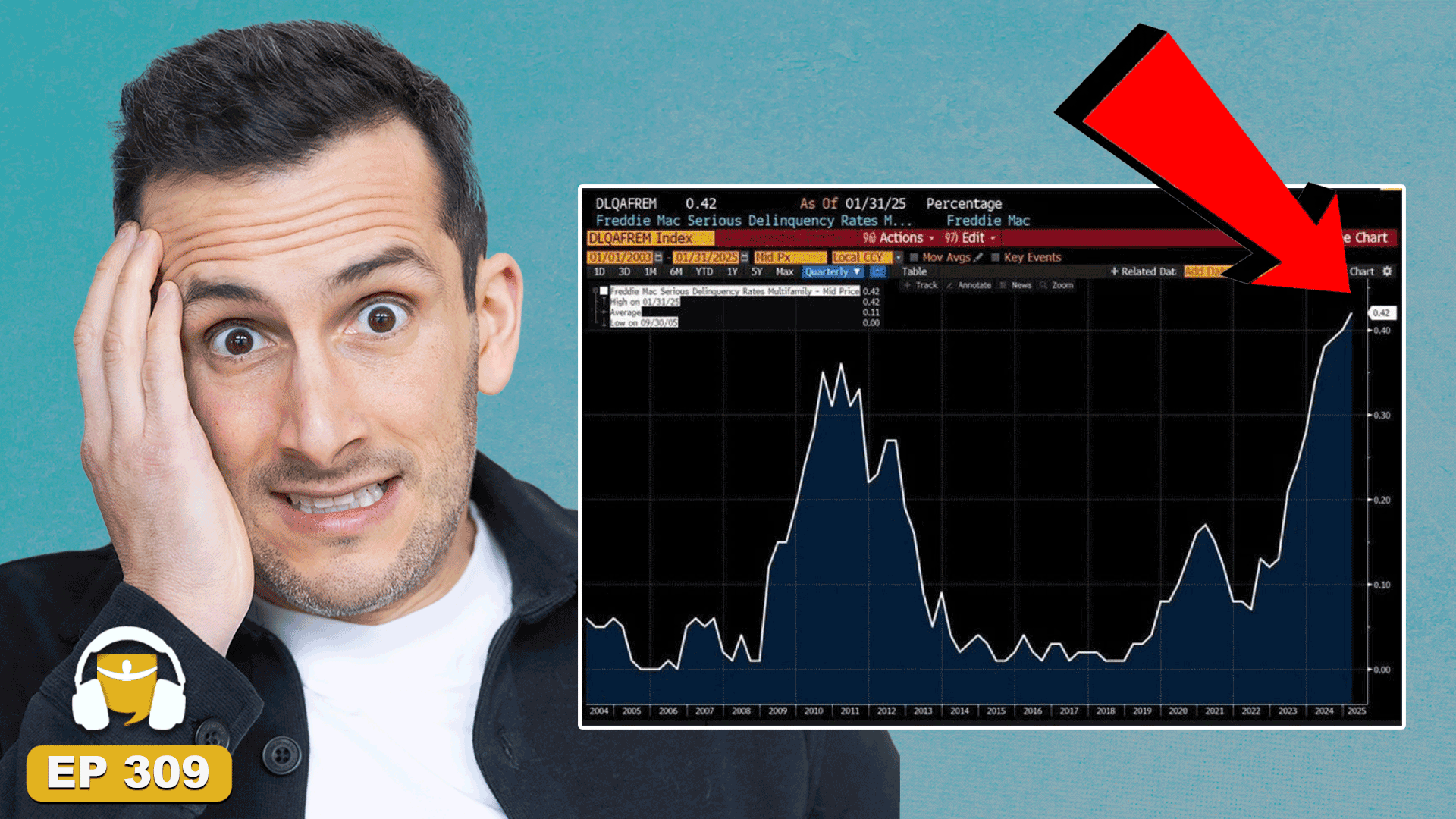

The common long-term U.S. mortgage price rose for the fifth straight week to its highest stage since breaching 7% in November, simply because the spring shopping for season will get able to kick off.

Mortgage purchaser Freddie Mac reported Thursday that the typical on the benchmark 30-year price climbed to six.73% from 6.65% final week. The common price a yr in the past was 3.85%.

The common long-term price hit 7.08% within the fall — a two-decade excessive — because the Federal Reserve continued to boost its key lending price in a bid to chill the economic system and quash persistent, four-decade excessive inflation.

At its first assembly of 2023 in February, the Fed raised its benchmark lending price by one other 25 foundation factors, its eighth improve in lower than a yr. That pushed the central financial institution’s key price to a spread of 4.5% to 4.75%, its highest stage in 15 years. Many economists count on a minimum of three extra will increase earlier than the tip of the yr.

In remarks to a Senate committee earlier this week, Fed Chair Jerome Powell appeared to indicate that the Fed would return to bigger charges hikes at its subsequent assembly March 21-22. That despatched markets tumbling on Tuesday, however Powell appeared to melt his stance on Wednesday throughout his look earlier than the Home, saying that Fed policymakers have but to resolve how massive an rate of interest hike to impose at its assembly in two weeks because it tries to corral excessive inflation.

Whereas the Fed’s price hikes do affect borrowing charges throughout the board for companies and households, charges on 30-year mortgages often monitor the strikes within the 10-year Treasury yield, which lenders use as a information to pricing loans. Traders’ expectations for future inflation, world demand for U.S. Treasurys and what the Federal Reserve does with rates of interest can even affect the price of borrowing for a house.

Earlier than falling again below 5% Thursday, the 10-year yield jumped to five.07% earlier this week, its highest stage since 2007.

The large rise in mortgage charges through the previous yr has hit the housing market hardest, with gross sales of present houses falling for 12 straight months to the slowest tempo in additional than a dozen years. January’s gross sales cratered by practically 37% from a yr earlier, the Nationwide Affiliation of Realtors reported final month.

For all of 2022, NAR reported final month that present U.S. residence gross sales fell 17.8% from 2021, the weakest yr for residence gross sales since 2014 and the largest annual decline for the reason that housing disaster started in 2008.

Greater charges can add lots of of a {dollars} a month in prices for homebuyers, on prime of already excessive residence costs.

The speed for a 15-year mortgage, widespread with these refinancing their houses, rose this week to to five.95% from 5.89% final week. It was 3.09% one yr in the past.