Wachiwit

Netflix, Inc. (NASDAQ:NFLX) has fallen from the heights of the pre-pandemic period, and entered an period of secular inventory market decline. That decline in inventory market efficiency displays a long-standing erosion within the aggressive benefits of the enterprise. Because the supply-side will get worse, the corporate’s potential to boost costs and increase its profitability decline. Netflix faces a price dilemma and should select between development and profitability. It can not have each. Administration appears decided to chase development, and with that, traders ought to count on a steep decline within the worth of the enterprise.

The Inventory Has Fallen from Its Highs

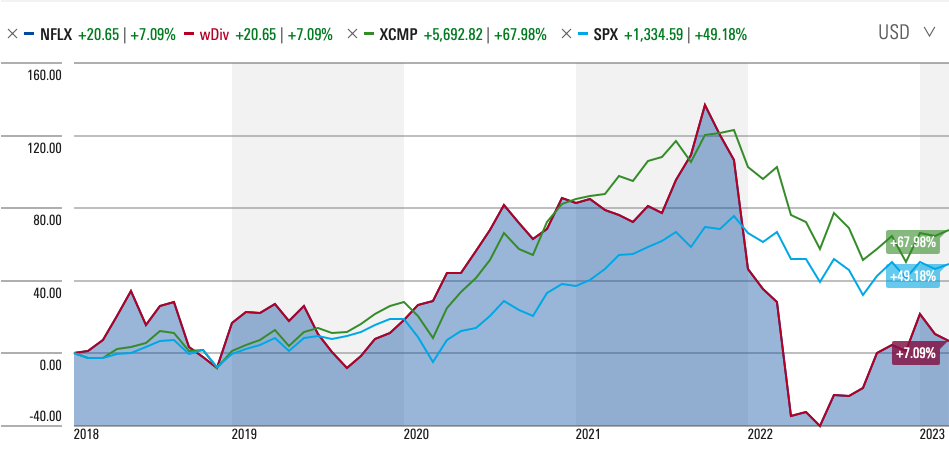

In 2019, Netflix was named the most effective funding of the last decade, incomes traders a 4,000% return in that point. But, within the final 5 years, the overall return to shareholders has been simply over 7%, in comparison with practically 50% for the S&P 500 (SPX), and practically 68% for the NASDAQ Composite Whole Return Index (XCMP). Netflix, as soon as a inventory market darling, has fallen from its highs.

Supply: Morningstar

Lengthy-term traders within the inventory have fallen right into a wide-spread investor error. Many traders, attracted by Warren Buffett’s philosophy, have come to imagine that long-term investing is grown-up investing. Nonetheless, analysis exhibits that 96% of shares, if held throughout their lifetime, don’t outperform Treasury payments. Certainly, even Warren Buffett doesn’t maintain all his shares for the long-term. One of many key explanation why shares have a tendency towards the identical charges of return as Treasury payments is that aggressive benefits, and subsequently returns on invested capital (ROIC), decline over time. The enterprise that resists this gravitational pull is uncommon. Netflix shouldn’t be one among them. Driving Netflix’ decline has been a gentle erosion of the enterprise’ aggressive benefits, an erosion that traders ignored for a few years.

Deteriorating Monetary Efficiency

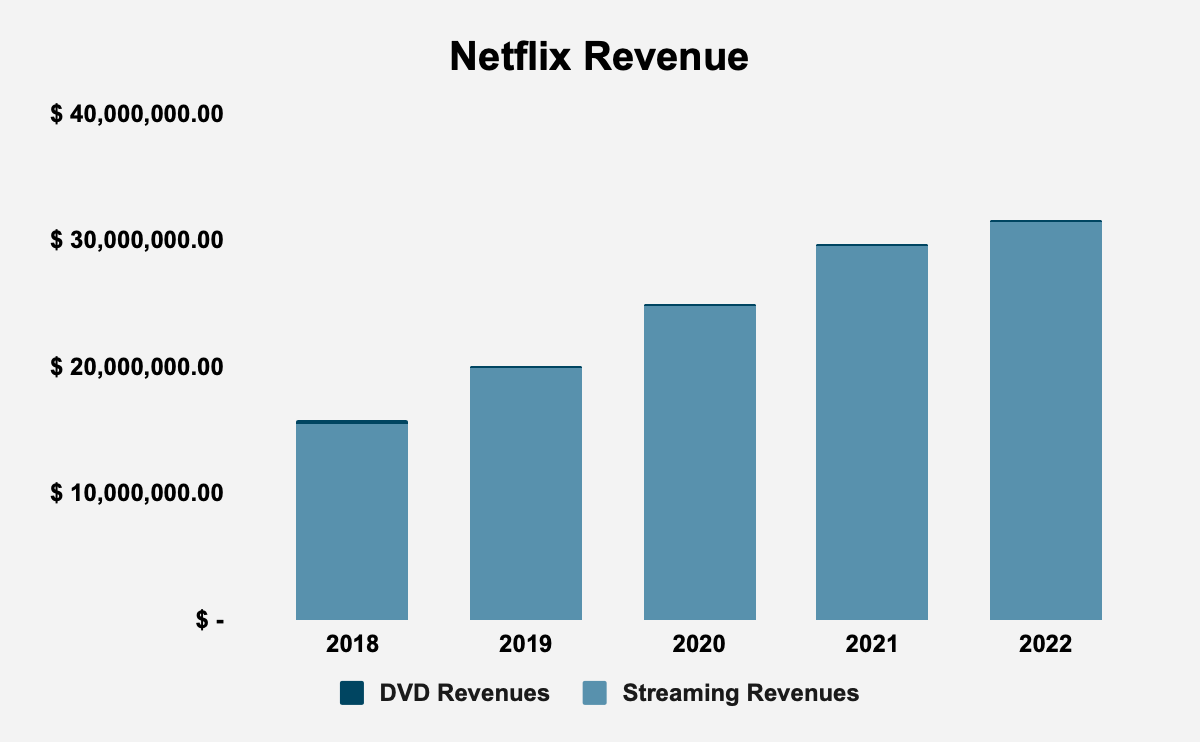

On this 5 yr window, income has declined from $15.79 billion in 2018 to $31.62 billion in 2022, at a 5-year compound annual development fee (CAGR) of 14.9%. In line with Crédit Suisse’s “The Base Charge E book”, within the 1950-2015 reference interval, 12.6% of corporations achieved an identical fee of development over a 5-year interval. Solely 14.5% of companies ever obtain a superior fee of development. The imply 5-year income CAGR is 6.9% and the median is 5.2%. (Whereas the reference interval is outdoors our evaluation interval, it serves as a reference level to guage Netflix’ outcomes, given that there’s some persistence within the tendency of these outcomes.)

In the present day, Netflix operates as one working section, and revenues emanate largely from membership charges associated to the supply of streaming providers. There are totally different streaming membership plans, every with its personal distinctive pricing, ranging, in the US, from $1 to $26 per thirty days. Members are billed at first of the month and revenues are acknowledged ratably over every month. Netflix nonetheless derives a residual income from the sale of DVDs. In 2022, streaming revenues have been 99.4percentof complete income.

Supply: Netflix, Inc. Filings and Writer Calculations

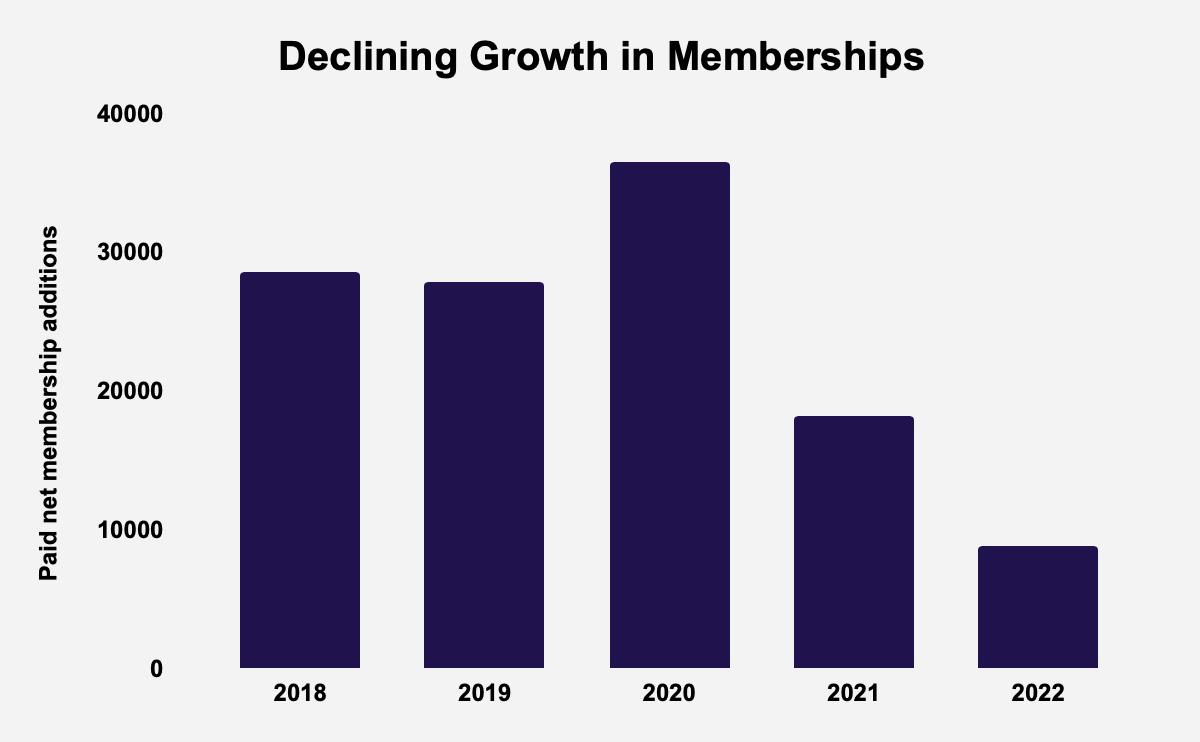

The variety of common paying memberships has risen from 139.26 million in 2018 to 222.92 million in 2022, at a 5-year CAGR of 9.87%. Though the membership is rising, development has slowed in recent times, with paid internet membership additions declining from 28.6 million in 2018 to eight.9 million in 2022, at a 5-year CAGR of -20.82%.

Supply: Netflix, Inc. Filings and Writer Calculations

Gross income have risen from $5.83 billion in 2018, to $12.45 billion in 2022, at a 5-year CAGR of 16.39%. Gross margins rose from 36.89% in 2018 to 39.37% in 2022. Gross profitability (gross income/complete belongings) rose from 0.22 in 2018 to 0.26 in 2019. That is nonetheless wanting the 0.33 threshold that Robert Novy-Marx’ analysis discovered was a beautiful stage of profitability.

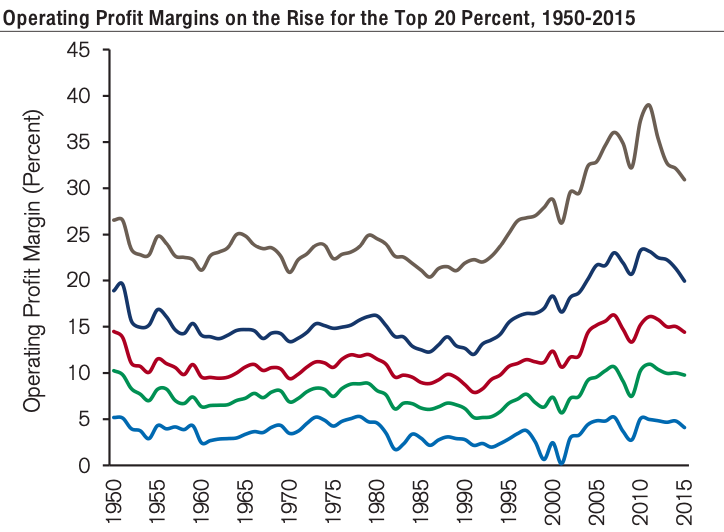

Working revenue has risen from $1.6 billion in 2018 to $5.6 billion in 2022, at a 5-year CAGR of 28.54%. Working margins have risen from 10.16% in 2018 to 17.82% in 2022. That is definitely increased than the imply working margin in shopper discretionary, which is 8.2%, or the median, which is 8%, nevertheless, it’s far decrease than the highest quintile working margin for all companies.

Supply: Crédit Suisse

Web revenue has risen from $1.2 billion in 2018 to $4.5 billion in 2022, at a 5-year CAGR of 29.97%, a consequence matched by simply 8.8% of corporations, with solely 7.5% of companies having fun with the next fee of earnings development over a 5-year interval. The imply 5-year earnings CAGR is 7.3% and the median is 5.9%.

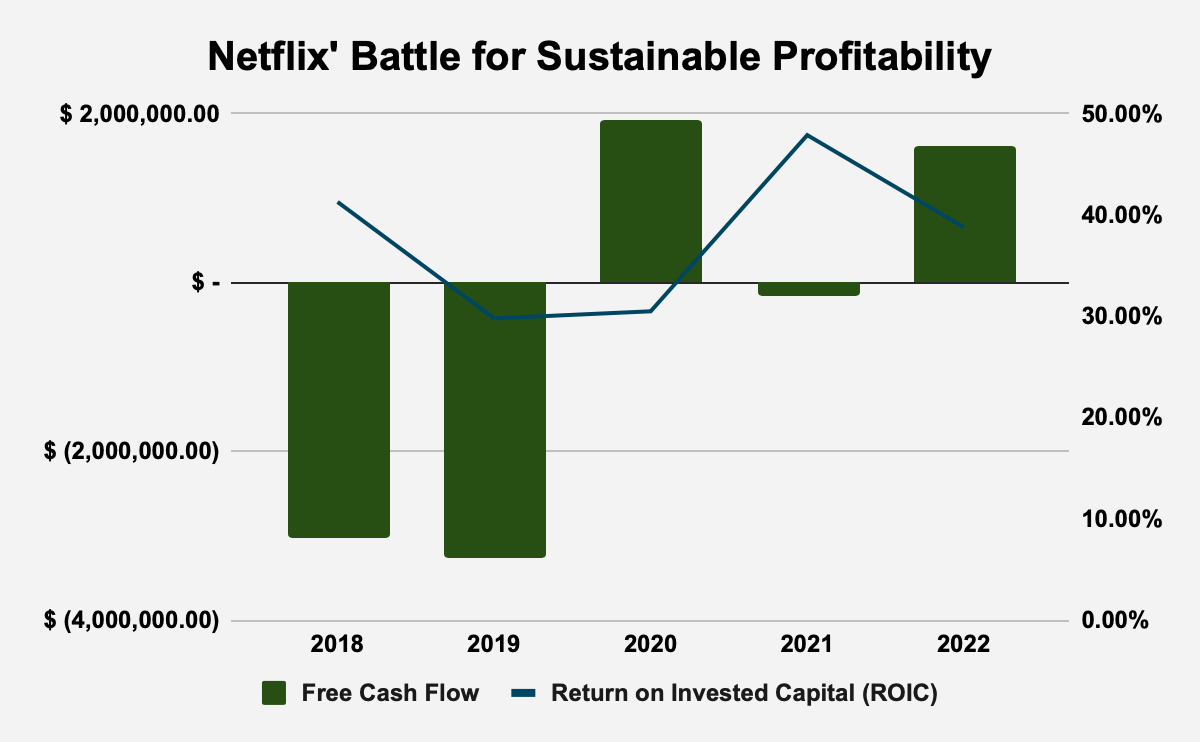

Free money circulate (FCF) rose from -$3 billion in 2018 to $1.62 billion. ROIC, in the meantime, has declined from 41.3% in 2018 to 38.8% in 2022. During the last 5 years, the corporate has struggled to sustainably generate FCF. Certainly, the online FCF era throughout that interval was -$2.9 billion. If a enterprise’ worth is the sum of the current worth of its future money flows, Netflix has gone backwards within the final 5 years, when it comes to rising company worth.

Supply: Netflix, Inc. Filings and Writer Calculations

It’s Provide, Silly

There will not be many truths which can be axiomatic in finance, however a type of truths is that a rise within the provide of a factor reduces the worth of that factor. It is vitally tough to forecast demand, and traders and managers are inclined to overestimate demand. Provide is simpler to forecast and to analyse and quite a bit could be concluded with out ever bothering with provide. Although there are definitely situations the place provide rises and costs rise as properly, these will not be as widespread as traders and managers would really like. The principal drawback each traders and managers face is that supply-side selections are taken with a ways from the costs that shall be noticed when the results of these provide selections are taken. So, as an example, a call to purchase a catalog of content material within the perception that demand the next yr when that content material shall be launched, shall be at a sure stage, carries with it some uncertainty: that forecasted stage of demand could also be a lot decrease than the vary of outcomes forecast. Progress industries are particularly susceptible to those errors. Or, extra appropriately, it’s helpful for a declining trade to underestimate future demand, however it’s dangerous in a rising trade to overestimate future demand. In rising industries, the incentives and biases are there to overestimate future demand, whereas in declining industries, the incentives and biases are there to underestimate future demand.

Whereas Netflix could as soon as have been the true king of streaming, that title is not theirs. Actually, the market has grow to be so aggressive that Netflix’ potential to boost costs has deteriorated within the face of competitors from different streaming providers. With over 15 streaming providers with not less than 10 million subscribers, folks have extra selection than at any level within the historical past of tv. Amongst these rivals are Amazon (AMZN), Apple (AAPL), Disney (DIS), HBO Max (WBD), Paramount (PARA), and YouTube (GOOGL), every of whom is a part of a worthwhile ecosystem that may fund the streaming providers. Netflix, however, is a pure-play streaming service with no significant revenue from one other income stream that might help the streaming enterprise. Its solely non-streaming income comes from the declining DVD-by-mail market. Secondly, these rivals all have wealthy catalogs of content material that they personal, whereas Netflix licenses a lot of its content material, though administration has tried to rectify this.

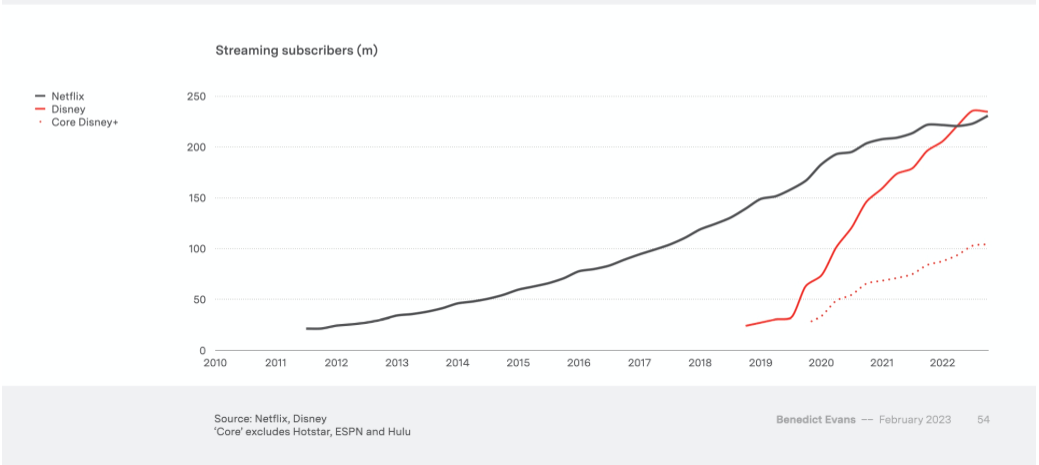

Disney, for instance, has already caught as much as, and handed Netflix, for the variety of streaming subscribers.

Supply: Ben Evans

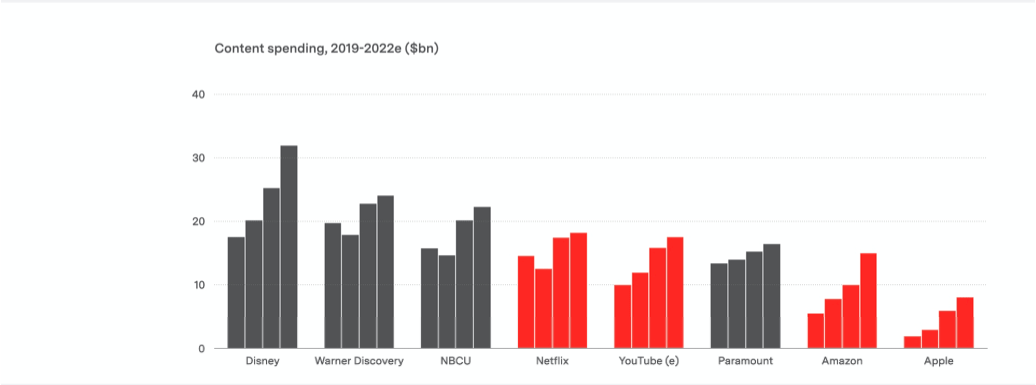

Moreover, Disney’s content material spending already exceeds that of Netflix within the final three years, reflecting how Disney is ready to dip into its worthwhile core enterprise to fund its streaming enterprise.

Supply: Ben Evans

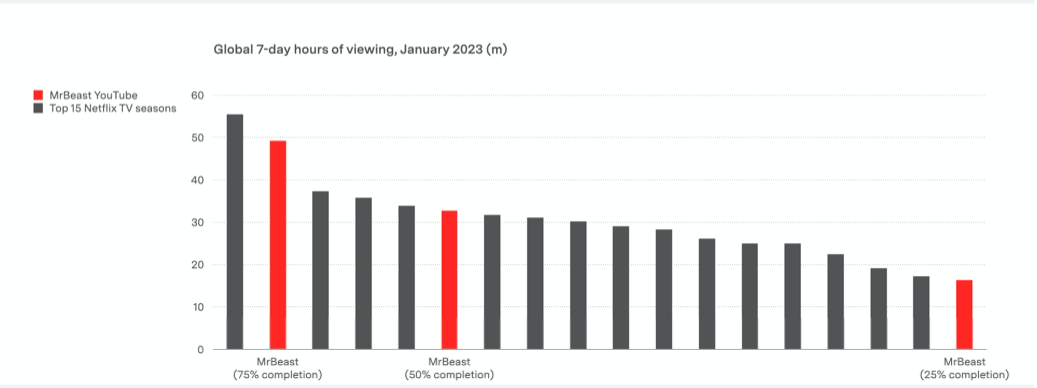

YouTube is especially fascinating and an instance of how Netflix’ aggressive benefits have been enormously exaggerated. YouTube’s creator payouts match these of TV manufacturing budgets, and the platform’s share of U.S. TV viewing already exceeds that of Netflix. Whereas Netflix has typically been hailed as disrupting TV, the reality is that YouTube is extra disruptive of TV than Netflix is. An instance of that is the present, MrBeast, whose viewing numbers examine favorably with these of a high 10 Netflix present.

Supply: Ben Evans

Netflix’ success and an evident need for streaming content material, has had the hostile impact of attracting rivals who’re bigger, wealthier, and have realized all the teachings that Netflix has needed to train. Slightly than being a disruptor, Netflix is a declining incumbent.

Netflix already costs the very best worth for its streaming providers, and with competitors so fierce, it’s onerous to see how they will increase costs any additional. Take into consideration the most important exhibits of the final decade, equivalent to Sport of Thrones, and even the derided Lord of the Rings: The Ring of Energy, and, it’s controversial that Netflix has not produced a single present that may contend for the title of the “finest”, or most watched. Even when they will, the truth that different providers can provide comparable and even superior content material has lowered Netflix’ pricing energy fairly considerably.

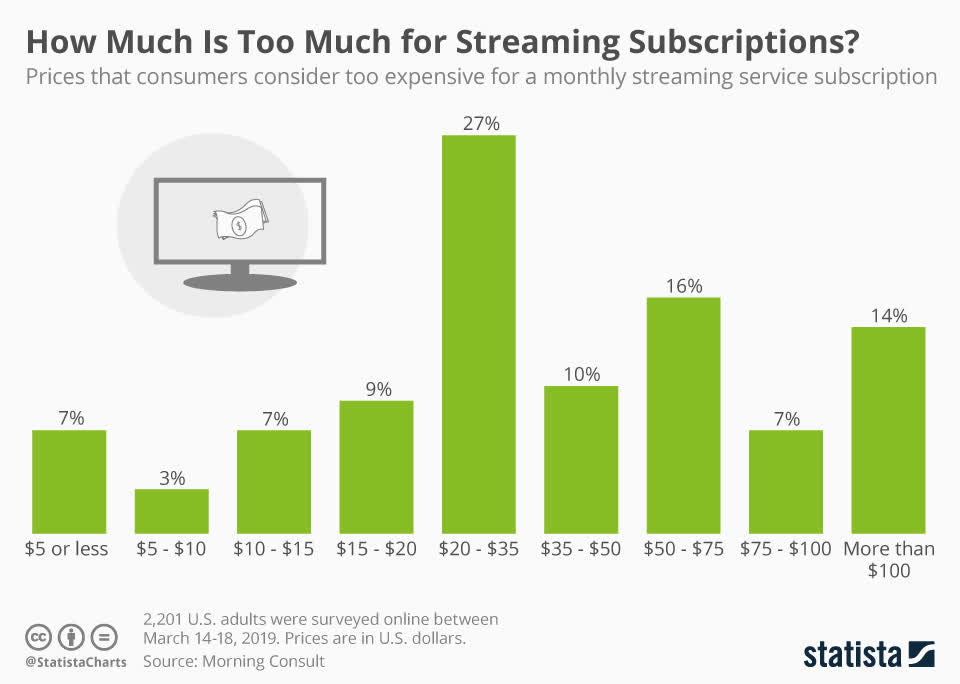

Supply: Statista

Moreover, there may be some proof that Netflix’ pricing is the restrict to which a streaming service can go when it comes to pricing. What number of subscribers would tolerate a $5 enhance within the worth of the premium service, as an example? Answering such fundamental questions reveals the extent to which Netflix’ aggressive benefits have eroded. There may be much less and fewer of a purpose to be on Netflix, and people causes decline with every day. Earlier makes an attempt to boost costs haven’t fared properly, and it’s unsurprising that the corporate has mulled an ad-model for this enterprise.

Supply: Statista

Most individuals assume adverts suck, and Reed Hastings has mentioned as a lot, so the concept the corporate shall be compelled into an ad-model is a sign of how unhealthy issues are at Netflix.

We noticed that Netflix has burnt by way of $2.9 billion in money over the past 5 years, and that is actually the worth of being a pure-play streaming service.

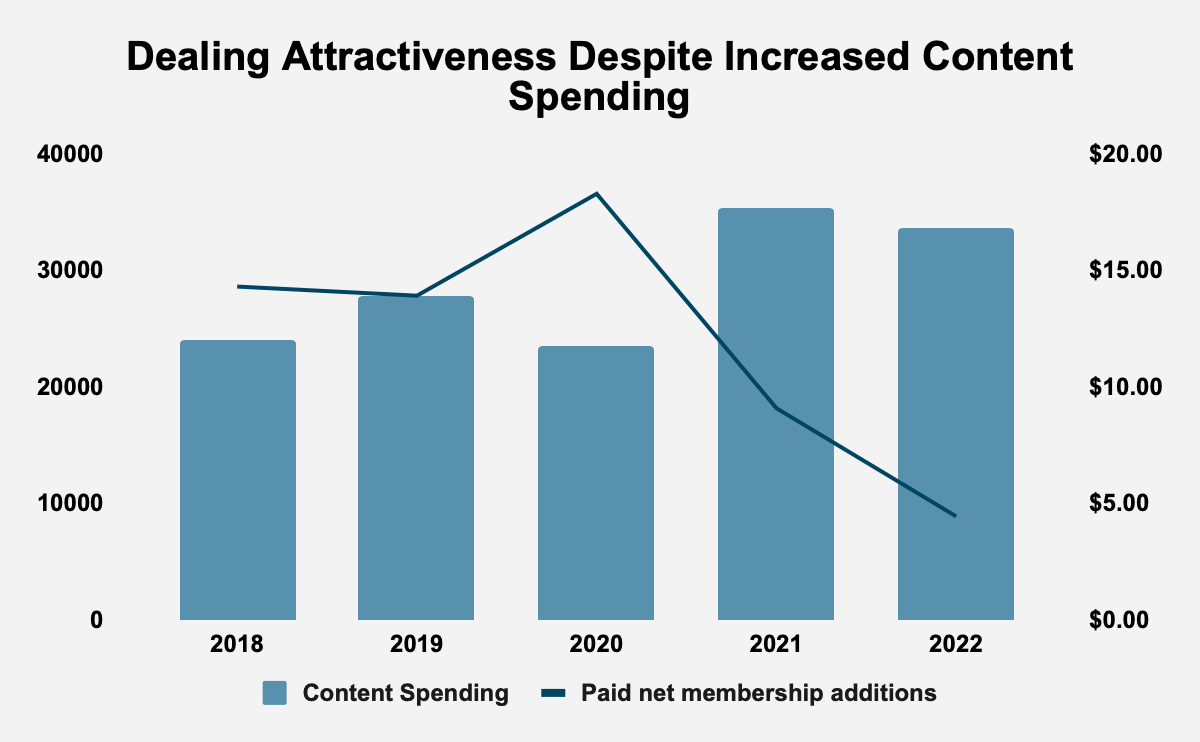

Netflix’ issues come into additional focus after we think about that regardless of growing spending on content material from $12.04 billion in 2018 to $16.84 billion in 2022, its potential so as to add new members has declined.

Supply: Netflix, Inc. Filings and Writer Calculations

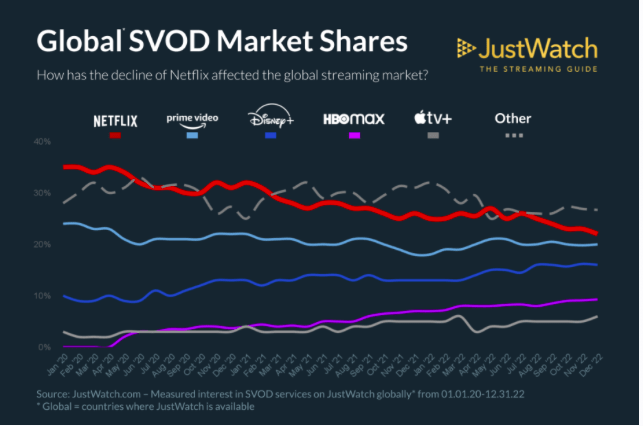

This all provides as much as a weakening market share, with Netflix shedding 13% of its market share between 2019 and 2022.

Supply: NASDAQ

In an more and more aggressive market, Netflix merely can not increase costs considerably, or develop profitably, moderately, administration has to play protection and deal with ROIC, a call that it doesn’t appear to have contemplated.

Netflix’ Worth Dilemma

The excellence between worth and development investing is superficial. As Warren Buffett as soon as remarked, “Progress is all the time a element within the calculation of worth, constituting a variable whose significance can vary from negligible to monumental and whose affect could be adverse in addition to optimistic.” Netflix is on the level the place development is a minus, and now, it has to decide on between development and bettering ROIC. The corporate is incapable of producing FCF with out slashing content material spending, and but appears incapable of accepting its destiny as a declining enterprise that needs to be taking part in protection. Progress is, in any occasion, largely unsustainable for many companies, and positively, Netflix’ development is slowing down. Actually, the pursuit of development is destroying worth, moderately than creating it. Accepting realities shall be helpful for shareholders, given {that a} 1% enhance in ROIC creates extra worth than a 1% enhance in income.

Netflix Overstates the Longevity of its Content material

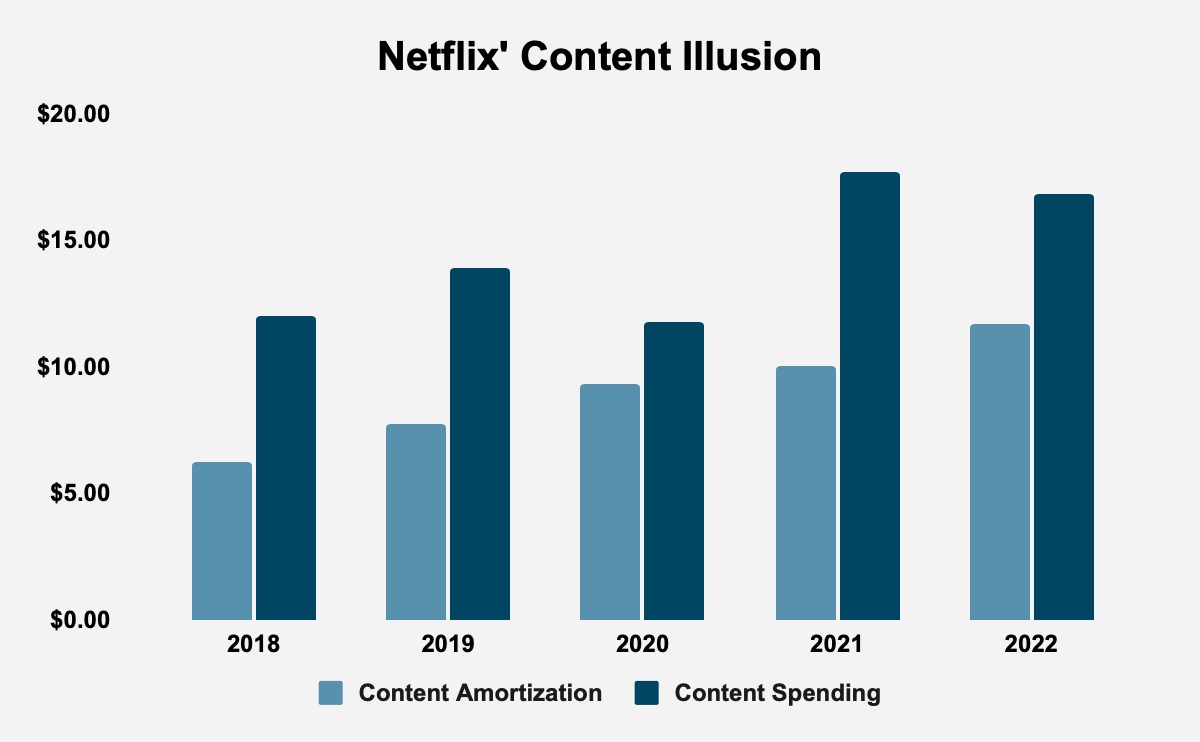

The vast majority of the corporate’s price of revenues are made up of content material amortization. As Stephen Clapham has identified, Netflix has aggressively elevated the content material amortization interval of its content material because the economics of the enterprise has deteriorated. That is important as a result of Netflix’ content material amortization durations exaggerate the longevity of their content material so as to enhance the agency’s reported monetary efficiency.

Supply: Netflix, Inc. Filings and Writer Calculations

Certainly, within the auditor’s report, Ernst & Younger as soon as once more raised the corporate’s content material amortization coverage as a “crucial audit matter”, saying:

As disclosed in Word 1 to the consolidated monetary statements “Group and Abstract of Important Accounting Insurance policies”, the Firm acquires, licenses, and produces content material, together with authentic programming (“Content material”). The Firm amortizes Content material primarily based on elements together with historic and estimated viewing patterns.

Auditing the amortization of the Firm’s Content material is complicated and subjective as a result of judgmental nature of amortization which is predicated on an estimate of future viewing patterns. Estimated viewing patterns are primarily based on historic and forecasted viewing. If precise viewing patterns differ from these estimates, the sample and/or interval of amortization can be modified and will have an effect on the timing of recognition of content material amortization.

We obtained an understanding, evaluated the design and examined the working effectiveness of controls over the content material amortization course of. For instance, we examined controls over administration’s overview of the content material amortization technique and the numerous assumptions, together with the historic and forecasted viewing hour consumption, used to develop estimated viewing patterns. We additionally examined administration’s controls to find out that the info used within the mannequin was full and correct.

To check content material amortization, our audit procedures included, amongst others, evaluating the content material amortization technique, testing the numerous assumptions used to develop the estimated viewing patterns and testing the completeness and accuracy of the underlying knowledge. For instance, we assessed administration’s assumptions by evaluating them to present viewing traits and present working info together with evaluating earlier estimates of viewing patterns to precise outcomes. We additionally carried out sensitivity analyses to judge the potential modifications within the content material amortization recorded that might consequence from modifications within the assumptions.

The content material amortization coverage is, to my thoughts, regarding as a result of it’s onerous to think about {that a} important a part of Netflix’ catalog has a life cycle of greater than a yr. But, within the firm’s most up-to-date “Overview of Content material Accounting”, says that 90% of its content material is absolutely amortized inside 4 years, after its first month of availability, with a most amortization interval of 10 years. Clapham argues that Netflix’ precise amortization interval is round 6 years. I can’t go into these claims, however will ask a unique query: what number of occasions do you watch Netflix content material that’s older than one yr? Amortizing the content material over 4 years, not to mention 6 years, appears fairly optimistic.

Whereas Netflix shouldn’t be doing something unlawful, the difficulty does level to the weaknesses of the enterprise mannequin and of the accounting requirements at play.

Valuation

Netflix has a worth/earnings (P/E) a number of of 31.36 in comparison with a P/E a number of of 21.45 for the S&P 500. With an enterprise worth of $147.26 billion, the agency has an FCF yield of 1.1%, in comparison with an FCF yield of 1.8% for the 2000 largest corporations in the US, in line with New Constructs. In different phrases, the corporate is valued increased than the market, whereas its FCF are buying and selling at a decrease yield. For anybody who has learn this far, the corporate’s economics are in secular decline and usually tend to match the returns of Treasury payments, moderately than beat the market. This means that additional declines available in the market worth of the enterprise are to be anticipated.

Conclusion

Netflix is in secular decline. The reason being pretty easy: competitors has elevated and is getting harsher and harsher. The corporate faces higher resourced corporations, who can outspend it, and within the case of Disney and YouTube, match or exceed its numbers, and who’re capable of operate with out as a lot concern for income. The times of pure-play streaming providers are over. Competitors is just too intense for companies that rely solely on streaming. In that gentle, traders ought to count on additional erosion within the worth of the corporate, till administration wakes as much as the impossibility of chasing development and being worthwhile.