Torsten Asmus

Thesis

The iShares Aaa – A Rated Company Bond ETF (NYSEARCA:QLTA) is an exchange-traded fund (“ETF”). The automobile invests in extremely rated funding grade bonds and runs a 7-year efficient period. As per its literature:

The iShares Aaa – A Rated Company Bond ETF seeks to trace the funding outcomes of an index composed of Aaa to A, or equivalently rated, mounted charge U.S. dollar-denominated bonds issued by U.S. and non-U.S. companies.

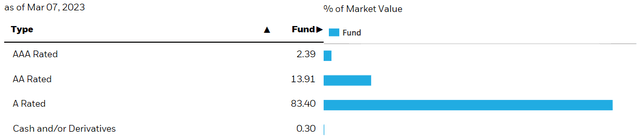

The fund is at present chubby “A” credit, which compose over 83% of its portfolio. From a historic efficiency standpoint, the QLTA fund could be very a lot aligned with the a lot better recognized iShares iBoxx $ Funding Grade Company Bond ETF (LQD), which aggregates many of the flows within the area.

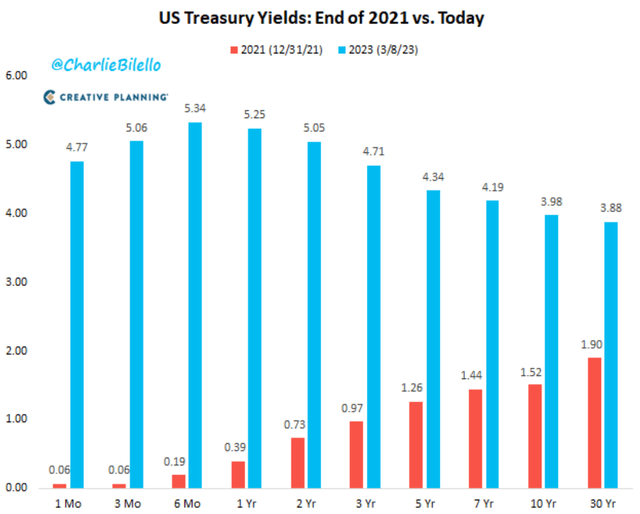

QLTA represents primarily a play on rates of interest, and secondly a play on funding grade credit score spreads. If we take a look at what charges have performed prior to now 12 months and a half, we get a reasonably stunning image:

Historic Charges Transfer (Inventive Planning )

Taking a look at 7-year charges, the period level that issues for this fund, we are able to see a tripling within the web yield. That transfer has resulted in QLTA posting a -11% worth efficiency prior to now 12 months, a transfer which is exterior the fund’s 3-year normal deviation.

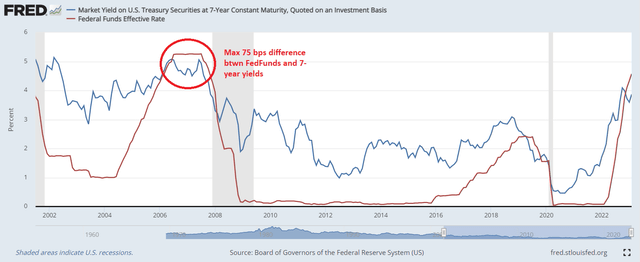

Wanting ahead to the place charges are going, our greatest guess is to take a look at the historic relationship between 7-year yields and Fed Funds:

Variety of Holdings (Fund Reality Sheet)

Through the previous “correct” tightening cycle in 2005-2007, Fed Funds peaked at 5.25% and stayed there for some time. Fascinating to notice that 7-year yields didn’t comply with, however spent many of the interval at a unfavourable distinction to Fed Funds, a distinction which peaked at -75bps.

We count on an analogous playbook this time round – the Fed will elevate charges (as per Goldman) to five.5% – 5.75% and preserve them there for some time. Using the historic precedent, that ought to translate right into a 7-year yield of round 4.75%, which implies one other 50 bps greater from right here.

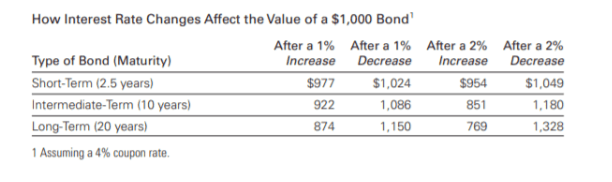

What does that imply for QLTA? Allow us to take a look:

Length Sensitivity (Vanguard)

So, we count on one other 50 bps widening in 7-year charges and possibly one other 25 to 50 bps from unfold widening throughout the subsequent leg down on this market. This interprets into one other 1% improve (nearly), so possibly one other 6% to 7% down for the QLTA fund.

Analytics

AUM: $0.8 billion. Sharpe Ratio: -0.56 (3Y). Std. Deviation: 8.6 (3Y). Yield: 5% (30-day SEC Yield) Premium/Low cost to NAV: 0% Z-Stat: n/a Leverage Ratio: 0% Efficient Length: 7 years Possibility Adj Unfold: 89 bps.

Holdings

The fund holds a portfolio of funding grade company bonds:

Issuers (Fund Web site)

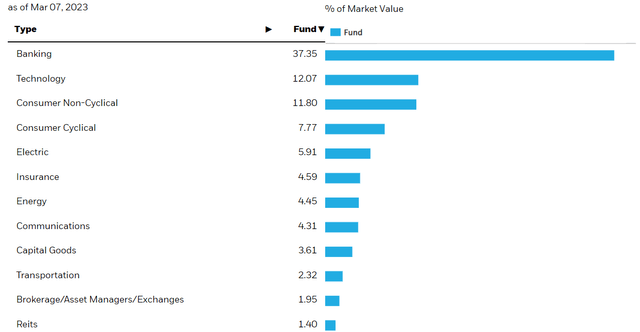

The automobile is chubby financials by way of its composition:

Issuers (Fund Web site)

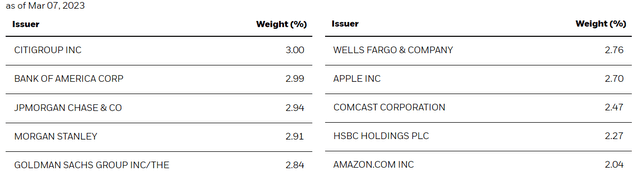

The QLTA fund has a granular construct, with no particular person issuer exceeding a 3% holdings threshold:

Issuers (Fund Web site)

Moreover, the QLTA automobile holds over 2,000 bonds in its portfolio:

Variety of Holdings (Fund Reality Sheet)

We don’t suppose the upcoming recession goes to be marked by extreme and sudden monetary shocks, subsequently, we don’t suppose the chance of default for any identify on this portfolio is value contemplating. We’re of the opinion that in 2023/2024 we’re going to witness the removing of the excesses witnessed in prior years, particularly on the tech and meme inventory aspect.

There are firms on the market which have very poor working earnings (and even unfavourable ones) that are at present burning by means of their money balances. As soon as the cash runs out, stated companies must shut down.

The easiest way to consider the portfolio of names right here is as a well-diversified funding grade collateral pool that might solely really expertise defaults in exterior eventualities such because the Nice Monetary Disaster (’08-’09) or Covid, after we had sudden exogenous occasions that noticed funding grade firms default.

Efficiency

The QLTA fund is down over -11% prior to now 12 months, posting a barely higher efficiency when in comparison with LQD:

Whole Return (Searching for Alpha)

On a 5-year foundation, their efficiency is sort of an identical:

Whole Return (Searching for Alpha)

We will see LQD outperforming throughout the zero charges setting that characterised 2020 and 2021, nevertheless it has re-traced since.

Conclusion

iShares Aaa – A Rated Company Bond ETF is a set earnings ETF. The fund aggregates a granular portfolio of funding grade bonds (“A” common ranking for over 83% of the portfolio)m, with an chubby tilt in the direction of financials. The fund has an efficient period of seven years, and has seen its NAV plummet as charges have spiked greater prior to now 12 months. QLTA has an nearly an identical efficiency to the a lot better recognized fund LQD.

The primary danger issue affecting QLTA’s efficiency is represented by charges, with credit score spreads secondary. With the Fed set to boost charges (as per Goldman) to five.5% – 5.75% and preserve them there for some time we really feel there may be nonetheless a bit extra weak point to come back for QLTA. Using the historic precedent from 2007, Fed Funds within the 5.5% vary ought to translate right into a 7-year yield of round 4.75%, which implies one other 50 bps greater from right here.

Coupled with barely wider credit score spreads, the above transfer provides us a worth level for iShares Aaa – A Rated Company Bond ETF which is round 6% decrease than immediately’s stage. The QLTA fund is thus a mushy Promote.