InsiderSentiment.com Dr. Nejat Seyhun

I wrote three articles in Could and June of 2022 explaining why I anticipate a U.S. recession inside a 12 months. Right here is one. These articles predated most economists who now anticipate one.

Not too long ago although (January 2023), the economic system confirmed indicators of life. Nonetheless, the market sees this excellent news as unhealthy information as it should push the Federal Reserve to boost rates of interest larger and for longer. What the Fed does is essential however individuals are overly obsessive about it. Whereas most observers concentrate on rates of interest and inflation, there are various different elements which might be impacting the economic system. All that I’ve listed below are important, however their impacts differ. Listed beneath first are 10 tailwinds the economic system is benefitting from adopted by 20 headwinds.

Tailwinds

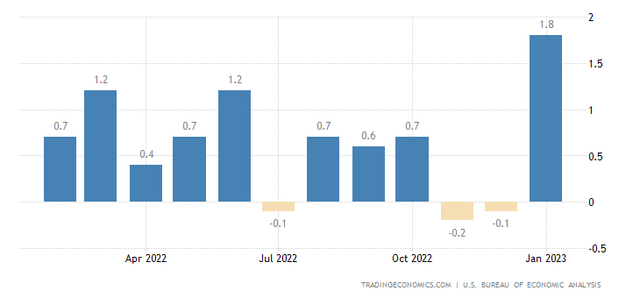

1. Client spending and retail gross sales jumped in January – Client spending, which had been slowing, jumped 1.8% in January from December. U.S. retail gross sales elevated much more by 3% from December to January. The cumulative twelve month progress in gross sales from January 2022 to January 2023 was 6.4%. Some economists attributed each to massive seasonal changes usually carried out in January. We are going to quickly see if this can be a sustained improve, a short lived improve, or simply noise within the changes.

Wolfe Analysis, Refinitiv, S&P, Bloomberg, Factset

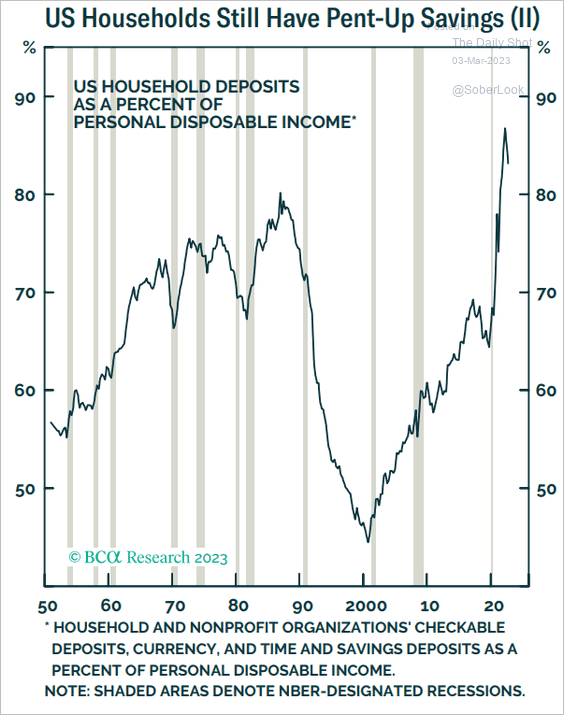

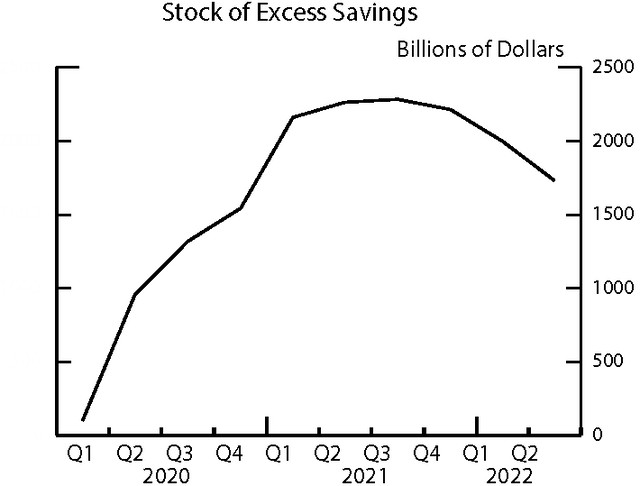

2. Client financial savings are nonetheless excessive, although declining- The federal government handed 4 packages of fiscal stimulus in 2020 and 2021 value near $4 trillion. This was far more than ever carried out earlier than and resulted in shoppers and companies with trillions of {dollars} of extra money. That additional money created a requirement surge that brought on the inflation we now face. Shoppers particularly, nonetheless have important additional money they did not have earlier than the pandemic.

BCA Analysis, Sober Look Federal Reserve Board

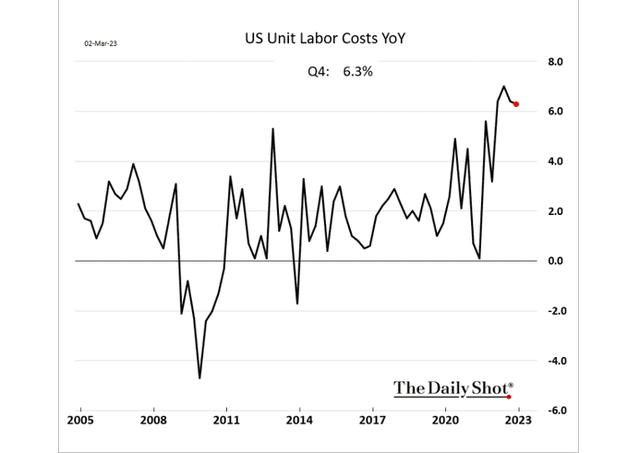

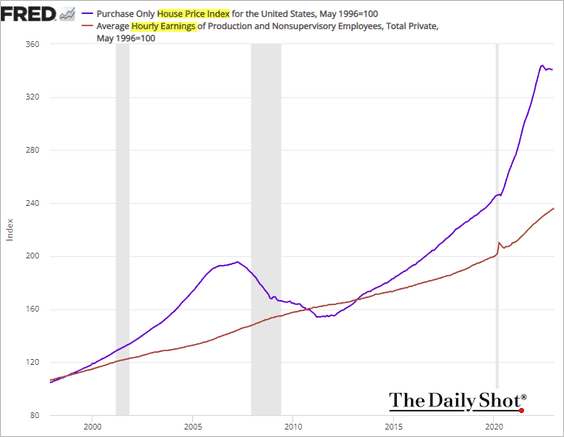

3. Wages are growing, particularly on the low end- I’ve written three articles in SA detailing why wage inflation goes to be arduous to cease and can seemingly be everlasting going ahead besides throughout occasions of financial weak spot. The latest is right here. The explanations are demographic developments resembling; a decrease start fee, extra child boomer retirements, a decrease labor participation fee, much less immigration, much less offshoring and continued company innovation and progress. Thus far, the Fed has had little affect on wage inflation. In the meantime elevated wages imply extra spending energy particularly since wage inflation is now exceeding many measures of total inflation.

The Each day Shot

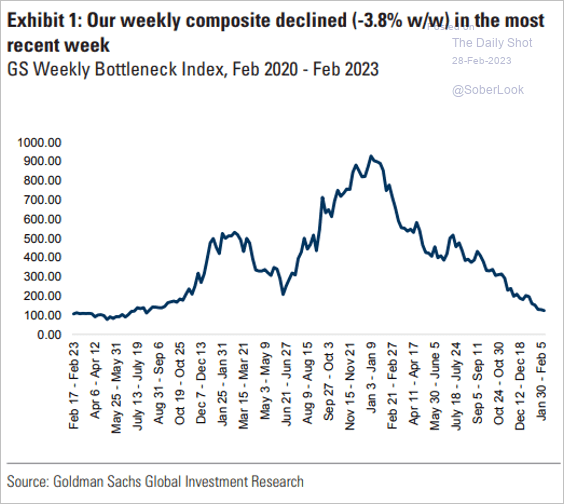

4. Provide chain drag largely gone- The economic system was considerably held again in 2022 by provide chain disruptions and excessive delivery prices. Each at the moment are largely gone.

Goldman Sachs International Funding Analysis

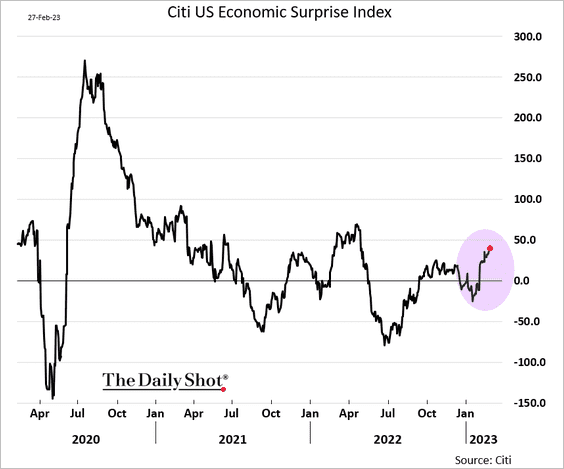

5. Shock index quickly going positive- This index reveals if financial readings are higher or worse than economist’s projections. Beginning in January, they’ve been persistently higher than anticipated, indicating a stronger economic system than anticipated.

Citi, The Each day Shot

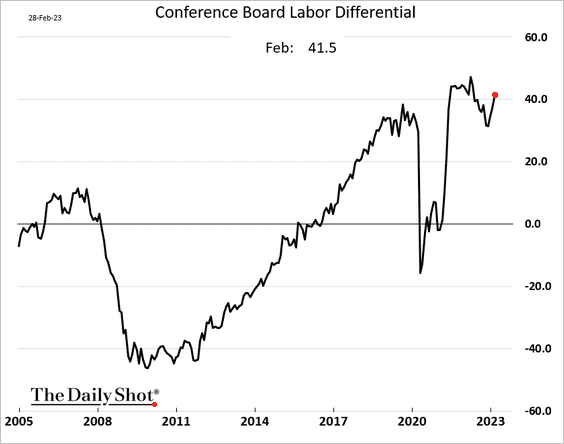

6. Sturdy jobs market – Individuals are not having bother getting jobs. That is along with larger wages as a result of it additionally will increase their confidence to spend. The labor differential (jobs plentiful minus jobs arduous to get) chart beneath as soon as once more factors to a decent labor market. Job openings nonetheless outnumber job candidates by nearly 1.9 to 1, a traditionally excessive degree.

Nationwide Affiliation of Realtors

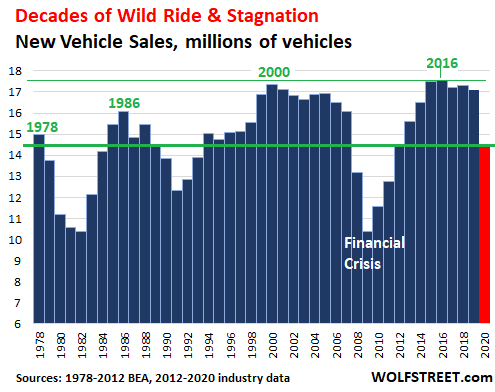

7. Pent up demand for automobiles – New auto gross sales had been held again significantly in 2022 resulting from elements shortages and delivery delays. This was very true for semiconductors utilized in automobiles. These shortages are receding, growing the availability of automobiles accessible on the market. Additionally, advances in EVs and sensors have created a brand new demand.

The Each day Shot

8. Innovation creating new merchandise – I wrote an article about this in 2019 explaining how the U.S. with 4.5% of the world’s inhabitants has near 50% of the market worth of all publicly traded companies on the earth. A giant motive is innovation. The overwhelming majority of latest innovations the previous 30 years have come from U.S. companies. They’ve created so many roles, that they needed to ship hundreds of thousands abroad and we nonetheless have a decent jobs market. Not like a lot of the different tailwinds, this isn’t a short lived scenario. It doesn’t look like slowing down although headwinds famous beneath resembling a closed IPO market, weakened enterprise capital and personal fairness markets and costlier loans could damage. The SIVB Financial institution blowup is all concerning the weak spot within the VC and PE industries.

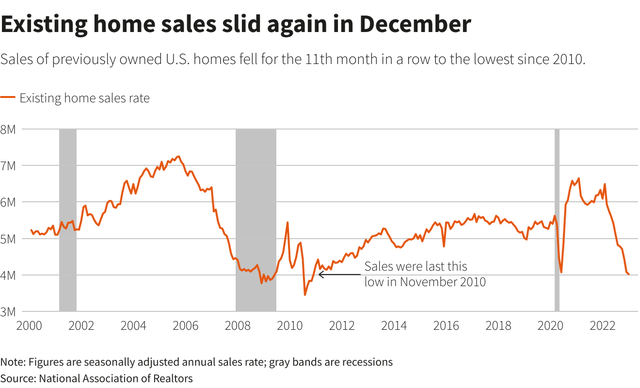

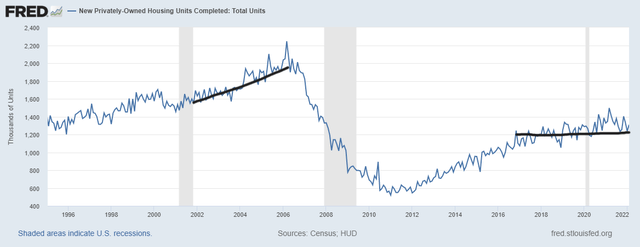

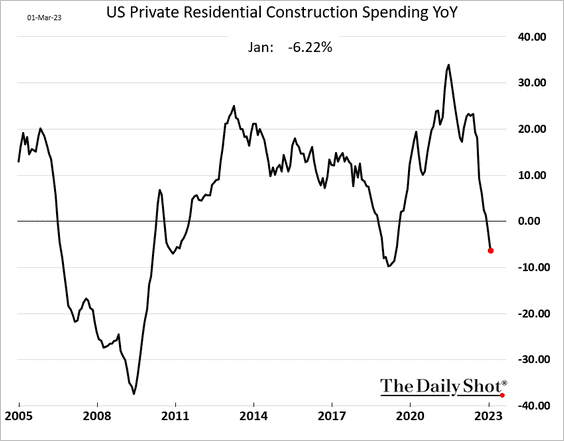

9. Below provide of housing- Gross sales of latest and present properties dropped dramatically throughout the 2007-2009 recession and haven’t recovered to satisfy demand since. Pent up demand is being held again by excessive costs and excessive rates of interest. However the demand is there. The huge surge in costs in 2022 the place properties had been typically promoting over checklist value is proof.

Nationwide Affiliation of Realtors Federal Reserve

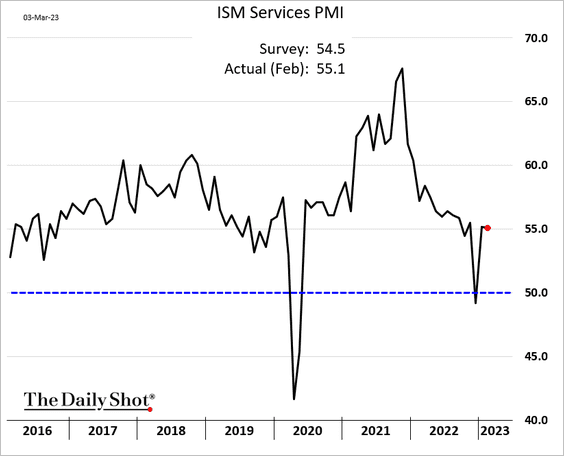

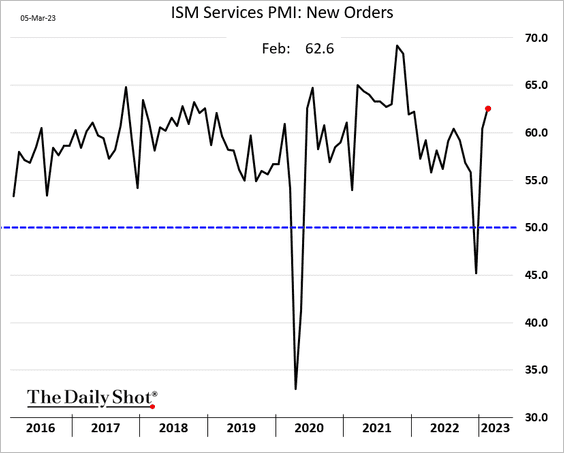

10. The service sector stays strong- Whereas manufacturing is weak and shopper spending slowing, the service sector stays robust. That is partially nonetheless resulting from restoration from the pandemic. There’s pent up demand for journey and leisure actions particularly, but additionally surgical procedures and plenty of different companies. Within the charts beneath, something over 50 is an growth.

The Each day Shot The Each day Shot

Headwinds

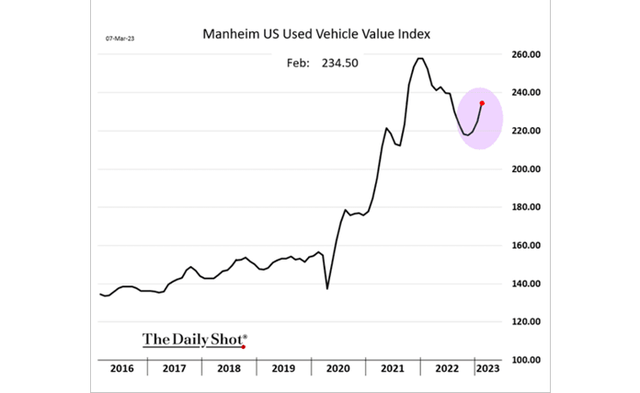

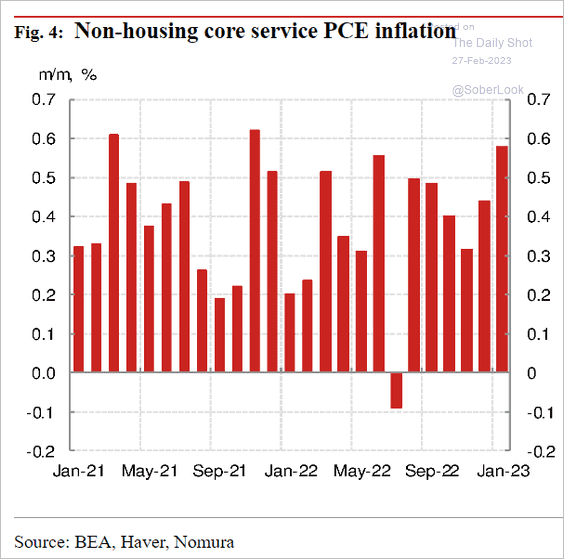

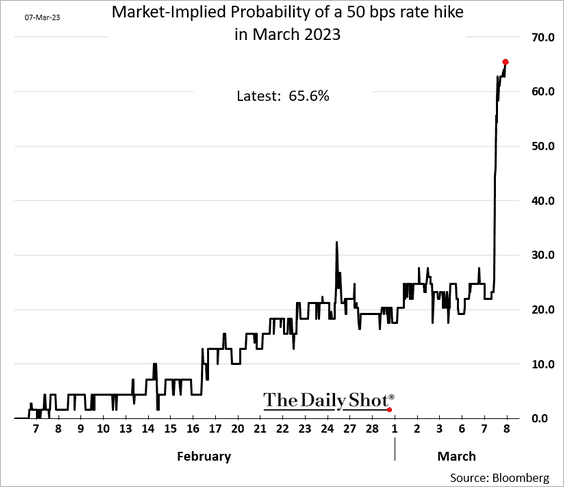

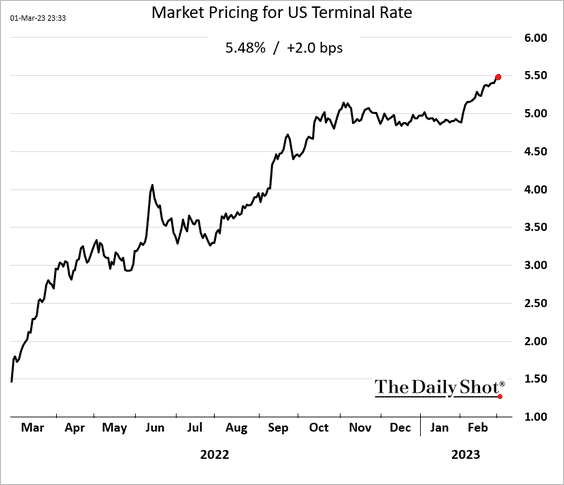

1. Inflation is effectively above norms and truly selecting again up – Quite a few latest stories confirmed inflation is just not solely nonetheless excessive, however in some circumstances at present rising. The chart beneath reveals one instance which is used auto gross sales. In response to ADP on March 8, 2023, annual pay rose 7.2% 12 months over 12 months. That is the primary motive the Fed has gotten extra hawkish recently and Fed Funds futures have been skyrocketing.

The Each day Shot, Manheim Varient Notion

2. Rates of interest are excessive and climbing – The Fed is being pressured to boost rates of interest greater than anticipated resulting from stubbornly excessive inflation. Excessive rates of interest can have a huge effect on some sectors of the economic system resembling housing but additionally company growth.

Euromonitor Worldwide The Each day Shot

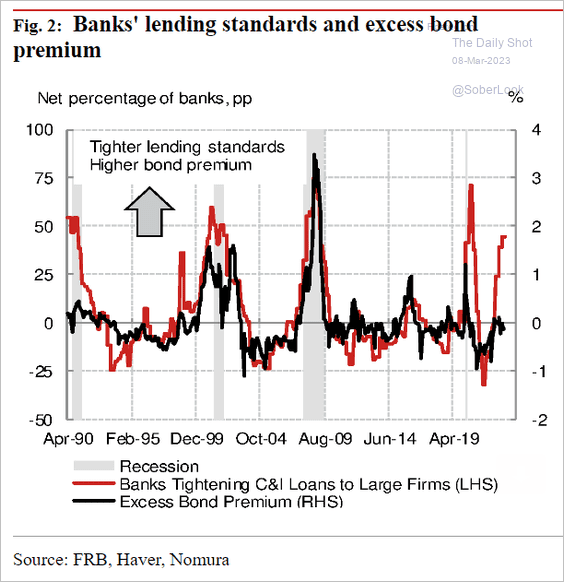

3. Banks are tightening credit score requirements – This normally leads to much less companies getting the credit score they should increase, keep or offset losses.

Federal Reserve, Haver, Nomura

4. Demand pulled ahead by huge stimulus – Pent up demand is such a strong financial issue that it has pulled us out of each recession (besides the final one) with or with out authorities stimulus. I exclude the 2020 transient recession as a result of the stimulus was to date above something ever carried out. In reality, the extreme stimulus pulled ahead demand. Pulled ahead demand is the alternative of pent up demand additionally fairly highly effective.

As I confirmed on this article the stimulus packages tried within the 2007-2009 recession all led to pulled ahead demand leading to a requirement drop off after the stimulus wore off. Federal authorities fiscal stimulus packages failed miserably over the last recession. The primary stimulus was the tax refunds in the summertime of 2008. The economic system fell off a cliff instantly after these refunds stopped. The subsequent massive stimulus was housing tax credit. These drove up house gross sales a bit and slowed the decline of house costs. As soon as the tax credit ended, house gross sales resumed their decline at a good sooner fee. The federal government additionally tried money for clunkers to stimulate automobile gross sales. Car purchases instantly returned to their former depressed fee as soon as this stimulus ended.

5. Stimulus fading- The federal government’s $4 trillion in stimulus has supported the economic system because it began in 2020. However most of that cash is now gone. These included rebate checks, PPP loans (truly grants) to enterprise, pandemic healthcare funds, enhanced unemployment advantages, enhanced meals stamps, scholar mortgage fee deferrals, mortgage and business mortgage fee deferrals and tax advantages. There are new stimulus packages such because the Inflation Discount Act, however it’s a lot smaller and unfold out over a long term.

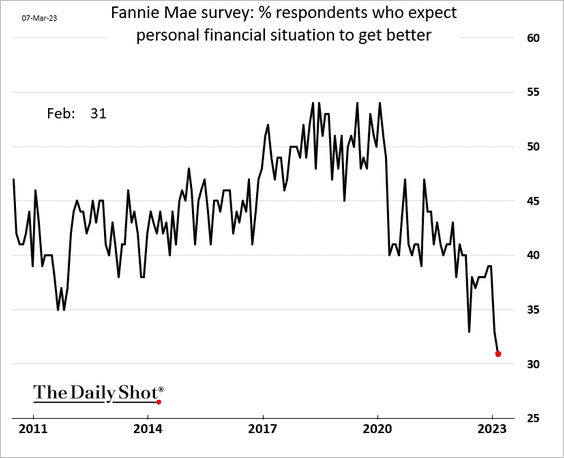

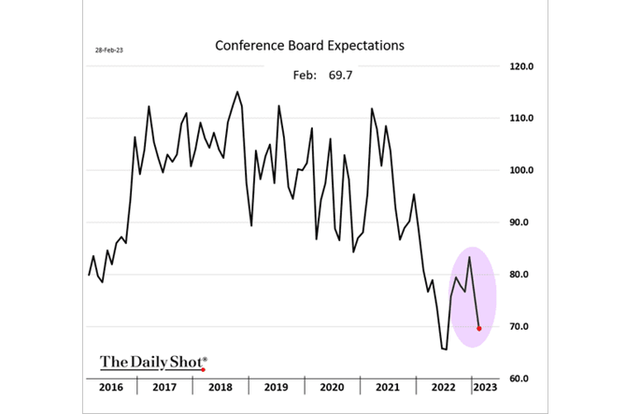

6. Client sentiment is low- Most surveys of shopper sentiment present it’s traditionally low. This was initially resulting from excessive inflation. Sentiment began to recuperate as inflation began to recede. However it’s declining once more resulting from a mixture of inflation, excessive rates of interest, and a probable recession.

Fannie Mae, The Each day Shot The Convention Board, The Each day Shot

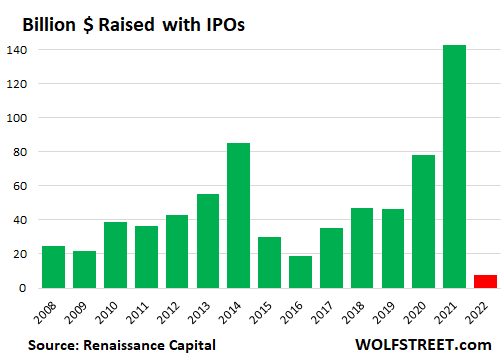

7. IPOs have fallen off a cliff – This implies corporations are having bother funding progress or losses. The variety of IPOs declined as 2022 went alongside and that exercise is nearly totally closed down proper now. Secondary issuances stay regular, however are literally a lot decrease when you think about what number of money-bleeding corporations want them now.

The Each day Shot

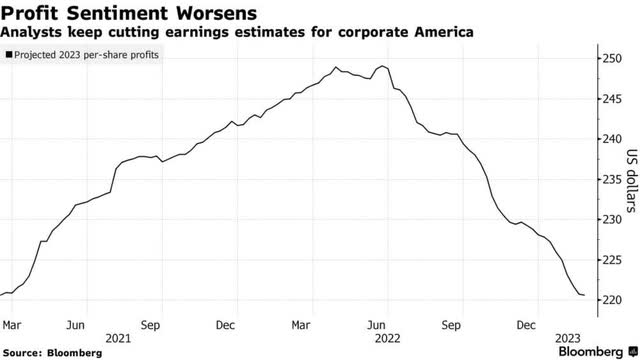

8. Company earnings estimates for 2023 are dropping quickly – Inventory market valuation is comprised of solely two elements, earnings occasions a a number of of earnings (PE ratio) to account for future money flows. Since mid-2022, analysts estimates for S&P 500 corporations earnings has persistently dropped for 2023. This can be crucial indication of a coming recession. I at all times watch earnings stories as they arrive out and an unusually excessive variety of corporations are guiding down proper now for 2023.

Bloomberg

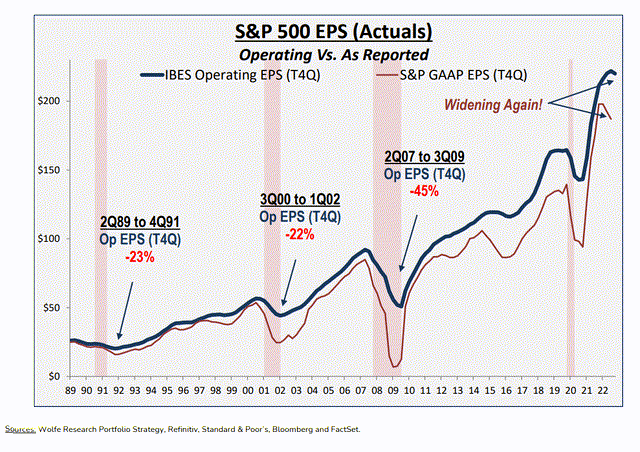

Along with the above, the standard of earnings can be dropping.

Wolfe Analysis, Refinitiv, S&P, Bloomberg, Factset

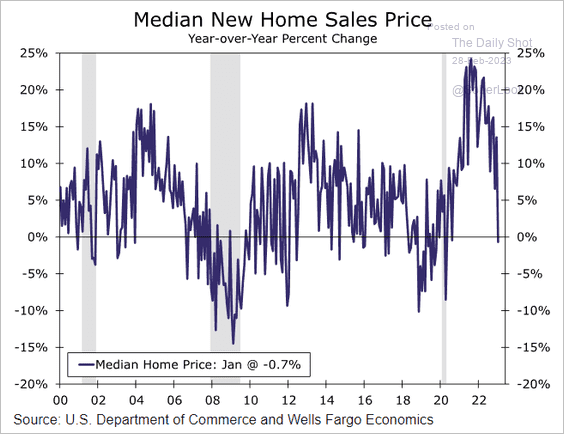

9. Housing is unaffordable and costs and new begins at the moment are declining – The 30 12 months mortgage fee has returned to over 7% after dropping some earlier this 12 months. Dwelling costs are traditionally excessive when in comparison with shoppers revenue. Each have brought on a big drop in new house development contracts. Additionally it is beginning to end in house value declines.

Federal Reserve, The Each day Shot The Each day Shot

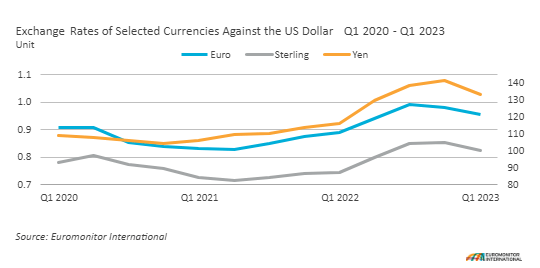

10. Energy of the greenback – The greenback is beginning to again off versus different currencies however remains to be fairly a headwind. Quite a few earnings stories point out the robust greenback diminished revenues and earnings final quarter. This additionally makes U.S. items costlier internationally, decreasing exports.

Euromonitor Worldwide

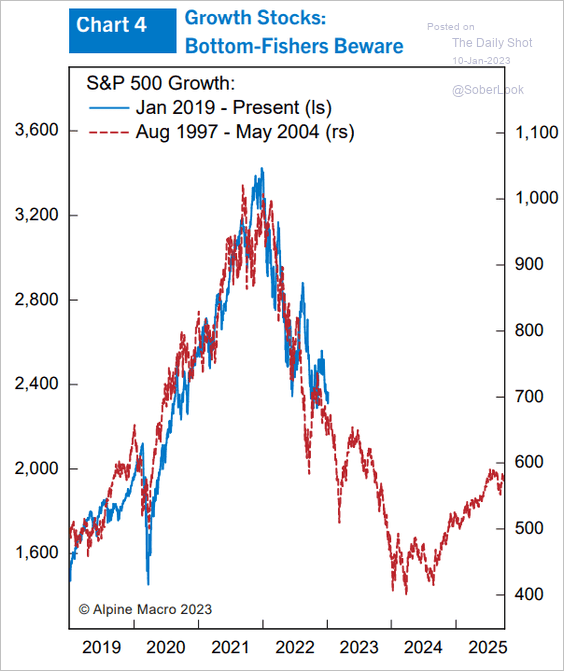

11. Bursting bubbles- This was major explanation for the 2000 and 2007-2009 recessions. In reality, there has at all times been a recession after a bubble burst going again to the Nice Despair. On this case, the quantity of bubbles was massive and included something larger danger. The final decade was an period of extreme danger taking that constructed up as the last decade progressed. Bubbles included speedy progress shares, IPOs, SPACs, cryptocurrencies, NFTs, meme shares and choices buying and selling. The chart beneath overlays the present market to the final inventory bubble in 2000.

Alpine Macro

12. The un-wealth impact of declining shares, bonds and possibly housing prices- Final 12 months most traders misplaced some huge cash on each shares and bonds. If a recession happens or charges proceed to go up, this may occasionally occur once more in 2023. Housing costs are simply beginning to decline.

US Division of Commerce, Wells Fargo

13. Refinance money out spigot shut off – Refinancing residences has traditionally been a significant supply of cash for shoppers to spend. With mortgage charges a lot larger, it’s too costly for a lot of to now faucet that supply. Additionally, house costs are beginning to decline, leaving much less fairness to borrow in opposition to.

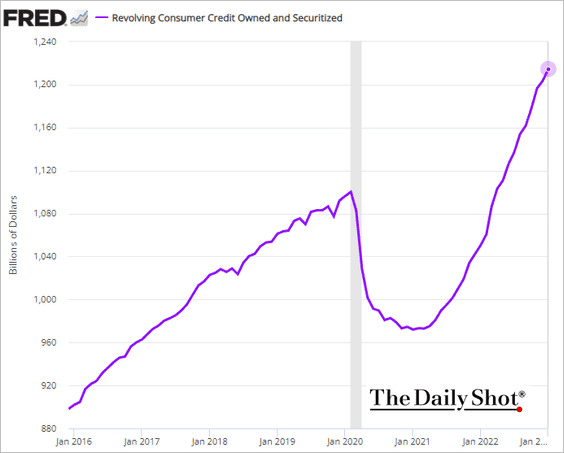

14. Client bank card balances growing now at a document pace- Bank card balances in 2020 and 2021 declined considerably as stimulus cash was used as a substitute. However the surge in bank card balances since signifies shoppers are more and more having bother paying for his or her purchases. It signifies the present shopper spending ranges could also be unsustainable.

Federal Reserve, The Each day Shot

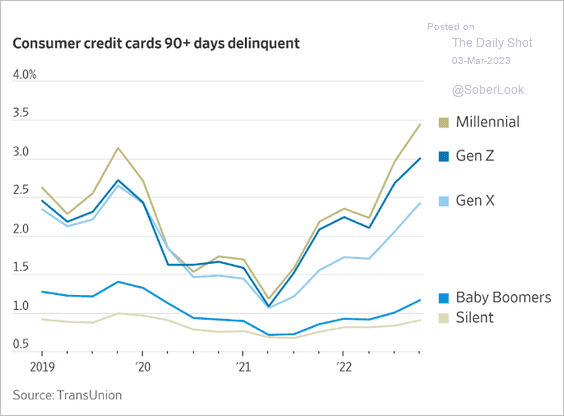

15. Client delinquencies at the moment are growing – Delinquencies have an extended option to go to get to disaster ranges however the pattern has turned destructive. The chart beneath reveals bank cards which normally have the best delinquency charges (apart from nonrevolving unsecured loans). However it is usually occurring in automobile loans and mortgages too.

Transunion

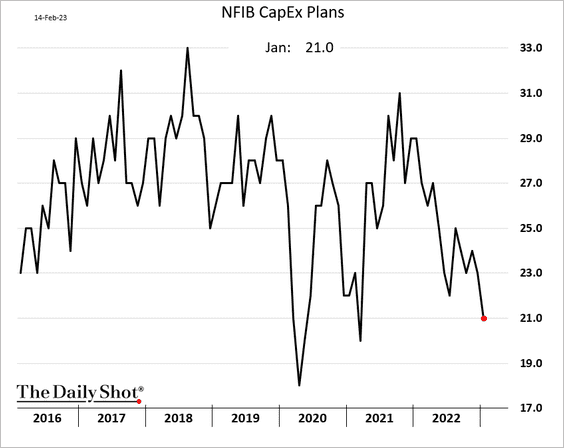

16. Executives now overwhelmingly anticipate a recession- It is a main drawback as a result of company executives in the reduction of on spending when anticipating a weak economic system. That’s typically a self-fulfilling prophecy. Much less spending means much less financial exercise.

Nationwide Federation of Impartial Enterprise, The Each day Shot

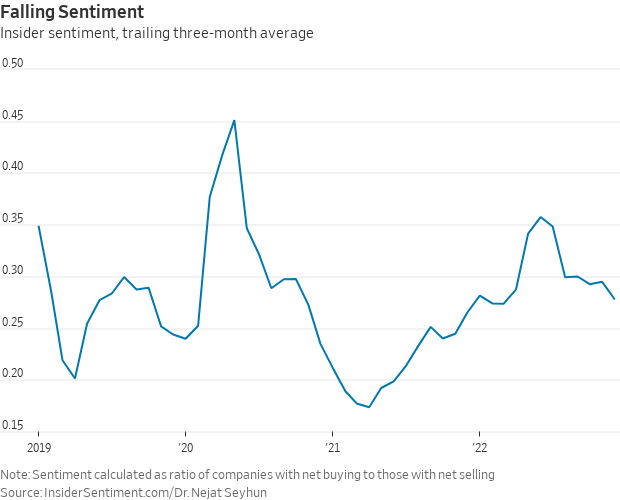

The chart beneath reveals insiders are beginning to promote extra and purchase much less of their very own inventory indicating much less confidence on future prospects.

InsiderSentiment.com Dr. Nejat Seyhun

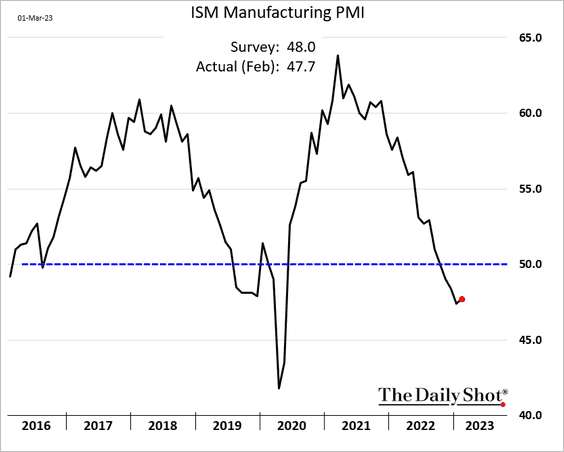

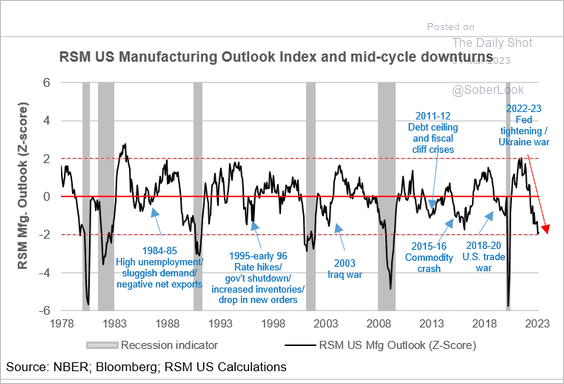

17. Manufacturing in recession- Manufacturing is already in recession within the U.S., beginning in late 2022.

The Each day Shot Nationwide Bureau of Economics Analysis, Bloomberg, RSM US Calculations

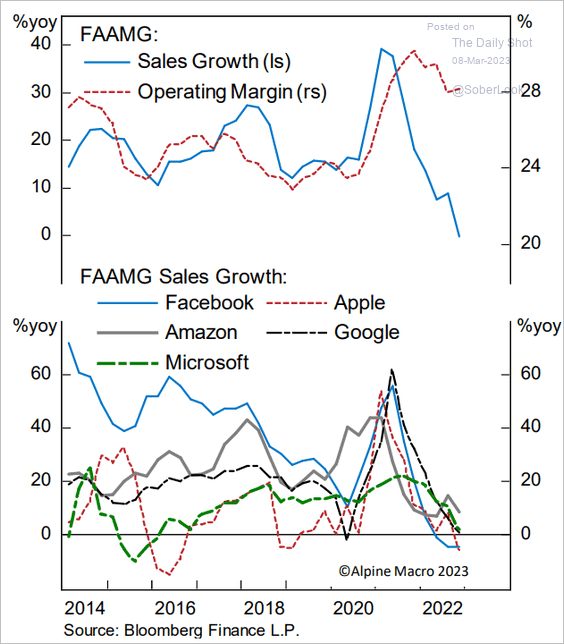

18. FAAMG shares have hit a wall – The FAAMG shares (Fb now Meta, Apple, Amazon, Microsoft and Google now Alphabet) drove the economic system and inventory marketplace for a decade till a 12 months in the past. Progress amongst simply these 5 was a big portion of our total financial progress. They’re now all dealing with little progress, elevated regulatory push again and declining margins. We might want to discover new inventory market and financial leaders.

Bloomberg

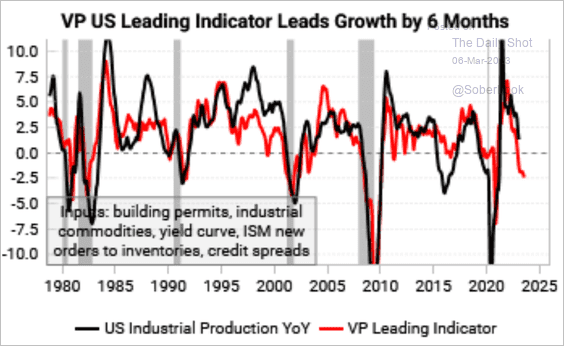

19. Main indicators sign a recession- The chart beneath reveals main indicators resembling constructing permits, commodities, new orders and credit score spreads point out we’re near a recession.

Varient Notion

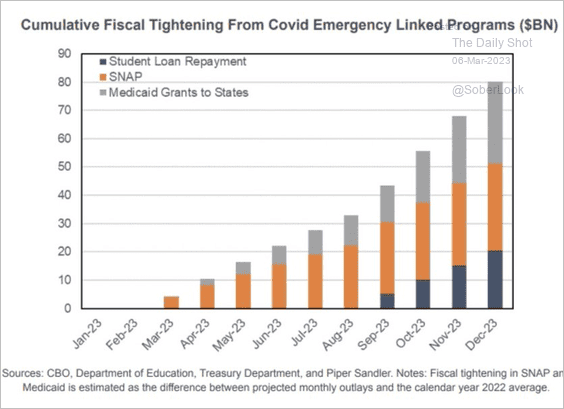

20. Fiscal tightening as Covid packages wind down- Stimulus packages are winding down.

CBO, Division of Schooling, Treasury Division, Piper Sandler

There’s one other potential large headwind that isn’t a difficulty but. The U.S. will run out of cash to pay on its obligations someday this summer season in accordance with the Treasury Division and different sources, if the debt ceiling is just not raised.

Sorting all of it out

The economic system is primarily being supported by shopper spending. This spending has slowed some however has continued at a robust sufficient degree to keep away from a recession. It has been extended by large continued money shopper financial savings from the stimulus packages, elevated bank card utilization, provide chain enhancements, and wage will increase. All of those are non permanent elements. Additionally, most retailers are beginning to really feel some slowdown.

After I analyze a person inventory, I first take a look at the tailwinds (I name them catalysts and strengths) and headwinds (I name them considerations or dangers). The second step is to take a look at that are essentially the most impactful. I do the identical when wanting on the economic system.

In my view. the 2 most impactful tailwinds are the surplus money being held by shoppers from the stimulus and the robust labor market. It’s because each are holding up shopper spending. The Fed is doing every part they’ll to weaken the labor market and the surplus stimulus has been steadily draining away. A lot of the tailwinds are non permanent conditions.

Most likely essentially the most impactful headwinds are #4, #5 and #8. Quantity 8 is the earnings estimates declines. Company earnings are probably the greatest indications of the economic system. Declining estimates have been fixed and present no signal of slowing down. Earnings estimates for the S&P 500 have declined to the purpose they’re nearly even to 2022. However they’re weighted towards a big decline on this quarter to an earnings improve within the second half of the 12 months. It’s unlikely the second half of the 12 months will enhance that a lot contemplating that rates of interest are prone to be larger then.

Headwinds #4 and #5 are the fading stimulus and the pulled ahead demand. One is shortly working out of capability to assist the economic system, the opposite has diminished demand going ahead.

Additionally regarding is the breakdown within the FAAMG shares and tech shares usually. These together with some healthcare shares have led the economic system for the previous decade. However progress throughout the board has slowed and elevating capital has gotten a lot tougher both by IPOs, personal fairness, enterprise capital or debt financing (larger charges).

One remaining notice. Recessions are wanted to shake out extra hypothesis and capability. And not using a shakeout we stay extremely susceptible to a good deeper recession. A lot of the shake out hasn’t occurred but. Nonetheless, the blow up of SVB Financial institution yesterday signifies it’s beginning not less than within the VC and PE industries.

Financial conclusion

There’s typically a couple of 9-month lag between Fed tightening and its affect being felt within the economic system. That signifies that the affect ought to begin in earnest quickly. I additionally consider the labor market is near an inflection level the place it should begin to weaken with accelerating pace.

Primarily based on the above, my view is that if Fed coverage stays tight into the summer season, the economic system will dip right into a recession by fall. Whereas the Fed pushing up rates of interest is only one of many headwinds, it needs to be sufficient to be a tipping level on prime of all the opposite headwinds. It’s because most of these tailwinds supporting the economic system could have pale considerably by then.

Take away

I nonetheless consider a recession is coming, and it’ll seemingly begin this 12 months.

Follow sectors much less prone to see large earnings declines resembling shopper staples, utilities, and telecom. Decrease weighting to cyclical shares resembling mining, discretionary, tech, and riskier financials. Keep away from something larger danger. We are going to seemingly be in a danger off world for some time.