Jose Colon/Getty Photos Information

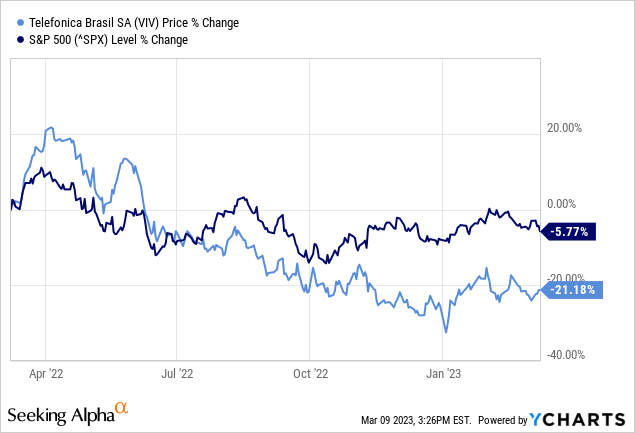

Telefônica Brasil S.A. (NYSE:VIV), also called Vivo, is a Brazilian telecommunications firm that gives a variety of fixed-line and cellular telecommunications companies to residential and company clients all through Brazil. Whereas the inventory had been performing nicely over the past yr, it started underperforming the market in July and is presently down -21.2% on a 1-year foundation, in comparison with the S&P500’s decline of -5.8%.

Funding Thesis

In 2022, Telefônica Brasil skilled income progress that exceeded the inflation price because of its sturdy working efficiency, indicating its skill to move prices onto clients whereas producing extra earnings. Moreover, the corporate is presently increasing its fiber optic infrastructure, and its variety of linked houses has presently reached 24 million and is predicted to rise to 29 million by 2024. The corporate’s potential for sturdy income progress is linked to its participation within the quickly increasing fintech market and the anticipated progress in cellular funds. This potential for progress is anticipated to yield important returns each within the close to future and over the subsequent decade. Regardless of being undervalued when in comparison with different telecommunication giants primarily based on metrics reminiscent of EV/Income and EV/EBIT, the corporate has a definite place to steer in 4G, 5G, and fiber applied sciences, making it a horny funding prospect.

Person progress, a robust indicator of market demand

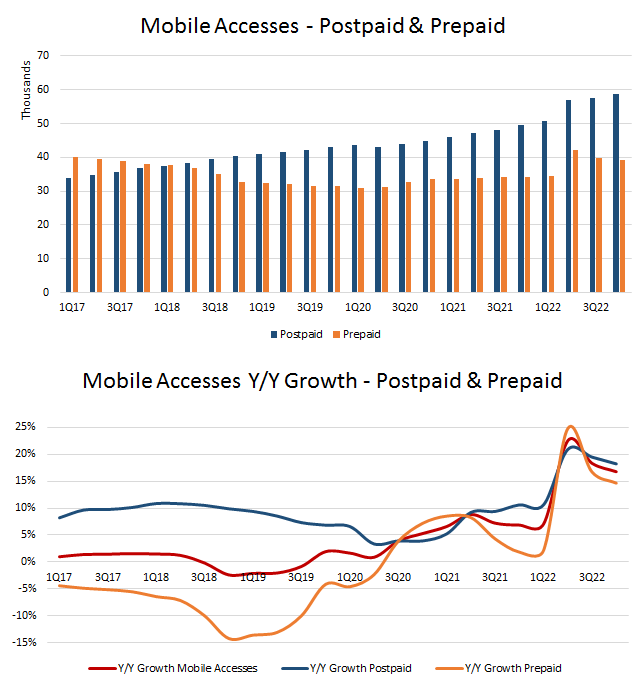

Telefônica Brasil’s consumer base has skilled a constant progress trajectory over the previous few years, with over 97.98 million cellular accesses and over 58.67 million fixed-line clients as of 4Q22. The spectacular 16.8% enhance in cellular clients and 18.2% enhance in fixed-line clients in comparison with the earlier yr might be attributed to the excessive demand for cellular knowledge companies in Brazil. Furthermore, the corporate has invested considerably in its cellular community infrastructure to fulfill this demand, leading to greater buyer acquisition and retention charges.

Telefônica Brasil Cell accesses (Firm filings (Created by writer))

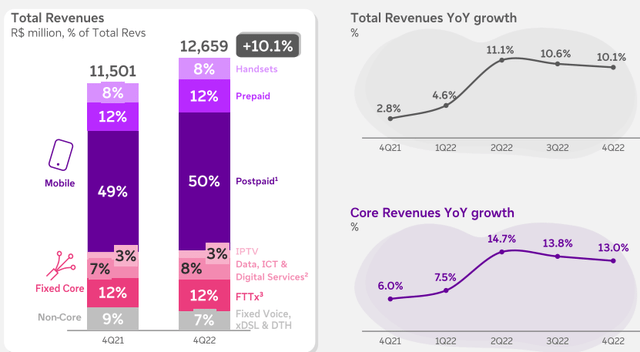

Telefônica Brasil’s pay as you go consumer base has skilled fluctuations over time; nevertheless, the corporate’s postpaid section has been a major driver of progress, contributing roughly 50% of the corporate’s complete income. In 2022, the postpaid section has grown at a double-digit price, resulting in elevated income for the corporate.

Telefônica Brasil Revenues (Firm presentation)

Telefônica Brasil is actively increasing its fiber optic infrastructure, with the aim of passing 29 million houses by the top of 2024. As of the top of 2022, the corporate had already handed 23.3 million houses with FTTH, a rise of three.7 million new premises from the earlier yr. This leaves the corporate with a goal of accelerating its footprint by a further 5 million houses within the coming years (roughly 2.5 million per yr, which is possible primarily based on the earlier progress pattern). The deployment of fiber infrastructure is a key driver of the corporate’s progress technique, because it permits for quicker and extra dependable web connectivity for each residential and company clients.

In 2022, Telefônica Brasil acquired a portion of Oi’s cellular belongings, with an estimated creation of R$5.4 billion ($1.09 billion) in worth, considering efficiencies in prices, investments, and incorporation prices. Because of this acquisition, Telefônica Brasil’s 2022 capital expenditures elevated by 9.7% year-on-year, totaling R$9,530 million, with R$0.5 billion being attributed particularly to the acquisition. The corporate goals to finish the migration of Oi Movel’s shoppers to its base by the top of Q1 2023.

Telecom in Brazil, a rising trade

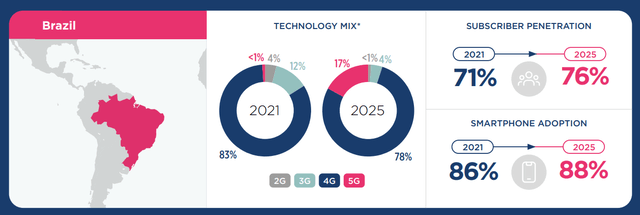

The Brazilian telecom market has been experiencing important progress, pushed by the nation’s rising inhabitants, demand for communication companies, and rising adoption of smartphone companies. This progress is predicted to be supported additional by regulatory authorities, who’re anticipated to play a significant position within the transition to the 5G community.

In accordance with the GSMA report, Brazil is predicted to have extra 14 million new cellular subscribers by 2025, with the adoption of 5G networks on the rise as 3G and 4G clients steadily migrate. This transition is supported by the enlargement of latest networks and the machine ecosystem.

Subscriber and know-how tendencies in Brazil (GSMA Report -The Cell Economic system Latin America)

However, Statista’s knowledge exhibits that over 167.54 million individuals accessed the web by way of cellular gadgets in 2022. It’s projected that this determine will enhance by roughly 12.7% to succeed in roughly 188.8 million cellular web customers by 2027. As well as, it’s anticipated that round 85.38% of cellular customers in Brazil may have entry to the web by way of their cellphones by 2027.

When it comes to market share, Vivo, owned by Telefónica, was the biggest wi-fi operator in Brazil within the second quarter of 2022, holding 38% of wi-fi subscribers. TIM and Claro adopted with 32% and 28% of the market share, respectively.

Based mostly on the sturdy fundamentals talked about above, Vivo’s progress prospects within the upcoming interval seem promising. Now, let’s transfer on to the monetary and valuation elements of the corporate.

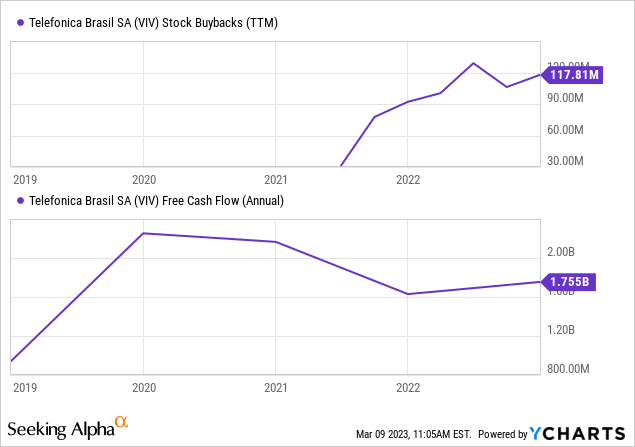

Strong Money Era and Shareholder

Remuneration Technique

Telefônica Brasil’s sturdy money technology capability is mirrored in its closing free money movement of BRL 7.3 billion, which allowed the corporate to distribute over BRL 5 billion in dividends and curiosity on capital, in addition to make investments BRL 600 million in share buybacks. The corporate believes its shares to be undervalued and has launched a brand new share buyback program concentrating on BRL 500 million over the subsequent 12 months. In 2022, the corporate delivered an 11.3% free money movement yield, among the many greatest within the sector, indicating the resilience of its enterprise beneath any circumstance.

Total, Telefônica Brasil’s sturdy money technology capability positions it nicely for future progress and shareholder remuneration.

Strong monetary efficiency

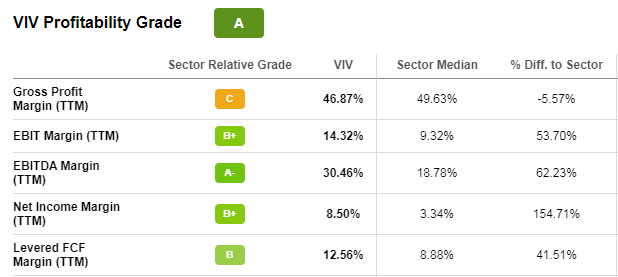

Profitability metrics outperforming friends

Along with its sturdy profitability metrics, Telefônica Brasil’s give attention to excessive funding in its networks, price effectivity, and strategic acquisitions have contributed to its superior efficiency in comparison with its sector friends. This has resulted in better-than-average EBIT, EBITDA, and internet earnings margins, indicating the corporate’s skill to generate greater earnings from its operations. Total, these elements show Telefônica Brasil’s dedication to sustaining a robust monetary place and its skill to maintain its profitability in the long term.

Telefônica Brasil – Profitability Grade (SeekingAlpha)

Valuation

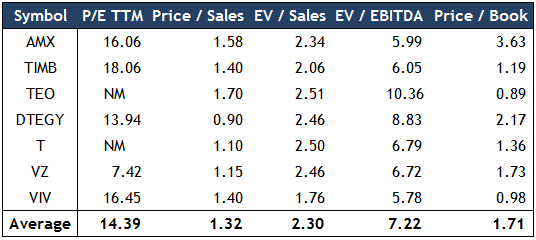

Telefônica Brasil’s valuation might be analyzed utilizing varied metrics, together with P/E, Worth/Gross sales, Worth/Guide, EV/Gross sales, and EV/EBITDA. By evaluating these multiples to its regional and worldwide friends, it’s potential to realize insights into the corporate’s relative valuation.

Telefônica Brasil Friends – Multiples (Information from SeekingAlpha – Desk by Creator)

To find out the truthful worth of the corporate, I calculated the typical valuation multiples of its friends. Accordingly, the estimated truthful worth of Telefônica Brasil primarily based on every of the talked about metrics is:

P/E TTM: 6.62 Worth/Gross sales: 7.18 EV/Gross sales: 11.29 EV/EBITDA: 10.74 Worth/Guide: 13.28

Due to this fact, the truthful worth of Telefônica Brasil is estimated to be between $6.62 and $13.28, relying on the a number of used, with a mean truthful worth of $10.48.

Funding dangers

Traders who’re contemplating investing in Telefônica Brasil ought to concentrate on the potential funding dangers related to the corporate. One main threat to think about is the excessive stage of competitors within the Brazilian telecommunications sector. With main gamers reminiscent of América Móvil and TIM Participações vying for market share, Telefônica Brasil might face challenges reminiscent of value wars, diminished margins, and decrease profitability.

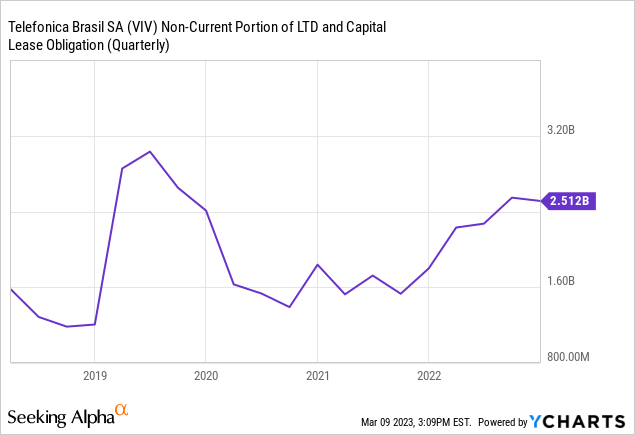

One other threat issue is the extent of indebtedness, which elevated considerably over the previous few years, which is a trigger for concern as rising world rates of interest might impression the price of borrowing and the price of implementing enlargement tasks. This might end in greater curiosity bills and decrease earnings, which may negatively have an effect on the corporate’s monetary efficiency.

Moreover, the corporate can also be uncovered to foreign money dangers, as a good portion of its debt is denominated in international foreign money. Any important fluctuations within the Brazilian actual or foreign currency may impression the corporate’s monetary efficiency and profitability.

Key Takeaway

To sum up, after conducting this evaluation, it seems that Telefônica Brasil S.A. is undervalued compared to its friends, indicating a promising upside potential for buyers. The corporate’s sturdy monetary efficiency, constant income progress, and profitability margins, together with its dedication to investing in community infrastructure and digital companies, place it as a robust participant within the telecommunications trade in Brazil. With a well-established infrastructure, the corporate has the potential to capitalize on its strengths and enhance its market share. Nevertheless, buyers ought to concentrate on the potential dangers related to investing in a aggressive and quickly evolving trade, and punctiliously take into account their funding choices.