Darren415

This text was first launched to Systematic Earnings subscribers and free trials on Mar. 3.

Welcome to a different installment of our BDC Market Weekly Evaluate, the place we focus on market exercise within the Enterprise Improvement Firm (“BDC”) sector from each the bottom-up – highlighting particular person information and occasions – in addition to the top-down – offering an outline of the broader market.

We additionally attempt to add some historic context in addition to related themes that look to be driving the market or that buyers should be conscious of. This replace covers the interval by way of the primary week of March.

Make sure you take a look at our different Weeklies – protecting the Closed-Finish Fund (“CEF”) in addition to the preferreds/child bond markets for views throughout the broader earnings area. Additionally, take a look at our primer of the BDC sector, with a give attention to the way it compares to credit score CEFs.

Market Motion

BDCs had been flat on the week, taking a pause from a robust current run. Yr-to-date, the sector stays the most effective performer throughout the earnings area, supported by continued dividend hikes and secure portfolio high quality.

Systematic Earnings

The full return index is flat from the beginning of 2022 – a welcome consequence for buyers, significantly for individuals who took benefit of various drawdowns in 2022 so as to add holdings.

Systematic Earnings

Common BDC valuation stays round 100%, not removed from its historic common. This leaves a smaller margin of security for buyers, significantly as internet earnings will increase are more likely to decelerate over the approaching quarters given the leveling off in short-term charges.

Systematic Earnings

Market Themes

Traders who’ve paid consideration to BDC Q3 and This fall earnings releases doubtless seen the quantity of internet earnings beats which appear to be there for nearly each firm. What’s driving such good internet earnings numbers and why had been analysts so pessimistic?

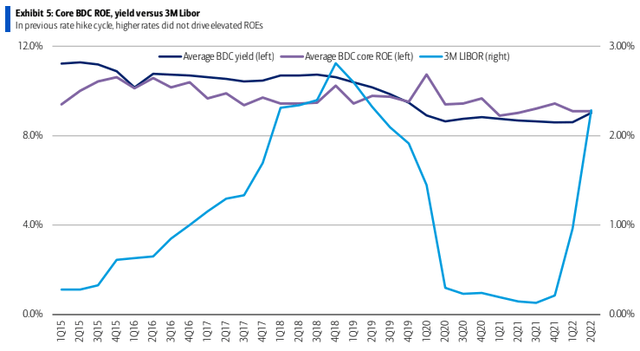

Aside from a possible conservative stance by analysts (who do not wish to seem like overly bullish cheerleaders), the important thing motive for such pessimism on internet earnings is that, within the final climbing cycle, internet earnings (or core ROE within the chart under) really fell as this chart reveals.

BOA

Nevertheless, as we mentioned in September, there are vital variations between as we speak’s climbing cycle and the earlier one.

First, the rise in base charges has been considerably increased and steeper this cycle than it was within the earlier one. Quick-term charges have already risen by over 4.5% (and are anticipated to maintain rising) versus round 2% within the final cycle.

FRED

Two, we’re going by way of a extra gentle default setting as the next chart reveals. This retains portfolios values and earnings ranges increased.

S&P

Three, many BDCs had been in a position to lock in ultra-low bond yields over 2021, additional boosting internet earnings ranges.

FRED

As we’ve got highlighted various occasions, the present setting is just about pretty much as good because it will get for BDCs. That mentioned, we do not anticipate the sorts of internet earnings positive aspects we’ve got seen over the past couple of quarters to final previous Q2 given the slowing in short-term charges because the Fed is approaching what’s more likely to be its terminal coverage price. This implies we’re additionally much less more likely to see the sturdy tempo of dividend hikes throughout the sector and this may take away an essential worth help mechanism. As we spotlight under, this growth alongside pretty excessive valuations means we’re turning extra cautious on the sector.

Market Commentary

Trinity Capital (TRIN) noticed a 4.2% NAV drop in This fall largely on account of additional writedowns in Femtech and bitcoin miner Core Scientific. From the seems to be of it, this (and extra) was solely priced in because the inventory rallied strongly on the information, leaving its 104% valuation 5% above the sector common. Web earnings rose by 10% for protection of barely above 100%.

The value of bitcoin has risen sharply because the begin of the 12 months in order that has supported its different miner positions. Given the corporate’s current NAV trajectory, there may be now a form of destructive margin of security within the inventory. It’s doubtless the market thinks the miner positions are going to get written again up given what’s occurred to bitcoin and that would very properly be the case nonetheless that’s a reasonably speculative guess since this factor very a lot is dependent upon the value of bitcoin.

Blackstone Secured Lending (BXSL) reported This fall outcomes. The corporate hiked the dividend by 17% to $0.70. Recall the corporate stopped paying the specials which had been there to help the inventory in the course of the lock-up expiries. That opened up a large hole between internet earnings and the bottom dividend, significantly in a interval of sharply rising internet earnings (BXSL has a excessive internet earnings beta relative to the sector, owing to an above common stage of floating-rate belongings, below-average stage of floating-rate debt and above-average leverage).

All this meant that a big dividend hike was on the playing cards as mentioned in our earlier article on the inventory. Nevertheless, even with the dividend hike, protection stays very excessive whereas internet earnings continues to extend. Non-accruals remained at zero and the NAV rose by a bit lower than 1% p.c. Laborious to ask for something higher.

Stance and Takeaways

Our current focus within the sector has been two-fold. One was to improve our allocations in direction of higher-quality, higher middle-market sub-sector and extra diversified BDCs comparable to BXSL, ARCC and OCSL. And the opposite was to begin to marginally unwind our allocation to the sector, decreasing a place that was elevated over 2022 in favor of extra resilient securities comparable to BDC child bonds. A lowered margin of security makes it much less compelling to succeed in for yield in higher-beta securities like BDC frequent shares, significantly at this stage of the macro cycle.