photoman

Owe Not For Your Soul by Paul Wong

Whenever you owe,

the fruits of your labor go.

To whom we have to know,

the grasping lords who lure us to give up our souls.

This poem is for each people and nations.

Introduction

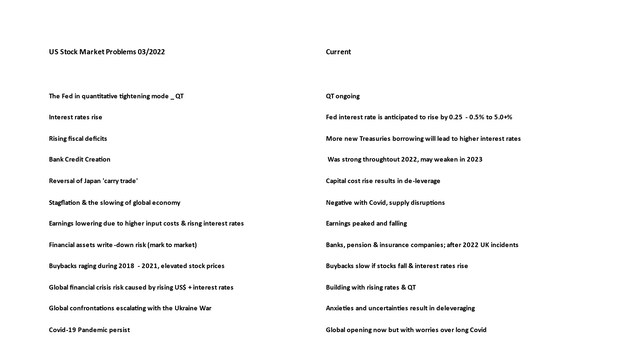

The US inventory market is dealing with powerful issues as listed beneath.

Paul Wong

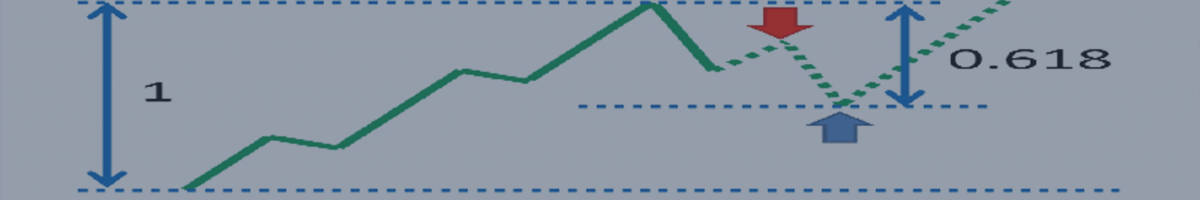

Lots of the issues are secular, corresponding to 40 years of falling rates of interest to zero that reverse quickly. Falling asset costs are the corrections of the extreme previous financial insurance policies. The desk beneath compares a few of the prior inventory crashes with the present situations.

Paul Wong

The combination of issues could make the present inventory market fall last more and deeper. These issues probably pose the largest problem in a century, as a result of now we have not confronted all these points on the identical time. Complete international money owed throughout rising rates of interest are the causes that may destroy the economic system and the monetary markets. The repair can solely be remedied by austerity, lowering fiscal and commerce deficits in direction of zero, however is discarded by politicians. As an alternative, peace is compromised as evidenced by international conflicts and will increase in navy budgets within the final 15 months. The interior debt issues of the developed nations are transferred to grow to be exterior geopolitical issues, as liberal democracies grow to be extra capitalistic. Freedom is granted however voices will not be heard.

The escalation of worldwide conflicts additional exacerbates troubles for the inventory market. The percentages are the present correction/bear market can be longer in period than the earlier crashes proven above. There’s little hope for international inventory markets for the following two years till the central banks renew financial easing once more.

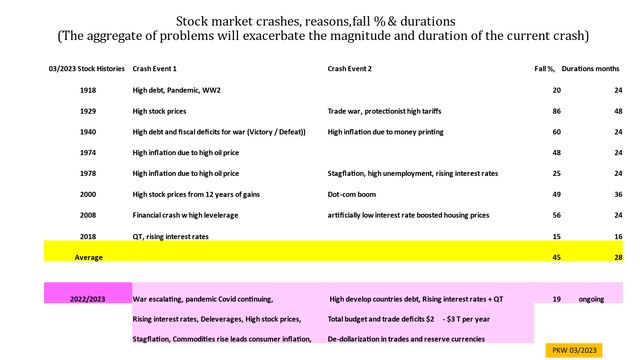

Shopper value inflation and Asset value inflation

Shopper value inflation and asset value inflation are the two sides of a coin of the results of central banks’ cash growth. Shopper value inflation, generally generally known as inflation, is extra advanced with a time delay by the central banks’ cash growth; however has little affect on quick inventory efficiency.

Asset value inflation describes the rise within the value of belongings and is usually instantly dictated by the quantity of progress of base cash and financial institution credit score within the system. Formulating this value, the impact by the reason for the sum of money and credit score, as an equation is feasible for extra analysis.

The chart beneath reveals the connection between shopper and asset value inflations, simplified as CPI and (SPY + TLT). Whereas asset costs reacted favorably to the Fed’s financial easing, shopper value inflation has a time lag of about 9 months. The inflation forces the Fed to boost rates of interest since March 2022 which has led to asset value deflation. If rates of interest rise extra, asset costs will fall in response. This course of doubtless will proceed. If that’s the case, the Fed might begin financial easing once more someday subsequent 12 months.

Hedging in opposition to shopper value inflation or the lack of buying energy of the greenback within the coming years begins with bodily gold and silver.

Paul Wong

The relativity of belongings

My analysis on relativity concentrates on the connection of every asset in opposition to the others utilizing easy formulation corresponding to averages, to spotlight or rank the belongings to assist timing for buying and selling functions. The work makes an attempt to complement different technical analyses; by broadening the comparisons with different belongings.

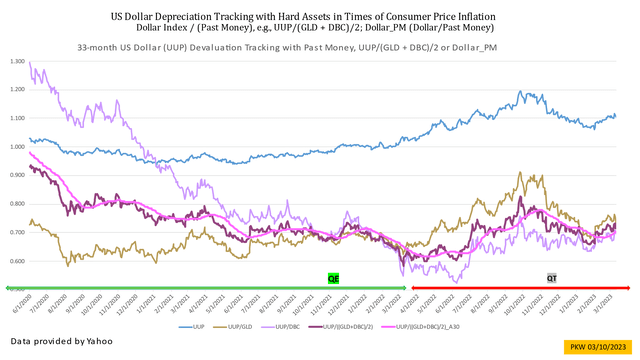

The next chart reveals the autumn and rise of the greenback index in mild blue colour in the course of the current quantitative easing adopted by quantitative tightening intervals. The pink colour curve is a smoothed curve of the greenback divided by previous cash, UUP/((GLD + DBC)/2). The curves are used to look at the pattern actions of every asset. Final summer time, the pink curve was falling regardless of rising of the greenback index indicating even stronger gold and commodity costs. When the fiat system is in hassle, the previous cash ought to carry out nicely as diversifying alternative.

The greenback has been robust the previous month. This power can lengthen additional for the following 3 months relative to the Euro and the Yen, each have critical issues of upper inflation or decrease rates of interest than the US.

The information place to begin for the charts was from June 2015.

Paul Wong

The worldwide fiat system is beneath the stress of excessive whole debt. The unrelenting rising rates of interest are responding to excessive shopper value inflation, most asset costs are deflating together with bonds; the UK pension disaster in October 2022 was only a preview with the greenback main the best way. A repeat of the disaster in 2023 is probably going when rates of interest preserve elevating.

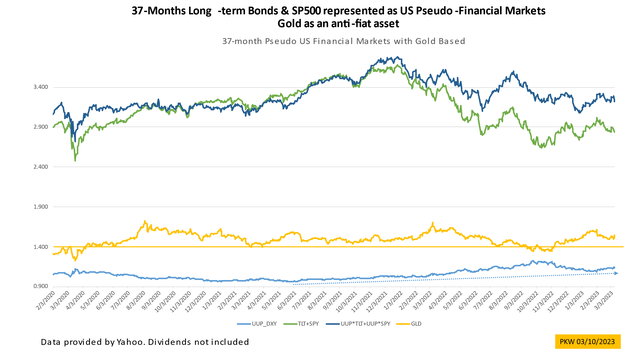

The charts beneath are composed of main asset lessons. The US pseudo-financial markets are represented by the sum of SPY and TLT in mild inexperienced. The mixture of SPY and TLT fell 24% in 2022 as a result of shares and long-term treasuries each carried out poorly, which seldom occurred earlier than suggesting larger difficulties than regular.

The pseudo-financial markets with the greenback index in darkish blue colour cushion the falls, due to the power of the greenback. This blue curve goals to characterize the US fiat system of foreign money, bonds, and shares. The asset value inflation from quantitative easing was accomplished by the tip of 2021. The following bond and inventory value deflations are ongoing with quantitative tightening; the greenback is one of the best performer when rates of interest are rising. Gold holds worth nicely.

This darkish blue curve with the identical parameters may also be used for different nations corresponding to UK or Japan, to check the fiat programs amongst nations. The US is in significantly better form due to the power of the greenback.

Paul Wong

In a rising fee and quantitative tightening setting, money performs nicely, and ultra-short-term treasuries are even higher.

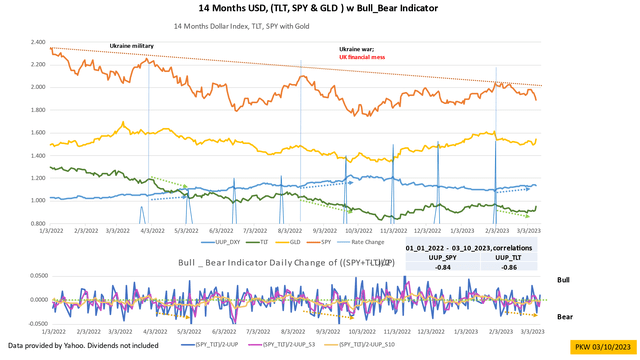

The burden of the rising nationwide debt is manifested by TLT, the long-term treasuries in inexperienced colour within the chart beneath. The worth slide that began in August 2020 touched -46% 4 months in the past. The autumn in value exemplifies the tip of the secular change after 40 years of reducing rates of interest. The primary motive for the once-steady long-term treasuries to fall drastically is because of rising rates of interest, which may be estimated by the online current worth method. Mark-to-market losses can be troublesome for a lot of banks and firms. A unique mentality in contemplating TLT is required as a result of additional loss is probably going if rates of interest preserve climbing. Sooner or later, the market will resolve how excessive the rates of interest can go.

A brand new black swan simply took flight. Silicon Valley Financial institution suffered a $1.8 billion loss attributable to the sale of a $21 billion bond portfolio consisting principally of U.S. Treasuries. Globally, the query of mark-to-market losses on long-term company and authorities bonds is damaging the stability sheets of many monetary corporations.

Each TLT and SPY, in orange, carried out inversely with UUP in mild blue. The correlations within the final 14 months are -0.84 and -0.86. The underside chart is a brand new try at a bull-bear indicator, the every day change of the typical of SPY and TLT minus UUP. Bull is constructive when the ensuing quantity is constructive, and detrimental for bear. The purple and darkish yellow curves are 3 and 10-day working means. The chart is meant for timing functions of rotating from inventory and bonds to money, risk-on to risk-off. Discover the inexperienced, blue, and darkish yellow arrows all lined up properly, signaling the swap to bear when the darkish yellow curve began sinking beneath the zero line.

The greenback is essentially the most important asset throughout this era of quantitative tightening and rising rates of interest. Gold is just like money in holding worth over the previous 12 months, though gold strikes inversely to the greenback every day.

Bull-Bear indicator of main belongings (Paul Wong)

Gold in instances of QT

Bodily gold is an anti-fiat asset that has no counterparty danger. Along with different commodities, they’re the origin of the cash which have been displaced by fiat currencies. Particularly after 1971, the greenback was now not backed by gold. Currencies can work nicely if governments are disciplined in balancing the budgets however report nationwide money owed in developed nations counsel in any other case. Within the truest sense, the worth of a foreign money ought to replicate the inverse of the sum of base cash and nationwide money owed as they’re backed by the religion and credit score of a rustic. This progress pattern of fiat cash and money owed favors gold going ahead compared to any foreign money.

The report accumulation of gold by many central banks in 2022 sends a transparent message that corporations and people ought to do the identical. Recently, many states are proposing to have some gold of their reserves.

Drawdowns within the COMEX vaults are vastly constructive for the longer term value of gold. The day of the worth represents bodily as a substitute of paper gold is approaching as quickly as year-end 2023. That is secular for gold and silver.

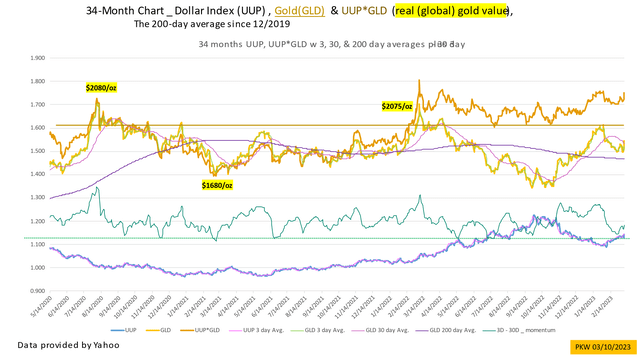

The chart beneath reveals the worth of the greenback in mild blue, gold, greenback multiplied by gold in orange colour. This actual gold worth curve is in an uptrend since mid-October indicating robust efficiency regardless of quantitative tightening by the Fed. The teal colour curve, 3 days -30 days momentum, appears to be timing indicator.

Paul Wong

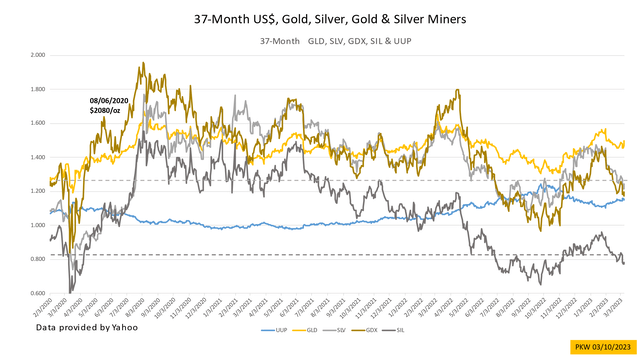

The miners bottomed in October, the uptrend has been interrupted lately by the robust greenback, which drove the costs of gold and silver down. The miners are undervalued as in comparison with different sectors due to being out of favor. Instances are altering when the worldwide monetary system is being examined with falling asset costs beneath excessive money owed. The miners are good diversifying decisions due to their ties to gold and silver.

Paul Wong

Conclusion

Report debt means the elites have by no means been richer and the individuals have by no means been poorer, from the diversion of web price previously 50 years. This spherical of economic asset value deflation could make the wealth hole even wider if the center class took the brunt of losses. The imbalance is inflicting protests in Europe that will unfold globally when inflation rises. To fight inflation with a better rate of interest labored earlier than with Volker however will deliver a slowing economic system and deflation of economic belongings for a few years.

The fiat system is beneath siege for the explanations talked about above. By separating the elements of the system into foreign money, bonds, and shares, funneling out the winners from losers turns into clearer throughout instances of quantitative tightening and rising rates of interest. As lingering stagflation takes maintain, shares and bonds can fall additional. Just like the mid-Seventies, shopper value inflation and asset value deflation occurred concurrently amid ascending rates of interest, and gold was the massive winner. The brand new charting instruments assist to simplify the buying and selling course of throughout turbulent instances; the timing to modify out and in of money to different monetary belongings all year long is the primary tactic. Gold is the following finest various now apart from money till the Fed turns into much less hawkish in tightening and elevating charges.

Prosperity for all individuals is our quixotic objective with gold in tow.

This text is for dialogue solely and isn’t supposed for any funding recommendation.