Full story: HSBC to purchase Silicon Valley Financial institution UK for £1 in authorities rescue deal

Kalyeena Makortoff

For those who’re simply tuning in….the UK authorities has struck a last-minute deal for HSBC to purchase Silicon Valley Financial institution’s UK operations.

The transfer, introduced at 7am, will save hundreds of British tech startups and buyers from large losses after the most important financial institution failure since 2008, my colleague Kalyeena Makortoff writes.

The takeover will override the Financial institution of England’s preliminary resolution to position SVB UK into insolvency, after a run on the lender that was initially sparked by fears over the a multibillion-pound shortfall on the US father or mother firm’s steadiness sheet.

The US financial institution was closed and its belongings seized by authorities on Friday.

The acquisition – which solely value HSBC £1 – adopted in a single day talks between Downing Road, the Financial institution of England and HSBC bosses together with the chief govt, Noel Quinn, as authorities rushed to guard the funds of SVB UK’s 3,500 clients.

These clients included enterprise capital buyers and a whole bunch of tech startups that feared they might go bust if their deposits had been worn out.

Right here’s the total story:

Key occasions

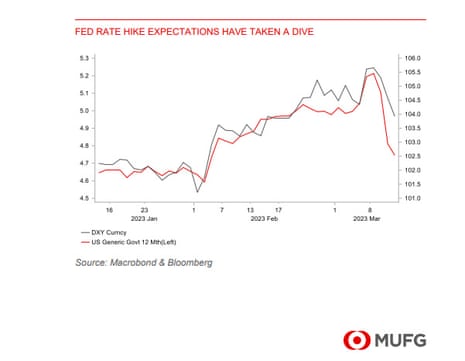

Traders are rethinking their forecasts for additional rises in rates of interest after the collapse of Silicon Valley Financial institution, says Richard Flax, chief funding officer at European digital wealth supervisor Moneyfarm.

Flax explains that the markets are concluding that the US Federal Reserve could also be much less hawkish this month, when it units rates of interest later this month. It could now limit itself to a quarter-point (25 foundation level) rise, he says:

“With the market turmoil following the collapse of SVB, there are actually heightened expectations that the Federal Reserve might be much less aggressive with its financial coverage.

In mild of the potential stress on the banking system, the market is now pricing a larger chance of solely a 25 bps hike on the subsequent assembly (from an nearly “sure” 50 bps pre-SVB collapse). The market’s expectation for the height Fed Funds charge has additionally fallen sharply from the place we had been every week in the past.

The subsequent US inflation report, due tomorrow, may additionally transfer markets, Flax provides:

Whereas the main focus will stay on the stresses within the monetary system, Tuesdays CPI launch will give an essential indication of how costs in the true economic system are shifting.”

Buying and selling in shares in Italy’s Unicredit financial institution had been briefly halted this morning, after they fell by nearly 5% in Milan.

That triggered a short circuit-breaker pause in buying and selling in Italy’s second-largest financial institution.

However buying and selling then resumed, and Unicredit are down nearly 8%.

Credit score Suisse shares hit new low

Again in Europe, shares in Credit score Suisse have dropped to a brand new low.

Credit score Suisse shares tumbled over 12%, and had been buying and selling beneath 2.20 Swiss francs at one state this morning, down from Friday’s low of two.41 francs.

The price of insuring Credit score Suisse’s bonds towards default has jumped this morning too.

Victoria Scholar, head of funding at interactive investor, explains:

Regardless of HSBC’s rescue deal, buyers are taking a cautious stance in the direction of the banking sector compounded by the truth that this might gradual the tempo of central financial institution charge hikes, making a headwind for banks’ internet curiosity margins.

Up to date at 07.34 EDT

Considerations over America’s regional banks don’t seem to have totally abated, regardless of final evening’s efforts by US authorities to shore up confidence.

First Republic, based mostly in San Francisco, will not be the one one below strain (nonetheless down over 50% in pre-market buying and selling).

PacWest Bancorp of Los Angeles has dropped 27% earlier than Wall Road opens, whereas Phoenix, Arizona’s Western Alliance Bancorporation is on monitor to fall round 47%. State regulators closed New York-based Signature Financial institution on Sunday.

As coated final evening right here, a brand new facility is being set as much as give US banks entry to emergency funds, with the Federal Reserve additionally making it simpler for banks to borrow from it in emergencies.

Plus, Silicon Valley Financial institution clients within the US will get full entry to their funds, not restricted by the restrictions on deposit limits.

However, the US authorities did refuse to bail out SVB – ruling that shareholders and sure unsecured debtholders is not going to be protected.

And different banks face the identical downside as SVB: if they’re compelled to promote belongings equivalent to authorities bonds because of clients taking out funds, they could take a loss (as a result of fall in bond costs because of larger rates of interest).

Chris Weston, head of analysis at Pepperstone, means that clients may migrate to bigger, stronger banks:

“The Fed will not be solely addressing issues over the financial institution’s asset facet of the steadiness sheet however on the legal responsibility facet, the place they’re primarily stepping in entrance of a bigger financial institution run, which…will be devastatingly swift to carry down any establishment.

“There’s probably going to be additional migrations to the stronger banks and people with a big asset base and low fairness will proceed to see depositors divest capital.”

Michael Purves, chief govt of Tallbacken Capital Advisors, cautions:

“There are nonetheless going to be lingering questions with different regional banks.”

Eurogroup president: euro space’s publicity to SVB fallout may be very restricted

The top of the Eurogroup, the gathering of eurozone finance ministers, has mentioned the collapse of Silicon Valley Financial institution was a reminder that danger and moments of change can occur very unexpectedly.

Eurogroup President Paschal Donohoe additionally instructed Bloomberg Tv in an interview this morning that the euro space’s publicity to the fallout from the collapse of SVB may be very restricted.

Donohoe insisted, forward of a Eurogroup assembly in Brussels at the moment, that:

“We’ve a really robust regulatory and backbone framework right here in Europe.

“However in fact any banking improvement equivalent to this does immediate questions, and naturally we’ll focus on this at the moment within the Eurogroup.”

The euro space’s publicity to the fallout from the collapse of Silicon Valley Financial institution may be very restricted, Eurogroup President Paschal Donohoe says https://t.co/FKluv2s7Rt

— Bloomberg Asia (@BloombergAsia) March 13, 2023

Nick Macpherson, the previous high civil servant on the Treasury, has congratulated his former division and the Financial institution of England for agreeing the rescue deal for SVB UK this morning.

Macpherson says it exhibits that the UK’s financial institution decision regime, launched after the 2007-2008 monetary disaster, is efficient.

An excellent consequence confirming that the restoration and backbone regime works, and that SVB UK was sufficiently properly regulated to have worth regardless of the travails of its father or mother. Congratulations to the Financial institution of England and HMT. https://t.co/ISqUJmIpEC

— Nick Macpherson (@nickmacpherson2) March 13, 2023

First Republic Financial institution slides over 50% in premarket amid SVB fallout fears

Shares in one other US lender, First Republic Financial institution, have greater than halved in pre-market buying and selling.

That’s regardless of its efforts to attempt to quell concern about its liquidity after the failure of Silicon Valley Financial institution.

First Republic mentioned in an announcement late on Sunday that it had greater than $70bn in unused liquidity to fund operations from agreements that included the Federal Reserve and JPMorgan Chase & Co.

As we speak, we introduced an additional strengthening and diversification of our liquidity place. This improve in obtainable liquidity additional reinforces the protection and stability of First Republic. We’re grateful to our shoppers for his or her continued assist. https://t.co/eucaVOEjoy

— First Republic (@firstrepublic) March 13, 2023

It mentioned:

“The extra borrowing capability from the Federal Reserve, continued entry to funding via the Federal House Mortgage Financial institution, and talent to entry extra financing via JPMorgan Chase & Co. will increase, diversifies, and additional strengthens First Republic’s current liquidity profile.

Nevertheless, its shares are down nearly 60% in pre-market buying and selling at $34.50, having dropped 15% on Friday to $81.76.

First Republic slumps greater than 60% in US premarket buying and selling as measures taken by US authorities to calm investor issues failed to offer aid to the regional lender’s shares. (BBG) pic.twitter.com/c8zU1gucEd

— Jimplas-Capital Administration (@JimplasE) March 13, 2023

“It’s all the way down to a pointy lack of shareholder confidence,” says Susannah Streeter at Hargreaves Lansdown to Reuters, including:

The banks aren’t being bailed out, however depositors are, and worries in regards to the viability of First Republic are rising… It’s extremely probably that there was a rush of extra depositors withdrawing cash.

Ipek Ozkardeskaya, senior analyst at Swissquote Financial institution, explains:

SVB’s flash crash raised questions that different comparable native banks within the US may additionally expertise liquidity points and should not be capable of pay their depositors again, until additionally they begin promoting their most likely loss-making portfolios.

So, the likes of First Republic Financial institution, PacWest Bancorp and Signature Financial institution [which was closed by regulators last night] suffered heavy losses on Friday.

Throughout Europe, large banks pulled indices down on Friday, as properly – though they don’t seem to be anticipated to have comparable liquidity points because the Silicon Valley Financial institution. Most large banks have a diversified consumer base and extra importantly don’t have the identical publicity to tech startups, that are extraordinarily charge delicate.

The contagion danger stays for small banks with extremely rate-sensitive shoppers, however the US authorities now step in to keep away from contagion. They mentioned that SVB depositors may entry their cash at the moment.

Inventory markets slide as market turmoil continues

European inventory markets have made a really weak begin to the brand new week, because the turmoil which started final week continues to grip the markets.

That’s regardless of US regulators defending Silicon Valley Financial institution deposits and attempting to shore up the monetary system final evening.

AJ Bell funding director Russ Mould says:

“Regardless of one of the best efforts of governments and regulators, the market was nonetheless very edgy on Monday as buyers thought of the fallout from SVB’s collapse.”

The FTSE 100 index has tumbled by 153 factors, or 2%, to 7595 factors. That’s its lowest degree because the first week of January, and round 6% beneath final month’s report highs.

Monetary shares are among the many fallers in London, with Commonplace Chartered dropping 5%, funding supervisor Abrdn off 4.3%, and Barclays dropping round 4.5%.

Europe’s STOXX financial institution index has dropped by 5%, having shed 3.78% on Friday, leaving it on monitor for its greatest two-day fall since Russia started its invasion of Ukraine in February 2022.

Mould explains:

“There’s loads to fret about whether or not or not it’s the battle in Ukraine, inflation, rising rates of interest and now a possible banking disaster has been added to the combination. Little shock individuals are feeling a bit spooked.

“For now, the panic which set in late final week seems to have been contained however whether or not the market can regain the boldness which noticed the FTSE 100 hit a report excessive earlier this yr stays to be seen.

“The funding atmosphere for expertise and start-up firms is definitely trying lots much less wholesome and focus could begin to flip to the asset managers and personal fairness funds that are invested in these companies.”

Throughout Europe, Germany’s DAX share index has misplaced 2.9% whereas Italy’s FTSE MIB has slumped by4.7%.

Martha Lane Fox, president of the British Chambers of Commerce, mentioned the failure of Silicon Valley Financial institution is “very completely different” from the collapse of Lehman Brothers in 2008.

She instructed BBC Radio 4’s As we speak programme this morning that SVB UK has performed an essential position serving to to develop the expertise and life sciences trade, and the broader economic system:

“It was a banker that offered further cautious providers for the sector that’s rising very quickly and is demanding consideration from all of us as a result of it’s going to be an important a part of how we place ourselves sooner or later and our economic system’s energy sooner or later.

“You possibly can argue it was a single level of failure, or you could possibly argue that it was enabling this patchwork of unimaginable companies to develop shortly.

This isn’t a collapse due to dangerous administration, she insisted (though SVB administration have been criticised for not defending itself higher towards rising rates of interest).

Lane Fox provides:

In some ways it’s not just like the banking collapse in 2008 or Lehman’s collapse or something like that.”

Krista Griggs, head of monetary providers & insurance coverage at expertise big Fujitsu, says HSBC’s resolution to purchase Silicon Valley Financial institution UK is ‘a welcome transfer’:

“The UK expertise trade is prospering and it requires a dedication to long-term success if the nation goes to attain its ambition of turning into a scientific and expertise superpower.”

“HSBC’s quick response is a welcome transfer that can guarantee continuity for companies in danger from the collapse of Silicon Valley Financial institution. It exhibits dedication to innovation and I anticipate to see extra involvement from conventional banks as they appear to offer stability throughout disruption – in addition to additional union between them and FinTech firms as this sector continues to quickly evolve.

There was a flurry of UK tech firms telling the Metropolis of London this morning the small print of their publicity to Silicon Valley Financial institution UK, or reassuring that they’re not a buyer.

Diaceutics, expertise and options supplier to the pharmaceutical trade, requested for its shares to be suspended on the London AIM market at the moment.

It says that almost all of its money was held at SVB UK, and it was unable to entry these funds in latest days.

In an announcement launched simply as information of the HSBC rescue deal broke, Diaceutics says:

As of 9 March 2023, the Firm held £22.2m in money and money equivalents (31 December 2022: £19.8m). Of this steadiness, roughly £22.0m was held in SVB accounts, an ongoing requirement of its Revolving Credit score Facility, with the bulk (£19.8m) held at SVB UK.

Regardless of rapid efforts by the Firm to maneuver obtainable funds to different banks earlier than SVB was closed, these transactions stay pending and the Firm has been unable to entry any of its funds held by SVB.

It is a quickly evolving state of affairs and the Board stays hopeful that the funds held with SVB will turn into obtainable, nevertheless it recognises that there’s a danger that this will likely take time to resolve and full or partial restoration above the insurance coverage limits could not materialise.

Clearly the state of affairs did certainly evolve quickly, with HSBC agreeing a rescue deal which implies depositors cash is secure.

Bare Wines says it has £14m in “a money sweep account” below which SVB acts as custodian for third social gathering cash market funds, and a $60m asset backed credit score facility, which is syndicated 50-50 between SVB and Bridge Financial institution.

However lower than £600,000 of its money had probably been danger at SVB accounts within the USA and UK, earlier than authorities took motion to guard depositors.

Bare Wines’ CEO Nick Devlin mentioned day after day operations had been unaffected, as Bare has £17m of money instantly obtainable, including “we don’t anticipate to incur any loss consequently”.

International evaluation firm Trustpilot mentioned SVB UK was its principal banking accomplice, however it nonetheless had various banking relationships that enable it to proceed to function.

Trustpilot says it had $36m held in SVB UK, of which $18m was “at the moment in switch out of SVB UK however pending affirmation”.

It additionally had $19m money on deposit with one other financial institution, and $4.5m assured by the US Federal Reserve following their announcement final evening (that US SVB clients will get their cash in full).

A number of companies launched assertion saying that they had no publicity to Silicon Valley Financial institution, together with e-commerce platform THG, IT agency Instem, and biotech firm Roquefort Therapeutics.

Central banks could also be much less keen to boost rates of interest larger, following the disaster at Silicon Valley Financial institution.

Policymakers may now be warier of breaking one thing else within the monetary system, by tightening financial coverage a lot additional.

That’s as a result of the steep will increase in borrowing prices over the past yr or so have pushed up the yield (or efficient rate of interest) on authorities bonds and mortgate-backed securities, which lowers their value.

That result in SVB struggling a $1.8bn loss when it offered its $21bn bundle of securities final week, following a rise in buyer withdrawals.

Traders have minimize their expectations for future rate of interest rises on each facet of the Atlantic.

For instance, one other quarter-point charge rise by the Financial institution of England this month to 4.25% is just seen as a 66% likelihood this morning, from an nearly certainty final week. Charges are not anticipated to rise above 4.5% this yr.

Expectations of future rate of interest rises within the US have additionally been dampened, having jumped final week after hawkish speak by Federal Reserve chair Jerome Powell.

Lee Hardman, senior foreign money analyst at MUFG Financial institution, explains:

The Silicon Valley Financial institution disaster has taken the wind out the US greenback’s sails by highlighting dangers related to rising charges.

The run on deposits compelled SVB to understand losses on their securities portfolios that triggered an additional lack of confidence in financial institution. It has made market individuals extra conscious once more that the Fed will ultimately break one thing if it retains elevating charges.

The pound has gained over half a cent towards the US greenback this morning, to $1.21.

Dom Hallas, govt director of Coadec, a foyer group representing UK tech start-ups, says at the moment’s deal has “saved a whole bunch of the UK’s most revolutionary firms”.

The Authorities deserves big credit score. From the very high, to HM Treasury who understood the problem and gripped it, to the PRA, to the large variety of civil servants who’ve probably not slept since Friday. They’ve saved a whole bunch of the UK’s most revolutionary firms at the moment.

— Dom Hallas (@Dom_Hallas) March 13, 2023

Shadow chancellor Rachel Reeves MP has welcomed the information that Silicon Valley Financial institution UK has been rescued, saying:

“That SVB has a purchaser might be a aid to the entrepreneurs and the hundreds of individuals working within the tech and start-up sectors, who awoke going through big uncertainty this morning.

Tech and life sciences are very important to getting our economic system rising once more.”