recep-bg

Final time, we concluded our publication by emphasizing Euronext (OTCPK:EUXTF) as a diamond in a unstable market atmosphere. Intimately, we had been reporting larger buying and selling volumes due to the brand new EU asset allocation, a rise in top-line gross sales from Borsa Italiana’s migration, and decrease price steerage, confirming our purchase score goal. Regardless of the sturdy outcomes launched in early February, Euronext misplaced greater than 13% to €67.3 on the inventory worth stage and was below stress from macroeconomic challenges and analysts’ doubts concerning the sustainability of Allfunds supply.

Allfunds Provide

Based in 2000, Allfunds is a buying and selling platform for mutual funds and institutional buyers which, as of September 2022, had €1.300 billion of belongings below administration. This information negatively surprises Wall Avenue primarily as a result of the 2 teams concentrate on completely different actions and likewise as a result of Euronext took over Borsa Spa in 2020 with an funding of €4.44 billion and remains to be finishing the synergies.

Final week, after due diligence, Euronext decides to withdraw its €5.5 billion supply and remains to be buying and selling at pre Allfunds supply. Asset administration corporations are thought-about recurring and have good revenue margins, which is why it attracts the eye of inventory exchanges that endure from durations of financial downturn and declining volatility. Intimately, Euronext’s acquisition proposal was set at €8.75 per share with a 19% premium on the value previous the information in a combined operation between €5.69 in money and 0.04059 new Euronext shares. The corporate was already engaged on the go-ahead with the 2 reference shareholders, Hellman & Friedman and BNP Paribas which collectively personal 46.4% of Allfunds, however the board rejected the proposal. Apart from the Wall Avenue consideration (that was completely different when Deutsche Boerse suggest the acquisition in 2021), we should always emphasize that Euronext has M&A functionality and is rapidly deleveraging.

This fall outcomes and long-term targets

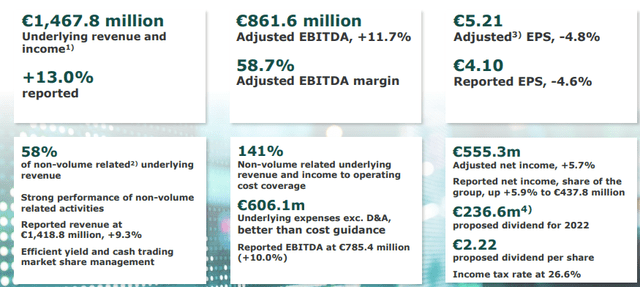

Briefly touch upon Euronext outcomes, the corporate delivered stable accounts demonstrating the corporate’s diversified enterprise mannequin mixed with price self-discipline. Gross sales had been confirmed and regardless of sturdy inflationary strain, adjusted EBITDA reached €861.6 million and was up by +€90.6 million in comparison with the 2021 numbers.

Euronext Financials in a Snap

Supply: Euronext This fall and FY 2022 outcomes presentation

What’s extra vital to report are our funding thesis issues:

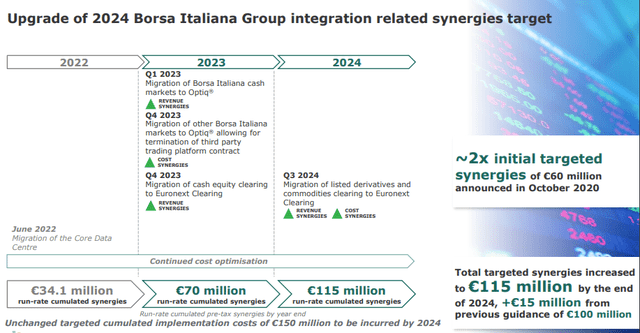

Non-volume-related gross sales represented 58.1% of 2022 underlying turnover, and this ratio reached 60% in This fall; Adj. EBITDA margin reached 58.7% and the corporate upgrades its 2024 annual run-rate pre-tax synergies by €15 million to €115 million (in step with our expectations); Web debt to adj. EBITDA stood at 2.4x due to a stable money circulate technology since Borsa Italiana Group’s closing; As introduced in the course of the half-year outcomes and contemplating a payout ratio of fifty% of reported internet revenue, the corporate is proposing a DPS of €2.22 per share for a complete fee quantity of €236.6 million;

The core knowledge middle is without doubt one of the strategic keys to the method of integrating Borsa Italiana into Euronext, which has already generated, on the finish of the second quarter, €24.1 million of the synergies envisaged within the marketing strategy, by way of cumulative annual run price. This contribution is anticipated to develop additional, intimately, 25% of European inventory buying and selling bodily passes by the Italian construction. The following step would be the migration of inventory alternate buying and selling to the Euronext platform, Optiq, beginning in March. At that time, all of the group’s share buying and selling will happen in Italy for a complete of round €12 billion in flows per day. However that isn’t all. MTS, the primary Italian authorities bond buying and selling platform, will even quickly migrate right here, as soon as the NEXI technological belongings might be accomplished. The shoppers co-located in Basildon have already adopted Euronext in Bergamo, this was additionally supported by the technological stage that the corporate has managed to achieve, with optimistic results additionally on their Scope2 and Scope3 emission, since this construction is a inexperienced knowledge middle, additionally designed to scale back the carbon footprint of Euronext itself. Clients all for co-location had been assured equity and proximity. The stunts informed by Michael Lewis in “The Huge Quick”, when in Chicago there was a contest to “pull” a cable as brief as potential from one’s management middle to the central one, are distant.

Integration price targets

Conclusion and Valuation

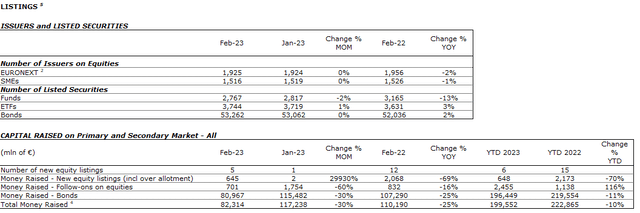

With Borsa Italiana’s integration virtually accomplished and a safer stability sheet (with the next dividend fee anticipated), we aren’t shocked to see that Euronext continues its development technique by exterior traces. The corporate is at present buying and selling at a 14x the value/earnings ratio and an EV/EBITDA ratio decrease than 12x, nicely beneath the comps common. In step with our purchase case recap, we’re nonetheless lacking the corporate’s newest knowledge. And looking out on the just-released February numbers, there have been already 5 new IPO in 2023 in comparison with the 15 achieved in 2022, whereas fairness/mounted revenue volumes had been nonetheless at a minus 20% in comparison with final 12 months’s outcomes. Regardless of that, with 60% of non-volume associated income recorded in This fall, and a unstable macroeconomic atmosphere, we nonetheless see Euronext inventory as a protected play on VIX. Subsequently, we determined to reiterate our valuation to €98 per share sustaining our outperforming score.

Euronext IPO volumes

Supply: Euronext Month-to-month volumes

Editor’s Observe: This text discusses a number of securities that don’t commerce on a significant U.S. alternate. Please concentrate on the dangers related to these shares.