Inflation trades are fading and gold (NYSE:) is ascending to its rightful place within the disinflationary macro.

The favored plan is figuring out effectively as we deliberate the This fall (2022) – Q1 (2023) rally again in November, and as lumpy because it has been, it’s intact to at the present time. Amid the fade in inflation trades, our projected management (Tech and Semi, amid a disinflationary interim Goldilocks theme) is totally intact as effectively.

However what about gold on this disinflationary interval? Goldilocks shouldn’t be sometimes pleasant to the steel that represents retained “worth,” as a Goldilocks economic system can burp up loads of speculative alternative elsewhere. Properly, word the phrase “interim” earlier than the phrase “Goldilocks” above. This isn’t anticipated to be the 2013-2019 interval that turned a full-fledged macro part. It’s interim, non permanent and perhaps a pleasant alternative for the bear market to suck in a whole lot of FOMOs (I’m lengthy key Tech shares and even , however not as an investor).

So take a look at gold laboring alongside in Tech phrases with the GLD/QQQ ratio. That, of us, is what we name an intact uptrend. Gold is a full participant on this pleasantly disinflationary part as a result of in my view, it won’t be nice for a full cycle (e.g. 2013-2019). Relatively, I count on Goldilocks to fail after a much-needed and anticipated rally in Tech as Tech management terminates in the future at larger ranges. Gold is solely marking time, which is what the steel has completed for time immemorial.

Gold/Tech (GLD/QQQ)

So gold is uptrending by way of the strongest fairness market sector on which I’m at present bullish.

However the actual macro play goes to line up later, when Tech finally succumbs and we get this logical adjustment within the markets over with and herald a important mass of “glad days are right here once more! Bear market over!” FOMOs on board. It was initially and nonetheless is projected to be a bear market rally, in any case.

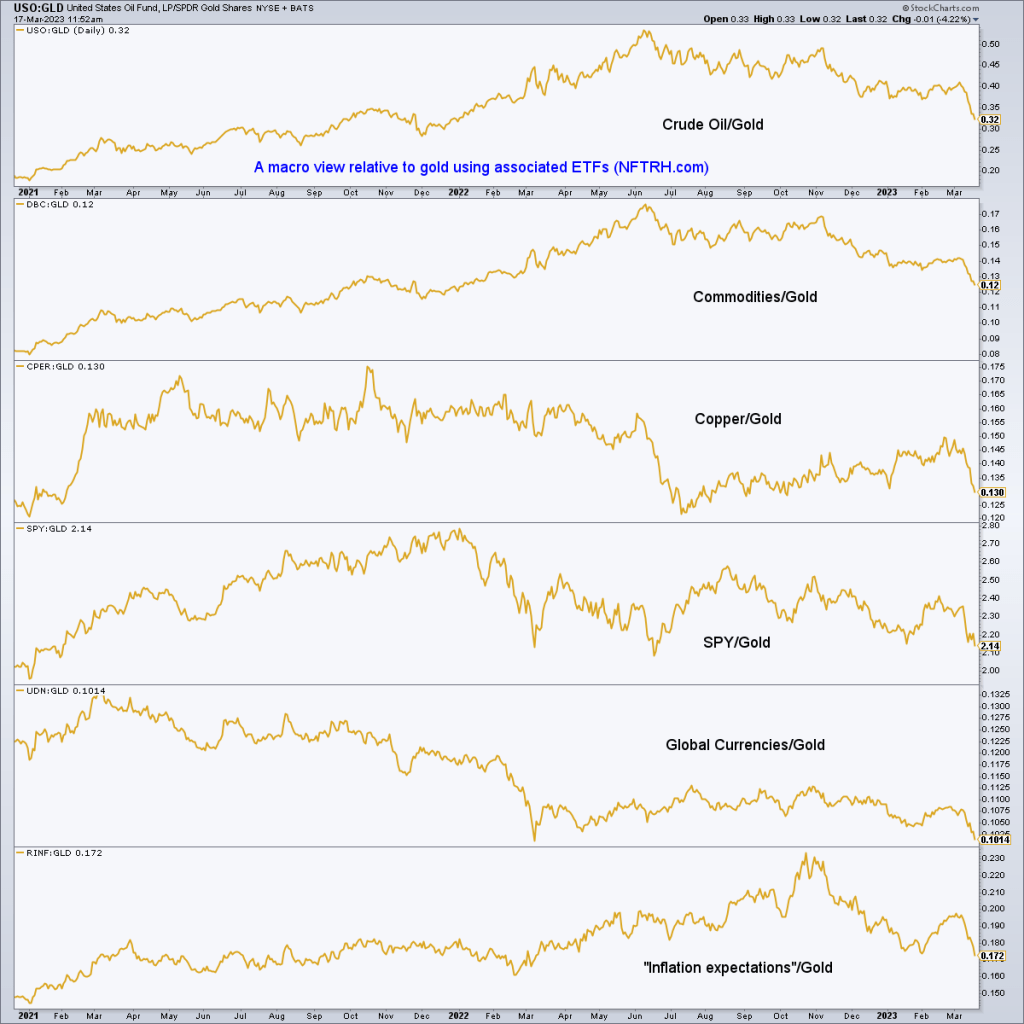

A take a look at key commodity and inventory markets plus the “inflation expectations” gauge (utilizing related ETFs) as adjusted by gold (utilizing GLD) exhibits that the – which we’ve been projecting for failure since spring of 2022 – is effectively on its manner and fully on plan. All alongside I’ve suggested that readers contemplate turning away from boilerplate evaluation speaking about gold and inflation as a result of that was not going to be the play, and certain sufficient, it wasn’t, and isn’t.

The play – assuming new developments stay intact – is a novel gold mining sector as soon as Goldilocks runs her course. With Tech wanting so constructive (per the tweet above) and really beginning to bull since, gold shares are usually not but distinctive. But it surely’s coming. The developments on this chart say so.

As necessary examples, what do you suppose will occur to gold-mining bottom-line operations – impaired as they have been through the post-2020 inflation cycle – as gold continues to carry out strongly in relation to cost-input commodity /vitality? What do you suppose will occur to buyers’ mindsets after they see their played-out inventory markets vastly underperforming the miners? Sure, precisely. You’ll have a novel sector performing for a similar causes most others are usually not.

After a troublesome stretch managing an entire lot of nothing (to the untrained eye), it’s now time to be at consideration and to separate ourselves from the investor herd, simply because the gold mining sector will from the herd of macro asset markets in 2023. Over the previous few weeks, NFTRH has gotten much more enjoyable to put in writing as a result of instability is enjoyable. Seeing autopiloted thinkers (together with the common inflationist) bewildered is enjoyable. Motion and alter are enjoyable.