Arnd Wiegmann/Getty Photographs Information

The Credit score Suisse (NYSE:CS) meltdown is threatening to spill over right into a systemic disaster affecting the worldwide monetary system at a time when the U.S. banking system is already extremely pressured within the wake of the Valley SVB Monetary Group (SIVB) and Signature Financial institution (SBNY).

Subsequently it’s not an enormous shock that The Swiss Nationwide Financial institution (“SNB”) and regulator FINMA need to orchestrate a shot-gun wedding ceremony this weekend as reported by the FT.

It is usually clear that final week’s intervention by the SNB didn’t allay the fears or stem the outflows from Credit score Suisse. The Swiss banking business might unravel in a short time and there may be little doubt that the Swiss authorities must intervene and rapidly. It seems that this weekend, a deal goes to get executed.

How Did Credit score Suisse Get Itself Into This Mess?

It was largely self-inflicted scandals and danger administration failures during the last a number of years that acquired CS up to now. Essentially the most consequential ones have been materials monetary losses and reputational injury suffered because of its engagement with the disgraced financier Lex Greensill and failed hedge fund Archegos Capital Administration in 2021.

Essentially the most painful episode, although, that instigated the downward spiral was the Archegos Capital debacle which demonstrated astounding danger administration failures within the Prime Finance enterprise unit. As an alternative of working to the exit as quickly as attainable, CS was trying to “coordinate” an orderly sale with its friends Goldman Sachs (GS) and Morgan Stanley (MS) over that fateful weekend. That was awfully naive. GS and MS bought the collateral held as quickly as attainable in block gross sales with minimal losses whereby CS ended up holding the child and ~$4 billion in losses. As a matter in fact, the Prime Finance enterprise unit ought to be low danger if managed correctly. On the time (when CS shares have been buying and selling at ~$10), I famous the next:

Past the monetary loss, there are different vital downstream implications for CS within the brief and medium time period. While the present share value seems enticing within the context of the long-term valuation of the inventory, I’m not fairly prepared to purchase the dip. There seem like main danger administration issues plaguing its funding financial institution and fixing these will seemingly be a protracted and dear course of.

Consequently, CS needed to elevate fairness to plague the capital gap created by the losses and trimmed down its ambitions within the funding financial institution. Nevertheless, this proved to be inadequate because the financial institution entered the bear market of 2022.

It was clear that CS would want a good market setting for its turnaround to succeed. Sadly, 2022 was not that 12 months because it utilized to the CS enterprise mannequin. CS funding financial institution is geared largely towards credit score markets and capital markets issuances. These have been areas that have been fairly challenged in 2022. Equally, CS’s areas of power in leveraged finance, M&A, and SPAC deal exercise have been both loss-making or inactive.

On the flip facet, CS has little publicity to FX buying and selling, charges, and commodities buying and selling which have been booming in 2022 and rewarded the likes of Barclays (BCS) and Deutsche Financial institution (DB). It was an ideal storm for CS and it was compelled to boost capital as soon as once more and announce an enormous restructuring of the Funding Financial institution with the expectation of bleeding losses for the foreseeable future.

At that time, given the newsflows, market members in addition to purchasers started to lose confidence within the agency and the contagion unfold to the wealth administration division as nicely. The fourth quarter of 2022 was characterised by unprecedented shopper outflows which have been most dramatic in its Asian wealth administration division that for a few years has been its progress engine. CS went right into a tailspin because it misplaced key employees and rainmakers to rivals.

UBS

UBS (NYSE:UBS), then again, has been executing exceptionally nicely lately. Following its bailout within the 2008/2009 international monetary disaster (“GFC”), UBS has de-emphasized the funding banking division and refocused its efforts on wealth and asset administration and this has confirmed to be the proper technique.

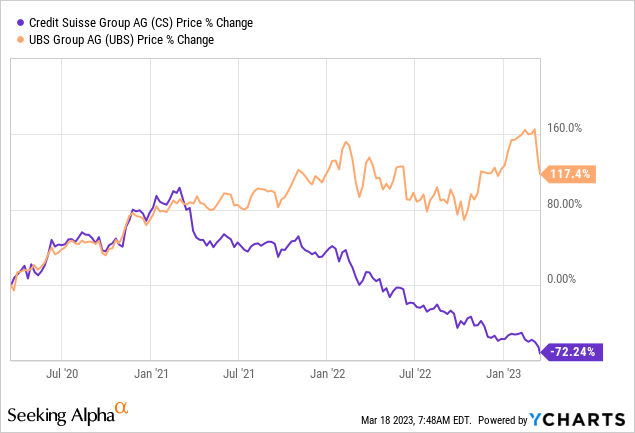

The relative value return within the final 3 years between UBS and CS, says all of it:

As may be seen above, the returns path diverged across the time of the Archegoes Capital episode in 2021.

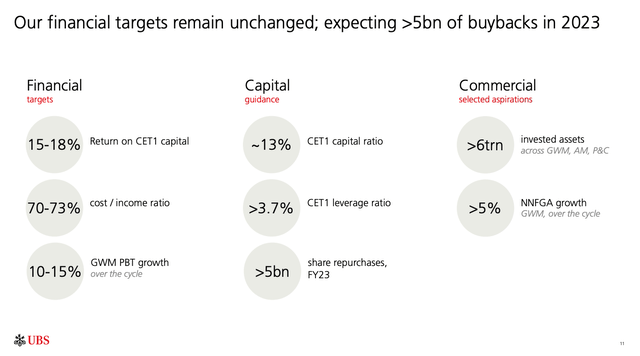

UBS enterprise, nonetheless, could be very steady and delivers excessive returns on capital in addition to sturdy capital returns to shareholders. It’s clearly an image of impolite well being when in comparison with CS.

UBS Investor Relations

What Would UBS Need To Purchase Credit score Suisse?

Wealth and Asset Administration profitability are extremely correlated to scale. UBS has the chance to scale up materially and instantaneously bringing on vital extra AUM and AUS. The operational leverage and vital synergies that may be derived could be exceptionally excessive. And UBS would seemingly solely have to pay a token quantity to finish this deal.

There are materials dangers in fact as CS could have numerous hidden skeletons within the closet. These could contain conduct or authorized prices that could be multi-billion and thus future fees might be each distracting and dear. On the finish of 2022, CS disclosed ~$1.3 billion of potential fines and authorized prices with a sign of extra fees to be supplied for sooner or later.

I additionally suspect UBS would have no real interest in taking over the funding financial institution. The unwinding of the CS funding financial institution is more likely to require a suitor to tackle vital losses for an indeterminate size of time. It’s actually a poison capsule for a would-be purchaser.

The Form Of The Deal To Come

Credit score Suisse’s crown jewel stays the Swiss home common banking unit which offers banking and wealth administration companies within the Swiss market. The home unit can be essential to the Swiss financial system and has seen few deposits and AUM outflows, even through the present disaster, in comparison with the worldwide wealth administration arm. It stays a useful banking enterprise and the worth of the franchise has not been impaired lately and it’s the solely a part of the franchise that remained constantly worthwhile all through the final 10 years.

The Swiss regulators’ first precedence could be to guard the home banking market and in my opinion, the desire could be for it to stay a stand-alone enterprise. I think will probably be spun off or IPOed to keep away from over-concentration within the Swiss home banking market and stop vital job losses.

UBS would most certainly take over the worldwide wealth and asset administration divisions which ought to be very complementary to its current companies. There’ll have to be regulatory approvals in a number of nations, notably the U.S. and the UK, however I count on these to be readily forthcoming given the worldwide and systemic nature of this disaster.

UBS will most actually search some type of safety from losses within the funding financial institution (if it does take it on) in addition to restoration for any authorized and conduct prices.

The Swiss regulators must coordinate intently with the U.S., UK, and different EU regulators to get this deal over the road and assist to settle down systemic dangers within the international banking markets. Everyone seems to be more likely to play ball in these circumstances, the dangers are too nice in any other case.

Last Ideas

This can be a shotgun wedding ceremony for positive. I’m not positive UBS is overly concerned about taking on the entire of Credit score Suisse. There are too many dangers concerned.

UBS was most likely already organically onboarding lots of the wealth-management purchasers that departed CS, it actually would not want to purchase the authorized shell however it might be compelled to. UBS is actually not concerned about buying the liabilities within the authorized construction in addition to the funding financial institution. Sadly, it might not have a alternative, if the Swiss regulators insist on this deal getting executed. This can be seen as a “nationwide service” so far as UBS is anxious. Its essential prerogative could be to restrict the draw back dangers concerned on this by acquiring onerous assurances on the dangers it absorbed from Swiss and different regulators.

I extremely suspect that the Swiss regulators would look to retain the CS home banking unit intact. UBS could purchase the remaining and look to eliminate the funding financial institution over time. Given the worldwide systemic and contagion dangers, that is all about detonating the CS “bomb” with not less than injury as attainable.

Nonetheless, the medium and long-term winner right here is clearly UBS. Wealth administration is all about scale, and UBS is about to get materially bigger.

I now charge UBS as a purchase and I’ll improve to a powerful purchase relying on the form of this deal.