Craig Barritt

Be aware:

I’ve lined Amyris, Inc. (NASDAQ:AMRS) beforehand, so traders ought to view this as an replace to my earlier articles on the corporate.

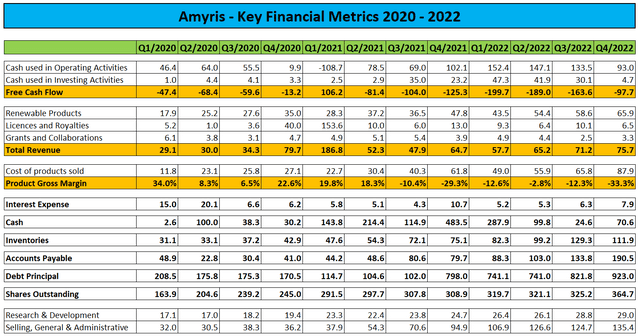

Final week, cash-strapped specialty renewable merchandise developer Amyris reported one other set of abysmal quarterly outcomes with revenues lacking consensus expectations by a mile and gross margins deteriorating to new multi-year lows.

Firm SEC-Filings

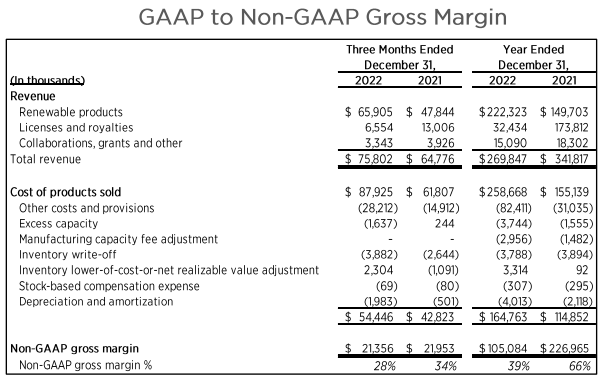

That stated, on the convention name administration claimed year-over-year progress in “non-GAAP gross margins” when adjusted for the impression of license revenues:

Non-GAAP gross margin was $21.4 million or 28% of income in comparison with $22 million or 34% of income in This fall 2021. Excluding the impression of know-how license income in each intervals, non-GAAP gross margin elevated by almost $6 million and was 400 foundation factors greater as a % of income than within the prior 12 months. This was primarily as a result of client income progress and improved client margins.

Firm Presentation

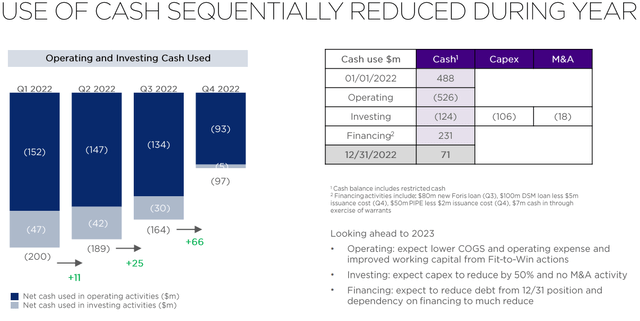

As well as, administration touted a considerable discount in quarterly money burn, however this was virtually solely achieved by rising accounts payable greater than 40% quarter-over-quarter. As well as, money utilization benefited from a significant sequential discount in inventories:

Firm Presentation

For the total 12 months, damaging free money circulation was an attention grabbing $650 million.

Following a $50 million emergency capital increase on December 29, Amyris completed This fall with $64.4 million in unrestricted money and $923 million in excellent debt principal.

On the convention name, administration reduce on its lately acknowledged goal to cut back 2023 money burn to a variety of $150 million to $200 million (emphasis added by creator).

We intend to carry our working money use in 2023 to round $200 million run-rate by the top of 2023 (…).

We’re delivering this discount in money use by way of our Match to Win agenda, portfolio rationalization of non-core belongings together with making certain we now have the correct measurement group for supporting our lean and targeted future. We’re additionally increasing our gross margin this 12 months by way of the manufacturing price financial savings within the Match to Win agenda, but in addition by way of the Givaudan earn-out and the underlying progress of our Flavors & Perfume enterprise and the impression this has on the DSM earn-out. Taken collectively, we count on these actions will allow us to satisfy our goal of ending 2023 as a rising self-sufficient enterprise with a capability to fund its progress.

Please word that this steering doesn’t have in mind $55 million in projected capital expenditures. Assuming $100 million in money use from working actions in Q1 and money utilization progressively declining to $50 million in This fall, money burn from operations would quantity to $300 million this 12 months.

Including the above-discussed $55 million in capital expenditures would lead to damaging free money circulation of $355 million for 2023.

Given the seemingly requirement to carry down elevated accounts payable balances, my money burn assumptions might simply show too beneficiant.

Whereas administration expects to obtain a $200 million upfront money fee from the lately introduced strategic transaction with Givaudan throughout the subsequent 30 to 45 days, roughly $50 million should be utilized for buying an extra 49% within the firm’s Aprinnova three way partnership from subsidiaries of Japanese Nikkol Group because the three way partnership’s manufacturing facility in North Carolina is required for changing Biofene into squalane and different last merchandise.

Making use of my above-discussed $355 million money burn estimate and contemplating the corporate’s year-end money place of near $65 million in addition to roughly $150 million in internet upfront money proceeds from the Givaudan transaction, Amyris must increase not less than $140 million in extra capital to make it into subsequent 12 months.

Nonetheless, this quantity doesn’t but account for $128.7 million in short-term debt maturities and an extra $15 million lately borrowed from an entity affiliated with key shareholder John Doerr.

On the convention name, administration projected round $150 million in money proceeds from the sale of non-core client manufacturers (emphasis added by creator):

We’re narrowing our investments to the place we now have and may’t lengthen market management and sustainable predictable progress, which incorporates the gross margin enhance I discussed earlier. We’re additional focusing our client model portfolio and count on to finish with 5 to six manufacturers that our market leaders symbolize over 90% of our present income and progress, use loads of our substances and their formulations and have a transparent path to profitability. This extra rationalization of non-core belongings in our client portfolio is anticipated to generate round $150 million of money proceeds this 12 months. The manufacturers that stay in our portfolio have a present market worth of round $2 billion. We’re in energetic discussions with potential consumers for these non-core belongings that we’re within the means of promoting. In parallel, we are going to cut back and get rid of all different spend by way of additional divestments and deep prioritization of the place we make investments our restricted {dollars}.

As well as, administration hinted to a possible three way partnership with one of many world’s high 4 sugar producers which I might assume to be Raízen given the truth that the corporate’s sugar mill can be positioned in Barra Bonita and gives feedstock to Amyris’ newly-constructed substances manufacturing plant (emphasis added by creator):

(…) We’ve got been approached and are in energetic discussions concerning a producing three way partnership. We’re exploring this chance with one of many world’s high 4 sugar producers, a mill in regards to the measurement of Barra Bonita. The proposed JV construction would mix a few of our biomanufacturing belongings would we lease a major amount of money from our present manufacturing belongings and the accomplice would fund the subsequent biomanufacturing facility and downstream processing services. They’ve accomplished preliminary diligence and are impressed with what we now have constructed at Barra Bonita and the standard of our groups and total functionality. (…)

Biomanufacturing consumes probably the most important quantity of our working capital and has a protracted money cycle time. (…)

Along with absolutely funding our a lot wanted subsequent manufacturing facility, this chance also can assist generate $50 million to $100 million in new money to our stability sheet within the short-term and liberate $50 million of present working capital that’s used to help our substances enterprise. If discussions proceed as deliberate, then we count on this facility to be in development by the top of this 12 months and be the 100% farnesene devoted biomanufacturing facility.

Studying between the strains, the corporate is prone to contribute its new Barra Bonita facility towards an upfront money fee of as much as $100 million with the three way partnership accomplice taking on accountability for working capital and enlargement capex necessities. Together with the anticipated working capital launch, Amyris expects as much as $150 million in near-term money advantages from this transaction.

However given what occurred to the much-touted strategic transaction with Givaudan in latest months, traders can be well-served to take these projections with an enormous grain of salt.

To be completely trustworthy, I might be stunned to see Amyris producing materials money proceeds from the sale of non-core manufacturers which in mixture accounted for simply 10% of the corporate’s client revenues this 12 months.

Contemplating the present market setting and Amyris’ very weak bargaining place, I don’t count on proceeds from the upcoming consolidation of the corporate’s client manufacturers portfolio to be wherever near the “as much as $150 million” envisioned by administration.

As well as, traders should not wager on the marketed manufacturing three way partnership to be up and operating anytime quickly as negotiations and subsequent paperwork finalization will take time. Furthermore, with Amyris being determined for money, the three way partnership accomplice seems to carry all of the aces.

Given these points, I don’t count on materials near-term money advantages from the above-discussed transactions which might seemingly consequence within the requirement to lift a considerable quantity of latest capital over the course of this 12 months.

Throughout the quarter, ongoing liquidity challenges resulted in additional delays to the commissioning of the Barra Bonita plant and lack of ability to meet over $14 million in ingredient product orders.

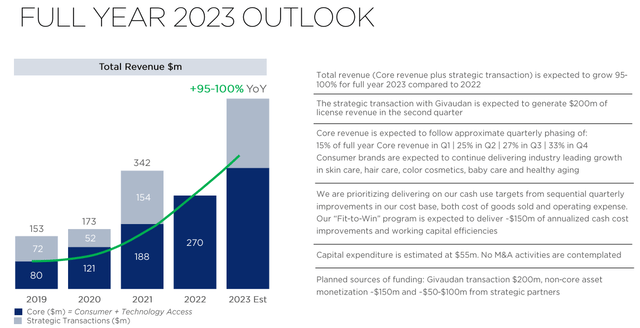

As Amyris is trying to promote non-core belongings and chopping again on advertising spend, core income progress going ahead shall be a far cry from administration’s earlier projections:

Firm Presentation

Please word that the 95% to 100% projected income progress within the slide above consists of the $200 million upfront fee from Givaudan.

Adjusted for the strategic transaction, 2023 core income steering interprets to only $325 million to $340 million or 21% to 26% year-over-year progress as in comparison with these projections offered by CEO John Melo on the corporate’s Q3 convention name in November (emphasis added by creator):

Our objective is to ship 10% working earnings on an estimated $200 million of income within the fourth quarter of 2023. We count on this to be our first stable quarter of working profitability for our core enterprise based mostly on sustaining our present progress fee and delivering on our Match to Win initiatives.

We count on over 10% working earnings for full 12 months 2024 and increasing that to over 20% working earnings by 2025 with a objective of greater than $1 billion in income throughout 2025.

Suffice to say, This fall/2023 revenues will not be wherever near $200 million, to not communicate of profitability. Generously assuming 25% core income progress going ahead, Amyris’ 2025 core revenues would are available in round $530 million.

Not surprisingly, analysts have bargain targets throughout the board citing considerably diminished progress expectations.

Backside Line

Following an abysmal 2022, renewed capital constraints have pressured Amyris to give attention to consolidating its buyer model portfolio and chopping again on advertising spend.

Because of this, the corporate’s progress trajectory is anticipated to take a serious hit going ahead.

As well as, Amyris’ 2023 money utilization shall be considerably above the $150 million to $200 million quantity offered by administration on the J.P. Morgan Healthcare convention in January, thus seemingly requiring the corporate to lift extra capital later this 12 months.

Whereas administration expects as much as $300 million in money proceeds and dealing capital aid from the sale of non-core manufacturers and the potential formation of a brand new ingredient manufacturing three way partnership, traders can be well-served to take these projections with an enormous grain of salt, significantly given the present market setting.

As the corporate’s distressed monetary situation is limiting entry to the capital markets, Amyris is prone to stay on life help by 30% shareholder John Doerr in the interim.

After initially dropping to new all-time lows beneath $1, shares rallied roughly 30% over the course of Thursday’s session as market members apparently cheered administration’s acknowledged determination to not sacrifice profitability for progress going ahead.

Sadly, Amyris’ administration has by no means delivered upon any kind of monetary steering offered in recent times and I don’t count on this sample to vary going ahead.

Given the seemingly requirement to lift a considerable quantity of capital over the course of this 12 months, traders ought to proceed to keep away from the shares and even think about promoting present positions.

.jpeg?itok=vRnDFKIa'%20%20%20og_image:%20'https://cdn.mises.org/styles/social_media/s3/images/2025-04/AdobeStock_GDP%20(2).jpeg?itok=vRnDFKIa)