As considerations over a looming banking disaster weigh on the minds of buyers, one economist says what occurs subsequent will rely upon three main questions:

Have policymakers executed sufficient to avert a system-wide disaster?

How might the scenario escalate?

What does all of this imply for financial coverage?

“Essentially the most quick query is how markets digest information of the united statesdeal to purchase Credit score Suisse,” wrote Neil Shearing, group chief economist at Capital Economics.

Late Sunday, UBS (UBS) introduced a deal to amass Credit score Suisse (CS) for just a little over $3 billion, information that despatched shares of Credit score Suisse down about 50% on Monday whereas UBS reversed early losses.

Shearing stated parts of UBS’ settlement are usually not solely clear, with the discounted worth of $3.25 billion suggesting, “a considerable a part of Credit score Suisse’s $570 [billion in] property could also be both impaired or perceived as being liable to turning into impaired.”

“This might set in prepare renewed jitters in regards to the well being of banks,” Shearing wrote.

On Monday, financial institution shares had been broadly larger.

Nonetheless, Shearing notes crises like what markets face at this time do not have a tendency to return and go in fast bouts.

“Containing crises is a bit like a sport of whack-a-mole — with new fires beginning as current ones are extinguished. A key problem over the subsequent week can be whether or not issues come up in different establishments or elements of the monetary system,” Shearing wrote.

Whether or not the banking disaster escalates, in Shearing’s view, hinges on any further unknown unknowns that emerge from the system as the results of aggressively rising rates of interest.

“Whereas it is tempting to dismiss the issues at SVB, Signature Financial institution and Credit score Suisse as idiosyncratic, they’ve revealed that issues are lurking within the monetary system as rates of interest rise,” Shearing wrote.

“Key areas to watch embrace smaller European banks and shadow banks, notably open-ended funds that may undergo from maturity mismatches.”

Story continues

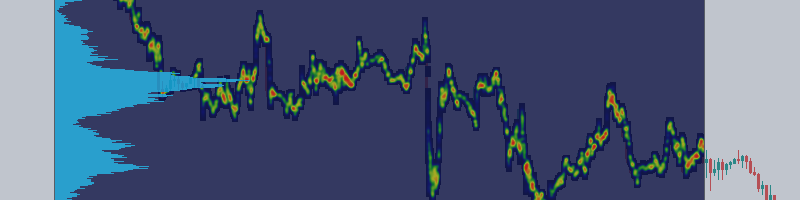

As Yahoo Finance’s Dan Fitzpatrick outlined over the weekend, some $600 billion in “unrealized” credit score losses are lurking within the U.S. banking system. However these losses, as Shearing notes, are largely the results of banks failing to handle rate of interest danger, somewhat than extending credit score to unhealthy debtors.

“Credit score Suisse apart, the issues up to now have been attributable to a failure to adequately handle rate of interest danger,” Shearing wrote. “An altogether extra critical disaster would develop if credit score dangers begin to emerge — or, to place it otherwise, if mortgage default charges rise as banks’ asset high quality deteriorates.

Which brings within the prime concern from buyers this week: What’s going to the Fed do?

As of mid-morning on Monday, markets are pricing in a ~70% likelihood the Fed raises charges by 25 foundation factors on the conclusion of its two-day coverage assembly on Wednesday, in keeping with knowledge from the CME Group.

Previous to the disaster, buyers positioned a better-than-50% likelihood on the Fed elevating charges by 50 foundation factors this month.

“It is a perilously tough path for central banks to tread,” Shearing stated, including final week’s developments show cash, credit score, and the monetary sector are simply as essential components as macro knowledge like inflation and jobs in the case of the Fed’s coverage play.

“Whereas the precise implications of latest occasions for financial coverage are nonetheless unclear, it’s prone to imply that rates of interest can be decrease than the markets had anticipated a few weeks in the past,” he predicted.

Alexandra Canal is a Senior Leisure and Media Reporter at Yahoo Finance. Comply with her on Twitter @alliecanal8193 and electronic mail her at [email protected]

Click on right here for the most recent inventory market information and in-depth evaluation, together with occasions that transfer shares

Learn the most recent monetary and enterprise information from Yahoo Finance