Roman Tiraspolsky

Funding Thesis

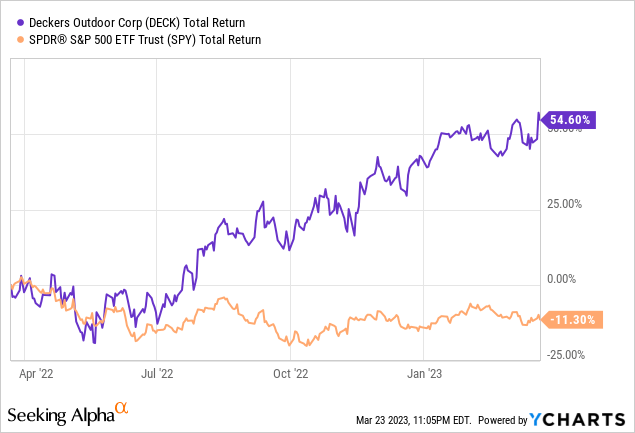

Deckers Outside (NYSE:DECK) has carried out extraordinarily effectively prior to now 12 months. Not like the S&P 500 Index, which dropped 11.7%, the corporate is up over 50% and presently buying and selling close to its historic excessive. Regardless of the current rally, I nonetheless imagine the corporate affords a stable shopping for alternative for traders. Its HOKA model is gaining sturdy momentum and will proceed to be a serious development driver. The newest earnings reported respectable development, with double digits will increase in each the highest and the underside line. The corporate can be buying and selling at a reduced valuation in comparison with friends, which ought to current additional upside potential.

HOKA Is A Development Driver

Deckers Outside is a California-based firm which owns a number of vogue and efficiency way of life footwear manufacturers. Its vogue manufacturers embody UGG and Koolaburra whereas its efficiency manufacturers embody HOKA, Teva, and Sanuk. Amongst all of the manufacturers, I imagine HOKA is the one which has huge development potential. In recent times, much more individuals have been selling an energetic wholesome way of life, and engagement in sports activities equivalent to Climbing and Yoga has elevated exponentially. The development has been boosting the demand for efficiency way of life footwear. In response to Statista, the athletic footwear market is estimated to develop from $53 billion in 2023 to $64.9 billion in 2028, representing a stable CAGR (compounded annual development charge) of 4.3%.

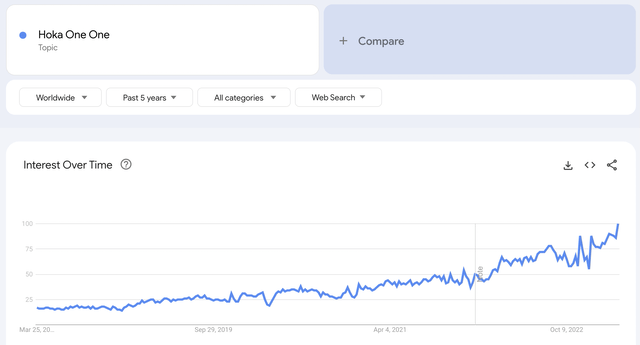

HOKA differentiates itself by means of superior consolation and efficiency, and its footwear has gained a number of awards prior to now quarter alone, which I’ve cited under. This has helped them win over prospects and continues to drive its model consciousness and adoption. From the Google Developments graph proven under, you possibly can see that HOKA’s reputation has grown considerably prior to now 5 years. In response to the administration staff, its US market share rose 5 proportion factors in December in comparison with the prior 12 months. The model’s growth alternatives are even larger within the worldwide area, which has even decrease model consciousness in the meanwhile. I imagine HOKA will proceed to be a serious development driver for the corporate.

Dave Powers, CEO, on lately profitable awards

On the product facet, HOKA has continued to introduce award-winning footwear, in October, HOKA was featured within the 2022 Males’s Well being Sneaker Awards with Bondi 8 being chosen for probably the most comfy cushion, and the Kaha 2 GORE-TEX famous as the most effective mountaineering sneaker boot. As well as, Outdoors Journal revealed its Winter Gear Information for 2023, deciding on the Mafate Velocity 4 as the most effective shoe for quick in rugged path runs.

Google

Financials and Valuation

Deckers Outside introduced its third-quarter earnings final month, and the outcomes are respectable contemplating the weakening financial system. The corporate reported web gross sales of $1.35 billion, up 13.3% YoY (12 months over 12 months) in comparison with $1.19 billion. Income development was 17.5% on a continuing forex foundation. The expansion was primarily pushed by HOKA and Teva. Income from HOKA grew 90.8% from $184.6 million to $352.1 million, now accounting for 26% of complete income. Whereas income from Teva from 48.3% from $20.6 million to $30.5 million. Gross revenue was $712.5 million, up 14.7% YoY from $621.2 million. The gross margin edged up 70 foundation factors from 52.3% to 53%.

The underside line confirmed even stronger development as working leverage improved. Regardless of double digits enhance in income, SG&A (promoting, normal, and administrative) bills solely rose 6.7% YoY from $327.8 million to $349.9 million. This resulted in working earnings rising 23.6% YoY from $293.4 million to $362.7 million. The working margin additionally expanded 220 foundation factors from 24.7% to 26.9%. The diluted EPS was. $10.48 in comparison with $8.42, up 24.5% YoY. The corporate’s stability sheet stays very wholesome with $1.06 billion in money and no debt, which offers ample flexibility for additional buybacks or potential acquisitions.

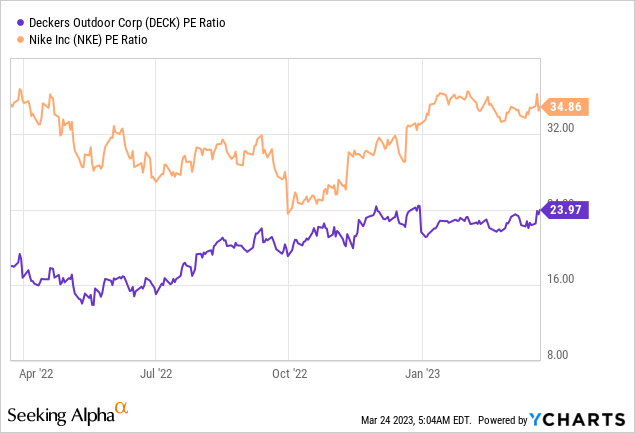

Regardless of the large rally, the corporate’s valuation stays compelling in my view. It’s presently buying and selling at a PE ratio of 24x, which is discounted in comparison with footwear friends with related development charges. For context, footwear big Nike (NKE) reported income development of 12% within the newest quarter, but it has a PE ratio of 34.9x, which characterize a big premium of 31.2%. This means that the corporate may even see additional growth in multiples, which might provide stable upside potential

Buyers Takeaway

I imagine Deckers Outside is a compelling GARP (development at an affordable value) firm. HOKA is seeing sturdy traction currently and the rising model consciousness ought to proceed to drive development. The truth that the corporate owns a number of respectable manufacturers additionally diversifies the danger of relying too closely on both model. Its newest earnings stay stable as HOKA led the top-line development whereas the underside line benefited from enhancing working leverage. Regardless of the large rally prior to now few months, its present valuation remains to be discounted in comparison with friends, particularly while you additionally think about its fundamentals and development. Due to this fact, I charge the corporate as a purchase.