Invoice Pugliano/Getty Photographs Information

Funding Thesis

Dow Inc. (NYSE:DOW) is going through a macro headwind that’s undercutting its attraction to buyers, though it is ready to use efficient value administration to maintain its money move and margin. Nevertheless, its long-term progress would largely come from its substantial efforts in inexperienced applied sciences and the corporate’s associated services and products to a number of industries and markets on a big scale. Though the trail is probably not easy, its progress upside ought to align with a greater inventory valuation.

Firm Overview

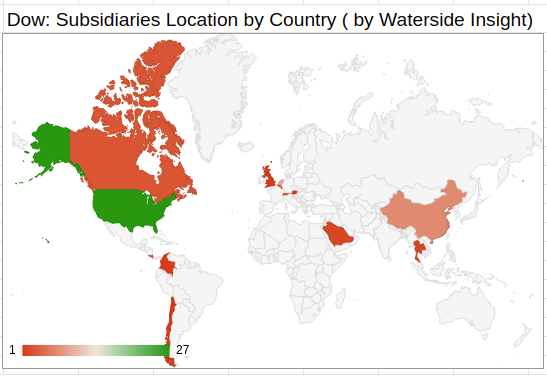

Dow Inc., included in 2018, was previously a part of DowDuPont Inc, which it separated from in June 2019. It serves as a holding firm for The Dow Chemical Firm and its consolidated subsidiaries (TDCC), which was included in 1947 because the successor to a Michigan company of the identical title, organized in 1897. Dow’s portfolio consists of plastics, industrial intermediates, coatings, and silicones companies relevant in markets akin to packaging, infrastructure, mobility, and shopper purposes. The corporate’s reportable working segments are Packaging & Specialty plastics, Industrial Intermediates & Infrastructure, Efficiency Supplies, and Coatings. It has 104 manufacturing websites in 31 nations.

Power

Dow has a worldwide scale in its manufacturing and markets throughout all continents, and main positions in key worth chains. With such a vastly broad attain, the corporate might choose areas and services that maximize its value discount. For instance, 65% of its manufacturing capability is positioned in cost-advantaged Americas.

Dow: Subsidiary Location by Nation (Charted by Waterside Perception with information from firm)

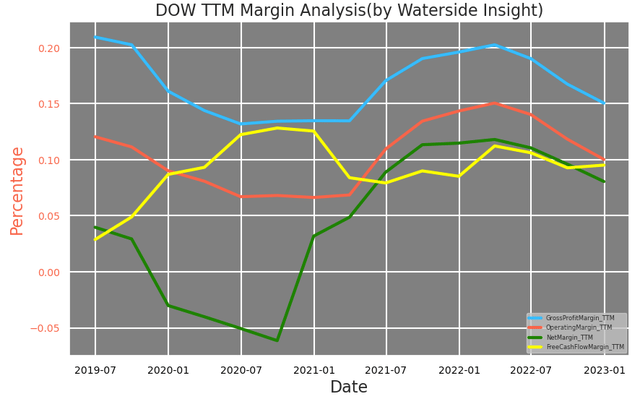

This effort displays in its web revenue margin ratio to gross revenue margin, which is near 50%; about half of its gross revenue margin turns into web revenue. Though its gross margin declined by This autumn, all different margins are nonetheless at their common ranges, with free money move inching upward in latest quarters.

Dow: Margin Evaluation (Calculated and Charted by Waterside Perception with information from the corporate)

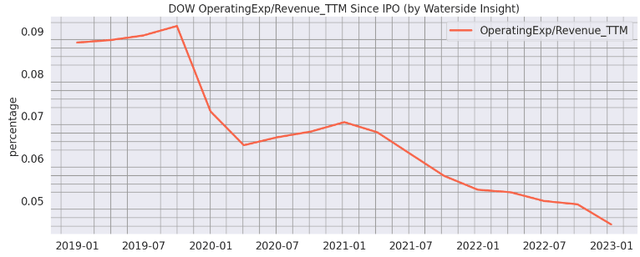

Though its gross margin had been declining as a mirrored image of the broader economic system in 2022, it has utilized its top-quartile value construction to decrease bills. Its working expense as a ratio to income has been steadily declining to the bottom stage in This autumn 2022. Dow, as a producer, producer, and marketer with deep and broad-based financial ties in lots of industries, is anticipated to proceed this efficient cost-control administration this yr going through a looming recession.

Dow: Working Bills vs Income (Calculated and Charted by Waterside Perception with information from the corporate)

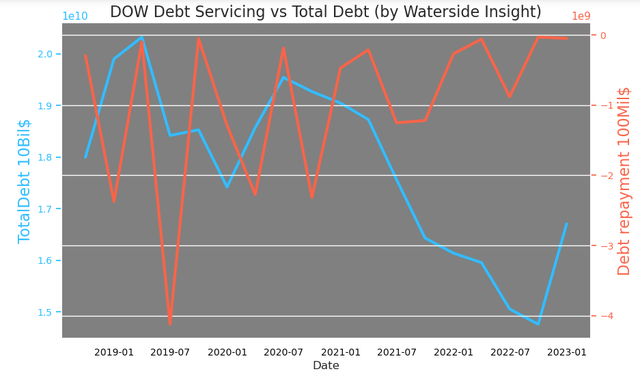

However, Dow has been actively paying down debt since its IPO. It has eradicated virtually 20% of its complete debt on this interval. At the moment, its debt-to-equity ratio is 0.8X. This debt discount effort has been constant, as we are able to see from the debt compensation historical past within the chart under. The corporate has been making such efforts yearly because it went IPO. It has no substantive debt maturities due till 2027, and almost all debt is at a hard and fast price. Its annual web curiosity expense can be steady at about $500 million per yr, with investment-grade credit score scores. This leads to the present larger rate of interest setting benefitting its near-term money conservation and progress stability.

Dow: Debt Servicing vs Complete Debt (Calculated and Charted by Waterside Perception with information from the corporate)

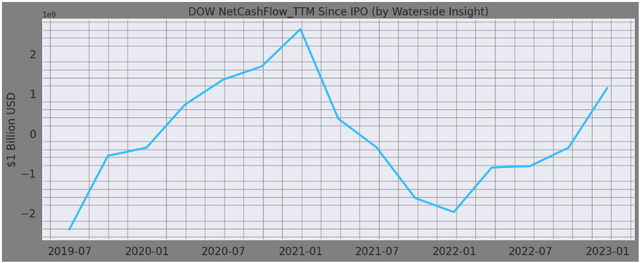

Even going by this debt discount effort, on high of paying $4.4 billion of dividends, Dow’s web money move remains to be holding regular.

Dow: TTM Web Money Stream (Calculated and Charted by Waterside Perception with information from the corporate)

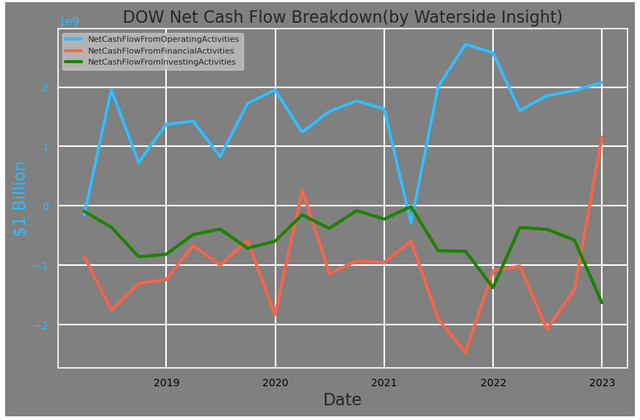

The optimistic contributors are primarily its robust working money move of $7.4 billion and a $1.6 billion long-term debt issuance. Its investing money move was down in This autumn, however yearly is at par in comparison with 2021 regardless that its capital expenditure elevated by 20% YoY. Total, its web money move is steady and rising.

Dow: Web Money Stream Breakdown (Calculated and Charted by Waterside Perception with information from the corporate)

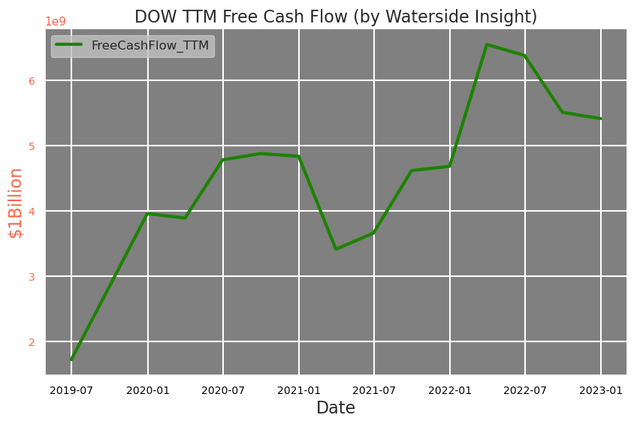

Despite the fact that its web working revenue dropped from $6.4 billion to $4.6 billion by 27% in 2022, Dow’s free money move nonetheless stays at its larger ranges on a TTM foundation. It was on account of each a discount in pension contribution and a rise in account receivables. It decreased its pension contribution from $1.2 billion in 2021 to $235 million in 2022, again to its stage in 2020. Within the meantime, its accounts receivables noticed a big enhance, from detrimental $2.1 billion in 2021 to $1.2 billion in 2022, and its accounts payable went from $2.4 billion in 2021 to detrimental $1.3 billion in 2022. Total improved money conversion and decreased pension contribution had been the most important optimistic contributors. It exhibits the corporate’s actively managing to remain in a wholesome monetary place.

Dow: TTM Free Money Stream (Calculated and Charted by Waterside Perception with information from the corporate)

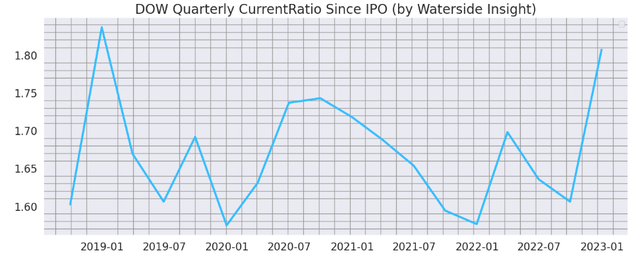

Not surprisingly, regular money move has helped Dow’s present ratio keep at a sufficiently excessive stage on a historic foundation.

Dow: Quarterly Present Ratio (Calculated and Charted by Waterside Perception with information from the corporate)

As an American firm with worldwide dominance, Dow is about to seize extra progress abroad in steadiness with its home income as properly. One of many driving tendencies available in the market this yr is China’s reopening and its affect on Rising Markets. If there’s extra progress on this theme, how a lot would Dow seize it?

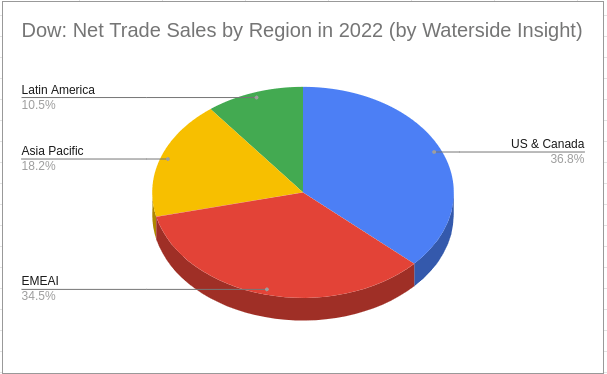

Dow: Web Commerce Gross sales by Area in 2022 (Calculated and Charted by Waterside Perception with information from the corporate)

As we are able to see from the chart above, the income contribution from the U.S. & Canada solely accounted for 35.7%, Asia Pacific solely accounted for 18.3%, and the remainder of the world accounted for 45%. The corporate noticed a couple of 6% down in gross sales in APAC in 2021, which may very well be worse in 2022 however higher in 2023. If the APAC area can get well 4-8% in gross sales, together with its ripple impact in different areas, it might contribute 2.5-5% to its income progress price in 2023.

Weak point/Dangers

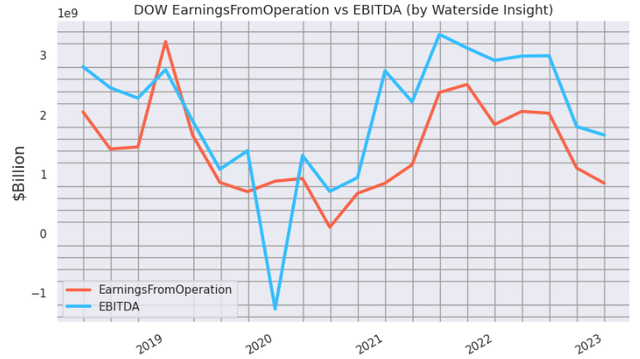

Dow continued to have the ability to obtain larger EBITDA than its earnings from operation, however they each have been inevitably impacted by the broader financial weak spot and trending downwards. In truth, the macro headwind is a near-term concern for the corporate.

Dow: Earnings from Operation vs EBITDA (Calculated and Charted by Waterside Perception with information from the corporate)

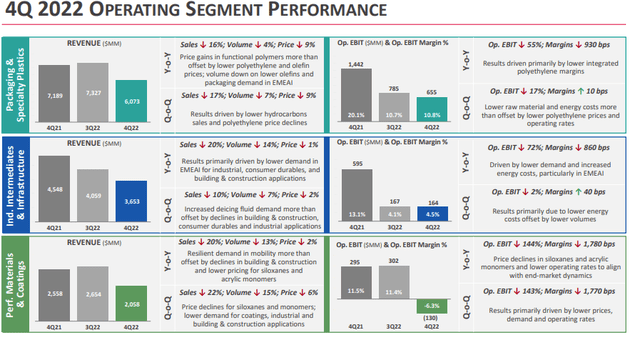

Dow had a cross-segment weaker efficiency in This autumn. Each section reported decrease quantity, decrease gross sales on a QoQ foundation, and decrease margins on a YoY foundation, whereas solely Efficiency Supplies and Coatings had a detrimental progress price in EBIT margin. They had been roughly consistent with the steering they gave about This autumn. Many of the decrease margin was pushed by decrease costs, demand, and working charges.

Dow: This autumn 2022 Working Section Efficiency (Firm Presentation)

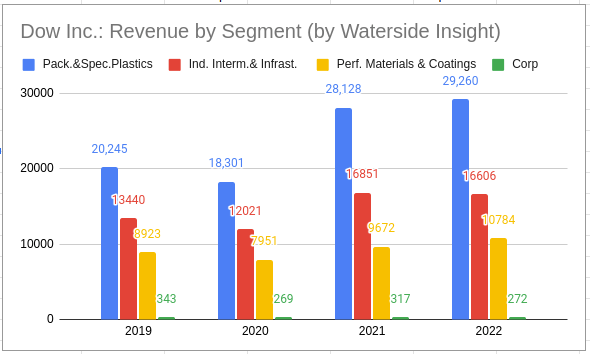

But additionally be aware that this decrease gross sales progress is constructed on a better annual foundation because of the YoY bounce of 21.5% in 2021. In absolute worth phrases, there’s nonetheless inching upward in its web gross sales and income.

Dow: Income by Section (Charted by Waterside Perception with information from the corporate)

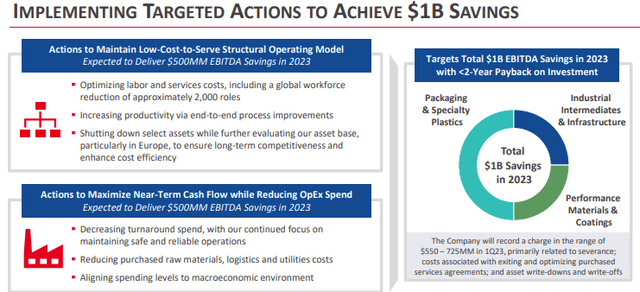

As a disciplined producer, Dow’s technique to deal with that is to decrease operational prices by its versatile working fashions. Particularly, they embody decreasing capability throughout polyethylene property, a worldwide chilly furnace idling program, and idling property throughout PM&C to handle value, match demand, and so on. Completely it’s anticipated to ship greater than $1 billion in value financial savings in 2023.

Dow: Implementing Focused Motion to Obtain $1B Financial savings (Firm Presentation)

To place that in perspective, its common quarterly value of income is about $1 to 1.2 billion. So it’s virtually equal to saving 20-25% of its value of income. If its income drops lower than 20% YoY in 2023, its total profitability might nonetheless enhance. Dow’s efficient bills and price management, which we alluded to earlier, will proceed saving it in margins in nerve-racking occasions.

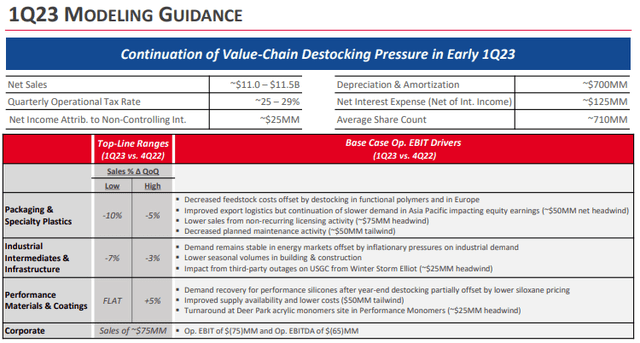

For Q1 of 2023, Dow gave modest steering that the top-line progress to be flat to detrimental within the segments. The anticipated web gross sales to be $11-11.5 billion, which is barely $500 million decrease than This autumn 2022’s web gross sales. It appears the corporate sees stabilizing market situations and demand in Q1. In keeping with the corporate, they see resilience from prospects in agricultural, pharma, and vitality markets, whereas shopper durables, constructing & development finish markets are underneath strain.

Dow: Q1 2023 Modeling Steerage (Firm Presentation)

Inexperienced Tech and Sustainable Development efforts

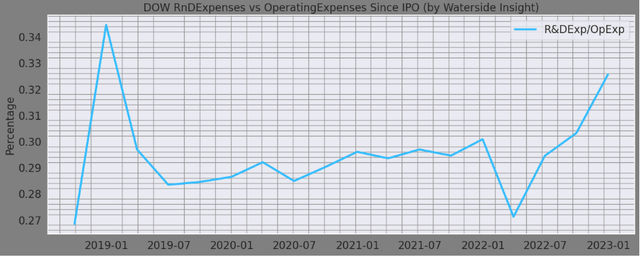

Dow’s analysis and improvement bills as a ratio to its complete working bills have all the time stayed round 30% and have regularly gone up not too long ago. It’s contributed by each the decline of working bills and rising R&D efforts.

Dow: R&D Bills vs Working Bills (Calculated and Charted by Waterside Perception with information from the corporate)

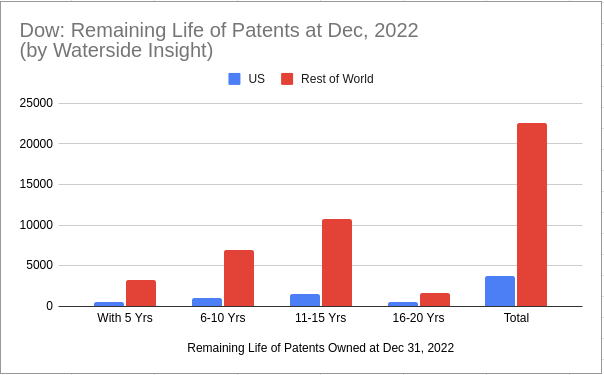

The corporate’s patent portfolio stays sturdy, particularly in the remainder of the world, the place its technological edge is most advantageous.

Dow: Remaining Lifetime of Patents (Charted by Waterside Perception with information from firm)

What’s Dow busy researching and creating? We consider the brand new inexperienced tech initiatives take up a big chunk of it. Within the latest JPMorgan 2023 Industrial Convention, Dow talked rather a lot about its inexperienced tech. The administration talked about “decarbonizing” 20 occasions, “recycling” 3 occasions, “emission” 2 occasions, and “web zero” as soon as. The theme of its inexperienced tech efforts is all through the presentation.

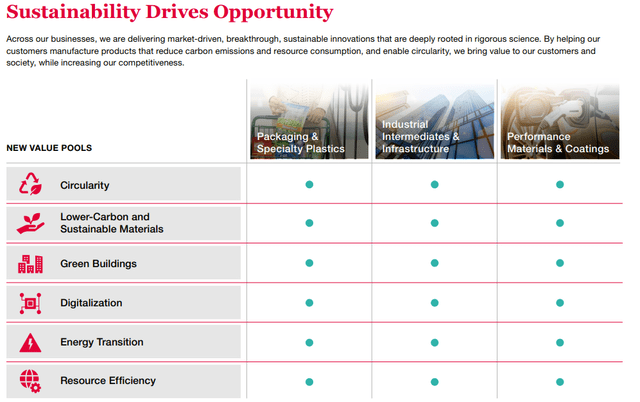

Past the inexperienced options of merely planting timber to offset emissions, Dow’s sustainability efforts have profound ramifications for its prospects and its backside line. The supplies it produces and the way it produces them are essential to many industries turning into extra sustainable and environmentally pleasant. This course of occurs to be monitorable and measurable at Dow since it will probably do it on the actual scientific stage, and may have a direct impact on the merchandise and their customers. In its 2021 ESG report and 2022 ESG Technique Overview, we see some highlights that may be immediately tied to income growth. It outlined six completely different areas the place the innovation can happen throughout all three of its main segments.

Dow: Sustainability Drives Alternative (Firm 2021 ESG Report)

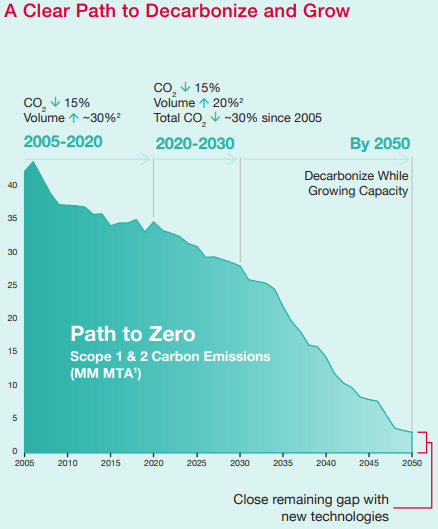

All through the upgrading efforts of those segments, Dow has outlined a path to its decarbonizing progress with a transparent goal.

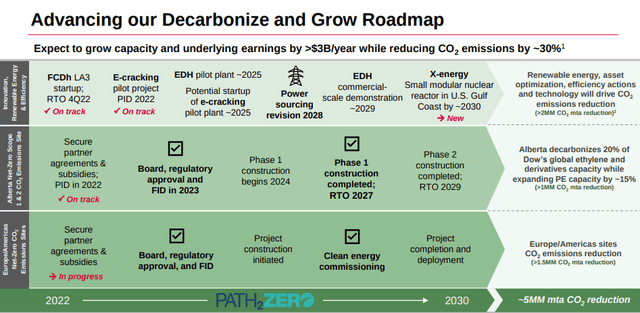

Dow: Path to Decarbonize and Develop (Dow’s ESG Report 2022)

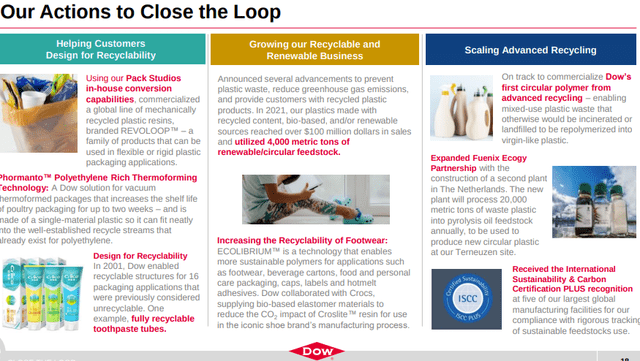

Right here we need to spotlight the market potential of the segments throughout the sustainability efforts. For instance, in its core enterprise section, the corporate’s implementing “Shut the Loop” goal, and it’s monitoring its progress in the direction of enabling 100% of its packaging utility to be reusable and recyclable by 2035.

Dow: Shut the Loop (Firm 2022 ESG Technique and Overview)

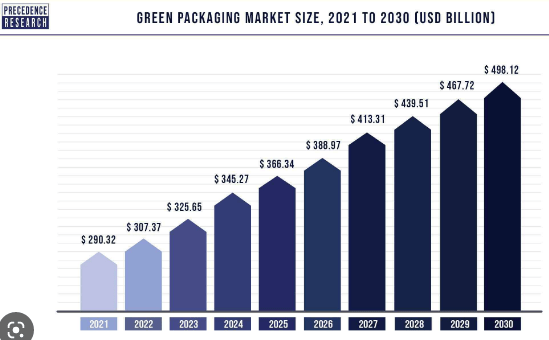

If we check out the inexperienced packaging market, its measurement is anticipated to double in market measurement by 2030.

Inexperienced Packaging Market Measurement (Priority Analysis)

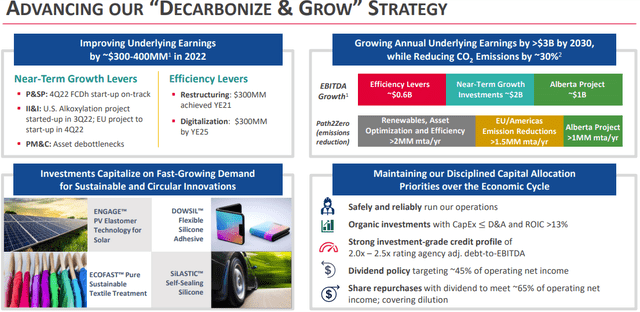

Decarbonizing is the core technique addressing sustainability progress and merchandise for Dow.

Dow: Advancing Decarbonize and Develop Roadmap (Firm 2022 ESG Technique and Overview)

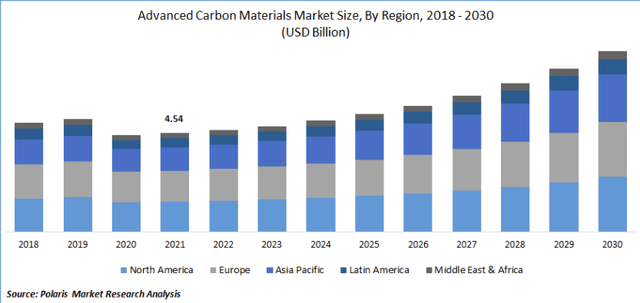

And the low-carbon supplies market is anticipated to develop by virtually 50% by 2030.

Superior Carbon Materials Market Measurement (Polaris Market Analysis Evaluation)

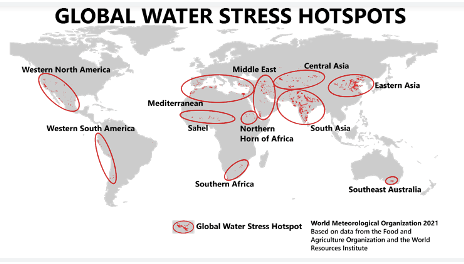

On a broader scale, the world is more and more going through acute water scarcity stress. In keeping with World Meteorological Group, the hotspot on this planet are the next:

World Water Stress Hotspots (World Meteorologist Group)

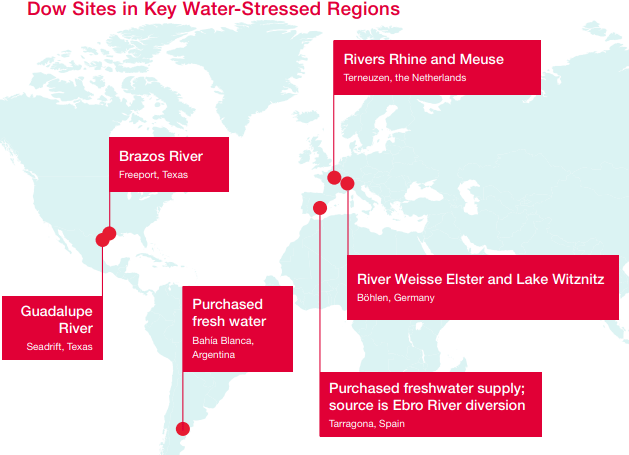

Dow has positioned its websites in half of those eleven hotspots. In these websites, it developed the capability to cut back the freshwater depth and speed up water options within the textile trade, akin to partnering with Ralph Lauren (RL).

Dow: Websites in key Water-stressed Areas (Firm 2021 ESG Report)

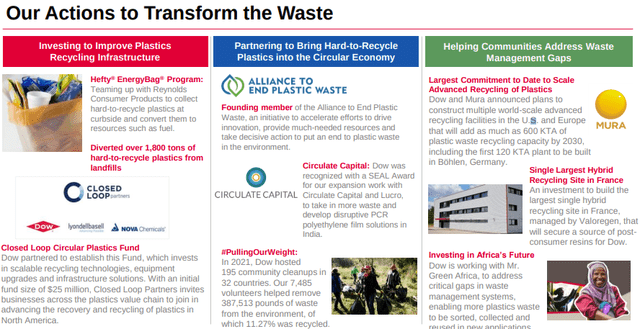

Final however not least, in waste administration, Dow will rework plastic waste and different types of various feedstock to commercialize 3 million metric tons of round and renewable options yearly by 2030. And the corporate’s effort in turning automotive waste into new automotive merchandise helps automotive producers meet their market and regulatory calls for for extra round merchandise.

Dow: Actions to Rework Waste (Firm 2022 ESG Technique and Overview)

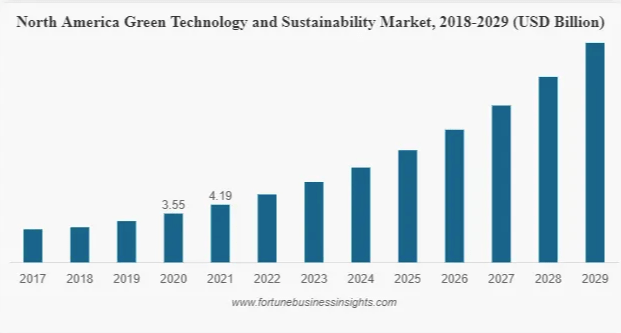

Together with its acceleration of utilizing higher-efficiency, lower-emission expertise and deepening its analysis in trans-formative, next-generation applied sciences, Dow might experience the wave of a quickly rising inexperienced tech market, whose progress in North America alone is anticipated to virtually triple by 2029.

North American Inexperienced Tech Market Projection (www.fortunebusinessinsights.com)

Inexperienced expertise usually implies extra effectivity and fewer waste, which is all the time good for the underside line. As a worldwide materials and chemical firm, Dow can make the most of its analysis and industrial capability to seize this wave of innovation and its market-driven utility. And that is all a part of its “Decarbonize & Develop” Technique, with particular near-term progress levers outlined in every section, whereas saving $300 million in 2021 and seeking to save one other $300 million by 2025. The newest announcement that Dow will construct a primary grid-scale superior nuclear reactor on considered one of its websites to offer long-term, dependable low-carbon vitality exhibits the corporate is making a strategic effort essentially.

Dow: Advancing Decarbonize & Develop Technique (Firm 2021 ESG Report)

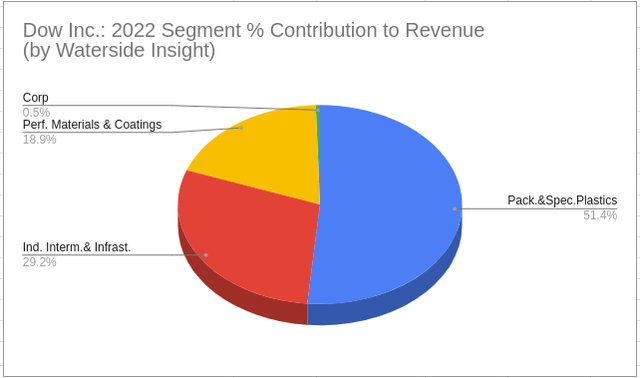

It expects its annual underlying earnings to develop by greater than $3 billion by 2030, which is about 50% greater than its present earnings. Its 2021 whole-year section income contribution is as the next:

Dow: Section Contribution to Income 2022 (Calculated and Charted by Waterside Perception with information from the corporate)

Combining the potential market progress potential of the areas we highlighted above, if we assume a gradual path P&SP grows by 6% yearly, II&I grows by 2-3%, and PM&C grows by 3%, then the whole annual progress of income could be about 37% by 2030. Together with its cost-saving advantages from improved effectivity, which it dubbed “Effectivity Levers”, to attain virtually 50% progress in earnings is bold however solely out of attain. However the progress path is rarely linear, particularly for a commodity-intensive firm that’s extremely versatile from the influence of exterior markets. To attain that purpose, it can’t have a single yr of detrimental money move progress. That will be unlikely given the weak macro we’re at present in, the corporate might have already got detrimental money move progress for 2023 and 2024. We’ll ponder on this when assessing its valuation.

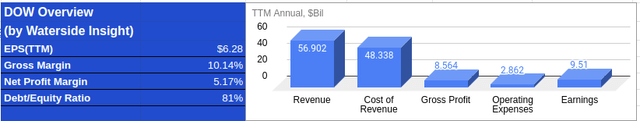

Monetary Overview

Dow: Monetary Overview (Calculated and Charted by Waterside Perception with information from the corporate)

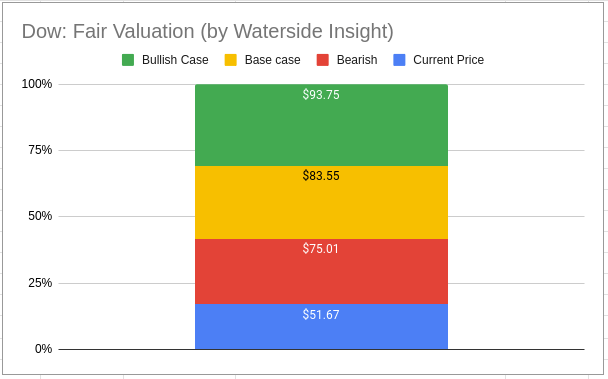

Valuation

We’re nonetheless this present day, which implies there are macro headwinds forward for Dow. We take into account all of the evaluation above and use our proprietary fashions to evaluate Dow’s truthful worth by projecting its progress prospects ten years forward. We used a value of fairness of seven.46% and a WACC of 6.21%. In our bullish case, the corporate faces earnings and money move contraction in 2023 and 2024 as much as double digits on account of decrease income progress and better prices, with additionally double-digit progress in later years as soon as the economic system recovers; it’s priced at $93.75. In our bearish case, the corporate has steeper detrimental progress on account of impacts by macro weak spot in ’23 and ’24, and has extra risky progress afterward, it’s priced at $75.01. In our base case, it nonetheless has detrimental money move and earnings progress in ’23 and ’24, however phases regular restoration in the long run within the double digits with volatility remaining; with decrease upside but in addition decrease volatility, it was priced at $83.55. Usually, even accounting for the near-term weak spot and impacts from risky exterior components, Dow nonetheless has robust upside potential for the long run. The present inventory worth is under all of our estimates. We consider the market is simply too bearish on the corporate.

Dow: Honest Valuation (Calculated and Charted by Waterside Perception with information from firm)

Conclusion

Dow’s world scale and numerous end-market utility of its merchandise present a powerful income stream to assist its steady progress. The corporate can climate the downturn higher with its versatile value and expense management. Essentially the most vital future growth of the corporate will come from its inexperienced tech initiatives and the associated services and products as a mixture. Though the trail is rarely easy, the upside stays attainable with the robust analysis and improvement efforts the corporate is dedicated to. We predict the market’s too bearish on the corporate’s volatility and macro headwind and we suggest a purchase.