Thomas Barwick

Elevator Pitch

I fee Inspirato Integrated’s (NASDAQ:ISPO) shares as a Maintain. ISPO’s 2023 monetary steerage wasn’t nearly as good as what one would have hoped for. Wanting forward, the corporate has put in place initiatives to spice up its prime line and backside line for the intermediate time period. ISPO’s valuation de-rating has already priced within the below-expectations 2023 outlook for the corporate, however it is going to take time for Inspirato to witness a big enchancment in its monetary efficiency. As such, a Maintain score for ISPO is honest.

Firm Description

Inspirato refers to itself as a “luxurious journey subscription model that gives prosperous vacationers entry to a managed and managed portfolio of hand-selected trip choices” in its media releases. As highlighted in its most up-to-date 10-Okay submitting, subscription income and journey income accounted for 42% and 58% of ISPO’s prime line, respectively for FY 2022.

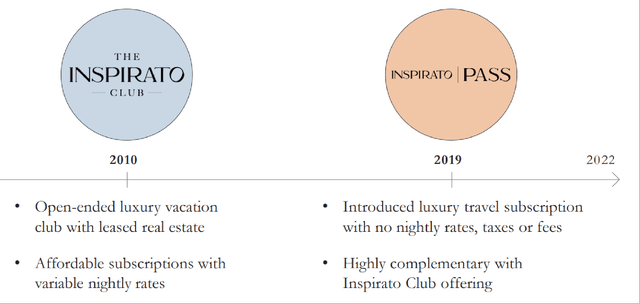

ISPO’s Key Subscription Choices

ISPO’s January 2023 Needham Development Convention Presentation

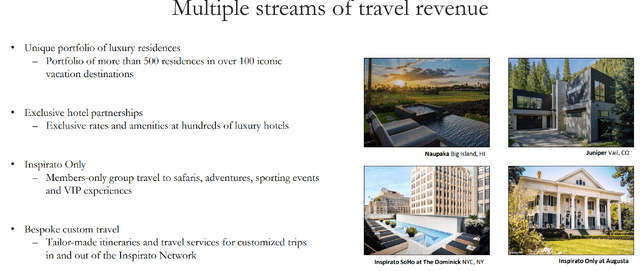

Inspirato’s Journey Enterprise Operations

ISPO’s March 2023 Company Presentation

ISPO’s 2023 Monetary Steerage Was A Disappointment

In mid-March 2023, Inspirato disclosed the corporate’s up to date administration steerage for full-year 2023. Particularly, ISPO guided for a prime line of $360 million and a non-GAAP adjusted EBITDA lack of -$15 million within the present 12 months based mostly on the mid-point of its monetary steerage.

The brand new steerage issued by ISPO implies that the corporate’s income enlargement may doubtlessly reasonable considerably from +47% in FY 2022 to only +4% for FY 2023. Additionally, Inspirato’s revised FY 2023 prime line steerage of $360 million is way decrease than its prior prime line steerage of $400 million.

Inspirato was beforehand a beneficiary of Work-From-Dwelling and different versatile work tendencies which gained momentum throughout the peak of the COVID-19 pandemic. ISPO acknowledged on the firm’s This autumn 2022 earnings briefing on March 16, 2023 that it expects “lowered (Inspirato) Cross subscribers” contemplating that “individuals who have extra normalized (workplace work) schedules” are “much less apt to proceed with their Cross (subscriptions).” The Inspirato Cross subscription is a significant income contributor for the corporate having accounted for near 30% of ISPO’s prime line for full-year FY 2022. However current subscriber development tendencies have been unfavourable with the variety of Inspirato Cross subscribers reducing by -7% QoQ in This autumn 2022.

Additionally, whereas Inspirato was anticipating to be worthwhile on the normalized EBITDA degree in 2023 as per its earlier steerage, the corporate’s newest monetary steerage factors to continued non-GAAP EBITDA losses for this 12 months.

At its Q3 2022 outcomes name in late December final 12 months, ISPO cited elements corresponding to “a bigger subscriber rely” and a “sturdy degree of reserving exercise” as the important thing drivers of its prior constructive EBITDA steerage for FY 2023. As mentioned above, the variety of ISPO’s Inspirato Cross subscribers is dropping, and the corporate has additionally lowered its full-year FY 2023 gross sales steerage. Slower income development for ISPO implies that the corporate’s backside line cannot profit from constructive working leverage in a significant manner. Due to this fact, it’s cheap that the timeline for reaching constructive normalized EBITDA has been pushed backwards.

Inspirato Has Plans To Reignite Development And Reduce Prices

ISPO has lately carried out a few initiatives with the goal of reigniting the corporate’s income development and decreasing its bills.

On March 14, 2023, Inspirato introduced that it “entered right into a strategic advertising partnership” with “Saks, the premier digital platform for luxurious trend.” As a part of the collaboration, shut to three,000 of Saks’ stylists will assist to advertise and market ISPO’s product choices starting in Q2 2023. For my part, this new partnership will assist to increase Inspirato’s attain to extra well-to-do vacationers.

Individually, Inspirato has made significant headway in penetrating the Enterprise-to-Enterprise or B2B journey section. In its March 2023 investor presentation, ISPO talked about that its new B2B operations branded as “Inspirato For Enterprise” supply “custom-made, flat-rate journey packages” that are included as a part of “company profit packages”. The corporate revealed at its most up-to-date quarterly earnings name that its B2B journey enterprise had already offered about $5 million price of contracts in This autumn 2022 and early 2023.

When it comes to monetary and price administration, ISPO appointed a brand new CFO final week, and it reduce the corporate’s workers power by -12% in January this 12 months. Robert Kaiden, previously from Twitter, takes over the CFO position from Net Neighbor. Net Neighbor is at present assuming the place of Chief Technique Officer or CSO and he turns into accountable for investor relations and different capital markets-related actions. For my part, it’s constructive that the brand new CFO (Robert Kaiden) will be capable to dedicate extra time and a focus to monetary administration and price optimization, whereas the previous CFO and new CSO (Net Neighbor) has nearer interplay with the analysts and traders. Individually, the workforce discount is predicted to translate into annualized value financial savings of $10 million for ISPO based mostly on administration steerage.

However time is required for Inspirato’s actions to translate into prime line development and improved profitability. As per the market’s consensus monetary projections obtained from S&P Capital IQ, ISPO is simply anticipated to return to double-digit proportion income enlargement and constructive EBITDA in FY 2025.

Closing Ideas

Inspirato’s consensus ahead subsequent twelve months’ Enterprise Worth-to-Income a number of has declined from a one-year peak of 1.27 instances registered on March 31, 2022 to 0.49 instances on the finish of the March 27, 2023 buying and selling day as per S&P Capital IQ information. I deem ISPO’s present valuations to be honest, justifying a Maintain score, in view of the corporate’s lackluster 2023 outlook and the time taken for its new initiatives to take impact.

Editor’s Word: This text covers a number of microcap shares. Please concentrate on the dangers related to these shares.

.jpeg?itok=vRnDFKIa'%20%20%20og_image:%20'https://cdn.mises.org/styles/social_media/s3/images/2025-04/AdobeStock_GDP%20(2).jpeg?itok=vRnDFKIa)