rrodrickbeiler

By Kevin Flanagan

Normally, when speaking in regards to the month of March, the previous saying was whether or not it got here and went as a lion or a lamb. Sadly, with the latest banking turmoil, a complete new dynamic was at play in 2023, and with it, the U.S. Treasury (UST) market skilled some uncommon buying and selling exercise. We not too long ago blogged in regards to the elevated volatility quotient in Treasuries, however on this piece, I needed to offer some perspective on what some key yields truly did in the course of the month.

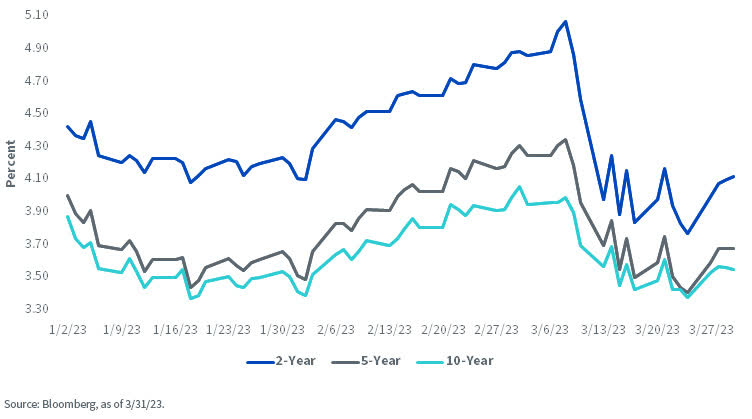

After developments via the lens of a graph, all I may take into consideration have been the rollercoasters at Six Flags. Particularly, this evaluation goes to concentrate on revisiting our good previous pals, the 2-, 5- and 10-12 months notes. Certainly, a uneven panorama was on show via January, however you bought a way {that a} buying and selling vary of some kind was nonetheless operative.

U.S. Treasury Yields

Then, following the Fed’s February 1 FOMC assembly, what was a seesaw kind of sample for yields moved in a decidedly upward trajectory, culminating with the latest peak readings following Chairman Powell’s hawkish semiannual financial coverage testimony in early March. To offer some perspective, within the intermediate to longer-dated sectors of the UST curve, the 5- and 10-12 months yields rose by about 80 foundation factors (bps) and 65 bps, respectively, as financial/inflation information surprises had traders reevaluate their fee outlooks.

Nonetheless, it’s the entrance finish of the curve the place much more seen yield actions have occurred. Certainly, the UST 2-12 months yield surged by 70 bps in February after which tacked on one other post-Powell enhance of 25 bps (just below 100 bps in complete) to achieve a peak of 5.07% on March 8, the primary time eclipsing the “5%” threshold since 2007. This spike mirrored the chance that the Fed may elevate charges greater than anticipated and was underscored by the implied chance for Fed Funds reaching nearly 5.70% for September.

Everyone knows what occurred subsequent, because the latest bout of banking turmoil turned the Treasury market the wrong way up and created the rollercoaster buying and selling sample I discussed earlier. Swiftly, day by day actions within the 2-12 months of 20, 30 or 40 bps in yield have been being noticed. After all, the Fed outlook shifted dramatically as effectively, with a number of fee cuts now being priced in starting this summer time. In reality, on March 24, the Fed Funds Charge was implied to come back in at roughly 3.75% in January 2024, representing a 170-bp reversal from earlier in March. For sure, the UST 2-12 months yield adopted go well with and plunged to three.55% on an intraday foundation, an unimaginable decline of greater than 150 bps in an instrument that’s usually considered as being much less unstable attributable to its shorter period profile.

Conclusion

That was then; what about what lies forward? Nice query. One factor that does appear possible is that the volatility quotient will stay elevated. Nonetheless, if the headlines surrounding the banking turmoil simmer down, yield actions will greater than seemingly not be as excessive as we witnessed in March. Final week, I blogged in regards to the Fed’s lending amenities, and the excellent news is that the whole utilization quantity for the week ending March 30 dropped by -$189 billion. Hopefully, the UST market can get again to focusing solely on the basics, such because the upcoming jobs and inflation stories, and naturally, the ever-present “will they or gained’t they” in terms of the Might FOMC assembly.

Kevin Flanagan, Head of Fastened Revenue Technique

As a part of WisdomTree’s Funding Technique group, Kevin serves as Head of Fastened Revenue Technique. On this position, he’s a member of WisdomTree’s Mannequin Portfolio Funding Committee, writes mounted income-related content material and travels with the gross sales workforce, conducting client-facing conferences and offering experience on WisdomTree’s present and future bond ETFs. As well as, Kevin works carefully with the mounted revenue workforce. Previous to becoming a member of WisdomTree, Kevin spent 30 years at Morgan Stanley, the place he was most not too long ago a Managing Director. He was chargeable for tactical and strategic suggestions and created asset allocation fashions for mounted revenue securities. He was a contributor to the Morgan Stanley Wealth Administration World Funding Committee, major creator of Morgan Stanley Wealth Administration’s month-to-month and weekly mounted revenue publications, and collaborated with the agency’s Analysis and Consulting Group Divisions to construct ETF and fund supervisor asset allocation fashions. Kevin has an MBA from Tempo College’s Lubin Graduate Faculty of Enterprise, and a B.S in Finance from Fairfield College.

Authentic Publish

Editor’s Observe: The abstract bullets for this text have been chosen by Searching for Alpha editors.