SPX Monitoring functions; Lengthy SPX on 2/6/23 at 4110.98

Monitoring functions GOLD: Lengthy GDX (NYSE:) on 10/9/20 at 40.78.

Lengthy Time period SPX monitor functions; Impartial

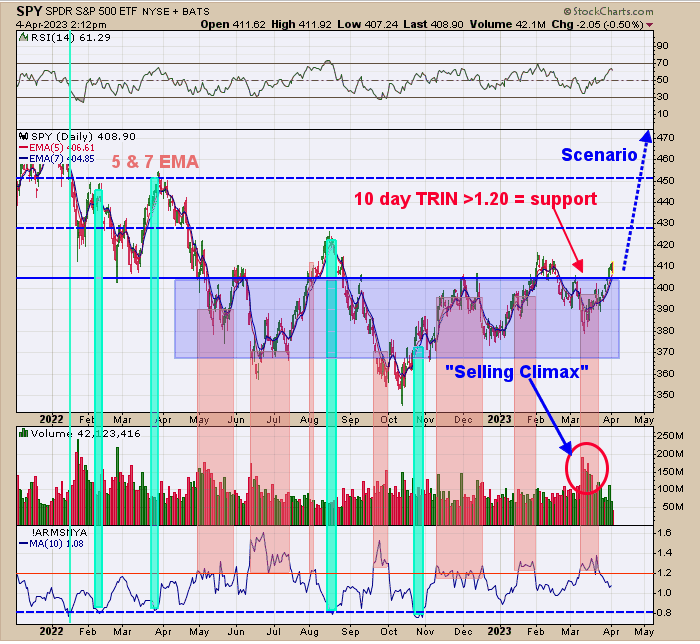

The above chart is the every day SPDR® (NYSE:). The pink space reveals the instances when the ten day TRIN was above 1.20, a studying which reveals panic and normally comes close to lows within the SPY. The blue space reveals when the ten day TRIN is beneath .80 and a studying that reveals euphoria and usually comes close to highs within the SPY.

Proper now, the ten day TRIN stands at 1.08 and close to impartial studying for the market. If the rally continues (which we expect it is going to) the ten day TRIN might drop to .80 or decrease and provides us a “Heads up” that market could also be close to a excessive and develop close to 470 on the SPY. The purple space reveals the place most of theten0 day TRIN studying was above 1.20, which was from the 370 to 405 vary on the SPY and lasted ten months, suggesting a assist space.

This sideways sample seems to be breaking out to the upside and provides a goal to the 470 vary, the January 2022 excessive. Some thrilling statistics; Pre-election years (this 12 months), April is up 94% of the time. If January was up (it was up over 6%), April is up 88% of the time.

The chart is up to date to at this time’s buying and selling; what we mentioned yesterday remains to be related. “The breakout out space on the month-to-month SPY chart is close to the 405 degree, which was exceeded on final Friday’s shut. There was additionally a “Signal of Power” for the month of March (famous in are chart). The sample that seems to be forming is a “Head and Shoulders backside” and has a measured goal to the 470 degree, which is the January 2022 excessive.

The SPY didn’t fairly get to the 50% retracement degree measured from the March 2020 low (50% degree famous on the chart). A 50% retracement suggests the market will at the least rally again to the previous excessive (January 2022 SPY 470) or can mark the midway level of the transfer up, giving a a lot greater goal. The underside window is the month-to-month Sluggish Stochastic, which turned up final November, suggesting an uptrend was began again then.”

***

Disclaimer: Indicators are offered as basic info solely and are usually not funding suggestions. You might be accountable for your individual funding selections. Previous efficiency doesn’t assure future efficiency. Opinions are primarily based on historic analysis and information believed dependable, there isn’t any assure outcomes can be worthwhile. Not accountable for errors or omissions. I could put money into the autos talked about above.