cbies

The February Commerce Deficit elevated for the third month in a row, rising by $1.9 billion. Internet Items got here in at -$92.9B with Internet Companies at $22.4B to achieve a complete of -$70.5B.

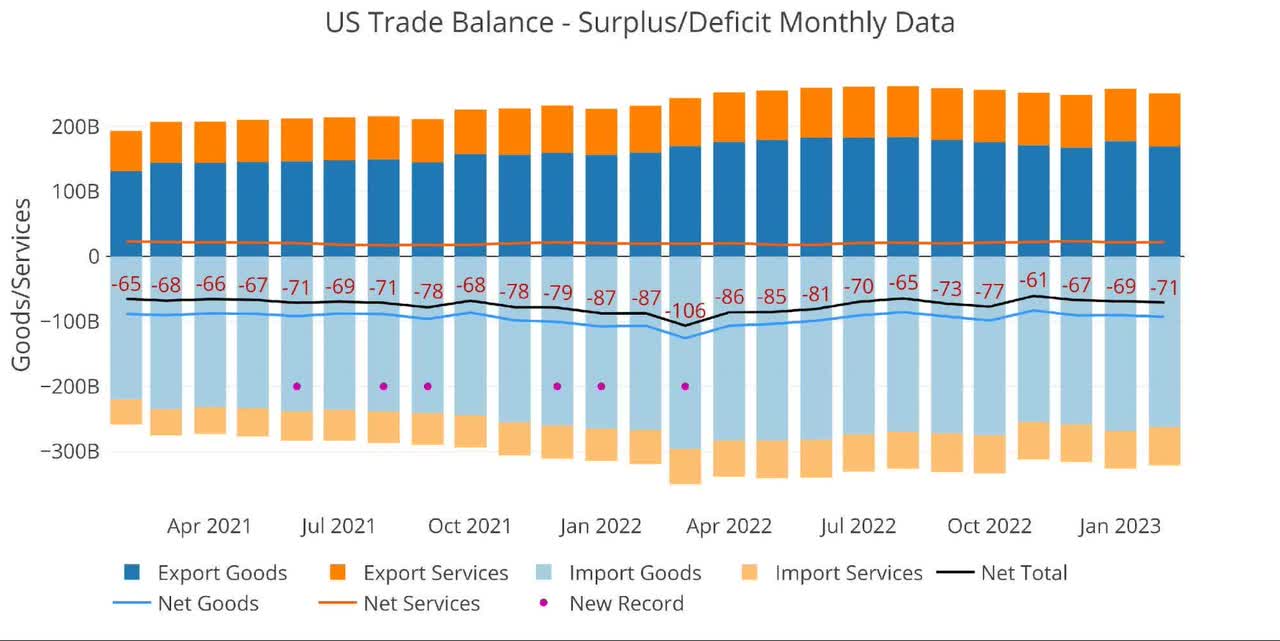

Determine 1: Month-to-month Plot Element

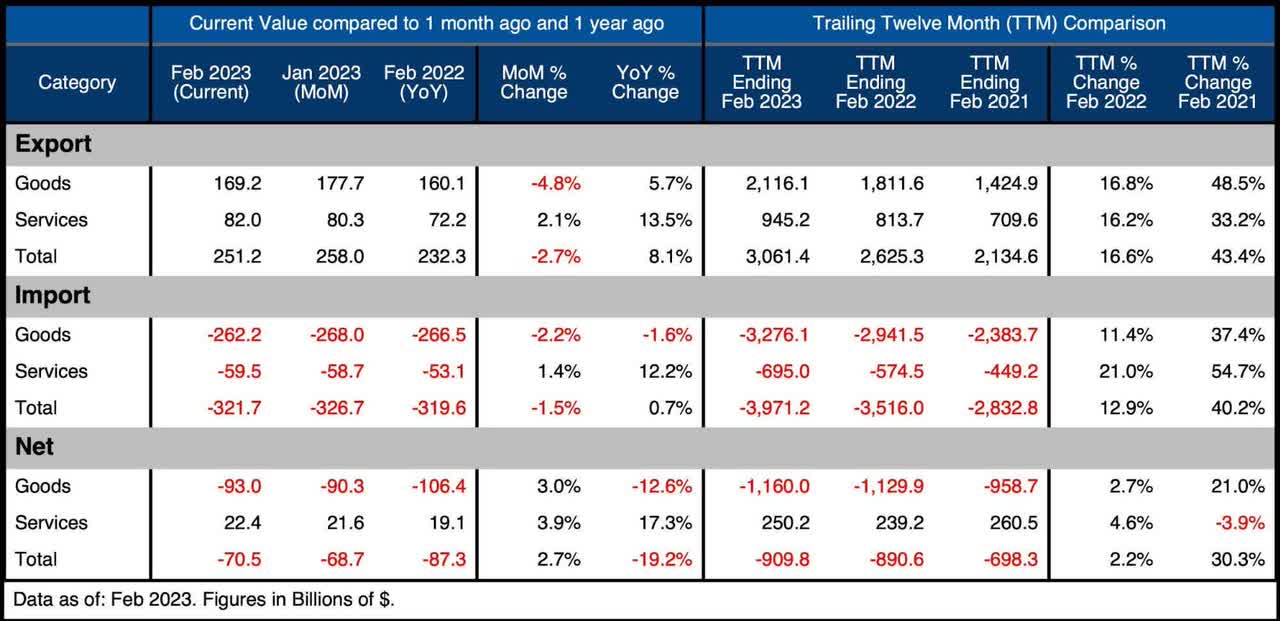

The desk under offers element.

Month-to-month Commerce Deficit

Items Imports and Exports each fell Exports fell by a higher margin than Imports driving the Items Deficit up by 3% or $2.7B Companies Imports and Exports each increasedExports elevated by a higher margin than Imports driving the Companies Surplus up by 3.9% or $800M

Trailing Twelve Month:

Exports and Imports in Items have grown considerably over the past yr, with Exports growing past $2.1T and Imports growing to over $3.2T With Exports growing sooner than Imports the TTM Items Deficit was up 2.7% to $1.16T The Companies Surplus noticed the same sample with will increase in each Imports and ExportsExports elevated sooner inflicting the Companies Surplus to rise by 4.6% The TTM Deficit fell to -$909B after reaching near -$975B final summer season. It’s nonetheless up YoY by 2.2percentTotal Exports has exceeded $3T with complete Imports closing in on $4T

Determine 2: Commerce Steadiness Element

Historic Perspective

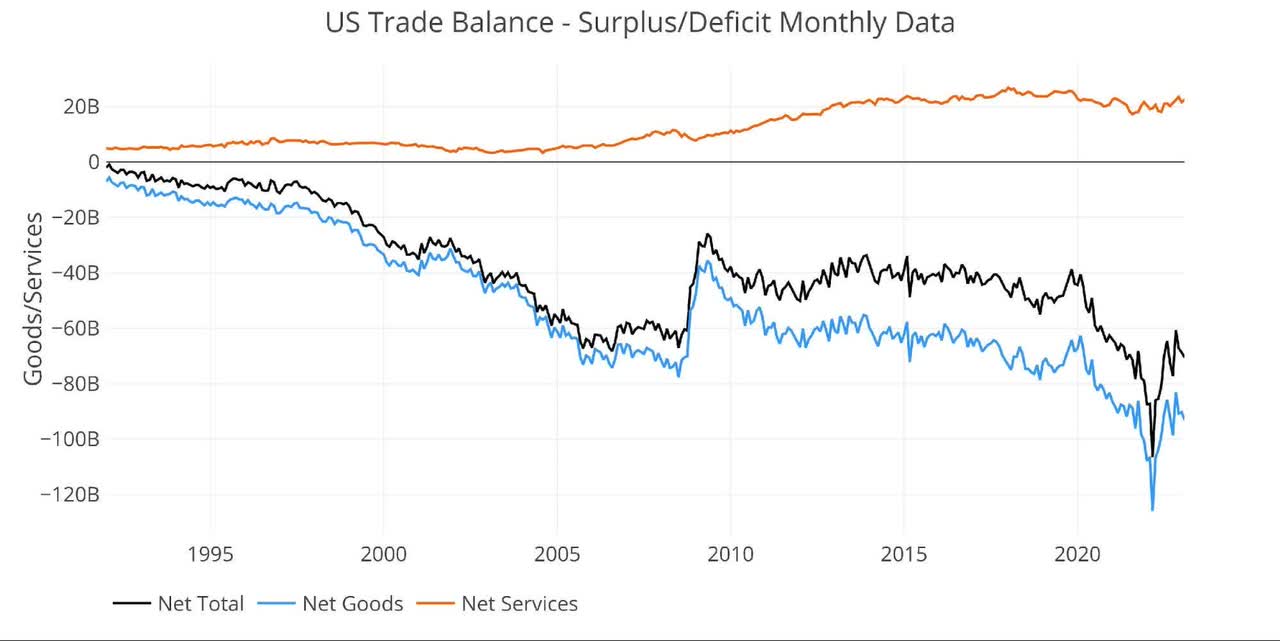

Zooming out and focusing on the web numbers reveals the longer-term pattern. We’re nicely off the lows seen final March, however the volatility has elevated dramatically. The Commerce Deficit appears to be trending again down after a quick restoration topped out in November final yr when the Deficit nearly fell under $60B.

Determine 3: Historic Internet Commerce Steadiness

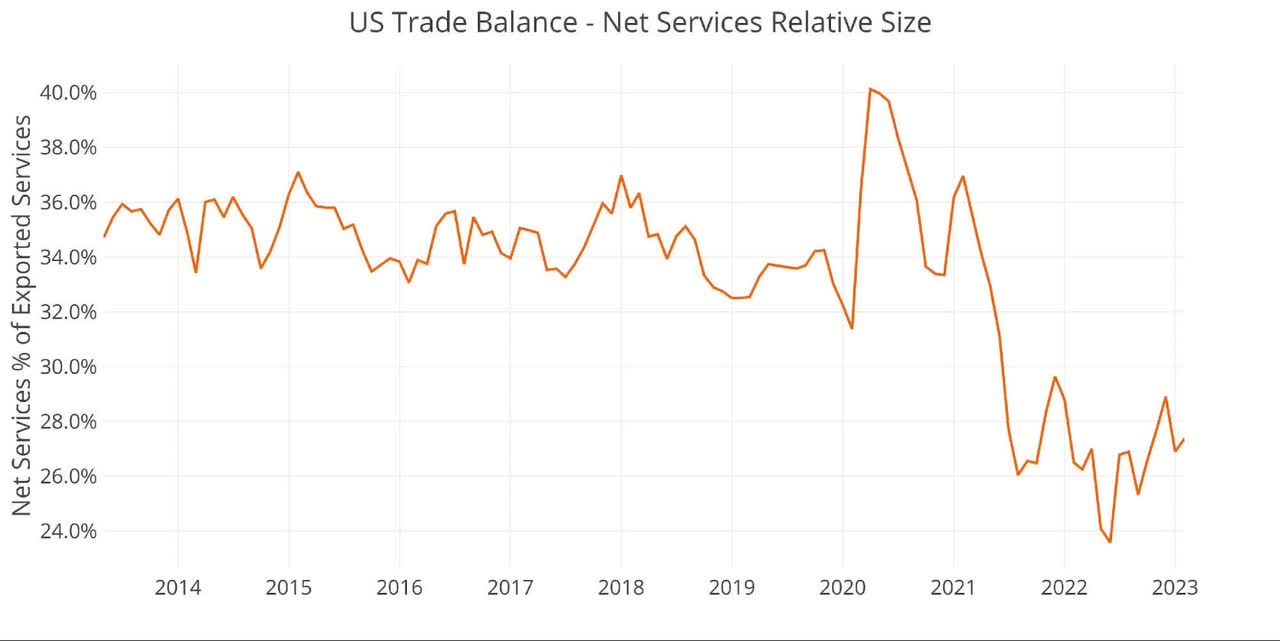

The Companies Surplus noticed a slight uptick this month. The chart under reveals that Internet Companies proceed to fall as a proportion of complete Exported Companies. The February quantity was 27.4%, down from the 35% common seen pre-Covid. The present worth is off the lows seen in mid-2022 however doesn’t seem to have damaged the downward pattern.

Determine 4: Historic Companies Surplus

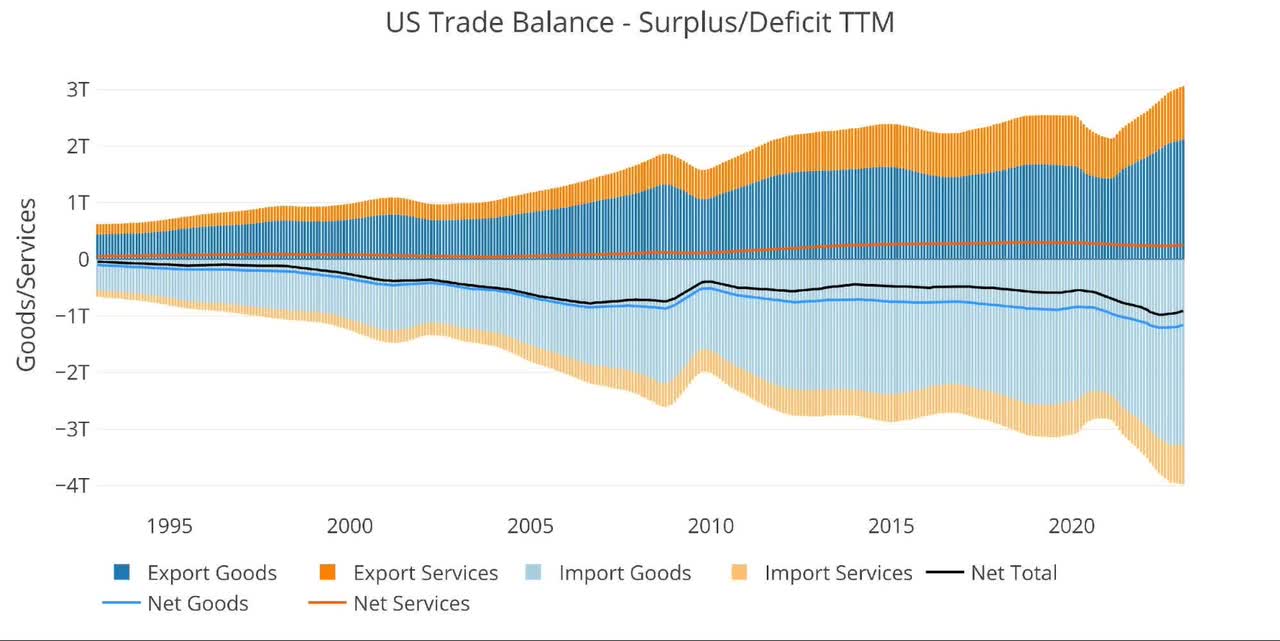

To place all of it collectively and take away a few of the noise, the following plot under reveals the Trailing Twelve Month (“TTM”) values for every month (i.e., every interval represents the summation of the earlier 12-months). The worldwide surge in consumption post-Covid is evident to see under, or, extra doubtless, the worldwide enhance in costs. The black line is displaying a light restoration on a TTM foundation pushed by a slight lower in Internet Items Deficit and a slight enhance in Internet Companies Surplus in current months.

Determine 5: Trailing 12 Months (TTM)

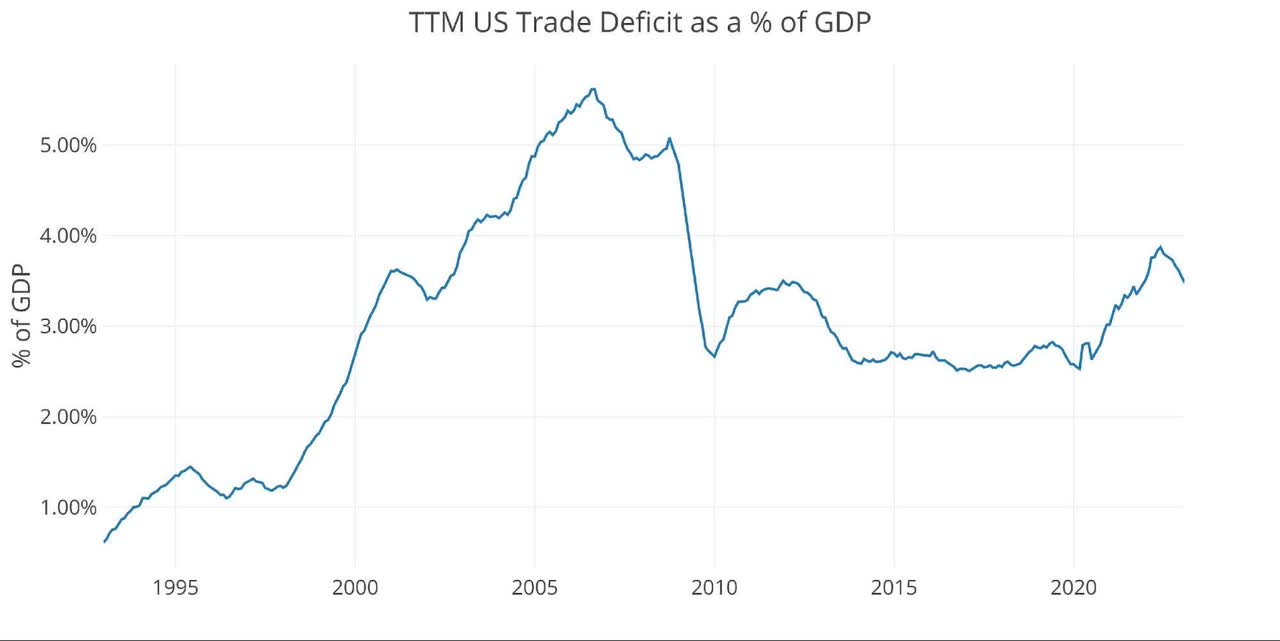

Though the TTM Internet Commerce Deficit is close to historic highs, it may be put in perspective by evaluating the worth to US GDP. Because the chart under reveals, the present information are nonetheless under the 2006 highs earlier than the Nice Monetary Disaster.

The present worth of three.48% is shifting again down however remains to be nicely above the two.5% from earlier than Covid.

Determine 6: TTM vs GDP

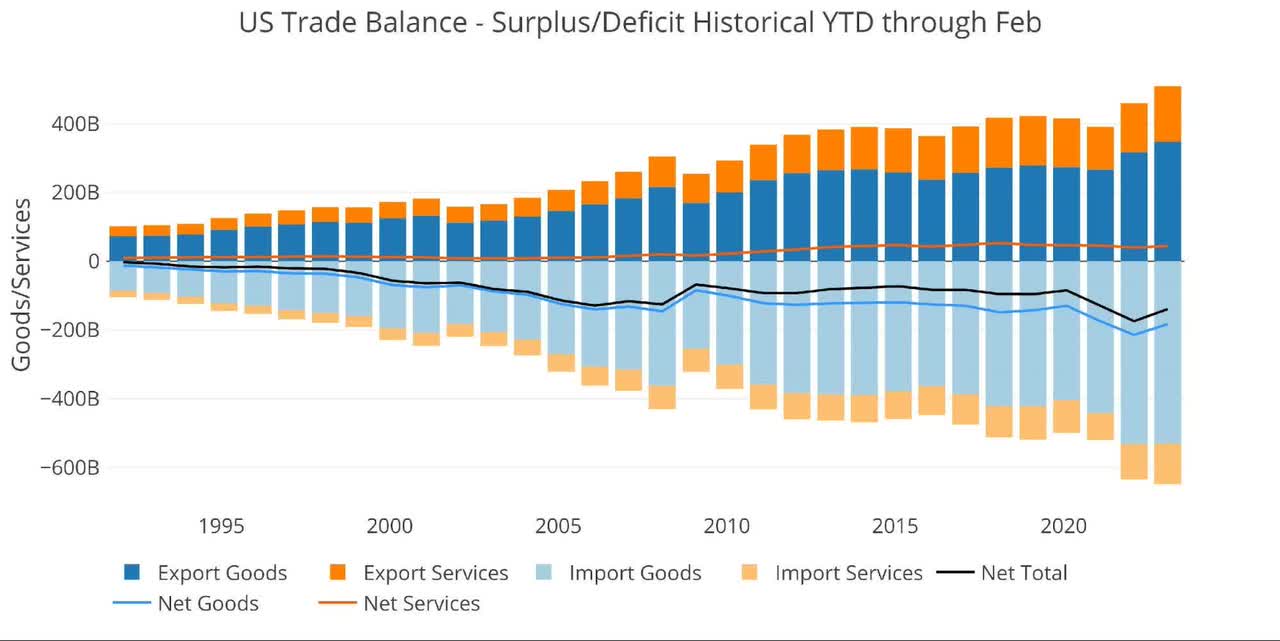

The chart under reveals the YTD values. As a result of the newest month is February, this solely reveals two months. It’s clear to see how this yr is bigger in all classes in comparison with final yr and in addition how Exports have grown greater than Imports.

Determine 7: 12 months to Date

Wrapping Up

The Commerce Deficit is down from the information set final yr, however the US remains to be printing very massive Deficits. This implies the US remains to be flooding the world with {dollars} in alternate for items. This can be a very harmful scenario for the US, particularly as extra indicators level to a transfer away from the USD. The BRICS are engaged on a brand new foreign money in a really particular try to de-Dollarize.

This could possibly be extraordinarily problematic. For many years, the US has benefited by having the world reserve foreign money. This has allowed Individuals to dwell approach past their means, buying and selling paper foreign money for bodily items overseas. The muse for enormous inflation has now been laid. If the USD loses its dominance and international demand for {dollars} falls, all these {dollars} are going to return speeding again to the US. The Fed is not going to be ready to then scale back the quantity of {dollars} bidding up items and providers domestically.

Additional exacerbating the issue is that the US has grown comfy with low cost imported items because the Commerce Deficit reveals. If the world begins turning away from the greenback, these overseas items will probably be more durable to acquire at present costs. Thus, you might have a double influence on inflation: extra {dollars} within the US chasing up items and a falling alternate charge making imports dearer.

Knowledge Supply: Commerce Steadiness: Items and Companies, Steadiness of Funds Foundation

Knowledge Up to date: Month-to-month on one month lag

Final Up to date: Apr 05, 2023, for Feb 2023

US Debt interactive charts and graphs can at all times be discovered on the Exploring Finance dashboard: https://exploringfinance.shinyapps.io/USDebt/

Unique Publish

Editor’s Observe: The abstract bullets for this text had been chosen by Looking for Alpha editors.