da-kuk/E+ by way of Getty Photographs

I’ve been bullish on Brazilian shares by way of the iShares MSCI Brazil ETF (NYSEARCA:EWZ) for a number of years, and whereas the ETF has paid double-digit annual dividends, its value has stagnated, at the same time as gross sales, earnings, and dividends have all soared increased. This has created a chance so as to add to lengthy positions as present valuations are unlikely to final lengthy.

In my most up-to-date article on EWZ in February I argued that prime actual borrowing prices have been optimistic for long-term returns primarily as a result of optimistic influence that they’ve on the Brazilian actual, which is a major driver of EWZ positive aspects. Since then, we have now seen the actual recognize however increased actual charges have weighed on the native fairness market, sending EWZ decrease.

This actual power has anchored inflation, which has begun to fall sharply, giving the Brazilian central financial institution room to chop charges aggressively over the approaching months. We must always then lastly see the native inventory market start to get well, driving EWZ increased. The primary dangers comes from weak spot in Brazil’s commodity export costs, however it might take a commodity value crash to justify such low cost valuations.

The EWZ ETF

EWZ tracks the efficiency of the MSCI Brazil index and prices an expense price of 0.57%. The ETF holds 50 firms at current and is closely weighted in the direction of commodities. The Supplies sector accounts for a report 23% of the index, due to iron ore big Vale (VALE), which has an 18% share. The Oil & Fuel sector accounts for an extra 17% on account of oil main Petrobras (PBR). The ETF presently presents a dividend yield of 13.0%, however this could fall over the approaching months again in the direction of the yield on the underlying MSCI Brazil index which is presently 10.3%.

Forex Power Is Supporting EWZ In The Face Of Native Market Weak spot

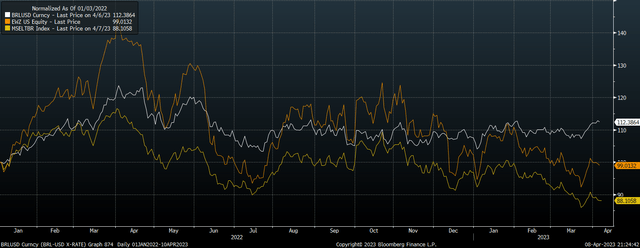

The efficiency of EWZ is set simply as a lot by the efficiency of the Brazilian forex as it’s by the native inventory market. Over the long run, excessive ranges of inflation have resulted within the native inventory market step by step rising and the worth of the forex step by step falling in opposition to the US greenback. Because the begin of 2022, nonetheless, and notably over the previous two months, the forex has appreciated whereas the native inventory market has fallen.

BRLUSD, EWZ, and MSCI Brazil Native (Bloomberg)

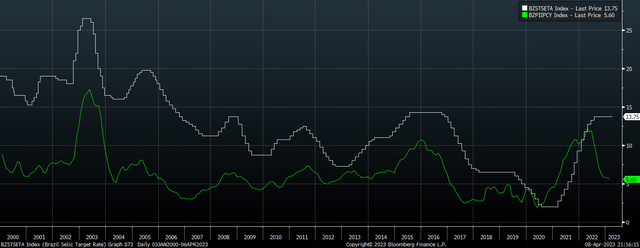

This power within the Brazilian actual and weak spot in native shares is a really uncommon incidence. Sometimes, power in the actual coincides with native fairness power as international funding flows and commodity costs are the important thing drivers of each markets. The previous 14 months has mirrored the acute tightening measures by the Banco Central do Brasil which have resulted within the in a single day Selic price rising to 13.75%, which compares with 5.6% trailing CPI and seven.2% 12-month breakeven inflation expectations.

Brazil In a single day Curiosity Price Vs Headline CPI (Bloomberg)

Price Cuts May Be The Set off For A Bull Market Reversal

These tight financial situations have raised the chance price of proudly owning native shares relative to money and bonds, which has outweighed the optimistic influence of rising gross sales, earnings, and dividends. This has seen valuations fall to close their lowest valuations on report, creating the best situations for a bullish reversal as soon as financial easing begins.

The MSCI Brazil now yields 10.3% and trades at a PE ratio of 5.3x. Even when short-term charges stay elevated, present valuations counsel sturdy long-term returns. As an illustration, with 10-year inflation expectations at 6.6%, because of this we should always see native shares return nearly 17% yearly over the following decade if dividends develop merely on the tempo of inflation, assuming no change within the dividend yield. Nevertheless, deeply undervalued markets like this one don’t have a tendency to stay that means for lengthy, and any signal of BCB easing might be the set off for a serious rally.

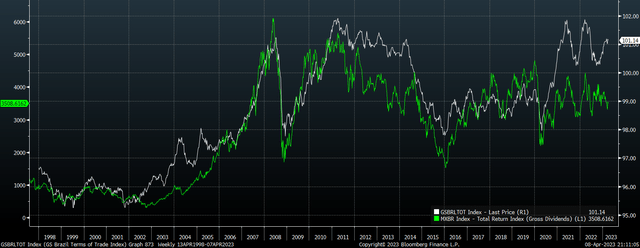

The primary threat comes from a draw back reversal in iron ore or soybean costs, which might reassert downward strain on the Brazilian actual. There was an extremely shut correlation between Brazil’s phrases of commerce index and the efficiency of the MSCI Brazil over the previous 25 years, with an r-squared of 0.83. Because the chart beneath reveals, the MSCI Brazil has usually been a lot increased when commerce situations have been equally favorable. Whereas any decline in commodity export costs would possible weigh on EWZ, no matter financial coverage situations, it might take a major drop with a view to justify the diploma of undervaluation we presently see.

Brazil Phrases Of Commerce Index vs EWZ Whole Return (Bloomberg, Goldman Sachs)

Abstract

Power within the Brazilian actual has allowed EWZ to carry water at the same time as native shares have moved decrease in a stark reversal of the long-term development. With actual rates of interest now extraordinarily excessive, the Brazilian central financial institution has vital room to chop charges, which can act as a set off for a restoration in native shares. Except we see a dramatic draw back reversal in commodity costs, EWZ ought to rise sharply as this cycle takes place. With a dividend yield of 13% on EWZ, and 10.3% on the MSCI Brazil, this engaging worth alternative is unlikely to final lengthy.