imaginima

Occidental Petroleum Corp. (NYSE:OXY) has had a troubled previous, however has, since 2020, turned its enterprise mannequin round, with monetary and working outcomes having fun with vital enchancment. The agency stays an excellent long-term wager, buying and selling at engaging ranges in comparison with the market and its friends.

5 Years of Bother

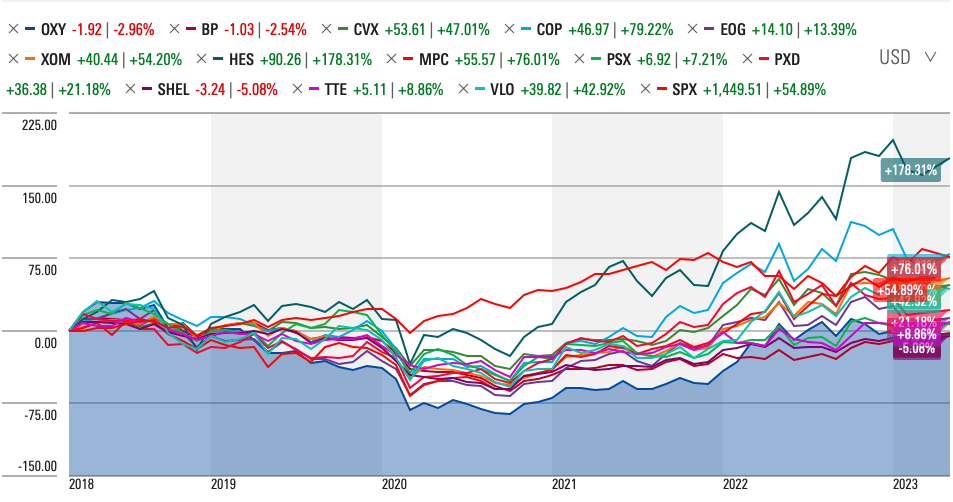

Within the final 5 years, Occidental has earned a complete shareholder return (TSR) of almost -3%. In that point, the S&P 500 has earned a TSR of almost 55%. Occidental additionally trailed its peer group, whose market cap. weighted TSR was 39.2%. The peer group consists of BP plc (BP), Chevron Corp. (CVX), ConocoPhillips (COP), EOG Assets, Inc. (EOG), Exxon Mobil Corp. (XOM), Hess Corp. (HES), Marathon Petroleum Corp. (MPC), Phillips 66 (PSX), Pioneer Pure Assets Firm (PXD), Shell plc (SHEL), TotalEnergies SE (TTE), and Valero Power Corp. (VLO).

Supply: Morningstar

The query for buyers is whether or not the corporate has the qualities for long-term superior TSR over the following five-year interval.

Incentives Align Shareholder and Administration Pursuits

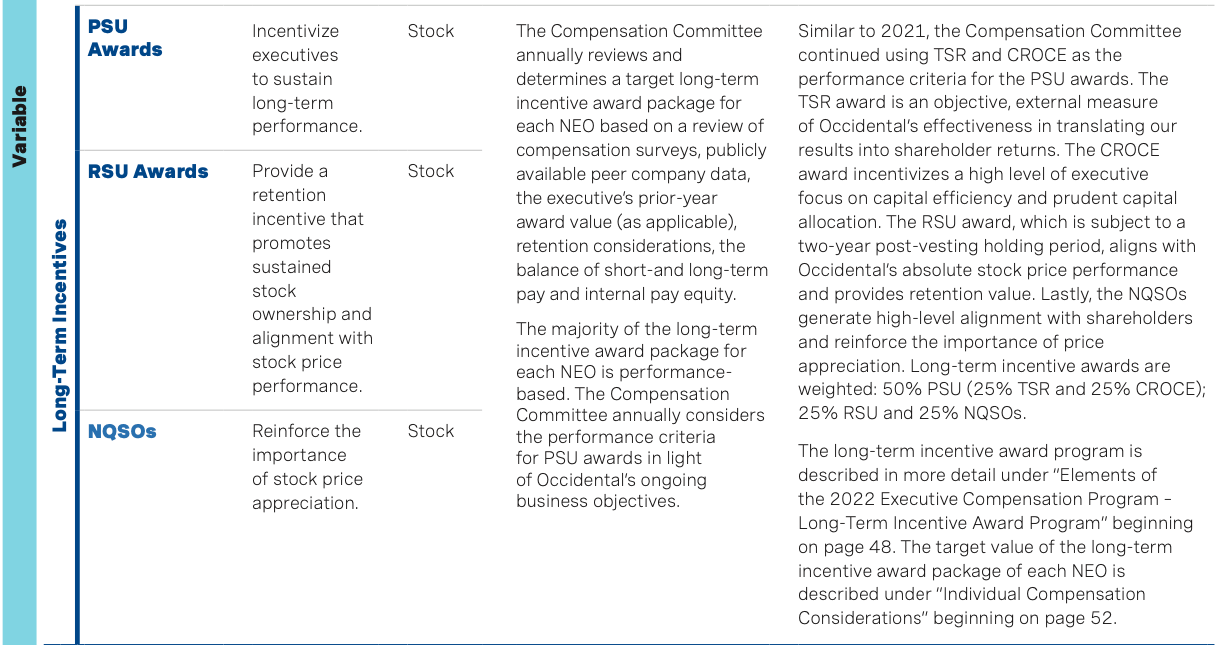

In response to the corporate’s 2023 Proxy Assertion, the manager compensation program, amongst different issues, goals to align the pursuits of named government officers (NEOs) with these of shareholders. Now, it is likely one of the few axioms of economic principle that worth is created when an organization earns a return on its investments better than the price of capital. Usually, corporations who search to resolve the principal-agent downside in companies use return on invested capital (ROIC), provided that it demonstrates how effectively a enterprise makes use of its capital to earn income for its shareholders. Nonetheless, there may be a whole lot of benefit in Occidental’s use of money return to capital employed (CROCE). As an investor, what you need to be actually extra concerned about is a enterprise’s repeatable potential to earn income from the capital employed, greater than its potential to earn acquisitive development at an inexpensive worth. The agency’s efficiency share models (PSUs) are tied to each TSR and CROCE, to reward administration for translating its outcomes into shareholder returns, and for its capital effectivity and prudent capital allocation. The PSUs are 50% of the long-term incentive awards.

Supply: 2023 Proxy Assertion, Occidental Petroleum Corp.

Within the 2020-2029 interval, CROCE has risen from 9% to 36%, for a 3-year CROCE of twenty-two.4%, in comparison with a threshold CROCE of 11%, and a goal CROCE of 13%? The TSR for the interval, though constructive, ranked fifth out of its peer group.

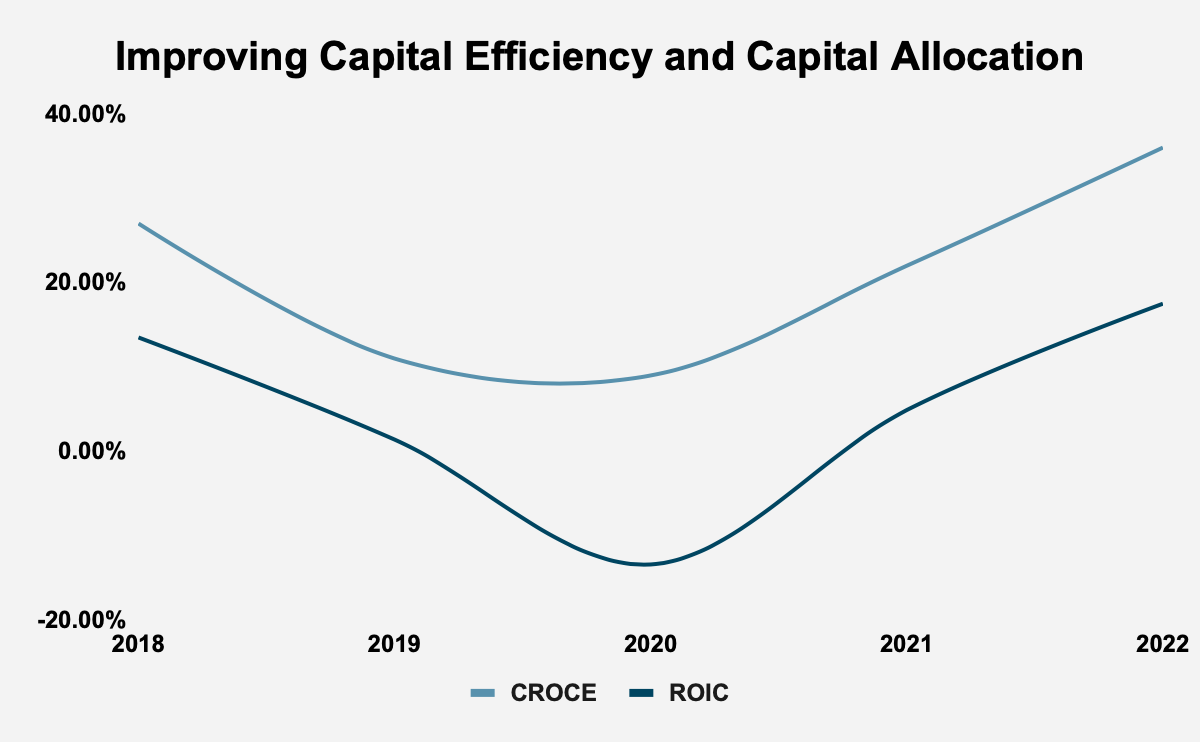

Bettering Capital Allocation

Occidental Petroleum has endured a sequence of well-publicized struggles within the final 5 years, and that is mirrored within the deteriorating capital effectivity and profitability of the corporate between 2018 and 2020. Nonetheless, since 2020, the corporate’s capital effectivity and capital allocation have improved, with CROCE rising from 9% to 36%, and ROIC rising from -13.4% to 17.5%.

Supply: Occidental Petroleum Corp. Firm Filings

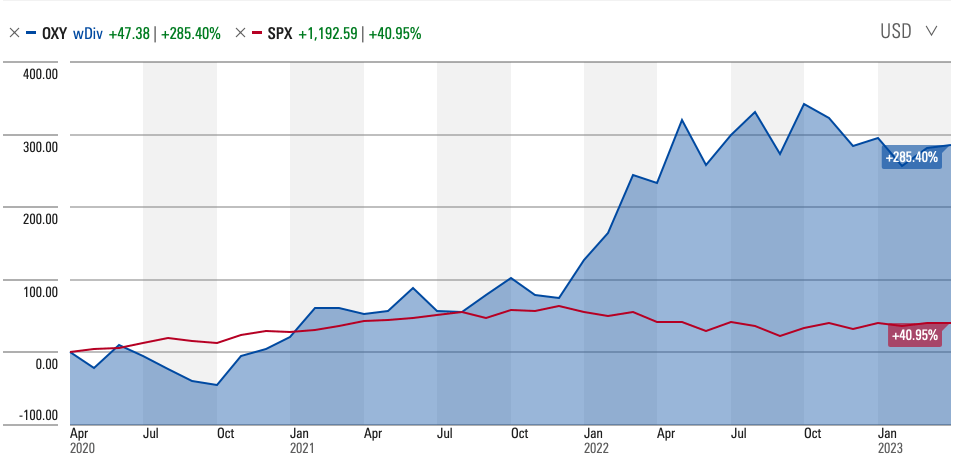

Given the correlation between an organization’s returns and its future company worth, it’s not stunning that within the interval since 2020, the corporate’s TSR has simply exceeded that of the S&P 500, with Occidental Petroleum reaching a TSR of over 285%, in comparison with a TSR of almost 41% for the S&P 500.

Supply: Morningstar

The corporate’s enhancing capital effectivity and prudential capital allocation is a testomony to president and chief government officer (CEO), Vicki Hollub’s administration. Certainly, no much less an knowledgeable as Warren Buffett stated that, “She’s working the corporate the suitable method”.

Worthwhile Progress

Income grew from $18.93 billion in 2018 to $37.1 billion in 2022, at a 5-year CAGR of 14.4%. In response to Credit score Suisse’s “The Base Charge E book”, 12.6% of corporations within the 1950 to 2015 interval achieved a 5-year gross sales CAGR of between 10% and 15%. The imply 5-year gross sales CAGR in that interval was 6.9% and the median 5-year gross sales CAGR was 5.2%.

The corporate’s gross income rose from $7.95 billion in 2018 to $16.56 billion, at a 5-year CAGR of 15.81%. Gross profitability, which scales gross income with complete property, rose from 0.18 in 2018 to 0.22 in 2022. Whereas it has risen, it’s nonetheless beneath the 0.33 threshold that Robert Novy-Marx recognized as a marker of a agency’s attractiveness. Occidental’s gross profitability additionally trails the market cap weighted common gross profitability of its peer group, which was 0.3 in 2022.

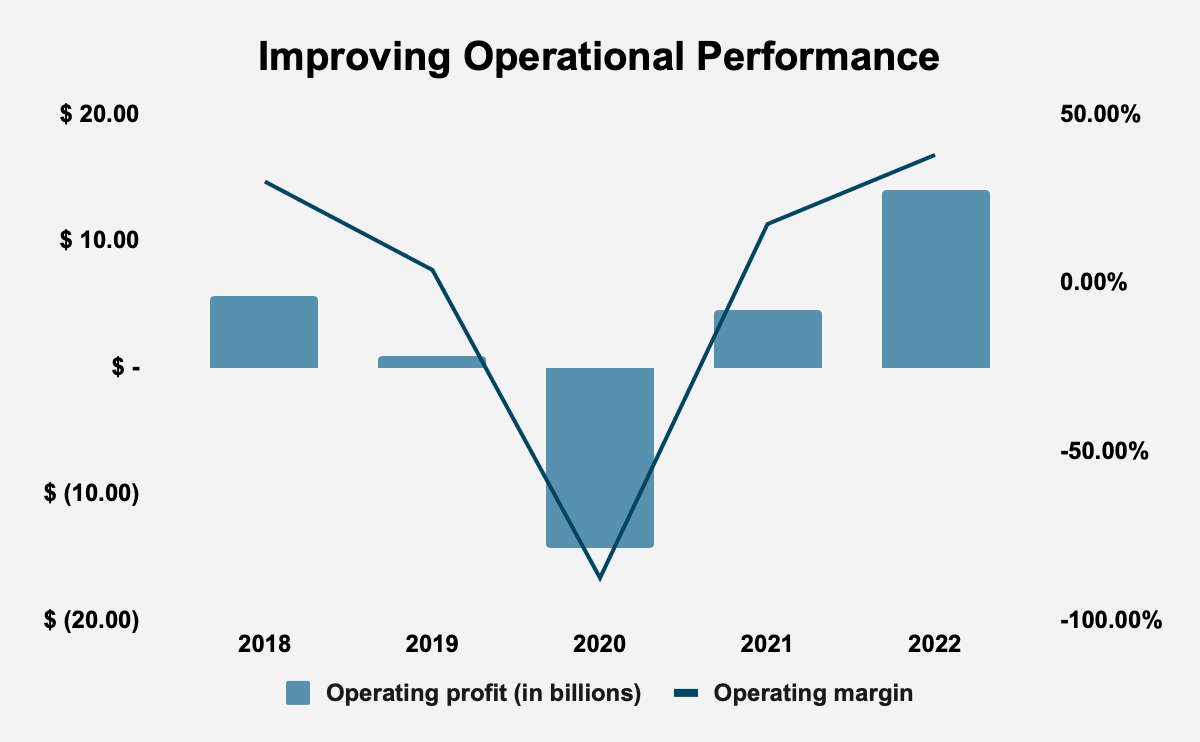

Occidental’s working revenue rose from $5.67 billion in 2018 to $14.04 billion in 2022, at a 5-year CAGR of 19.88%. The corporate’s working margin rose from 29.93% in 2018 to 37.84% in 2022. Within the 1950-2015 reference interval, the imply working margin was 11.6%, and the median working margin was 12.1%.

Supply: Occidental Petroleum Corp. Firm Filings

Earnings rose from $4.13 billion in 2018 to $13.3 billion in 2022, at a 5-year CAGR of 26.35%. In distinction, in our reference interval, 8.8% of corporations loved a 5-year earnings CAGR of between 20% and 30%, with a imply 5-year earnings CAGR for the interval of seven.3% and a median 5-year earnings CAGR of 5.9%.

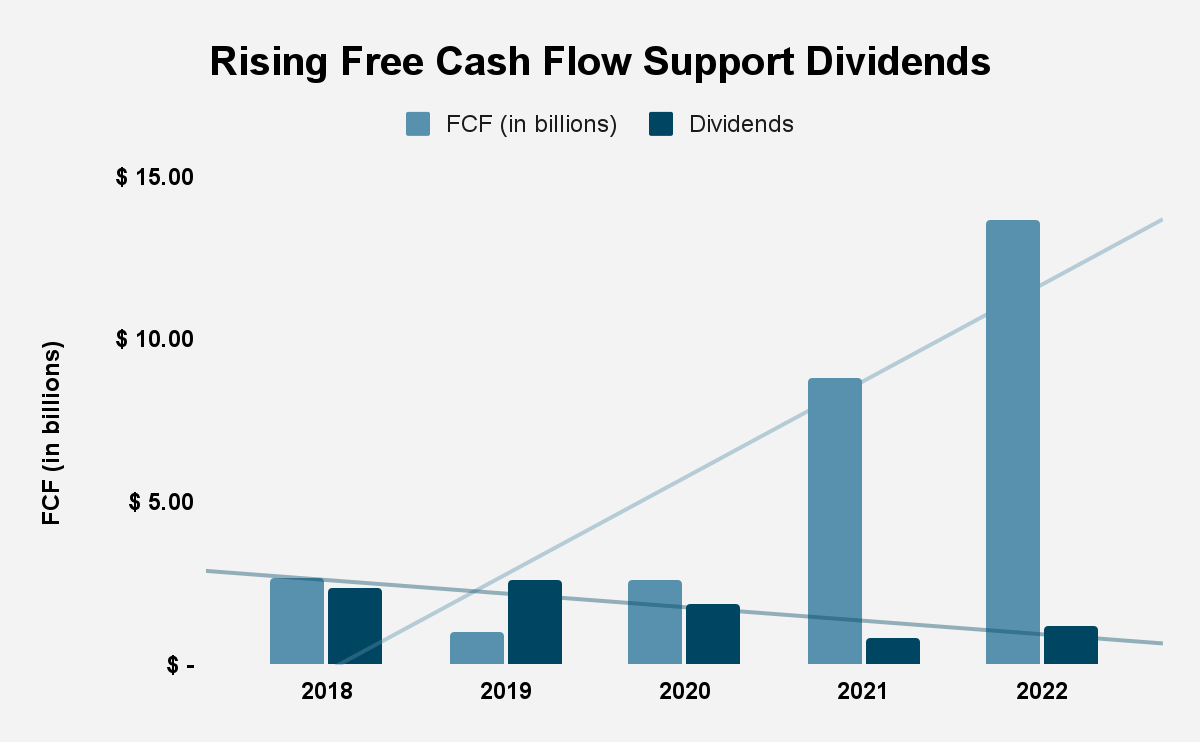

Free money stream (FCF) rose from $2.69 billion in 2018 to $13.64 billion in 2022, at a 5-year CAGR of 26.35%. In that point, the agency generated $28.73 billion in FCF, or over half of its market capitalization. We all know that the worth of a enterprise is the current sum of its future money flows, and so, by rising its FCF, administration is rising the worth of the enterprise.

Supply: Occidental Petroleum Corp. Firm Filings

The expansion in FCF has supported the corporate’s dividend coverage. Dividend payouts fell from $2.37 billion in 2018 to $1.18 billion in 2022, given the difficulties the agency has had, however, between 2021 and 2022, dividend payouts grew from $809 million to $$1.18 billion.

Valuation

Occidental has a price-earnings (PE) a number of of 5.08, in comparison with a PE a number of of 21.94 for the S&P 500. In flip, the corporate has an FCF yield of 24.09%, in comparison with a market cap. weighted common FCF yield of 16.02% for its peer group. As well as, the corporate’s gross profitability of 0.22 is decrease than the 0.3 market cap. weighted common gross profitability of its peer group. Lastly, Occidental’s shareholder yield of three.59% is decrease than that of its peer group, which is 6.86%. What this tells us is that the corporate is more likely to outperform the S&P 500, and its peer group, regardless of providing a much less worthwhile enterprise mannequin.

Firm

Ticker

TSR

Gross Profitability

FCF Yield

Shareholder Yield

Market Cap. (in billions)

Occidental Petroleum Corp

OXY

-2.96%

0.22

24.09%

3.59%

$ 56.62

BP plc

BP

-2.54%

0.27

25.27%

8.85%

$ 117.01

Chevron Corp

CVX

47.01%

0.28

12.60%

3.13%

$ 319.65

ConocoPhillips

COP

79.22%

0.40

14.02%

8.79%

$ 129.51

EOG Assets, Inc.

EOG

13.39%

0.39

9.18%

6.92%

$ 70.16

ExxonMobil Corp.

XOM

54.20%

0.31

12.47%

5.83%

$ 468.37

Hess Corp.

HES

178.31%

0.30

2.83%

1.01%

$ 43.13

Marathon Petroleum Corp.

MPC

76.01%

0.31

24.69%

21.19%

$ 56.83

Phillips 66

PSX

7.21%

0.25

18.18%

-3.73%

$ 47.40

Pioneer Pure Assets Firm

PXD

21.18%

0.37

14.95%

10.65%

$ 48.92

Shell plc

SHEL

-5.08%

0.19

22.74%

10.99%

$ 207.74

TotalEnergies SE

TTE

8.86%

0.31

20.89%

7.74%

$ 154.20

Valero Power Corp.

VLO

42.92%

0.28

22.07%

5.69%

$ 48.77

Peer Group Common

39.20%

0.30

16.02%

6.86%

$ 1,711.69

Click on to enlarge

Supply: Firm Filings

Conclusion

Occidental Petroleum, at one time, was headed for bother, and was seen as a really dangerous wager by buyers. Nonetheless, since 2020, the corporate’s working and monetary outcomes have improved, and with that, the corporate’s inventory market and TSR efficiency have additionally risen. The corporate stays undervalued in comparison with the market, with a really engaging FCF yield, and so the agency is more likely to proceed to carry out properly in opposition to the market.