sefa ozel/iStock by way of Getty Photographs

One of many Bitcoin (BTC-USD) miners that I’ve had on look ahead to a while is Digihost Know-how (NASDAQ:DGHI). It is a a lot smaller cap public miner but it surely has a doubtlessly compelling setup in that the corporate has no debt, would not spend as a lot on SG&A relative to friends, and trades under e-book worth. The corporate launched its full 12 months earnings and March manufacturing figures on Monday and I see a couple of warning indicators.

Full 12 months 2022 Efficiency

Purely from a income standpoint, it may have been worse. Digihost pulled in $24.2 million from digital forex mining in 2022. This was down simply 3% from the $25 million the corporate earned in 2021. Many different miners noticed income decline between 15 to 25% 12 months over 12 months. For Digihost, the decline within the headline quantity is a results of decrease Bitcoin costs relatively than declining manufacturing as the corporate had a 60% 12 months over 12 months enhance within the quantity of BTC mined.

Nevertheless, the rise in manufacturing did include a bigger transfer up in expense as Digithost’s value of income practically doubled from 2021:

December 312022 December 312021 YoY Change Income from digital forex mining 24,190 24,952 -3.1% Price of gross sales -20,278 -10,542 92.4% Depreciation and amortization -10,709 -3,281 226.4% Gross revenue -6,797 11,129 -161.1% Click on to enlarge

Supply: Digihost, figures in tens of millions of USD

The 92% enhance in value of income and the 226% enhance in machine amortization adopted what was $11.1 million gross revenue in 2021 with a $6.8 million gross loss in 2022. Once we add within the different bills for Digihost, we come to a full 12 months working lack of $28.3 million:

December 312022 December 312021 YoY Change Basic and administrative and different bills -8,352 -10,646 -21.5% Loss on settlement of debt -294 -390 -24.6% Achieve (loss) on disposition of cryptocurrencies -11,574 291 -4,077.3% Loss on digital forex choice calls -1,950 – Working revenue (loss) -28,285 2,923 -1,067.7% Revaluation of warrant liabilities 32,010 1,551 1,963.8% Click on to enlarge

Supply: Digihost, figures in tens of millions of USD

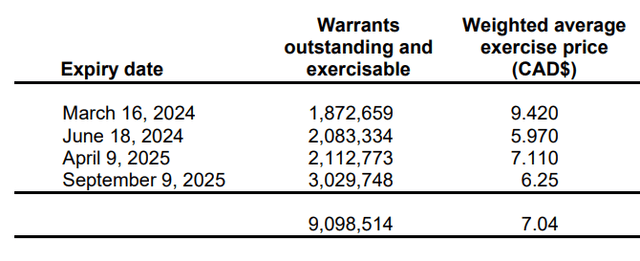

Whereas it actually wasn’t the largest driver of the corporate’s adverse working revenue for the 12 months, it’s a bit regarding seeing Digihost give away $2 million in choices calls. I also needs to level out that Digihost is displaying a $4.3 million optimistic internet revenue 12 months that’s totally attributed to a $32 million legal responsibility revaluation of the corporate’s 9.1 million excellent warrants:

DigiHost

These warrants have a weighted common train worth of $7.04 and do not start expiring for one more 12 months.

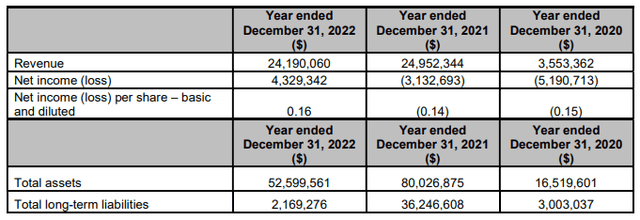

Property, Liabilities, & Manufacturing

Digihost ended the 12 months with $52.6 million in belongings and simply $2.1 million in long run liabilities. This can be a dramatic enchancment from the $36.2 million in long run liabilities on the finish of 2021:

Digihost

The corporate’s debt scenario is in a a lot better place than it was in 2021, however I would say there’s a probability we may see that change this 12 months. Digihost is making an attempt to scale an extra 100MW by the tip of subsequent 12 months and has already foreshadowed via its MD&A that the corporate should increase capital via financing to take action:

The Firm presently anticipates that further financing possibly required to amass further energy technology amenities sooner or later with a purpose to meet the Firm’s goal of acquiring entry to an extra 100MW of energy by the tip of 2024. The Firm additionally anticipates that further financing can be required to buy the miners required to make the most of its most capability.

We have already seen share dilution over the past 12 months and the corporate simply raised one other $380k via share issuance over the past 3 months. Nearly all of the corporate’s $52.6 million in belongings are property, plant, and tools. As of the March manufacturing replace, DGHI has about $3 million in money, BTC, and deposits.

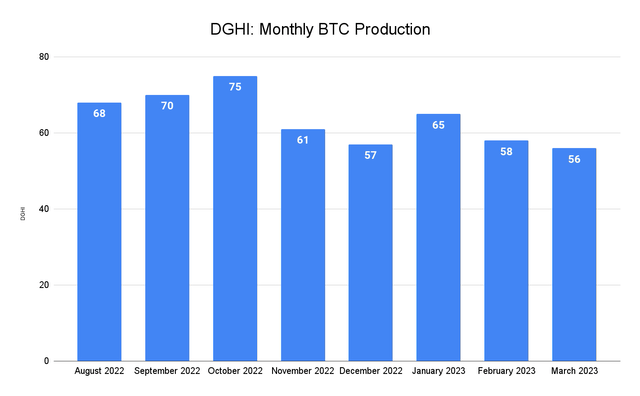

Month-to-month BTC manufacturing (Digihost)

The basic downside for all miners is the worldwide BTC mining exahash continues to make new highs every month. With out with the ability to scale mining capability in keeping with international EH progress, the share of block reward every miner earns turns into harder to amass. We are able to see that enjoying out with Digihost which has seen declining BTC manufacturing over the past a number of months

Abstract

Except we get a drastic enchancment within the worth of Bitcoin, I am unable to see a lot of a purpose to lengthy DGHI at this level. And if that transfer up in BTC does happen, there are merely different miners that may profit extra due to the significantly bigger BTC stacks that they maintain relative to their market capitalizations. For instance, Marathon Digital’s (MARA) $1.3 billion market cap is backed roughly 24% by a $322 million unencumbered BTC place. DGHI merely would not have that backstop to drive valuation greater.

In Digihost, I see an organization that’s in all probability going to lag mining friends. Due to the debt-free stability sheet, the corporate may theoretically be a buyout candidate for a bigger agency that desires to scale with rigs which are already energized. But when there may be any risk of that, if I had been a shareholder, I would hope it occurs sooner relatively than later earlier than extra capital will get misplaced in name choices.

Editor’s Be aware: This text covers a number of microcap shares. Please concentrate on the dangers related to these shares.