jroballo

What’s The Projection For The Lithium Market?

At one stage there’s completely nothing flawed with Lithium Royalty Corp (OTCPK:LITRF), the lately IPO’d lithium, um, royalty firm. OK, so its essential itemizing is in Canada, which could give South Park followers some thought. However different than that? It is a normal business approach, they’ve simply raised cash to broaden, gained that itemizing. They’re in a scorching market, so, what’s to not like?

Effectively, actually, the one factor is whether or not that market goes to remain scorching.

With minor metals there is a time to promote, a time to purchase

As I’ve identified a number of instances right here there are cycles to minor metals markets. Some new use for one among them – whichever it’s – arrived and so it appears to be like as if there will probably be a scarcity judging by present extraction capability. The quick time period worth rises and many appear to suppose that is going to proceed.

However this misses that there is merely no scarcity on the market of something we’d need to use. OK, among the quick lived radioactives perhaps. However apart from that, effectively, Earth is an enormous place. So, the value rises, junior miners kick into motion and search for, discover, begin mining this new extra fascinating aspect.

Because it occurs extra begin than is absolutely fairly crucial, some smaller quantity handle to truly produce however once more, greater than maybe is completely and wholly crucial. My favorite quantity for this comes from Jack Lifton again after China restricted uncommon earth exports in 2010. He stated that at one level there have been 420 uncommon earth performs all searching for finance. Solely two main ones acquired into manufacturing, Molycorp and Lynas and that was sufficient to crash RE costs again beneath what they have been in the beginning. Molycorp ultimately went bust (the mine is open once more as MP Supplies) and Lynas required a close to whole recapitalisation. As I’ve identified round right here Altura went bust operating a wonderfully good lithium mine (it is now the premise of these huge income at Piedmont). Altura went bust as a result of we had a lithium worth rise and exploration growth again in 2013, however by the point Altura got here to market so had others and the value was effectively again down once more. Till the subsequent growth in fact.

The purpose is – in financial phrases – that positive demand is versatile. However so is also provide. There is no such thing as a scarcity of any explicit aspect. There’s only a scarcity of individuals extracting it. OK, that is not wholly, precisely and fully true but it surely’s an excellent working thesis.

Tesla’s Grasp Plan

Now we have an attention-grabbing affirmation of this in Tesla’s (TSLA) Grasp Plan 3 simply launched. The bits for us begin on web page 31 right here. They’ve calculated simply how a lot of every thing goes to be wanted to impress every thing (though they agree with me about Rolls Royce and jet fuels – see, they should be proper, as with everybody else those that agree with me are, by definition, appropriate). Now, OK, such grand planning tends to not work out very effectively – if the planning is about how we do that and detailing who does it and so forth. The Soviets did not have a superb time with that concept. However as a calculation of what’s wanted effectively, why not?

The reply is that we will want 20% of lithium sources.

No, that is all, 20%.

Sources aren’t what there may be

Right here we’d like a little bit of techspeak. Reserves are, largely sufficient, the inventory at already extant or about to open mines. Sources is a wider quantity. However it’s nonetheless very important to know what the definition is. It is – right here, lithium sources – the aspect in rocks that we find out about, that we all know tips on how to course of. So, that is brines, clays and exhausting rock (spodumene) sources. What’s not included right here is all the opposite potential extraction strategies. Some declare they’ll extract from desalination plant wastes and that is smart to me. There’s a number of work being performed on geothermal waters. A few guys insist they’ll extract economically from the Pink Sea. None of those are included in sources as but. Sources are issues we find out about, even when we have not likely confirmed it – proved turn out to be reserves.

Sources do not embody the identified unknowns, nor the unknown unknowns. We’re actually fairly positive we all know the full quantity of lithium within the lithosphere. To inside a couple of hundred billion tonnes no less than, ok accuracy with numbers this massive. And sources simply aren’t that, by no means. It is a lot, a lot, nearer to deposits of rock we all know tips on how to course of that we find out about to some stage of data however to not a stage of proof.

That’s, sources simply aren’t “every thing out there”. It is a a lot narrower definition than that, by comparability when it comes to tonnes it is tiny.

As Tesla additionally factors out all that is actually required to show sources into reserves after which usable materials is funding and energy. That is implicit within the definition we’re utilizing in the beginning.

However this is Tesla saying we’d like solely 20% of what we already find out about to realize the plan. At which level there’s nonetheless that room for funding and energy to get effectively forward of demand, is not there? The implication for the value there is identical because it has been in so many different minor metals cycles – it drops like a stone.

So, how a lot effort goes into lithium?

That is a kind of instances when a Searching for Alpha subscription is so helpful. A chunk on lithium juniors information for February this yr. Now simply take a look at the itemizing of corporations there. We’re all completely sure that lithium manufacturing goes to proceed to lag behind demand, are we? That the lithium worth goes to remain elevated?

I am not.

You do not have to agree with me about whether or not that lithium provide will meet up with demand and the implications for the value. I simply insist that that is the essential query on this sector. Extra particularly, it is essential to Lithium Royalty.

What does a royalty firm do?

Effectively, clearly, it collects royalties, D’Oh. Relatively extra importantly, it is actually a Enterprise Capital firm for mining corporations. For these royalties are purchased by paying among the early stage exploration bills of the mining firm. A few of these come good, some go unhealthy. Some exploration finds one thing and is ready to take it right through to manufacturing – at which level royalties receives a commission. However there are clearly exploration corporations which handle to seek out nothing and fold their tents and steal away into the evening (sorry, go bust) making the potential royalty price nothing.

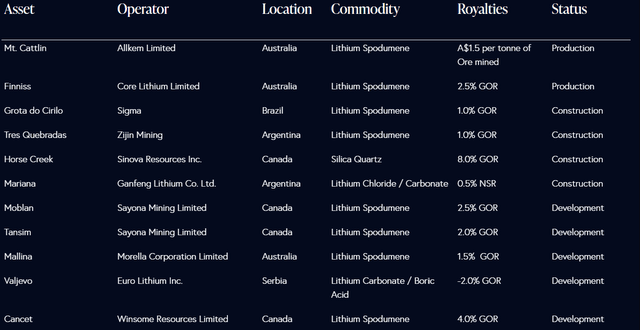

This can be a danger enterprise. Lithium Royalty’s present itemizing from their website:

Lithium portfolio (Lithium Royalty)

Lithium portfolio (Lithium Royalty)

Lithium portfolio (Lithium Royalty)

Now, there’s completely nothing flawed with any of that. At the least that I or anybody else is aware of about. However it is very important observe that it is so as of growth and due to this fact danger. That first firm, Allkem is producing and delivering about $700k in funds. OK. That final, Avro, no less than so far as I can discover out (which could possibly be a product of my Google Fu) is at current little greater than a shell firm that is going to do one thing actual quickly now. Larvotto is on the stage of reporting attention-grabbing drill outcomes. Which is a protracted, lengthy, means away from really producing something.

That is how mining royalties are acquired. By offering the very early stage danger capital – probably much more like Angel Buyers than VCs – to get folks scouting the countryside for attention-grabbing rock.

Nothing flawed with that in any respect, somebody’s acquired to finance this. As with Angel or VC investing it’s a necessity to have a portfolio, some will probably be duds, the occasional one will probably be a wonderful 50 to 100 bagger and that is how the enterprise works.

Please observe, I’m not arguing with the enterprise fashion, the sector or the way of enterprise being performed. I am high-quality with the sector, the important level and goal of how this works and so forth. Provided that this can be a very latest IPO and the portfolio is – effectively, let’s be well mannered right here – lower than mature we can also’t actually choose the selecting abilities of the administration.

There is a helpful sector of the Canadian inventory alternate (which is why this IPO was in Canada at a guess) which accommodates numerous corporations which have been very profitable at this up to now.

So, this is my fear

Lithium Royalty is at the moment investing additional in that exploration. That is what the proceeds of the IPO – that $100 million and alter – are for. They’re additionally very early within the maturity phases of that portfolio.

However I feel that the lithium market goes to enter oversupply quickly sufficient. So, they’re shopping for on the prime of the market and the revenues are going to come back by way of later – after I suppose they are going to be significantly depressed from present ranges.

Sure, we will suppose that the value of these early stage investments is low due to course the danger signifies that it at all times is low. However early stage investments in a scorching market like lithium proper now are clearly dearer than in one thing like, effectively, boring like gallium, simply to present an instance. Or germanium. On the premise that different folks additionally need to put money into lithium proper now due to this fact there’s competitors.

It is also true that if the lithium worth falls – observe the if – then some to many of those investigations aren’t going to finish up being producing mines. This can be a totally different danger from not discovering any lithium, that is worth danger not geological. In spite of everything, when costs change completely viable deposits at increased costs turn out to be unviable. Or, extra to the purpose, uninvestable into manufacturing.

My view

As I say, I’ve not an issue in any respect with the bottom concept, the development of the market concept. Royalty corporations are, when checked out correctly, VC corporations for exploration stage mining corporations. VC – royalty purchases by discovering exploration work – works throughout a portfolio, it is a excessive danger enterprise. Some few monster mines pay for all of the failures.

However the trick of the enterprise is to be paying the suitable, danger adjusted worth, at that entry stage into the investments. I simply suppose that the lithium market is so elevated that investments at this stage aren’t going to pay out. So I might counsel Lithium Royalties is one to take a seat out.

Why I is likely to be flawed

Effectively, if every thing I feel I find out about mining and worth cycles is flawed then clearly it is potential that the lithium worth goes to remain elevated. Maybe climb to new heights for years, a long time even. If it does then I am flawed.

Do not suppose I’m however then even my ego will not help the concept I am by no means flawed.

The investor view

I simply suppose that Lithium Royalty is a completely high-quality enterprise construction which is placing cash into lithium on the flawed level of the value cycle. Due to this fact there are different and higher locations to place our cash.

Wanting to play on the lithium worth can also be high-quality. There are maybe different, higher alternatives to try this. At present producing mines maybe.

My considering is just that Lithium Royalty is doing a wonderfully smart factor however simply on the flawed level of the value cycle.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please pay attention to the dangers related to these shares.