LeoWolfert/iStock by way of Getty Photos

Intro

We wrote about MiX Telematics Restricted (NYSE:MIXT) (Cell Asset Administration Agency) again in Could of final 12 months after we said {that a} dividend minimize could also be a possible end result over the close to time period. Though there was a minor lower of roughly 3% within the quarterly payout final September, the foremost ADS dividend minimize got here in December when the quarterly payout dropped from $0.06 to $0.04 per share. In consequence, shares are down roughly 14% since our most up-to-date commentary which is a sizeable quantity contemplating the S&P rallied roughly 3% over the identical timeframe.

When it comes to the fiscal 2023 Q2 numbers which lastly led to the dividend minimize, web revenue really got here in unfavorable at $1.2 million regardless of the corporate reporting development in particular areas for the quarter. Subscription revenues elevated by 10% in Q2 to virtually hit $31 million & Annual Recurring Income (ARR) jumped by 17% surpassing $128 million. Then in Q3, the corporate bounced again into revenue ($2.8 million of web revenue for the quarter) and as soon as extra reported development in ARR, subscription revenues, and the all-important subscriber base which grew to 959k within the quarter. The corporate continues to report buyer wins however we aren’t seeing these wins being mirrored in shareholders’ returns as of but.

Extra Development Wanted

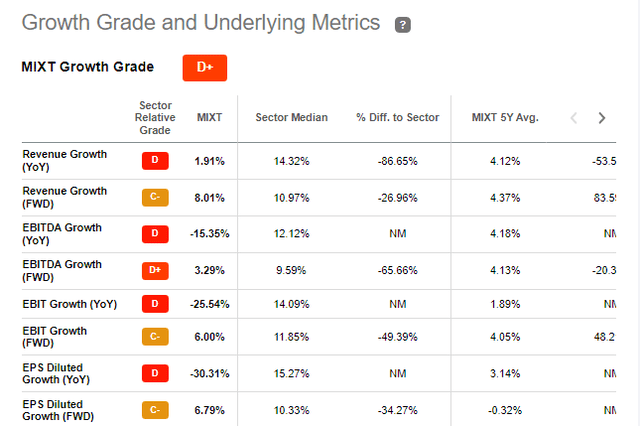

Nonetheless, not sufficient development is being realized with a view to considerably transfer the needle with respect to bottom-line profitability as we see within the firm’s broader development metrics beneath. Though ahead development numbers relating to top-line gross sales in addition to EBITDA have been enhancing, they nonetheless path the sector basically by a ways, particularly on the revenue facet.

MIXT Development Metrics (Looking for Alpha)

Technicals

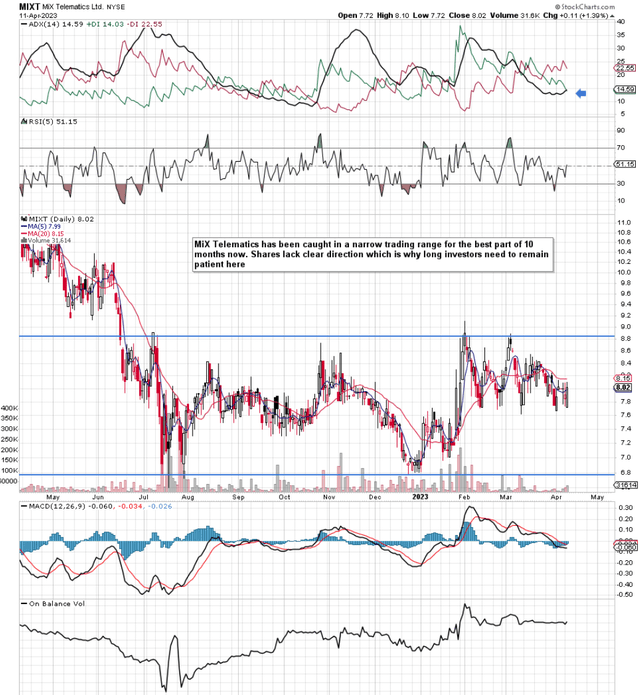

Then you could have the technicals as we see beneath which present that MiX Telematics has been caught in a $2 per share buying and selling vary for the most effective a part of 10 months now. Suffice it to say, it stands to motive that the longer consolidation durations persist, the harder it will likely be for shares to interrupt out above overhead resistance. Moreover, current consolidation has seen the favored ADX development indicator come proper again down beneath the 15 degree which principally implies that shares lack a transparent development at current. This factors to extra consolidation which is why we might not put capital to work in MiX Telematics at this current second in time.

MIXT Telematics Technical Chart (Stockcharts.com)

Dividend Worries Persist

MiX Telematics has been averaging greater than $5 million in its capital spending funds in current occasions. Subsequently, the corporate’s working money circulate ($17.5 million over the previous 4 quarters) has not been excessive sufficient to cowl this spending which suggests optimistic free money circulate era has been absent on this timeframe. The truth is, even from an earnings standpoint, the trailing GAAP payout ratio at the moment is available in at a really elevated 86%. This implies no less than over the close to time period, MiX Telematics will discover it very tough to develop the payout which actually is what traders want at current. Why? As a result of if stagflation within the share value persists (Which can end in little capital acquire appreciation within the inventory), traders want a thriving dividend with a view to defend their respective buying energy. With inflation working at roughly 6%, a gradual rising 2.74% dividend yield from MiX Telematics is not going to be sufficient to provide actual returns in a stagnating surroundings.

Return On Fairness

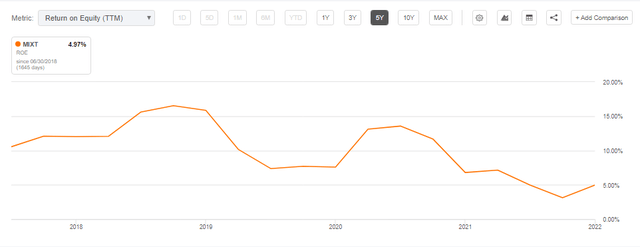

Bulls will clearly level to the very eager valuation MiX at the moment trades at in addition to the corporate’s robust stability sheet however the market will solely reward MiX correspondingly if the corporate can show it might probably develop its earnings constantly. The return on fairness profitability metric allows us to see the earnings energy of MiX when derived from the corporate’s fairness on the stability sheet. Suffice it to say, having loads of fairness on the stability sheet is one factor but when this fairness isn’t being productive in producing earnings, then the market will take discover rapidly. If we plug the corporate’s numbers into the components the place

ROE = Trailing 12-Month Web Revenue / Shareholder Fairness

Return On Fairness = 5.7 / 111.8 = 5.1%.

Now though the corporate’s most up-to-date quarter (after we common out the quarterly web revenue quantity) noticed a rise within the firm’s ROE, we proceed to see a below-average ROE development which is clearly not what shareholders needs to see.

MiX Telematics ROE Pattern (Looking for Alpha)

Conclusion

Subsequently to sum up, though MiX Telematics has been rising, this development has not been coming as quick because the market would love. Moreover, with the corporate’s robust overhead resistance on the technical chart, excessive payout ratio, and below-average ROE share, we deem MiX Telematics a maintain at this stage. We look ahead to continued protection.