Kira-Yan

Fb modified its title to Meta Platforms (NASDAQ:META) however that didn’t enhance its revenues or earnings. In truth, it lowered earnings and the worth took a dive to the underside. You may see that on the chart beneath. META has introduced large layoffs to enhance earnings and that has created a pleasant bounce off the underside, however price chopping shouldn’t be progress.

Nevertheless, in keeping with Looking for Alpha’s Quant Scores, it will get a poor grades for the Valuation metrics and a weak grade for progress. That spells hassle if the PE is simply too excessive as a result of worth will drop on any market pullback. Traders could take income after the large bounce from $88 to $214.

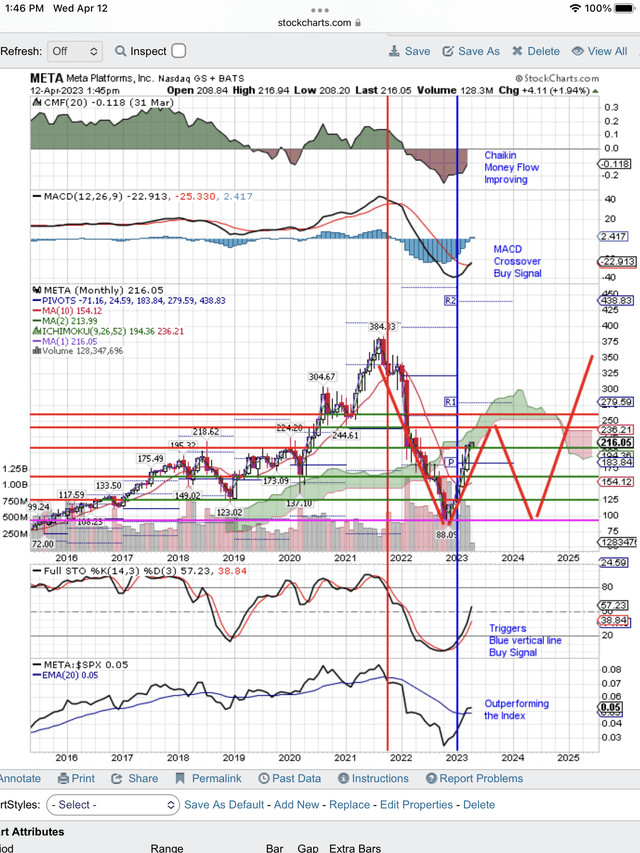

Right here is the month-to-month chart exhibiting what appears to be like to be a useless cat bounce off the underside:

Meta Platforms forming a “W” backside? (StockCharts.com)

As you possibly can see on the above chart, all of the indicators are nonetheless constructive. Chaikin Cash Move is enhancing. The Transferring Common Convergence/Divergence (MACD) sign has a crossover Purchase Sign. The Full Stochastic (Full STO) has triggered our vertical, blue line Purchase Sign. The uptrend in META:SPX signifies that META is outperforming the market. So what’s the issue?

If you happen to faucet the SA Valuation tab, you will notice all the issue metrics that point out META is overvalued at these costs. That could be a slight drawback for aggressive progress shares. Nevertheless, META is now not aggressive progress, and so it must be nearer to pretty valued. Overvalued metrics point out that it’s in for a future worth adjustment.

We expect that comes when earnings are introduced or when the market pulls again or each. We’ve got outlined that projection with crimson traces underneath worth exhibiting what we predict will likely be an eventual retest of the underside earlier than worth strikes increased once more, particularly if now we have a recession and advert income drops.

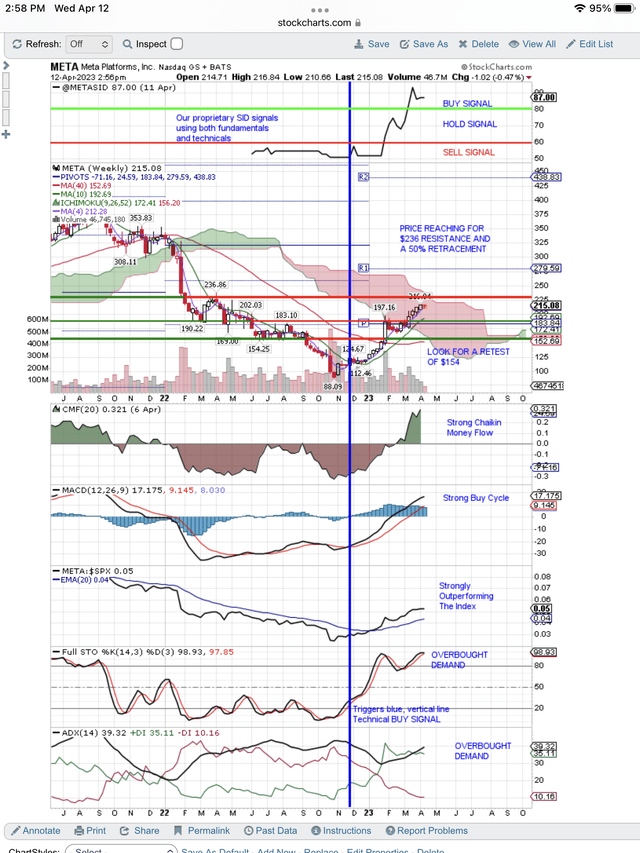

So why is our StocksInDemand (SID) system arising with a Purchase Sign? Primarily due to the robust bounce up and the persevering with purchase indicators on the chart. META is trying a 50% retracement of the dive down and that’s not uncommon. SA is giving good grades to META for Profitability, Revisions and Momentum. Clearly our SID Purchase Sign likes that and overlooks the Valuation drawback in the intervening time. The market is probably not so beneficiant with a excessive PE and low progress inventory, particularly if earnings disappoint or the market pulls again, as we anticipate within the subsequent few months.

Right here is our weekly chart exhibiting the blue line technical purchase sign for the bounce. On the high of the chart is our proprietary SID Purchase Sign that’s slower than the technical purchase sign as a result of it makes use of each fundamentals and technicals. Earlier than the layoffs, fundamentals weren’t trying pretty much as good because the technicals. Our SID rating wants each good fundamentals and good technicals to set off a Purchase Sign. Clearly our SID system Purchase sign thinks we now have that mixture. Nevertheless, Valuation and Development challenges make META weak to a market pullback or disappointing earnings experiences.

Meta purchase indicators reaching for subsequent resistance (StockCharts.com)

As you possibly can see on the high of the chart, META has our proprietary Purchase Sign scoring 87 out of a attainable 100. This sign makes use of each fundamentals and technicals and is considerably slower to flash a Purchase Sign than the purely technical purchase sign that triggers the blue, vertical line.

As indicated above, we predict the technical purchase indicators are focusing on a check of resistance at $236. Then we predict on any market pullback that it’ll retest the help at $154 and close to the 200-day shifting common.