viper-zero

Earnings season has kicked off with Delta Air Strains, Inc. (DAL) reporting its Q1 outcomes. Regardless of offering stable numbers and sustaining full 12 months steering, DAL inventory continues to be buying and selling down. A day earlier, American Airways Group Inc. (NASDAQ:AAL) inventory tumbled greater than 9% after issuing preliminary outcomes that upset analysts and buyers, which I imagine was principally associated to analyst expectations being set unrealistically excessive. In a roundabout way, it appears quite a bit like airways should information extraordinarily robust for quarters forward and present extraordinarily robust Q1 outcomes with a purpose to fulfill the market.

On this report, I shall be taking a look at what United Airways Holdings, Inc. (NASDAQ:UAL) expects for the primary quarter and the way that stacks towards analyst estimates. United Airways will report first quarter outcomes on the 18th of April after market shut, with an earnings name scheduled for the subsequent day.

United Airways Guides Down On Q1 2023 Earnings

United Airways

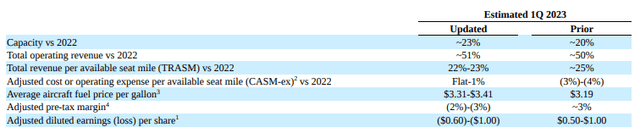

*Not mirrored within the steering is the influence of the associated fee timing on margins, which ought to put the pre-tax margin within the adverse 2 to 4 p.c as an alternative of adverse 2 to three p.c as United shared in a correction submitting.

With out going by the steering line by line, we are able to already say that United Airways is completely different in comparison with that of Delta Air Strains and American Airways. Delta Air Strains maintained its steering in March, whereas American Airways elevated its steering in April. United Airways was the one out of the key three carriers that really guided down. It already did that in March, and so what we do see is that whereas the market dynamics are the identical, the steering instructions are vastly completely different. Whether or not United Airways really guided all the way down to decrease expectations solely to blast previous them stays to be seen.

Total, the revised steering is pushed by greater capability within the first quarter that doesn’t appear to be favorable for the unit revenues. United Airways guided capability to be up 23% year-over-year from an earlier capability improve of 20%. One would assume that may imply a lift to Q1 steering. That isn’t the case. A worrying manner to take a look at issues is that capability is rising in extra of unit income progress, which may very well be a worrying indicator that, as capability is being added, the unit revenues weaken. United sees it extra in a disconnected trend, it appears, indicating the capability improve is pushed by better-than-expected completion charges.

The decrease TRASM steering is pushed by seasonality patterns. Mainly, low demand months see much less progress in demand than excessive demand. Q1 is of course a weak quarter, in order that has pushed down the expectation for unit revenues, however as we head into Q2 with a greater demand profile, we should always see some extra progress driving mid-teens income progress expectations for the second quarter. So, we have already got considerably of a sign for the second quarter, and will probably be fascinating to see whether or not United will keep that steering because it releases Q1 outcomes in addition to its steering for the second quarter.

Pushed by the prices of a brand new collective bargaining settlement with workers and the timing of that settlement from Q2 to Q1, the unit prices are actually anticipated to be kind of flat or 1% decrease in comparison with a 3 to 4 p.c enchancment anticipated earlier. That is along with greater gas costs that drove down the margin expectations from 3% to a loss margin of two to three p.c and a loss per share of $0.60 to $1 per share, whereas beforehand a $0.50 to $1 per share revenue was anticipated.

United Airways

When simply viewing the numbers, it appears quite a bit like Q1 capability growth goes on the expense of unit revenues whereas prices are greater. That doesn’t present a pleasant backdrop for airways. The fact, nevertheless, is that the completion price in Q1 was greater, however with the timing of the collective labor settlement and better gas costs, there may be some strain on Q1 however the CLA influence and the TRASM progress being decrease are timing points. That can also be why United expects mid-teens progress in working revenues for the second quarter and has maintained its full 12 months steering of $10 to $12 per share with a pre-tax margin of 9%. So, the airline continues to be guiding for a really robust 12 months.

What Are Analysts Anticipating?

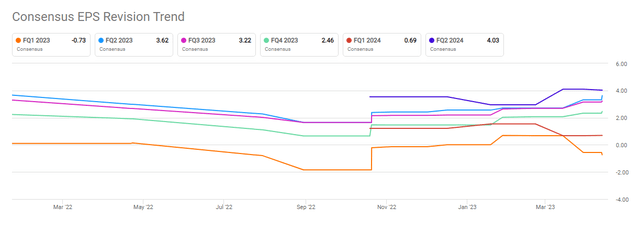

Looking for Alpha

For the primary quarter, analysts expect $11.43 billion in revenues up 51% YoY, which is according to the income progress that United Airways has guided for. Since United Airways offered its up to date steering in March, EPS estimates have been coming all the way down to a $0.73 per share loss from an anticipated revenue of $0.68 per share. Total, evidently airways should hit a house run on earnings and steering to fulfill buyers. Nevertheless, as I identified, for American Airways the expectations had been merely set too excessive, whereas Delta noticed some decrease capability in the course of the quarter affecting its quarterly outcomes. United Airways had already offered some on Q2, anticipating mid-teen income progress, main analysts to extend EPS estimate for the second quarter to $3.62.

We are able to’t predict how the market will react. Nevertheless, maybe, with the extra colour that United Airways already offered earlier for the second quarter and the power that Delta sees going ahead, we received’t see any important share value retraction as we noticed with American Airways.

Is United Airways Inventory A Purchase Or Promote?

Looking for Alpha

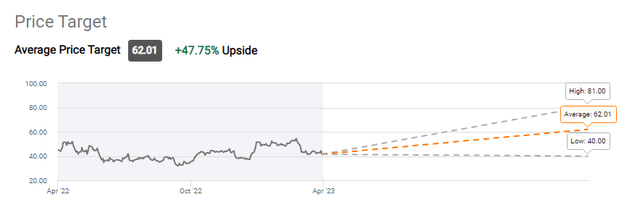

In a chunk printed in February, I upgraded United Airways inventory to purchase from maintain. That was not a lot pushed by the topic of that report which was an funding in a sustainable aviation gas fund, however it was pushed by continued anticipated power this 12 months in addition to United Airways positioning for the long run with its Subsequent fleet renewal program. Gas costs have trended up lately, and subsequent technology plane as United Airways is absorbing now present a damper on gas consumption. The airplanes is not going to be delivered to United the subsequent day after ordering, however having value effectivity in thoughts is vital. Procuring gas environment friendly airplanes is, after all, an vital a part of controlling prices the place they are often managed.

Conclusion: United Airways Shares Presents Vital Upside

Whereas it appears to be extraordinarily tough for airways to please the market proper now, I proceed to imagine United Airways inventory affords important upside and, due to this fact, I’m sustaining my purchase ranking on the inventory. United Airways has already guided down for Q1, and whether or not they beat or miss analyst expectations, what counts for me is that they’ve already offered some colour on Q2, making it clear that a number of the Q1 power earlier anticipated is flowing into Q2 and a few prices that had been anticipated in Q2 are flowing into Q1. The corporate has already reaffirmed its targets for the total 12 months regardless of these timing points, exhibiting the market that it’s certainly a timing difficulty and never a weakening in demand.

Clearly, the 12 months is lengthy and the market can change, however I don’t count on a meltdown as we noticed with American Airways inventory. It’s because United was fast to dial down expectations pushed by timing of demand and prices, plus the expectations for American Airways had been just too excessive. Maybe United Airways Holdings, Inc. offering some perception into Q1 efficiency so late additionally prompted a extra aggressive inventory value response. What I proceed to control is sustained demand power, as a result of with greater labor prices locked in, having a continued robust setting for air journey demand is of utmost significance.