Montes-Bradley

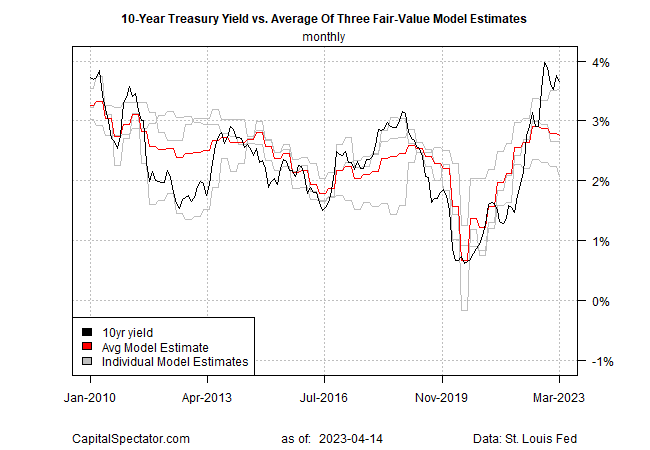

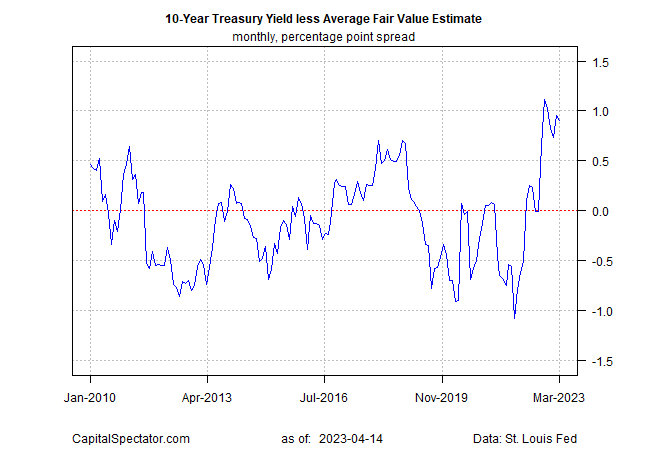

The ten-year Treasury fee continues to commerce nicely above CapitalSpectator.com’s truthful worth estimate, however the days of a giant premium look numbered. As proof mounts that inflation continues to ease, cash provide stays sharply unfavorable on a rolling one-year foundation and the economic system faces stronger headwinds, the chances are rising that the yawning hole between the present 10-year yield and our truthful worth estimate will slender.

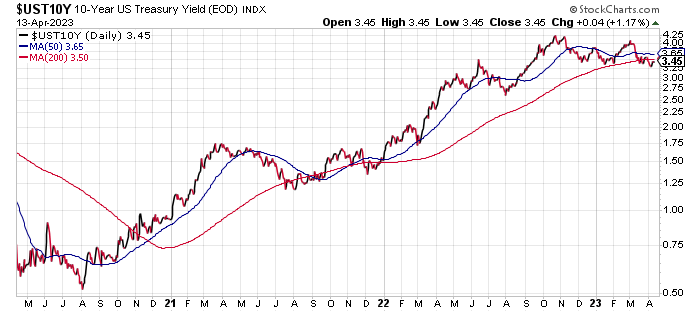

The query is whether or not the truthful worth estimate will rise, the 10-year fee will fall, or a little bit of each. The market has already trimmed the 10-year fee barely since final month’s replace. In yesterday’s buying and selling, the benchmark yield was 3.45% (as of Apr. 13), or almost 20 foundation factors decrease because the March 15 replace, after I wrote: “My view is that many of the unfold narrowing shall be borne by a decrease market yield. That is primarily based on the belief that inflation will proceed to ease and financial development will stay comparatively subdued at greatest.”

These situations stay in play because the second quarter begins. As reported yesterday, the US shopper inflation development continued easing in March. Nonetheless, the Federal Reserve remains to be anticipated to lift its benchmark fee by 0.25-point once more on the subsequent FOMC assembly on Might 3. However as proven by as we speak’s replace of truthful worth modeling for the 10-year yield, the numbers proceed to recommend that the benchmark fee has peaked.

The truthful worth for the 10-year fee slipped to 2.76% for March, down fractionally from the earlier month’s estimate. The truthful worth is predicated on the common of three fashions, outlined right here.

The market yield remains to be almost 1 share level greater, which means that buyers proceed to overvalue this Treasury Observe by a comparatively vast margin. Average levels of overvaluing and undervaluing are regular, in fact, partially as a result of no mannequin absolutely captures all of the elements that decide bond costs in actual time. Nonetheless, the extent of overvaluation currently has been excessive, as proven within the chart beneath – a situation that provides to the expectation that the 10-year yield has peaked for the close to time period and can in all probability edge decrease.

What would change the calculus in favor of a flat or greater 10-year fee? A revival in inflation’s tempo is the main candidate, together with firmer-than-expected financial development. However on each fronts, the numbers are anticipated to skew decrease for the close to time period. In flip, the comparatively excessive premium for the 10-year fee seems set to slender within the months forward.

Authentic Put up

Editor’s Observe: The abstract bullets for this text have been chosen by Searching for Alpha editors.