cgtoolbox

By Elisa Mazen, Michael Testorf & Pawel Wroblewski

Differentiated Financials Publicity Helps Outcomes

Market Overview

Worldwide equities exhibited resilience within the first quarter, trying previous potential financial institution contagion and cussed inflation to increase positive aspects. The benchmark MSCI EAFE Index superior 8.47% for the quarter whereas the MSCI Rising Markets Index added 3.96%. Small caps trailed bigger corporations with the MSCI EAFE Small Cap Index forward by 4.92% within the quarter.

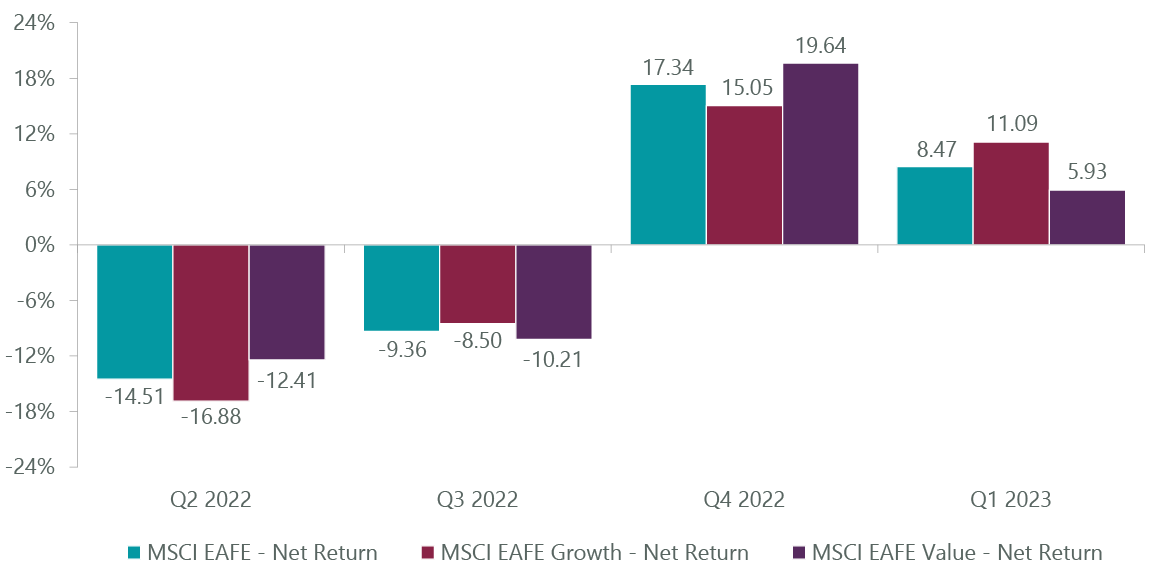

After trailing for a lot of 2022, non-U.S. progress shares earned a reprieve with the MSCI EAFE Progress Index gaining 11.09% for the quarter, outperforming the MSCI EAFE Worth Index (+5.94%) by over 500 foundation factors. This was pushed by a rotation out of banks and extra cyclically-exposed worth sectors comparable to vitality, into data expertise (IT) and comparable progress corporations deemed extra insulated from potential dangers to the monetary system and probably benefiting from a pause, and even reversal, in central financial institution tightening.

On a sector foundation, the very best performers within the quarter have been IT (+19.56%), client discretionary (+17.21%), industrials (+11.72%) and communication companies (+10.45%), 4 areas the place the Technique is effectively represented. Laggards included vitality (+0.41%), financials (+2.72%) and well being care (+5.37%). The supplies (+7.59%), client staples (+7.58%) and utilities (+8.18%) sectors additionally underperformed the MSCI EAFE Index.

Exhibit 1: MSCI Progress vs. Worth Efficiency

As of March 31, 2023. Supply: FactSet.

Click on to enlarge

Extra pronounced progress publicity enabled the ClearBridge Worldwide Progress EAFE Technique to outperform within the quarter and pull forward of the benchmark over the trailing 12 months. We attribute latest outcomes to the Technique being considerably much less tilted in direction of financials than the index, ending the primary quarter with a financials underweight of roughly 460 bps, and a financial institution underweight of roughly 700 bps.

The Banking Disaster

The Technique has traditionally been underweight financials, and we had been within the technique of lowering our publicity previous to the market dislocations brought on by the closure of Silicon Valley Financial institution (SIVB) and Signature Financial institution (OTC:SBNY) within the U.S. and the compelled sale of Credit score Suisse (CS) to UBS. As we neared worth targets in our European banks, French-based international financial institution BNP Paribas (OTCQX:BNPQF) and Italian lender Intesa Sanpaolo (OTCPK:ISNPY), we started to trim positions. By the tip of the quarter, we had diminished our place in BNP by over 50% and Intesa by greater than 35%. The selections have been equal components danger discount and revenue taking after the robust upward efficiency for every inventory over the 12 months main as much as the financial institution disaster.

The European banking sector trades at a P/E of simply 6.1 for 2024 consensus earnings and is roughly half the a number of of the broader index. Our holdings are the respective champions of their nations and must be the recipients, slightly than donors, of deposits. Regulators and central banks have a vested curiosity in these banks’ stability and would help them with liquidity traces, if wanted.

We have now no publicity to Credit score Suisse, whose funding financial institution has been in restructuring mode for years. Out of three companies at Credit score Suisse, we imagine two are sound (their home financial institution and wealth administration enterprise) whereas the funding division has confirmed weak. As well as, the corporate’s administration turmoil, operational missteps and deposit outflows had been persistent headwinds for a few years. The present disaster has seemingly simply accelerated an inevitable restructuring/breakup. Whereas we imagine the compelled takeover isn’t an ideal answer, it’s the greatest that could possibly be accomplished in a brief time period to permit the contagion dangers from Credit score Suisse to subside.

Whereas we’ve got considerably trimmed again our European financial institution publicity — our solely financial institution publicity — we imagine this market ought to expertise much less adjustments than the U.S. as a consequence of extra stringent oversight in Europe, larger liquidity protection ratios, substantial capital will increase and uniform regulation throughout European banks of all sizes. Whereas deposit prices for European banks will however enhance, negatively impacting earnings over the following a number of quarters, we preserve that the business is best positioned essentially than within the U.S.

Probably the most vital a part of our monetary publicity is in inventory exchanges, together with London Inventory Alternate Group (OTCPK:LDNXF), Deutsche Boerse (OTCPK:DBOEY) and Hong Kong Exchanges & Clearing (OTCPK:HKXCF). The primary two outperformed for the quarter and the group ought to see little impression from the SIVB closure and Credit score Suisse takeover. Greater volatility, widespread in instances of financial institution sector stress, is a constructive for a lot of points of their operations.

Past financials, relative efficiency was pushed by our client discretionary holdings, largely centered on the luxurious market. French style and spirits holding firm OTCPK:LVMHF was the main contributor for the quarter. It is a secular grower and long-time portfolio holding, with a various enterprise combine that may work at totally different factors within the cycle. The shares have been boosted by robust working outcomes, constructive reception to its newest Dior line in addition to optimism across the reopening of the Chinese language luxurious market. Mid-priced Spanish retailer Inditex (OTCPK:IDEXY), which operates the Zara model and others, was additionally a strong contributor with good full-year numbers introduced through the quarter.

Portfolio Positioning

We added a brand new holding in Kering (OTCPK:PPRUF) which, like LVMH, is a French proprietor of luxurious manufacturers headlined by Gucci and Saint Laurent. To make room for Kering, we exited a place in British style retailer Burberry (OTCPK:BURBY) at what we seen as a full valuation. Each of those shares are going by way of turnarounds with new artistic groups however Kering is priced at a significant low cost. Inside luxurious, scaled gamers like Kering and LVMH take pleasure in vital benefits over smaller corporations which may solely have single manufacturers – gamers with scale possess the very best actual property, artistic/merchandising/administration expertise and management over distribution.

One other vital addition through the quarter included secular grower SAP) within the IT sector. We imagine the German software program maker is well-positioned as we’re on the early innings of a mega enterprise useful resource planning (ERP) improve cycle to the cloud, which is able to final a number of years and return the corporate to sustainable, double-digit progress. SAP ought to profit from extra recurring revenues from cloud-based subscriptions in addition to a broad vary of options throughout the enterprise together with human assets, buyer relationship and spend administration.

Compelling valuations and rising optimism about China’s reopening motivated the repurchase of Tencent (OTCPK:TCEHY), a Chinese language Web and social media conglomerate, whose shares had fallen sharply since we offered it in 2021. The corporate’s earnings estimates suffered as a consequence of a weak Chinese language economic system shut down by COVID restrictions and many purchasers curbing spending as a consequence of elevated authorities regulation, which negatively impacted Tencent recreation approvals. We now imagine estimates have bottomed and may begin transferring larger because the economic system reopens, with promoting spending coming again on Tencent’s social media and different media property and firms restarting spending on cloud companies. As well as, regulators are prone to restart approval of recent Tencent video games throughout the limits on children play time.

Outlook

As we come out of a gentle winter, Europe and the UK have withstood vitality shortages however proceed to battle stubbornly excessive inflation. Yields have risen to aggressive ranges because the ECB and Financial institution of England have adopted the U.S. Fed in tightening monetary circumstances. Whereas we’re watching inflation prints and earnings stories fastidiously, we proceed to favor the area as it’s dwelling to many high-quality companies that meet the traits we search for in secular and structural progress corporations. We’re additionally very selectively returning to rising progress corporations, repurchasing a small place in Canadian e-commerce enabler Shopify, as valuations have reset after the pandemic increase in 2020 and 2021 and progress selloff final 12 months.

We are going to proceed to comply with our course of and improve the portfolio. The Financial institution of Japan has a brand new governor, so we’ll monitor his feedback to find out the path of financial coverage and whether or not Japan will take away its very straightforward stance. Sudden strikes in direction of larger charges in Japan might impede a really sluggish restoration from the COVID lockdowns final 12 months. China’s restoration submit their zero-COVID lockdowns has been sluggish. A number of of President Xi’s key lieutenants in China have a expertise background, which provides us some optimism after the very damaging perspective towards expertise leaders final 12 months. World politics stay difficult for non-Chinese language traders to re-engage as they’ve beforehand. Our positioning in China is reasonable and concentrated in shares that ought to advance off very low ranges of final 12 months, no matter international politics.

The previous few years have been difficult to long-term traders as model cycles have vacillated meaningfully. Each progress and worldwide shares have been very out of favor submit the Russian invasion of Ukraine in February 2022, whereas worldwide worth shares reached report highs towards progress shares. In the present day, cash provide world wide is tightening meaningfully from traditionally excessive ranges, rates of interest are transferring up and the price of capital is rising. We have now been watching these strikes and are constructive on our present positioning. We preserve high-conviction exposures in progress corporations which not solely generate ample free money circulate however who even have wholesome money balances and low debt ranges. We have now been trimming and promoting extra cyclically-oriented positions. Over the following few quarters, we’ll see if the impression on economies from larger charges launched over a 12 months in the past begins to take maintain. Ought to weak point emerge in worldwide markets, the Technique has a sound basis to face up to it.

Portfolio Highlights

In the course of the first quarter, the ClearBridge Worldwide Progress EAFE Technique outperformed its MSCI EAFE Index benchmark. On an absolute foundation, the Technique noticed positive aspects throughout 9 of the ten sectors through which it was invested (out of 11 complete) with the buyer discretionary and IT sectors because the main contributors.

On a relative foundation, total sector allocation results and inventory choice contributed to efficiency. Specifically, inventory choice within the financials, well being care, client discretionary and communication companies sectors, an chubby to IT and underweights to financials and vitality drove outcomes. Conversely, inventory choice within the industrials, client staples and IT sectors weighed on efficiency.

On a regional foundation, inventory choice in Europe Ex U.Ok., North America, the U.Ok. and Japan and an underweight to Asia Ex Japan contributed to efficiency whereas an chubby to North America and inventory choice in Asia Ex Japan detracted.

On a person inventory foundation, the most important contributors to absolute returns within the quarter included LVMH within the client discretionary sector, Novo Nordisk (NVO) within the well being care sector, Keyence (OTCPK:KYCCF) and ASML within the IT sector and Deutsche Telekom (OTCQX:DTEGY) within the communication companies sector. The best detractors from absolute returns included positions in Recruit (OTCPK:RCRRF) and Computershare (OTCPK:CMSQF) within the industrials sector, AIA Group (OTCPK:AAGIY) within the financials sector, Roche (OTCQX:RHHBY) within the well being care sector and Shiseido (OTCPK:SSDOY) within the client staples sector.

Along with the transactions talked about above, we initiated a place in Safran (OTCPK:SAFRF) within the industrials sector. We additionally closed seven positions. We offered Aflac (AFL) within the financials sector to maintain our monetary place smaller submit the market dislocation, Adidas (OTCQX:ADDYY) within the client discretionary sector after the brand new CEO joined and previous to his resetting of earnings in addition to Dassault Systemes (OTCPK:DASTY) and Elastic (ESTC) within the IT sector in favor of SAP. We exited Ashtead (OTCPK:ASHTF) within the industrials sector after it reached our worth goal and offered Barrick Gold (GOLD) within the supplies sector after the thesis had performed out for this structural progress holding.

Elisa Mazen, Managing Director, Head of World Progress, Portfolio Supervisor

Michael Testorf, CFA, Managing Director, Portfolio Supervisor

Pawel Wroblewski, CFA, Managing Director, Portfolio Supervisor

Previous efficiency is not any assure of future outcomes. Copyright © 2023 ClearBridge Investments. All opinions and information included on this commentary are as of the publication date and are topic to alter. The opinions and views expressed herein are of the creator and will differ from different portfolio managers or the agency as an entire, and usually are not meant to be a forecast of future occasions, a assure of future outcomes or funding recommendation. This data shouldn’t be used as the only real foundation to make any funding determination. The statistics have been obtained from sources believed to be dependable, however the accuracy and completeness of this data can’t be assured. Neither ClearBridge Investments, LLC nor its data suppliers are answerable for any damages or losses arising from any use of this data.

Efficiency supply: Inside. Benchmark supply: Morgan Stanley Capital Worldwide. Neither ClearBridge Investments, LLC nor its data suppliers are answerable for any damages or losses arising from any use of this data. Efficiency is preliminary and topic to alter. Neither MSCI nor every other social gathering concerned in or associated to compiling, computing or creating the MSCI information makes any specific or implied warranties or representations with respect to such information (or the outcomes to be obtained by the use thereof), and all such events hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or health for a selected function with respect to any of such information. With out limiting any of the foregoing, in no occasion shall MSCI, any of its associates or any third social gathering concerned in or associated to compiling, computing or creating the info have any legal responsibility for any direct, oblique, particular, punitive, consequential or every other damages (together with misplaced earnings) even when notified of the potential for such damages. No additional distribution or dissemination of the MSCI information is permitted with out MSCI’s specific written consent. Additional distribution is prohibited.

Click on to enlarge

Unique Submit

Editor’s Notice: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please pay attention to the dangers related to these shares.