If you already know Web3, you already know OpenSea. Since its launch on the finish of 2017, the NFT market has largely been the poster youngster for the world of Ethereum and crypto artwork, and it’s received the numbers to show it.

OpenSea’s whole historic buying and selling quantity sits at simply shy of $41 billion, in accordance with Dune analytics. To place that in perspective, KnownOrigin, one in all OpenSea’s opponents that launched across the identical time, has a complete buying and selling quantity of simply over $30.5 million.

Having dominated the marketplace for virtually six years, OpenSea has been as influential to the NFT ecosystem as any mission, artist, or builder. Nevertheless, this outsize impression hasn’t all the time been for the higher, as the corporate has more and more begun to conflict with NFT group members over some fairly vital Web3 points.

The final six months, specifically, have introduced {the marketplace} with a number of challenges with which it’s nonetheless grappling, in addition to the primary actual contender with a shot at changing it as NFT market ruler. With that in thoughts, right here’s a have a look at every little thing it’s essential to learn about OpenSea.

What’s OpenSea?

OpenSea is among the most well-known, peer-to-peer NFT marketplaces in existence. Customers should purchase, promote, commerce, and create NFTs on the platform in varied classes starting from pictures and PFPs to gaming, membership tokens, and fantastic artwork initiatives.

OpenSea is the all-around hitter of NFT marketplaces. It’s straightforward to navigate and supplies a restricted however versatile suite of analytics instruments and sorting choices for customers trying to dig deeper into assortment histories or NFT trait rarities. Slightly than honing in on a specific area of interest of Web3 customers, the platform is a stable one-stop store for a broad vary of lovers, together with newcomers, skilled merchants, and low-volume retail NFT patrons.

OpenSea’s rise to energy

It’s troublesome to overstate the magnitude of OpenSea’s rise. Having been based in 2017 by software program engineer and entrepreneur Devin Finzer and programmer Alex Atallah, {the marketplace} hit a $1.5 billion valuation by the summer time of 2021. By January 2022, that quantity surged to $13.3 billion after the corporate raised $300 million in a Collection C funding spherical.

Whereas NFTs had been round in some type since 2011, that they had but to hit an inflection level and achieve vital traction within the public’s eye, even in 2017. In creating OpenSea, Finzer and Atallah had recognized a must construct a platform that might operate as a focus for the then largely disparate communities of Web3 lovers.

“At first, Devin and Alex got down to create a market to unite siloed communities through the early days of NFTs,” stated an OpenSea spokesperson whereas talking to nft now. “Whereas embracing a variety of potential outcomes, the upside was all the time there: turning into a vacation spot the place folks may work together with NFTs, and thus discover a model new financial system on the web.”

That financial system has grown considerably because the platform’s launch, even contemplating Web3’s most up-to-date crypto winter. As of September 2022, buying and selling quantity within the Ethereum NFT sphere hit 8.22 million ETH ($11.5 billion). Moreover, a June 2022 report by analysis and consulting agency Verified Market Analysis predicted the market cap for the NFT business may attain $231 billion by 2030.

OpenSea has performed an important function in serving to that market mature. From Could 2021 to November 2022, the platform was accountable for almost all of buying and selling quantity within the NFT house.

OpenSea instruments and options

OpenSea rolls out new options and instruments on the platform with some regularity, all geared toward growing belief within the platform, person security, and bettering infrastructure for the bigger ecosystem.

One of many platform’s vital updates got here in June 2022 with the introduction of Seaport, a Web3 market protocol that allows customers to extra safely and effectively purchase and promote NFTs. Earlier than Seaport, OpenSea used Wyvern, a less-efficient protocol created by a 3rd occasion. As compared, Seaport cuts down on redundant transfers and, in accordance with an organization weblog publish on the event, reduces fuel charges for customers by 35 %. Seaport is open supply; OpenSea doesn’t management or function it, and the corporate has inspired good contract builders to enhance the protocol with them.

{The marketplace} has launched a number of options within the final 12 months, together with a copymint detection system, a method to disguise suspicious NFT transfers to customers’ wallets, and a capability for creators to launch collections with devoted drop pages immediately on OpenSea known as Drops. However not all of its product launches have been well-received.

OpenSea’s royalty woes

All through the years, OpenSea has launched or made modifications to its services that connect with Web3’s most urgent points — and never all the time gracefully. The platform has continuously clashed with artists and creators, who castigate {the marketplace} for what they understand to be offenses to the well being of the NFT group and the people that type its bedrock.

The critiques could be troublesome to weigh pretty. As a result of its stature and lengthy historical past within the house, OpenSea makes for a simple goal, whether or not or not its detractors’ arguments are authentic. Regardless, like each market within the ecosystem, the corporate has had its share of difficulties and shortcomings. The platform has struggled with creating a good and efficient stolen gadgets coverage, has a historical past of website performance points throughout instances of excessive visitors and following durations of intense progress, and has taken a quite centralized strategy to implementing guidelines regarding its person base.

However the highest-profile problem that the Web3 group takes with OpenSea is its inconsistent stance on creator royalties. Royalties (also called creator charges) allow artists to be compensated for a piece properly past its main sale, giving them a minimize of the income each time their NFT modifications arms. Royalties have helped artists and builders in Web3 create a wealthy, various, and thriving artwork ecosystem and play a significant function in its sustainability, offering an important revenue supply for the funding of future initiatives.

Till the current growth of on-chain enforcement instruments, royalties weren’t initially enforceable on a technical stage. Even so, some collections on OpenSea weren’t created on upgradable good contracts, stopping them from having the ability to use the newly developed instruments. For collections constructed on upgradable contracts, nevertheless, it’s as much as the marketplaces facilitating the shopping for and promoting of their NFTs to implement and implement these royalties funds by means of these new instruments.

Till lately, OpenSea had accomplished an incredible deal to help artists on this manner. As of October 2022, {the marketplace} was the platform that had paid out probably the most creator royalties by a big margin. And in November of the identical 12 months, {the marketplace} introduced that it might introduce a software for brand spanking new collections to implement royalties on its platform — its first crack at an on-chain answer for royalties enforcement.

Whereas this was hailed as a constructive, creator-friendly transfer, customers have been unsettled by the truth that such royalty enforcement wasn’t going to use to present collections on OpenSea — the very collections that helped set up the platform as a number one Web3 pressure.

After extreme backlash from almost each distinguished NFT artist and mission head within the house, OpenSea introduced it might proceed to implement creator charges on legacy collections, a transfer that many on the time noticed as each a win for creators and an occasion that catalyzed a form of unionization motion in Web3.

In February 2023, nevertheless, OpenSea once more altered its place on royalties. In a Twitter thread, the corporate introduced that it might be shifting collections that don’t use on-chain enforcement instruments (the overwhelming majority of collections on its platform) to non-obligatory royalties. As soon as once more, many artists in the neighborhood took umbrage with this.

OpenSea has cited a sea change in market dynamics as the principle cause for its transfer to non-obligatory royalties on its platform, and there’s some credibility in that declare. Collectors merely don’t need to pay royalties if they’ll keep away from it, and marketplaces must take heed to the collectors that make up their target market. This development isn’t theoretical — marketplaces are more and more abandoning royalties enforcement, and zero-royalty platforms like Blur have begun siphoning off large quantities of buying and selling quantity from OpenSea, usurping the corporate’s previously-held majority market share.

OpenSea vs. Blur

The rise of Blur is among the most vital developments in NFT market historical past and has every little thing to do with what OpenSea is making an attempt to attain with its royalties strikes. Blur’s technique of interesting to a small however sturdy demographic of professional merchants by rewarding its customers with free airdrops of its token has confirmed broadly efficient in its present aim of optimizing for market share. Since November 2022, Blur has both sat neck-and-neck with OpenSea or fully outpaced it by way of buying and selling quantity (though OpenSea nonetheless retains the upper depend of energetic customers).

Nevertheless, OpenSea could bear some accountability for partially catalyzing the market shift it’s now lamenting. The royalty coverage it lately canned pressured creators to decide on between incomes full royalties on both OpenSea or Blur, setting royalties to non-obligatory upon detection of a set’s buying and selling on royalty-optional platforms. Satirically, it was OpenSea’s personal Seaport that enabled Blur to sidestep this coverage, drawing much more customers to Blur’s shores. Regardless, the transfer put creators and collectors in an uncomfortable place.

OpenSea’s makes an attempt to uphold royalties so long as it did are price appreciating, and the platform isn’t the artist-hating behemoth that some make it out to be. However because it and others vie for dominance within the NFT ecosystem, creators are caught within the center in what many see as a race to the underside of one in all Web3’s founding ideas: empowering and correctly compensating artists.

In the end, as some have argued, it might be the case that Web3 platforms are merely extra involved with gaining market share, as success on this aim permits them to safe extra financing by means of enterprise rounds. Both manner, the present market dynamic sits poorly with the group of artists that generates the wealth the NFT ecosystem swims in and who sincerely imagine within the means of Web3 tech to foster a extra equitable future for creatives.

OpenSea Professional

In early 2022, the NFT ecosystem was experiencing a good quantity of progress and alter, largely fueled by influential NFT collectors who pushed the house ahead. One of many issues OpenSea did in response to this was to accumulate Gem, one of many high NFT aggregators on the time, in April of the identical 12 months.

On April 4, 2023, OpenSea introduced Gem v2, which rebranded the aggregator as OpenSea Professional — the corporate’s energy user-centered response to Blur.

Whereas OpenSea maintains OS Professional is directed primarily at “pro-collectors,” the pro-trader demographic will discover a lot to love in regards to the platform, which compiles NFT listings and offers from 170 marketplaces. Options embrace dwell cross-marketplace information, superior order choices, optimized fuel charges, cellular compatibility, and dwell mint overviews.

To incentivize exercise on OS Professional, the corporate can be rewarding customers with a Gemesis NFT drop, given to those that purchased an NFT on the beforehand named Gem platform earlier than March 31, 2023. Customers will be capable to declare their NFT till Could 4, 2023.

On April 19, OS Professional customers’ Genesis NFT rarity traits have been revealed, with ranks reflecting how early Gem customers purchased an NFT on the aggregator. The highest one % of customers acquired NFTs with distinctive visuals. Many in the neighborhood are questioning if these NFTs will include future utility, however OpenSea has but to supply any readability.

Regardless, OpenSea’s anti-Blur measures appear to be taking impact. Since its launch, OpenSea Professional has overtaken Blur by way of day by day transaction depend. Whereas the latter nonetheless dominates by way of sheer buying and selling quantity general, the hole has been steadily shrinking since February.

The decentralization conundrum

A number of of the issues OpenSea will get criticized for haven’t any straightforward options. The platform’s stolen merchandise coverage, which has led to the inadvertent punishment of customers who unknowingly bought a stolen NFT on {the marketplace}, is only one instance. It’s price noting that OpenSea listened to group suggestions and consequently up to date its coverage to higher disincentivize theft and enhance the accuracy of stolen merchandise stories. It’s additionally applied malicious URL detection and elimination, and a system that goals to stop the reselling of stolen gadgets.

Whereas there’s an argument that OpenSea ought to have accomplished extra to develop as truthful and efficient a coverage as attainable for stolen gadgets sooner than it did, it’s additionally not a stretch to say that coping with safety in a decentralized world stays an inexact science, particularly when a corporation is making an attempt to make sure authorized compliance within the U.S.

The platform’s March 2022 hiccup in the way it approached U.S. sanctions legislation necessities likewise falls below this class. Balancing a largely nameless and worldwide person base with probably ruinous authorized repercussions is troublesome.

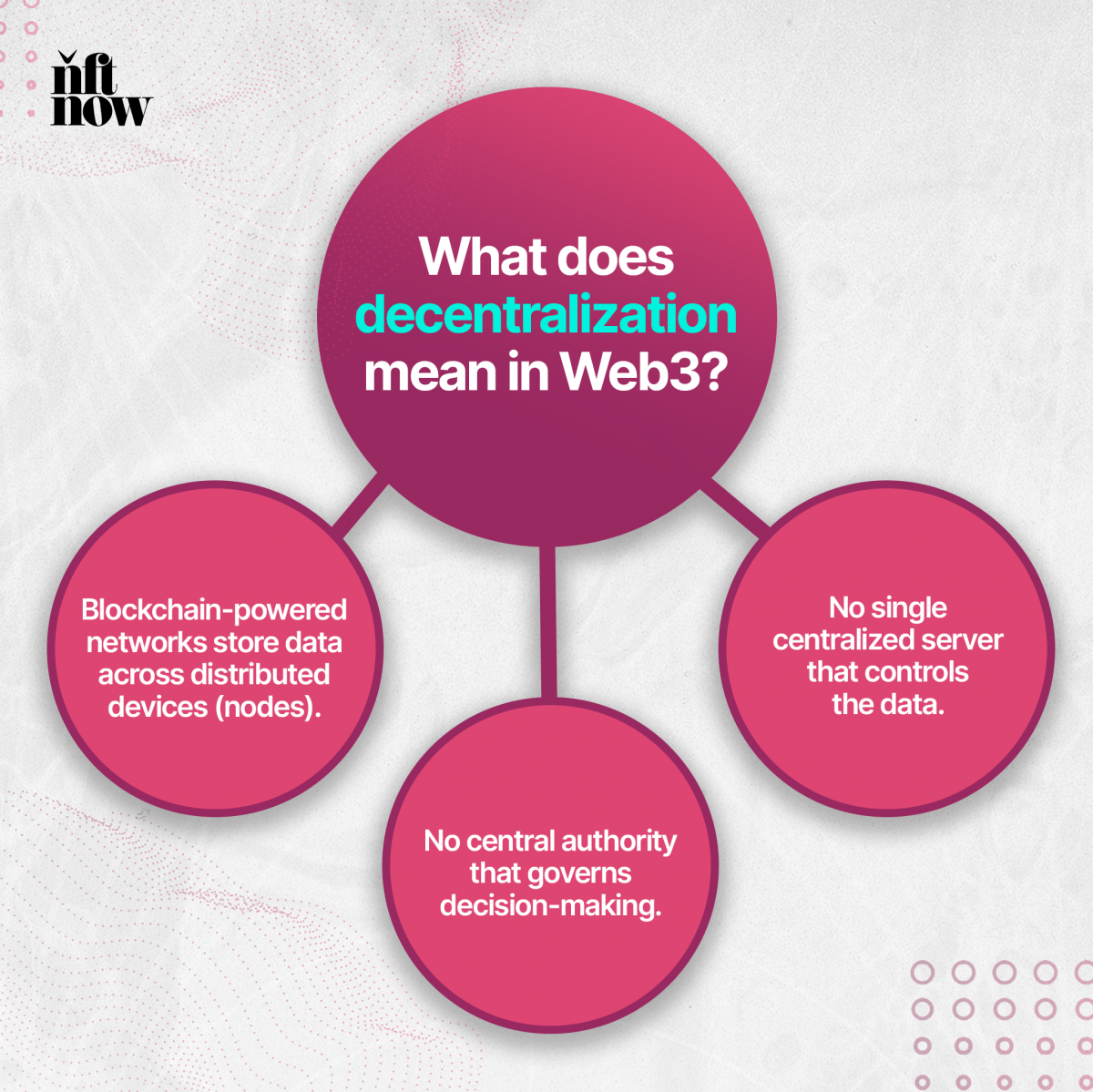

All of those points dwell below the banner of one in all Web3’s founding tenets: decentralization, the concept that broad authority to make modifications affecting a group must be dispersed all through that group quite than vested in a single particular person or group. Huge NFT platforms like Opensea are in an unenviable place right here. Requires a “really decentralized market” can be acquainted to anybody who has been within the NFT house for quite a lot of weeks. These calls, nevertheless well-intentioned, are typically ill-thought-out.

OpenSea believes that the centralization debate is an important and compelling one which, like each controversial problem within the house, evolves and requires an strategy that may be adjusted if vital. Whereas it’s straightforward to argue that OpenSea is a centralized entity, it’s additionally price noting that the majority Web3 entities are.

Centralization is a spectrum. Nifty Gateway, for instance, is a custodial platform that shops its customers’ NFTs in a pockets from which they have to be withdrawn to be traded on different platforms. Even the founders of SuperRare have acknowledged that decentralization is a piece in progress and that “decentralization by centralized means” could also be among the finest methods of fullying realizing the promise of this explicit tenet of Web3.

OpenSea believes coordinated motion on some authoritative stage is typically essential to hold issues operating easily and its customers protected in an setting stuffed with dangers and unknowns. Web3 is a risky panorama that shifts by the hour. Anticipating anyone particular person to maintain up and reply completely to it’s unreasonable; having the identical expectations of an unwieldy, multi-billion-dollar group is unreasonable.

OpenSea’s future

None of which is to say that OpenSea can’t do a greater job on the issues the NFT group usually rebukes it for; it should if it desires to take care of its spot as a high Web3 market. It owes creators — not simply collectors — innovation they’ll use that upholds their rights as Web3 residents. Likewise, it will probably do extra to obviously talk sudden modifications in coverage and implement choices transparently.

“We imagine that finally, the bodily financial system will shift on this route, and it’s attainable that someday, almost every little thing we personal can be owned and transferrable on the blockchain within the type of an NFT,” CEO Devin Finzer underscored of the corporate’s strategy to the evolution of Web3 in a November 2022 weblog publish. “We’ve conviction that this know-how will finally energy the most important markets on the planet and basically rework society. That’s the imaginative and prescient we’re rallying round at OpenSea.”

All of which sounds rhetorically on the cash. However rhetoric is simple; how {the marketplace} decides to execute that imaginative and prescient pretty whereas dealing with quickly shifting market dynamics, growing aggressive stress, and a motion of creators coalescing across the royalties problem stays to be seen.