Inflation continues to move decrease, however not on the desired tempo.

And, as market volatility rises, buyers ought to attempt to readjust their portfolios.

The 60/40 portfolio is an effective way to try this because it has traditionally confirmed efficient.

Regardless of a point of stagnation, the pattern in inflation continues to be bearish, with every Client Value Index () studying being decrease than the earlier one since peaking at 9%.

Whereas the speed of change in inflation is slowing down, it isn’t lowering on the desired price, because it stays considerably sticky.

Listed here are the annualized readings (U.S. CPI) for the previous yr:

Nevertheless, the difficulty with inflation lies within the price of change because the starting of the pandemic, which has been important. That is partly because of the affect of the labor market, rising wages, and fast financial restoration.

The info introduced within the graph illustrates that the post-pandemic employment restoration amongst people aged 25-54 has been quicker than in any earlier recession.

That is thought-about to be a uncommon prevalence. Probably the most notable findings from the information is that low-income employees are experiencing the quickest wage development.

Whereas it’s constructive that inflation is trending downward. However at 5%, it nonetheless stays excessive. Therefore, it is unsurprising that many buyers want to hedge towards inflation.

Final yr, commodities served as a hedge towards inflation. Along with their hedging functionality, additionally they functioned as a diversifier.

That is particularly helpful when shares and bonds are much less engaging choices. Listed here are the returns of those 3 asset courses in 2022:

Shares (): -19.5%

Bonds (): -14.3%

Commodities (): +17.5%

How Do You Cut back Your Portfolio’s Volatility?

The straightforward reply can be to diversify by finding out varied sub-funds and sectors throughout the fairness market and figuring out diversification alternatives.

Bonds are often thought-about essentially the most most popular asset for balancing out a portfolio. Nonetheless, this method might not all the time be efficient, significantly when rates of interest rise steeply, as in 2022.

In such situations, it might be worthwhile to think about decreasing publicity to equities and exploring commodities.

If we transfer out of equities an excessive amount of, it would cut back volatility. However that additionally reduces long-term returns an excessive amount of, after which the sport is just not definitely worth the candle.

Wanting on the chart, we will see that over the past 70 years, the S&P 500 has delivered constructive returns 81% of the time. Moreover, if we take into account funding horizons of 20 years or extra, it has delivered constructive returns 100% of the time.

It is necessary to notice that beating the market or outperforming one’s benchmarks is just not so simple as deciding on an asset and hoping for 200% returns in a yr. Simply assume why the overwhelming majority of hedge funds fail.

Based mostly on the information introduced earlier, it is clear that the longer the funding horizon, the extra seemingly it’s that benchmarks will outperform hedge funds.

As particular person buyers, our main mantra ought to be diversification. This technique might result in decrease efficiency throughout bullish markets, however it may additionally result in larger efficiency throughout bearish markets.

By diversifying our investments throughout varied asset courses and sectors, we will cut back our danger publicity and probably obtain higher long-term outcomes.

The 60/40 portfolio technique, which entails allocating 60% to shares and 40% to bonds, has had a tough interval lately. The chart beneath reveals that 2022 was an exception.

Earlier damaging returns, reminiscent of these skilled in 2000-2003 and 2008-2009, had been primarily attributable to inventory market crashes. We have now to return to 1981 to discover a yr just like 2022, by which shares and bonds had double-digit losses.

This highlights the significance of getting a long-term funding horizon and never counting on short-term fluctuations. The 60/40 portfolio technique has traditionally been dependable over a sufficiently lengthy timeline.

One of many advocates of this technique is the passively managed fund big, Vanguard.

Of their U.S. portfolio, Vanguard used the S&P 500 Index for U.S. equities and the Bloomberg U.S. Combination Bond Index for bonds. For the globally diversified 60/40 portfolio, they allotted 36 % to U.S. equities utilizing the MSCI US Broad Market index, 24 % to non-U.S. equities utilizing the , 28 % to U.S. bonds utilizing the Bloomberg U.S. Combination Bond index, and 12 % to non-U.S. bonds utilizing the Bloomberg International Combination ex-USD index.

Forecasts for the yield (annualized) elevated from 3.83 % on the finish of 2021 to six.09 % on the finish of 2022. The upward revision comes from the improved efficiency anticipated from bonds, and the 60/40 has probability of getting a constructive decade.

Rebalancing shouldn’t be underestimated and ought to be finished periodically to regulate the chances of property in a portfolio, whether or not it’s a 60/40 or another sort of portfolio.

It’s crucial when the chances turn out to be skewed in favor of a specific asset or when the portfolio volatility will increase. At the moment, in accordance with analysis performed by JP Morgan, buyers ought to favor extra defensive property.

Lastly, listed here are two extra indicators:

1. Based on Goldman Sachs indicators, the market is predicting a recession throughout the subsequent yr, as indicated by the market-implied likelihood of a recession beginning inside 1 yr (blue line) and the market-implied likelihood of a recession occurring (blue line).

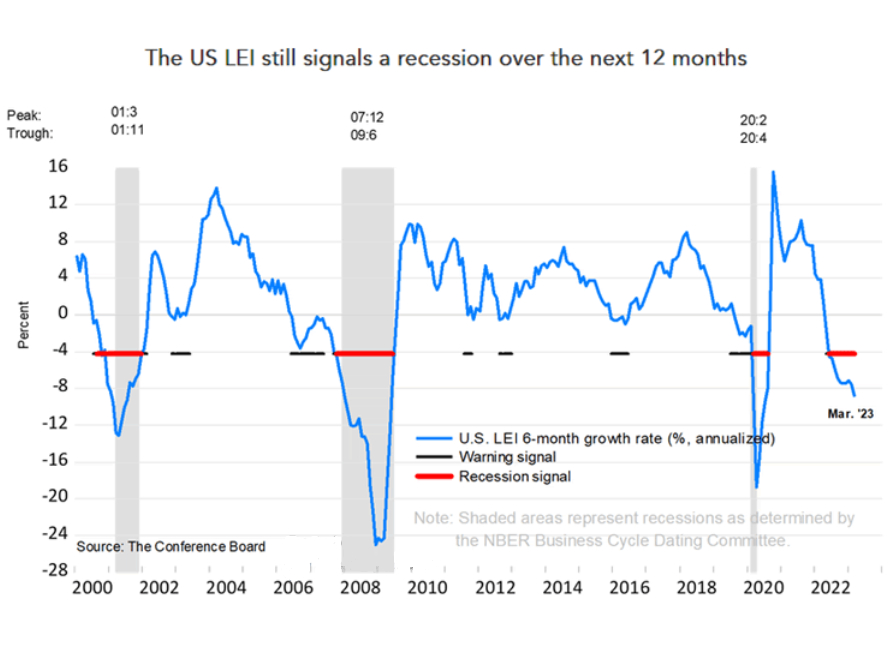

2) The Convention Board Main Financial Index alerts a recession within the subsequent 12 months.

To conclude, buyers ought to always remember:

Simplicity is every part.

Lengthy-term returns are the one ones that matter.

Markets are irrational within the quick run.

Predicting actions in markets is nearly not possible.

Get All of the Data You Want on InvestingPro!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, or advice to take a position as such; it isn’t meant to incentivize the acquisition of property in any method. I want to remind you that any sort of asset is evaluated from a number of factors of view and is very dangerous subsequently, any funding determination and the related danger stay with the investor.