z1b

Co-authored with “Hidden Alternatives.”

The inventory market could be a very risky place. Costs are sometimes swayed by “investor sentiment,” which outdoors of Wall Avenue, could be referred to as feelings. The market is full of merchants who’ve their fingers poised on the buttons to purchase or promote at a second’s discover. These merchants really feel like they need to race everybody else. Their revenue is set by whether or not or not they are often sooner than their friends and whether or not or not they’ll predict short-term value modifications extra precisely.

This can be a race I do know I can not win. There are corporations on Wall Avenue with complicated laptop algorithms and whole groups devoted to making an attempt to win this race. Luckily, I haven’t got to win the race. They’re like youngsters, operating to be first in line at a buffet. I am going to sit again and allow them to have the primary choose. Then when the traces are empty, I’ll make my approach as much as the road to leisurely have my choose. Newsflash, the buffet is not going to expire of meals.

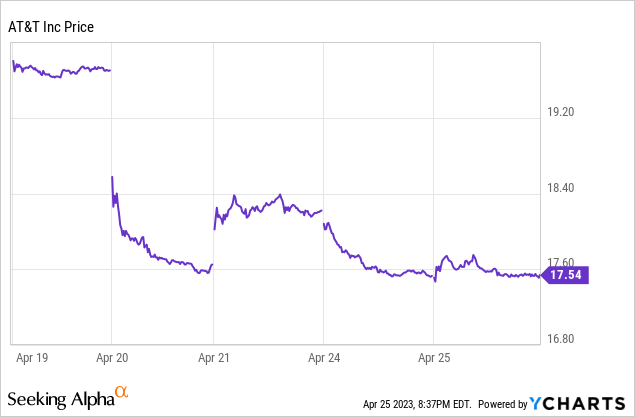

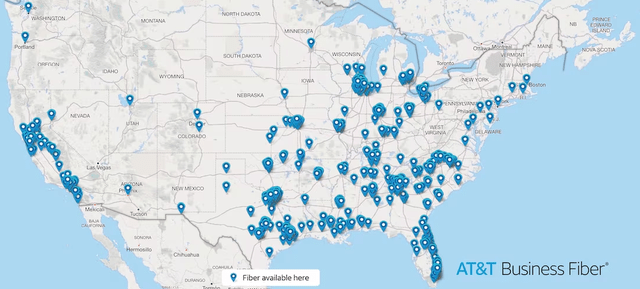

AT&T Inc. (NYSE:T) introduced Q1 earnings on April twentieth, and as at all times, Wall Avenue behaved just about like they at all times do – Promote First And Study Particulars Later. All these buyers have been in a rush to promote due to what they perceived as a “unhealthy” quarter.

Marketwatch.com

Supply.

A very powerful takeaway from the earnings report is that T’s core wi-fi and client wireline companies carried out nicely in Q1, and the FY 2023 steerage stays unchanged. But, headlines are designed to induce worry, regardless of being fairly deceptive. We’ll study the main points immediately.

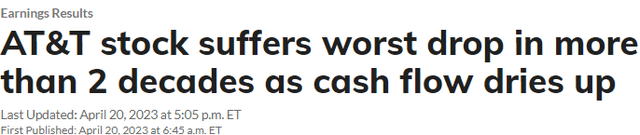

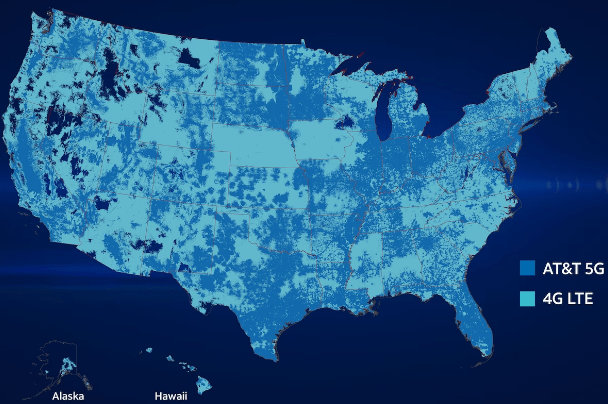

Widening Moat Via Community Growth

Throughout Q1 2023, T continued increasing protection of 5G and Fiber applied sciences, rising availability to the American inhabitants. T’s mid-band 5G spectrum now covers over 160 million individuals; nationwide, 5G has reached 290 million individuals. T is presently positioned to serve fiber to 19.7 million shoppers and greater than 3 million enterprise buyer areas in additional than 100 U.S. metro areas. In the course of the quarter, the telecom firm reported 424,000 postpaid cellphone web provides, and 272,000 Fiber web provides. Supply.

AT&T Web site

Supply.

AT&T Web site

Income, Profitability, and Debt

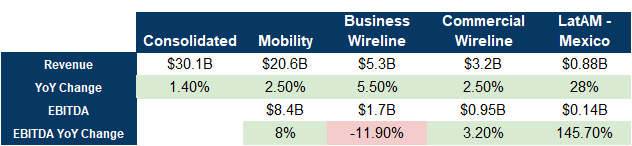

T reported top-line progress in each enterprise section, and consolidated quarterly income rose to $30.14 billion. T’s EBITDA was $8.4 billion, up 8% YoY, with an EBITDA margin of 40.7% (up from 38.6% in Q1 2021).

Writer’s Calculations

5G and Fiber buildout are important bills for international telecom corporations, and T expects to spend $24 billion in Capital Expenditure for the fiscal yr. Notably, $4.3 billion was spent in Q1 2023.

On the finish of Q1, T reported that 95% of its debt was fastened at a mean charge of 4.1%. The corporate continues to anticipate to realize a web debt-to-adjusted EBITDA ratio to drop to the two.5x vary by early 2025.

The market didn’t actually have a look at any of the parameters talked about above, however was fixated on a selected metric with flawed expectations.

Allow us to discuss concerning the Free Money Stream

As an example you earn $4,000 month-to-month and spend roughly $3,000, forsaking a wholesome $1,000 in the direction of financial savings. Suppose your Air Conditioner breaks down in August, and also you spend $6,000 for a substitute. So that you have been at adverse $5,000 for the month. Does that instantly time period you an over-spender, which means lenders will disqualify you in your mortgage software in September?

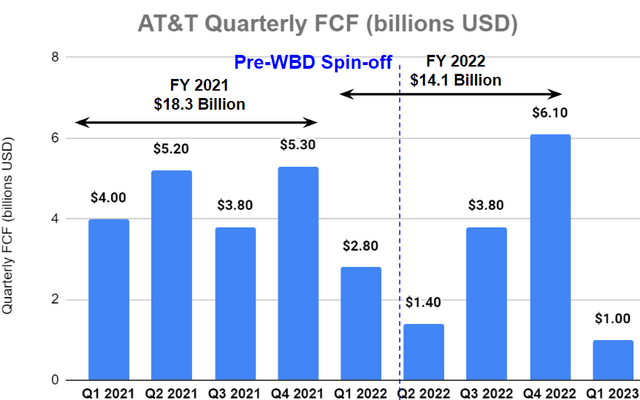

Free Money Stream (“FCF”) is a non-GAAP metric and, most significantly, a lumpy one. Let me clarify extra. FCF is calculated as money from the corporate’s operations plus the money distributions from DIRECTV minus capital expenditures and money paid for vendor financing. We all know T is spending closely on 5G and fiber rollout. Money spent on Capex will be irregular or lumpy relying on after they spend money on completely different initiatives. Main money bills are accounted for instantly and considerably impression quarterly numbers. This lumpiness makes quarterly FCF numbers much less prone to point out the annualized quantity, a lot much less the flexibility to gauge annual dividend protection.

The market thinks that T’s quarterly dividend spend of $2 billion isn’t lined by the reported $1 billion quarterly FCF and is elevating the 200% FCF payout ratio in a false alarm.

We consider the lumpy quarterly numbers may result in deceptive conclusions (as clearly seen from the corporate’s inventory value efficiency for the reason that earnings launch).

Writer’s Calculations

Combining the numbers of the final 4 quarters makes higher sense (trailing 12 months, or TTM). The $12.3 billion TTM FCF adequately lined T’s $8 billion dividend for a similar interval at a 65% payout ratio.

In direction of the tip of This autumn, administration offered $16 billion in FCF steerage for FY 2023. This steerage was additional affirmed after Q1 2023. Notably, administration had instructed us after This autumn that they anticipate increased expenditure in Q1 and that the FCF can be increased because the fiscal yr progresses.

Just like final yr, we anticipate better free money move era within the again half of the yr primarily based on increased capital funding ranges and machine funds within the first half of the yr in addition to the timing of the annual incentive compensation payout. – Pascal Desroches, CFO (This autumn 2022 Earnings Transcript).

Taking a look at numbers from latest quarters, it’s not unreasonable to anticipate the corporate to fulfill its projected annual $16 billion FCF.

…We got here in precisely as we anticipated. Bear in mind, in my commentary on the year-end once we gave steerage, we stated that Q1 was going to be the low watermark totally free money move for a number of causes. One, it is the best quarter of machine funds. Recall, This autumn vacation gross sales is the heaviest quantity for units we pay for these in Q1. You noticed our capital spend is elevated relative to the annual steerage that we gave. And Q1 is the quarter we pay incentive comp. Whenever you issue all these issues in, together with our expectations that we are going to proceed to develop EBITDA, we really feel actually good about delivering $16 billion or higher. – John Stankey, CEO (Q1 2023 Earnings Transcript).

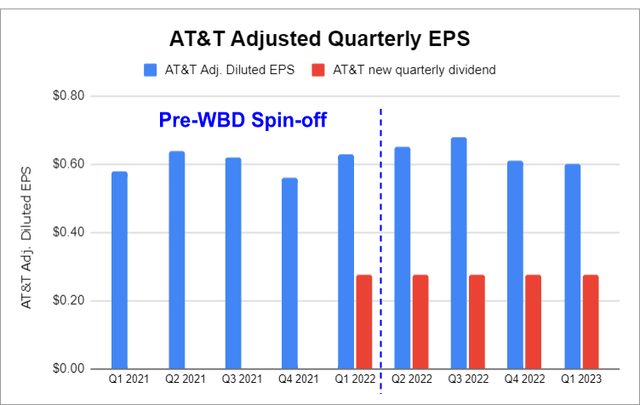

Wanting into the TTM Adjusted Earnings Per Share (“EPS”), T maintains a 43% dividend payout ratio. Notably, the corporate’s quarterly dividend maintains protection via Adj. EPS, which has been extra constant over between quarters.

Writer’s Calculations

Investor disappointment is probably going as a result of, for Q1, Wall Avenue analysts had forecast a $3 billion FCF. Frankly talking, we see no such quantity from any of the experiences or interviews printed by T or its management. How did the analysts provide you with that quantity when administration talked about that Q1 FCF could be on the decrease aspect?

The corporate’s FY 2023 FCF steerage of $16 billion adequately covers the $8 billion annual dividend spent and leaves a wholesome quantity behind for debt paydown. T trades at a 7.2x ahead P/E ratio presenting a cut price at these ranges, and WSJ analysts have a $22 median value goal for the corporate (~21% upside from present ranges).

Conclusion

AT&T’s Q1 outcomes aligned with administration steerage, and the 2023 outlook was reaffirmed. The corporate’s dividend stays adequately protected when taking a look at TTM efficiency numbers objectively. There’s nearly no basic motive for the steep selloff.

Wall Avenue analysts usually have quarterly expectations and short-term value targets, which affect post-earnings inventory motion. Bear in mind, these analysts don’t give you the results you want and aren’t as centered on the larger image as you suppose. Whether or not they’re proper or mistaken with their expectations tells you extra concerning the analysts than the corporate.

So whereas Wall Avenue races in the direction of the exit, we’re completely satisfied to step in and purchase our revenue at a cheaper price. At HDO, we’re shopping for extra T which is a part of our “mannequin portfolio,” and carries an general yield of +9%. AT&T Inc. is cheaply valued, and this panic-driven selloff is a present to purchase the dip. A professional 6.3% yield in your prudence and persistence via Mr. Market’s irrationality!