marchmeena29

As anticipated, the market capitalization of latest properties offered within the U.S. constructed continued rising in March 2023. Will increase within the variety of new properties offered and their sale costs are accountable for the event, constructing on the momentum from February 2023’s first enhance of the nation’s new house market cap after 11 months of steep decline.

That decline coincides with the Federal Reserve’s sequence of fee hikes that started in March 2022 when the Fed lastly responded to inflationary pressures that started constructing a 12 months earlier. The speed hikes have contributed to pushing up mortgage charges, which peaked round 7.0% in November 2022 and have come down since. A 30-year typical mounted fee mortgage reached a mean post-peak low of 6.3% in February, earlier than bouncing as much as a mean of 6.5% throughout March 2023.

Whereas mortgage charges averaged barely larger in March, it wasn’t sufficient to beat the optimistic momentum for brand new house gross sales, as Reuters studies “the worst of the housing market rout is probably going over”. However they observe there is a cloud to go together with that silver lining – extra on that later…

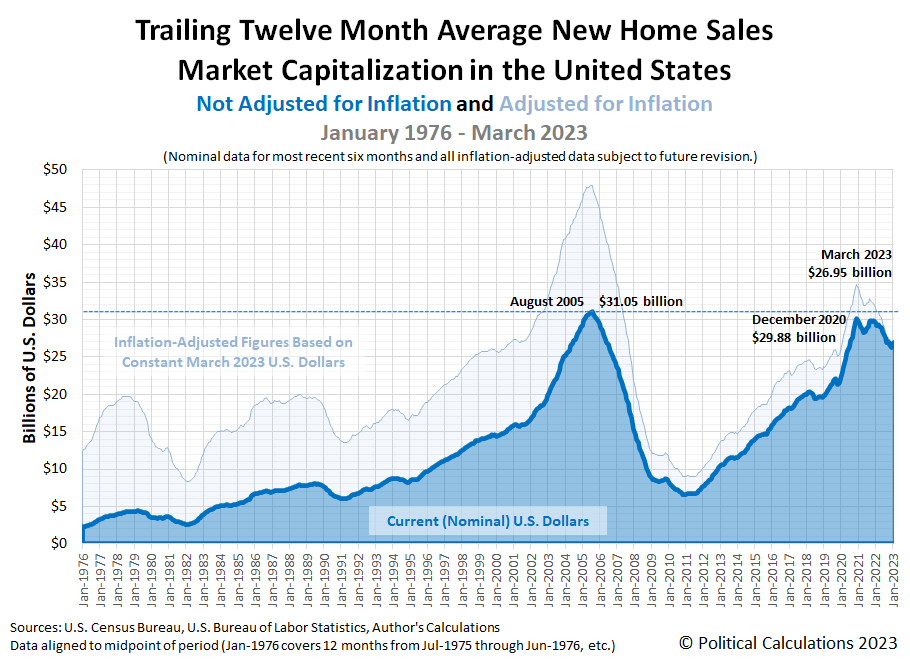

Right here is the most recent replace to our chart monitoring the tendencies for the market cap of latest properties, which illustrates how U.S. new house builders and this sector of the U.S. financial system are faring:

The chart exhibits the time-shifted rolling twelve month common of the U.S. new house market capitalization for March 2023 is $26.95 billion. This determine is an preliminary estimate, which might be topic to revision throughout every of the following three months.

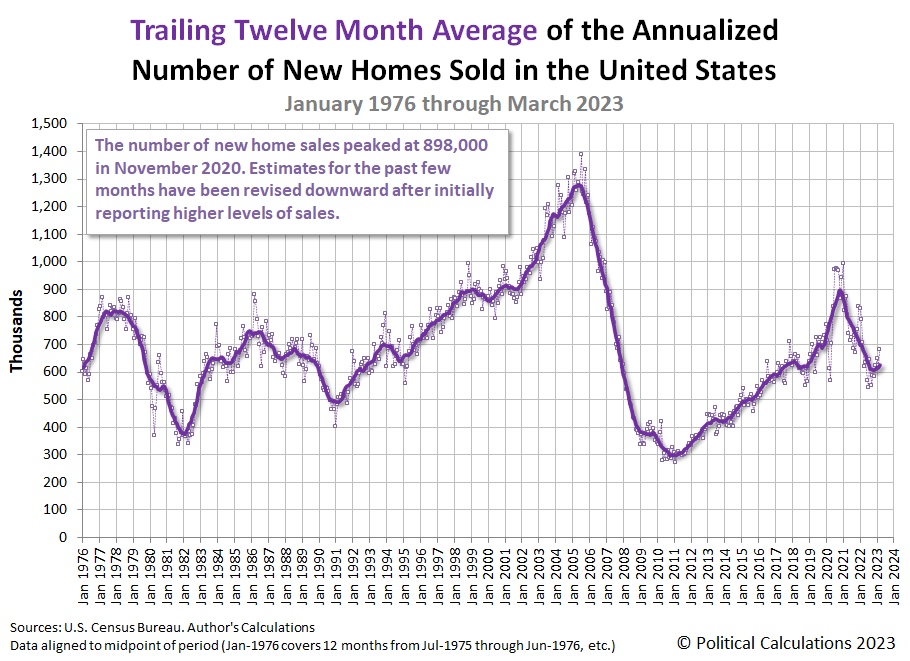

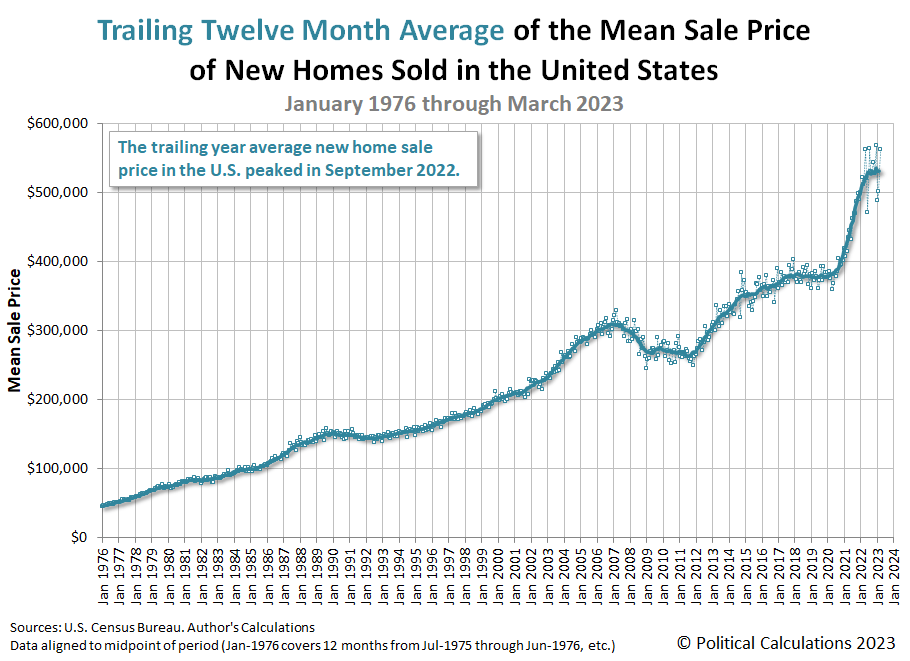

The subsequent two charts present the most recent modifications within the tendencies for brand new house gross sales and costs:

Gross sales of latest properties rose:

New house costs elevated:

As we talked about, there’s a cloud within the silver lining for U.S. new house builders. Reuters finds the potential for gloom after pointing to the glittery lining:

Dwelling builder sentiment continues to creep up, although it’s nonetheless depressed. Single-family housing begins have risen for 2 consecutive months in March and permits for future building elevated to a five-month excessive.

Nonetheless, challenges stay. Banks have tightened lending requirements, which may make it tougher for homebuilders to entry funding for brand new initiatives and for potential house patrons to safe loans to buy homes.

The median new home value in March was $449,800, a 3.2% rise from a 12 months in the past. There have been 432,000 new properties in the marketplace on the finish of final month, down from 434,000 in February. At March’s gross sales tempo it will take 7.6 months to clear the provision of homes in the marketplace, down from 8.4 months in February.

The query for brand new house builders continues to be whether or not the optimistic momentum can overcome the damaging situations which can be creating within the U.S. financial system. Now that we’re previous the primary quarter of 2023 and shortly reaching what’s anticipated to be the top of the Fed’s sequence of fee hikes, the reply to that query will hinge on different creating financial components.

References

U.S. Census Bureau. New Residential Gross sales Historic Information. Homes Bought. [Excel Spreadsheet]. Accessed 25 April 2023.

U.S. Census Bureau. New Residential Gross sales Historic Information. Median and Common Sale Value of Homes Bought. [Excel Spreadsheet]. Accessed 25 April 2023.

Unique Submit

Editor’s Word: The abstract bullets for this text have been chosen by In search of Alpha editors.