adempercem/iStock by way of Getty Photos

Might will characteristic probably price hikes by the Federal Reserve, the European Central Financial institution, and the Financial institution of England. The banking stress that erupted in March seems contained, although one regional financial institution’s dramatic lack of deposits noticed it rekindle at the tip of April. What makes the Might price hikes necessary is that the derivatives markets are assured (once more) that is the final hike for the Fed. The swaps market anticipates two extra hikes from the BOE and the ECB. Headline CPI within the UK has been above 10% for seven consecutive months via March. The ECB, which was slower than the others to provoke the tightening cycle, is known to not be fairly completed both.

Earlier than the financial institution stress emerged, the market had priced in a peak Fed funds price of practically 5.75%. Now, the Might hike to 5.25% is anticipated to be the highest. Equally, the swaps market had the ECB’s goal price rising to 4.0% by the tip of September, and now it sees the height between 3.50% and three.75%. The market thought the Financial institution of England’s base price would prime between 4.75% and 5.0% in This autumn 22. After pulling again to 4% in late March, the swaps market completed April again close to its pre-stress ranges.

We suspect the market is under-appreciating the danger of a Fed hike after Might. Certainly, the futures market has moved dramatically within the different route, pricing in a minimize in Q3 and for the year-end price to be about 4.50%. That suggests 75 bp in cuts over 5 FOMC conferences that stay after this month., which appears unreasonably aggressive. It will probably take greater than a quarterly contraction to discourage the Fed. It will indicate some form of shock. The financial system was contracting when the Fed started the tightening cycle.

The median Fed forecast in December was for the financial system to gradual to 0.5% year-over-year this yr. This was shaved to 0.4% in March. These are downbeat numbers and could also be about as shut because the central financial institution will get to projecting a recession. In March, the Fed’s workers warned {that a} gentle downturn is probably going later this yr. The preliminary official estimate was that the US financial system expanded by 1.1%, virtually assembly this yr’s Fed progress forecast within the first quarter.

China’s financial system expanded by 2.2% in Q1 23 after stagnating in This autumn 22, earlier than its pivot from zero-Covid. Though this was above expectations, many appear disenchanted with the reopening of the financial system and see the value weak spot as an indication of weak demand. In some sectors, like autos, falling costs appear to be a perform of extra capability within the business and intense value competitors. The IMFs up to date forecasts see China rising by 5.8% this yr, and the median estimates in Bloomberg’s survey challenge a 5.3% growth. After the GDP figures, some economists revised their forecasts for above 6%.

Financial exercise within the eurozone and Nice Britain has fared higher than anticipated. The periphery has carried out effectively within the eurozone, and the banking stress didn’t spur widening within the intra-EMU yield differentials. The comparatively greater German inflation can bolster the competitiveness of the periphery. Sarcastically, the German center-left coalition authorities exhibits extra strains than the rightist Italian coalition. The UK financial system is defying recession calls, together with beforehand by the central financial institution, and seems to have expanded in Q1.

Japan’s financial system is increasing slowly. Industrial manufacturing has been held again by weaker exports. Nonetheless, the spring pay elevate and authorities vitality subsidies have bolstered consumption whereas decreasing inflation. Nonetheless, the underlying image is unsettled because the CPI measure that excludes contemporary meals and vitality reached a brand new cyclical excessive in March. Surveys present the bulk count on the brand new management of the Financial institution of Japan to regulate coverage within the June-July interval.

The Financial institution of Canada acknowledged that progress was stronger than anticipated this yr however not sufficient to maneuver it from its “conditional pause” in its tightening cycle. It expects the financial system to gradual for the remainder of the yr. The Reserve Financial institution of Australia joined the Financial institution of Canada, pausing its hikes. Regardless of enhancing commerce ties with China, the financial system is struggling. Governor Lowe’s time period ends in September, and it’s nonetheless being decided whether or not he will likely be granted a three-year extension like his two predecessors.

As a subject for dialogue, the greenback’s future is at all times lurking within the background. Within the mid-to-late Nineteen Eighties, some thought the massive Asian nation with a continual commerce surplus was the challenger, however the Japanese yen by no means took maintain. Then some thought that if Europe had a standard foreign money, it might rival the greenback. The euro is the second largest reserve foreign money, however it’s hardly bigger than the sum of its elements (the legacy currencies, just like the Deutschemark, French franc, Italian lira, and many others.). Now, the Chinese language yuan is recommended because the greenback’s substitute.

The problem resurfaced following the assembly between Saudi Arabia and China late final yr and once more in interviews with French President Macron after returning dwelling from a go to to Beijing and conferences with President Xi. Inside a fortnight of Macron’s go to, Brazil President Lula visited Xi and repeated his curiosity in decreasing the reliance on the greenback. Technological advances in cost techniques have lowered obstacles to entry. The sanctions on Russia and Iran have additionally spurred the usage of options to the greenback, together with the Chinese language yuan and the UAE dirham (pegged to the greenback).

The US greenback continues to be overwhelmingly used for commerce and funding. But, a yuan bloc might type. Russia and Iran are the plain preliminary members. There could possibly be a number of extra members over time, however finally if this membership types, China would draw not the nations that wished to dump the greenback however those that had been kicked out, because it had been, by way of sanctions. Furthermore, given the rate of interest differentials, Chinese language exporters are in no hurry to promote the {dollars} they earn. Finally, the important thing to the greenback’s position is a retailer of worth (the depth, liquidity, and transparency of the US Treasury market), not a method of alternate (commerce settlement).

Final September, buyers struck towards the try by a brand new UK authorities to fund its proposed fiscal stimulus within the face of a recession forecast with debt. Consequently, the Financial institution of England took measures to assist the Gilt market. As sterling was bought to document lows, pundits stated the UK was an “rising market,” and the Economists referred to as it “Britaly.” We acknowledged it as a mirrored image of maximum market sentiment. In an analogous vein, we suspect that the deluge of articles within the social and mainstream media concerning the demise of the dollar is extra a mirrored image of psychology than substance.

The G7 Summit (Might 19-21) will likely be held in Japan’s Prime Minister Kishida’s dwelling metropolis, Hiroshima. The opposition to Russia’s invasion of Ukraine has been a galvanizing precept. French President Macron is getting ready a peace proposal with China as mediator, however we suspect this won’t garner broad assist. The US will shortly announce new limits on American enterprise funding (broadly conceived) in China, particularly high-tech (e.g., semiconductors, synthetic intelligence, and quantum computing. But, despite the fact that the Biden administration couches its actions on the elastic nationwide safety umbrella, it appears to many as an try to carry again the event of a rival superpower. Different G7 members could also be reluctant to totally embrace the American place with out better provocation.

Greece holds its parliament election on Might 21. Greece is among the fastest-growing European economies within the post-Covid interval, has decrease inflation than Germany, and is prone to document a main price range surplus (excludes debt servicing prices). The New Democratic Get together is anticipated to retain its majority. The UK has native elections on Might 4. Within the earlier contest in 2019, the Tories misplaced round 1000 council seats, and the celebration chair now warns of losses of comparable magnitude. Labour additionally misplaced seats and councils in 2019 because the Liberal Democrats carried out greatest. On a nationwide stage, the Tories have narrowed the hole with Labour, however it stays broad. A common election is probably going subsequent yr.

Turkey’s nationwide elections (parliament and president) are on Might 14. A run-off will probably be needed on Might 28. Erodgan has drawn on his energy of incumbency. Within the run-up to the election, he has raised the minimal wage, supplied backed loans, and eradicated the age requirement for retirement advantages (based mostly on years of labor relatively than age). There will likely be vital financial and geopolitical implications if Erodgan loses. Chile (Might 7) and Thailand (Might 14) even have common elections.

In April, rising markets as an asset class had been little modified. The JP Morgan Rising Market Foreign money Index was barely softer (~0.3%), whereas the EMBI unfold over Treasuries was nearly unchanged, somewhat above 400 bp. A yr in the past, it was nearer to 380 bp. The MSCI Rising Markets fairness index eased by round 1.8% in April, whereas the MSCI index of developed equities rose by about 1.5%.

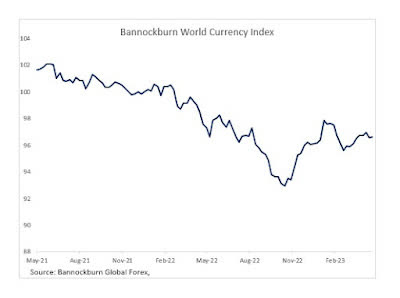

Bannockburn’s World Foreign money Index, a GDP-weighted index of the 12 largest economies, eased barely (~0.1%) in April after rising 1% in March. It has been alternating between month-to-month beneficial properties and losses this yr. It traded quietly in April between roughly 96.40 and 97.05. 12 months-to-date, it’s up virtually 0.5%.

Leaving apart the greenback itself, seven of the remaining 11 currencies had been +/- greater than 1%. Sterling was the strongest, with somewhat greater than a 1.8% achieve. It reached its greatest stage since final June on the finish of April ($1.2585). After hitting its document low close to $1.03 within the turmoil final September, sterling recovered to just about $1.2450 in the course of December.

The euro was second, rising 1.6% final month. It approached $1.1100 within the final week of April, its highest stage since final April. It first breached the $1.10-level in early February and has been mainly in a four-cent vary within the three months via April. After hitting its document low close to $1.03 within the turmoil final September, sterling had recovered to just about $1.2450 in the course of December. The Brazilian actual was the one different foreign money within the index that rose by greater than 1%.

Exterior of the Russian rouble, which fell by 3.1% as sanctions bit and the exterior steadiness deteriorated, the yen and the South Korean gained had been the weakest performers within the index, shedding about 2.5% and a couple of.7%, respectively. Round half of the yen’s losses had been recorded on the final buying and selling day in April after the Financial institution of Japan left coverage unchanged. There was no robust sense of urgency, although stronger than anticipated, Tokyo April CPI was disconcerting. The deterioration of South Korea’s exterior steadiness and low coverage price (3.5%) weighed on the gained. 4 currencies within the index (the Canadian greenback, Chinese language yuan, Indian rupee, and Mexico peso) had been little modified (+/- 0.5%).

Greenback: The greenback was combined in April. It was stronger towards most G10 currencies however not the Swiss franc, euro, or British pound. The Swiss franc (~2.4%) led the advancing European currencies, besides the Norwegian krone, that depreciated by 2.5% and was the worst G10 performer final month. 12 months-to-date, it’s off 8.1%. Within the race to the highest this yr, sterling has edged forward of the Swiss franc (~4.0% vs. 3.5%). Final yr, the Swiss franc’s 1.25% loss was the least within the G10. After a quarter-point hike in early Might, the derivatives market is discounting three quarter-point price cuts earlier than the tip of the yr. There’s a clear consensus favoring a weaker greenback and decrease Fed funds. As a result of we’re suspicious of the latter, we see the danger that when market views converge with the Fed’s (relatively than the opposite means round), it can buoy the greenback. Certainly, we suspect one other price hike after Might’s transfer is extra probably than 75 bp of cuts the market is discounting. The labor market is slowing, and value pressures are easing, although not quick sufficient from the Fed’s perspective. The bottom impact suggests value pressures can proceed to ease via Q2, however the second half of the yr might show harder. In the meantime, the debt ceiling continues to loom,, distorting the invoice market and thinly traded credit-default swap market (offers insurance coverage towards default). It’s onerous to know when the so-called “x-date” is, however after the latest tax revenues, the very best guess now appears to be in within the first a part of Q3. Assuming that the political brinkmanship doesn’t take us over the brink, a decision would probably see a rebuilding of the Treasury’s Basic Account, which implies money balances on the Federal Reserve, and a soar in invoice issuance, and a normalization of the money-market curve.

Euro: The euro reached a brand new 12-month excessive in late April of just about $1.1100. The excessive in Q1 23 was set in early February close to $1.1035. Earlier than the financial institution stress hit, the euro had fallen to just about $1.05. Its climb over the previous six weeks has, a minimum of partly, been fueled by the diverging price expectations. The hawks have indicated they wish to talk about a 50 bp enhance on the Might 4 assembly, however it appears unlikely. The deposit price is at 3.0% now, and the terminal price is seen between 3.50% and three.75%. The ECB’s steadiness sheet contracted by round 3% within the yr’s first 4 months. Then again, the Federal Reserve and Financial institution of Japan’s steadiness sheets expanded (For various causes: the Fed is making collateralized loans to banks, whereas its holdings of presidency and company bonds are falling. In BOJ continues to purchase bonds as in its quantitative easing). The euro has appreciated by about 7.5% on a trade-weighted foundation because it bottomed final August (a couple of month earlier than the euro recorded its low towards the greenback). A lot of the excellent news for the euro has been discounted. Development followers and momentum merchants appear to be lengthy or obese, and the speculators within the futures market have amassed the biggest internet lengthy place since 2020. There could also be two alerts to observe for a change in development. First, the euro has been discovering assist forward of the 20-day shifting common, which begins Might close to $1.0950. The second, when the five-day shifting common falls the beneath the 20-day shifting common, may additionally sign a change in development.

(April 28, indicative closing costs, earlier in parentheses)

Spot: $1.1020 ($1.0840)

Median Bloomberg One-month Forecast $1.0960 ($1.0825)

One-month ahead $1.1040 ($1.0860) One-month implied vol 7.5% (7.7%)

Japanese Yen: With two shallow and transient exceptions, the greenback had been confined to a JPY130-JPY135 buying and selling vary from mid-March via April. It surged on the finish of the month as the brand new management on the central financial institution signaled no sense of urgency to regulate financial coverage. The brand new Financial institution of Japan forecasts proceed to indicate value pressures easing shortly after the Tokyo CPI warned of upside dangers to the nationwide determine. The greenback surged to JPY136.55 after the BOJ assembly, the best stage since March 10, to finish the month. That was two days after what’s up to now the yr’s excessive (JPY137.90). A transfer above their targets JPY139.50-JPY140.00.That stated, with a view to maintain the transfer, we suspect that firmer US charges could also be needed. The Financial institution of Japan’s subsequent assembly is June 16. Surveys and press accounts had prompt a powerful expectation for a change in coverage within the June-July interval. After Governor Ueda’s endorsement of present coverage settings in a extra formal means, the markets seem considerably much less assured of that timeframe. The yen’s weak spot is much more pronounced towards the euro. The euro closed April at its greatest stage towards the yen since 2008 (above JPY150).

Spot: JPY136.30 (JPY132.85)

Median Bloomberg One-month Forecast JPY133.05 (JPY131.85)

One-month ahead JPY135.75 (JPY132.20) One-month implied vol 9.5% (13.0%)

British Pound: Sterling rose above the $1.2450 cap that had held it again since mid-December to strategy the $1.2550 space twice in April earlier than pushing to $1.2585 on the final buying and selling day of April. The subsequent necessary chart space is close to $1.2670 after which the $1.2750 space. March shopper costs had been greater than 10% year-over-year for the seventh consecutive month. The core price stands at 6.2% after peaking final yr at 6.5%. The financial system has proved extra resilient than anticipated, leaving scope for added financial tightening. The Financial institution of England meets on Might 11, and a 25 bp within the base price to 4.50% is extensively anticipated. Because the banking stress emerged, the swaps market implied year-end price fell from about 4.85% to 4.0%. It trended again in April and reached 4.85%. The 2 key high-frequency information factors are the employment report (Might 16) and the CPI (Might 24). The outcomes of the native elections on Might 4 might pose headline danger however are unlikely to drive the markets.

Spot: $1.2565 ($1.2335)

Median Bloomberg One-month Forecast $1.2480 ($1.2290)

One-month ahead $1.2575 ($1.2345) One-month implied vol 7.6% (8.5%)

Canadian Greenback: The US greenback has been in a reasonably clear buying and selling vary towards the Canadian greenback since late Q3 22. The higher finish of the vary is round CAD1.3850-CAD1.3900, and the decrease finish of the vary is within the CAD1.3225-50 space. The dollar trended greater within the second half of April and approached CAD1.3670. Nonetheless, this transfer was greeted by robust promoting stress. This leaves the US greenback weak to a return towards the CAD1.3400-50 space within the coming weeks. The financial institution stress in March had spurred hypothesis of great price cuts this yr. The goal price is ready at 4.50%, and in late March, the swaps market had a 3.60% year-end price discounted. The market corrected, and by mid-April, it briefly flirted with the concept of a price hike. Nonetheless, renewed banking stress on the finish of April noticed the swap market value a minimize once more. The Financial institution of Canada meets subsequent on June 7. Canada studies April CPI (Might 16), and it would appear to be progress is stalling, however one other lurch decrease is probably going when the Might information is launched in June. Nonetheless, most of this yr’s enchancment will happen in H1. In H2 22, Canada’s CPI was virtually flat, making difficult comparisons.

Spot: CAD1.3550 (CAD 1.3515)

Median Bloomberg One-month Forecast CAD1.3475 (CAD1.3475)

One-month ahead CAD1.3540 (CAD1.3510) One-month implied vol 5.8% (6.7%)

Australian Greenback: Sarcastically, the central financial institution of New Zealand stunned the market with a 50 bp hike in early April, and whereas the Reserve Financial institution of Australia paused, and nonetheless the Australian greenback outperformed, albeit the New Zealand greenback (~-1.50% vs. -1.65%). However, the Australian greenback is weak and approached the March low (~$0.6565) in late April. A break might spur a transfer towards $0.6400. The RBA meets on Might 2, and a hike would catch the markets off-guard. After a benign Q1 CPI report, the market downgraded the probabilities of a hike from virtually a 20% probability of a quarter-point to zero. In the meantime, the alternate price’s rolling 60-day correlation with gold and copper has risen after trending decrease via the primary quarter. The inverse correlation with short-term US charges has slackened. Its correlation to the S&P 500 is recovering after weakening to its lowest since March 2022. The Labor authorities solidified its maintain of practically all of the state governments and is taking two vital initiatives: Implementing central financial institution reforms proposed by the impartial assessment. It could appear to be the Financial institution of England with a separate financial coverage committee and common press conferences after the coverage assembly. The Labor authorities is also dedicated to vital adjustments in its army posture. It would function new land-based missile techniques. Australia may also increase its home capability for protection manufacturing. Australia will lengthen the vary of its weapons from round 25 miles (40 km) to about 185 miles and, with the acquisition of precision strike missiles, greater than 300 miles.

Spot: $0.6615 ($0.6685)

Median Bloomberg One-month Forecast $0.6710 ($0.6760)

One-month ahead $0.6625 ($0.6700) One-month implied vol 10.1% (11.1%)

Mexican Peso: After appreciating within the first three months of 2023, the peso spent April consolidating. The greenback’s excessive for the month was about MXN18.40, after peaking in March amid the bank-stress-induced risk-off close to MXN19.23. The low was seen across the center of April, barely forward of MXN17.93, holding above the five-year low set in March, barely beneath MXN17.90. Carry-trade methods nonetheless appear standard, and it requires not solely comparatively high-interest charges but in addition a low-volatility alternate price. The peso’s historic (precise) one-month volatility was about 6.6% in April, round half of the opposite Latam contenders for carry methods, just like the Chilean and Colombian pesos and the Brazilian actual. Mexico’s central financial institution meets on Might 18. It had been anticipated to match the Fed’s transfer (25 bp), however feedback by Governor Rodriguez on April 25, suggesting a pause will likely be thought of, helped put a ground underneath the greenback. The dollar’s lack of draw back momentum and a “correction” in US rate of interest expectations might see the greenback get better in Might. The MXN18.25-MXN18.40 space might supply the preliminary goal space after which round MXN18.60.

Spot: MXN18.00 (MXN18.05)

Median Bloomberg One-Month Forecast MXN18.26 (MXN18.26)

One-month ahead MXN18.1250 (MXN18.15) One-month implied vol 10.3% (11.5%)Chinese language Yuan: China’s Q1 growth of two.2% quarter-over-quarter was higher than anticipated, and the stagnant This autumn 22 GDP was revised to 0.6%. Nonetheless, despite the fact that retail gross sales (home consumption) had been robust, and plenty of economists revised progress projections this yr to six% or somewhat greater, others expressed disappointment. The CSI 300 reached two-month highs a day after the GDP figures and proceeded to dump sharply to its lowest stage since early January. The slide of Chinese language equities, whether or not they commerce on the mainland, Hong Kong, or the US, weighed on the yuan. Nonetheless, the energy of Q1 GDP appears to rule out stable near-term stimulus, and geopolitical issues stay elevated. We suspect that US sanctions and funding prohibitions will act solely as a minor hindrance and can see China commit sources to develop its personal capabilities. Furthermore, Beijing might use areas the place it enjoys a technological lead, similar to silicon processing and photo voltaic panel manufacturing, to additionally restrict exports on nationwide safety grounds. If the market reassesses the chance of a Fed minimize in Q3, a broad US greenback bounce might even see the dollar re-challenge the February-March highs round CNY6.97-CNY6.98.

Spot: CNY6.9185 (CNY6.8735)

Median Bloomberg One-month Forecast CNY6.8570 (CNY6.8480)

One-month ahead CNY6.9060 (CNY6.8560) One-month implied vol 4.9% (6.5%)

Authentic Submit

Editor’s Be aware: The abstract bullets for this text had been chosen by Looking for Alpha editors.