courtneyk

Pricey readers/followers,

I typically area questions on excessive yield/revenue investing versus development investing. Years in the past, my technique included very clear targets that just about made it unimaginable to, whereas following these targets, put money into something with lower than a 2-3% yield. For the previous 1-2 years, I’ve slowly been shifting this technique to include increasingly firms with precisely such traits.

The overall precept you typically hear from monetary advisors is that you just older you get, the extra income-oriented you wish to be. This isn’t a foul technique as such.

Strategic investments make our invested capital multiply. And these approaches needn’t essentially be at odds with each other – it is simply that within the eyes of many traders, together with myself, they typically are. As soon as you’ve got determined to take a position your cash, you additionally have to resolve find out how to make investments that or have somebody to make it easier to make investments primarily based in your targets.

Probably the most frequent flaws I see in my work is individuals who, no less than based on me, make investments very in a different way then I imagine they need to be primarily based on their targets.

Investing and Targets – Which manner is best for you?

I’ve actually had folks inform me that they need revenue however then proceeded to inform me they’ve 30% in Tesla (TSLA) and 20% in Amazon (AMZN). Whereas this can be a strong portfolio for some mentalities and targets, revenue investing is definitely not one in all them. I’ve additionally had folks inform me they really need their capital to develop however then proceeded to inform me they’ve “adopted me” into Telco investments with 20-30% of their capital.

Tesla and Amazon investments will not be revenue investments, and Telco investments corresponding to Verizon (VZ) or Telenor (OTCPK:TELNY) will not be development investments. After I began investing, I did not pay sufficient consideration to what function an funding would play in my broader portfolio – or what I anticipated from it.

Not doing this implies not realizing what to do when sure situations happen, corresponding to overvaluation. If you’re in it for revenue, as an illustration, and your income-oriented inventory balloons 30% in a short while effectively past the place I might say it is “deserved”, then your M.O in all probability must be rotation into one thing that offers equal or larger revenue yield, however together with your new, grown capital. This can be a good instance of what has occurred with some Telco shares that I’ve bought, or some shares within the industrial/chemical phase that even have decently excessive 5-7% yields.

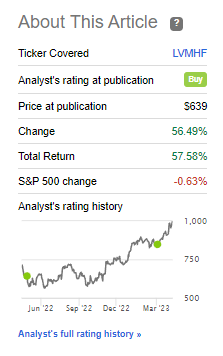

Then again, I personal a major 4% portfolio stake in LVMH (OTCPK:LVMUY). That place, since I known as it a “BUY” in Might of final yr, is up over 60% together with FX.

LVMH IR (SeekingAlpha)

But I have not bought a single share, nor do I plan to within the close to time period. It isn’t that I haven’t got a trim or a promote goal for the inventory – I’ve trim and promote targets for each firm I personal and canopy. It is simply that LVMH, which is extra a development firm, is one thing I’m seeking to personal partially for the upward potential and partially for the protection – and we have seen a lot larger.

Are you beginning to see a sample right here?

Usually talking, higher-yielding securities and investments are:

Extra unstable Much less “protected” Have much less motion potential to the upside, except considerably undervalued.

Once more, these are normal pointers. Usually talking, lower-yielding investments are the precise reverse. The “tech inventory” mania we have seen over the previous yr is the exception to this rule as a result of we’re shares that for my part are each unstable and unsafe with huge motion potential, however with no yield/revenue.

That’s the reason I keep away from 99%+ of that market.

REITs are clearly a part of this equation as effectively, and you will find very low-yielding REITs that are usually seen as a lot safer, whereas the higher-yielding workplace property (instance) REITs corresponding to Kilroy Realty (KRC), Boston Properties (BXP), and others are thought-about to be extra unstable.

You in all probability already know that development investing focuses on appreciating property – and that is usually thought-about a long-term technique. it really works when you do not want the money now and within the close to future. Development investing is extra devoted towards a future “payout” or revenue, versus buying a type of revenue proper now.

Development investments can, usually talking, be thought-about to be larger threat than revenue investments due to this push for speedy development reasonably than sluggish reliability and revenue – no less than in some investments.

As you would possibly anticipate, I attempt to steadiness these approaches considerably. I’ve owned shares that don’t pay a dividend, however solely because of getting the inventory assigned by choices, or by a spin-off. Usually talking, I am very centered on my demand {that a} dividend is a “should” for me when investing.

The dividend can, nonetheless, be as little as 1% and even decrease. It’s the precept, nonetheless, that after I “mortgage” cash to somebody or put money into one thing, even to an organization, I need an curiosity fee as a part of my returns. Probably the most attention-grabbing issues I famous, after I began investing a few years in the past, was the truth that Warren Buffet is laser-focused and that the majority/all of his investments pay a dividend, however his personal firm, Berkshire Hathaway, doesn’t.

My Personal Strategy – From day one till now

You could possibly have a look at my portfolio from a high-level in the present day, and see that I’ve a few 30/70 break up, with 30% being lower-yielding, extra growth-oriented investments, whereas the opposite 70% usually tends to have a 3%+ yield, extra to the income-oriented aspect. All of my investments are at the place I might contemplate them attractively priced/not at “TRIM” ranges.

Going ahead, I’m seeking to change this combine extra towards a 50/50. My general portfolio YoC is presently at 5.8% – that is up with this yr’s dividend will increase – and I wish to get this right down to under 4.5-4.8%.

As your investments evolve and your place as an investor evolves, your targets and your approaches will evolve alongside them. After I began investing, I used to be laser-focused on my objective that I wished an “common month-to-month dividend of $x”, as a result of in spite of everything – then I might be “free”. I reached that dividend after quite a few years, solely to appreciate that my objective of turning into “free” had made myself give allowances to investing in companies at costs and with characters that I actually did not wish to personal long-term.

So I modified up – rebalanced, refocused, and reinvested capital in firms I seen as “higher”, nonetheless yield-focused however much less so than earlier than.

As soon as once more, I reached my revenue targets, and as soon as once more I regarded over my composition and targets.

And as soon as once more, I reached the conclusion that this wasn’t 100% what I wished. I might discovered by meticulous record-keeping that my finest investments had been ones that weren’t essentially 6%+ on the yield aspect, however nearer to 1-4%, purchased at a trough, after which actively managed. I additionally began out with 70-80 investments at over 1% every. I am now right down to round half that, by way of portfolio positions at giant allocations.

So as soon as once more, I modified up. Any place that didn’t meet my objective of high quality, valuation, upside, and yield needed to go. I had reached a degree of capital the place a place yielding even 1% and being 3-4% of my general portfolio being underwater for 1-2 years actually didn’t hassle me or affect my general revenue negatively – not if the payout finally got here.

At one time or one other, I used leverage/margin in my portfolio, as much as 1.2x. I reduce this throughout Christmas of 2022, as a result of I forecasted an enormous enhance in charges and volatility, and didn’t wish to be caught even at a 1.2x. So I now run with out leverage – although I do use margin availability as security for by-product buying and selling.

In 2022, I began utilizing conservatively dated and priced put choices to generate above-average curiosity revenue on out there money and margin. That is one thing I’ve additionally included in my technique, and why I presently run with an 11% money place and anticipate this place to really enhance going ahead.

Wanting again over my evolution as an investor, it is very straightforward to make the argument that I did not “have” to vary up my technique. I might merely have stayed maybe on the balanced revenue iteration with out the necessity to enter extra actively managing positions and derivatives as I’m doing in the present day. You’d be 100% right on this.

And doing so stands out as the precise proper factor for you.

Nevertheless, I like to be taught, and I like to grasp and check out new issues, to see if issues will be improved. I like doing issues “higher” – and that is why I in all probability won’t ever cease adjusting my method.

You could possibly characterize my method as each very conservative and considerably dangerous. I do use derivatives, and that is by no means advised to laymen. Nevertheless, I by no means permit any publicity to any firm or safety I contemplate to be dangerous, and I run a really diversified portfolio with nothing greater than 4-4.5% of my complete. What’s extra, I make use of sector, foreign money, and geographic diversification.

I additionally dwell in among the finest (if not the most effective) geography for dividend funding that exists. Swedish residents investing in ISKs and KF’s (account sorts) don’t pay any capital beneficial properties taxes, nor will we pay a tax on dividends (we pay a flat tax fee, between 1-4% of the overall).

All of these items form my method to the market. Tax loss harvesting just isn’t a consideration for me, neither is potential taxation of a sale of a inventory.

I’ve additionally been very fortunate. After I began investing, principally bumbling into issues, I managed to catch a “leg up” out there. My funding combine on the time was dicey, and for elements of it, I had little thought what I used to be doing. Had I invested 6 months later, I might have simply misplaced 20-30% of my preliminary funding in a short time. Nevertheless, because of a mix of luck and my love for voracious studying and studying, I’ve by no means had anybody lack of capital exceeding $2,000 in all of my profession – and I do know that’s uncommon.

My present technique and my present biggest problem

So, you could possibly say that I presently:

Put money into income-oriented shares paying the next, 3-8% dividend, with out an excessive amount of deal with “development”, however maybe reversal. Put money into growth-oriented shares, paying 0.2-3% yield, with the next deal with long-term development and better RoR. Use derivatives corresponding to put and name choices to boost my technique and my returns from money, whereas attempting to flatten a few of the volatility and curves and incomes a 9-13% annualized curiosity on my money place.

All of my investments have a “TRIM” or a “SELL” goal. I now not make use of a “B&H Without end” technique – although I’m snug holding “perpetually” if a inventory would not go above a sure degree.

My very own private biggest problem presently (and I do not discuss this typically), about which I’ve spoken to Millionaires and even a near-billionaire (in Sweden, not the USA, so round €100M web price) is the information that my technique has a “cap” by way of returns. The way in which I make investments can over time, make me rich, even very rich, however it can by no means give the form of 500-1000% RoR that is wanted to catapult somebody into the higher echelons.

Put this manner; this technique can take and has taken a $200k portfolio and turned it into $1M – with time and persistence, and reinvestment. It can’t take a $200k portfolio and switch it into $100M – no less than not with out intensive time, and doubtless extra time than most of us have.

The methods of reaching such ranges of wealth are very totally different – however frequent to the entire approaches is that they arrive at nice price within the type of threat. Whether or not you open your personal enterprise and attempt to develop it, put money into a inventory, shoot a film and attempt to promote it, or one thing else with a ten,000% RoR potential, from the get-go that it is riskier than pushing $100,000 into Microsoft (MSFT). As a result of what you want is that form of a number of potential – one which’s discovered outdoors of the mainstream.

It is also why I inform anybody who has not but “reached” what I might contemplate a baseline financial freedom or security, to remain distant from something with that form of threat profile. It is one of many issues that “hurts” probably the most to see – that individuals with the least quantity of investable capital appear to put money into the riskiest and dodgiest form of investments with an “all-or-nothing” mentality.

As a private anecdote, after I had simply began out investing, I had an expensive buddy of mine provide the chance to take a position $30,000 within the taking pictures of a music video that will catapult the buddy into stardom and finally see me get a 4-5x return on that funding. I can’t put into phrases how comfortable I’m that I kindly declined the provide – as doing so would have probably set me again a number of years in my mid-20s.

Anybody who tells you that they’ve a “risk-free” or “low-risk” manner of doubling your cash in 12 months, or 24 months, is probably going mendacity by their tooth, or don’t perceive the dangers concerned in what they’re proposing.

These issues will not be actually necessary to many people. Cash, in spite of everything, is not every little thing. Household and high quality of life, residing a full life, for many individuals, would not require greater than a reasonably set quantity that’s realistically achievable utilizing a technique like this.

However, I like difficult myself. Even when I might “cease” presently and simply dwell my life, I like pushing it and seeing the place I might go. It is enjoyable, it is very rewarding, and the life it permits me to dwell lets me meet a few of the most fascinating folks and be in probably the most attention-grabbing locations I might think about.

So I’ll hold pushing.

I am not a monetary advisor, however I’ll say that I’ve discovered probably the most success is in shaping or “tiering” your method to your present circumstances in addition to your long-term targets.

Wrapping up

This can be a verbose piece – I understand that. Nevertheless, for these of you who’ve come this far, I really do imagine that articles corresponding to these give you way more worth than the “Purchase this at this worth”-pieces that I and different authors usually do.

It is the equal of sitting down with me for a beer and speaking about investing and targets – the place I share my journey and attempt to provide insights into yours.

My hope is that you just:

Learn this text by. Have a look at your funding portfolio. Take into account your positions and the place they’re within the larger image. Take into account your targets, and the way they align with these positions. Take into account what might, when you wished to, be modified, and the way these adjustments would impression your targets and your threat. Take note of, and be trustworthy with your self the place you’re by way of threat and reward. Are you the place you wish to be? If there may be something that wants altering, change it.

Be happy to share your opinions under.

And to not make this completely a verbose piece, here’s a fast “BUY” from me.

I’ve been pushing cash to work in Billerud by straight shopping for in my company account, and writing conservative choices in my non-public portfolio, a number of of which had been assigned this Friday.

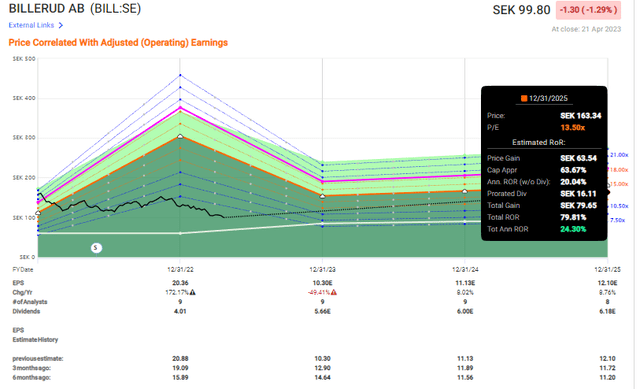

Billerud AB is a principally income-oriented play in forestry and packaging out of Sweden. It is presently coming off its highs due to an enormous up-leg in 2022, which is predicted to normalize, however which has pushed the valuation for the corporate to under 9x P/E to a normalized EPS of 12 SEK/share.

Contemplating a normalization solely to 11-13 SEK in EPS and a 12-15x P/E, this firm combines a 7%+ yield with a payout date in Might of this yr, with a 20%+ annualized return with out the dividend to a 13.5x P/E.

Billerud Upside (F.A.S.T graphs)

Billerud is an above-average firm within the sector by way of margins, among the finest growers within the area, and has a debt/fairness of lower than 0.2x. Even assuming solely a 3-5% development fee going ahead, a easy DCF implies a 220 SEK/share worth goal. Analyst targets vary from 110 SEK on the low aspect to 150 SEK on the excessive aspect, with a mean of 125 SEK/share, showcasing an analyst upside of 25%.

Whereas the corporate might go decrease, we have reached ranges the place I’m busy setting new choices in addition to shopping for the inventory. I imagine an contemplate this firm to be a really strong play on this sector, and one that might generate superb returns and revenue for you when you have entry to the native.

With that mentioned, I thanks for studying the article, and hope each the knowledge and possibly the decide was of worth to you.

All the most effective!