JHVEPhoto/iStock Editorial by way of Getty Pictures

Funding Thesis

MasterBrand (NYSE:MBC) has a blended income and margin outlook. Its gross sales are anticipated to face near-term challenges because of softening housing market and normalized backlog ranges. Nonetheless, the corporate has a long-term alternative to achieve market share and is probably going to renew development in FY24 as soon as the housing market bottoms. On the margin aspect, gross sales deleveraging and a combination shift in the direction of lower-priced cupboards are anticipated to have an effect on margins negatively within the coming quarters. However, value discount and productiveness initiatives ought to assist margins in the long term. The inventory shouldn’t be dear, buying and selling at a P/E of 7.69x, however I would favor to be on the sidelines and anticipate the near-term challenges to abate. Therefore, I’ve a impartial score on the inventory.

Income Evaluation And Outlook

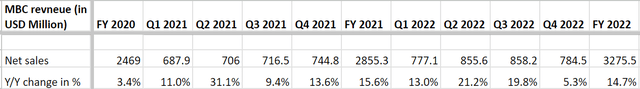

MBC, which was beforehand a part of Fortune Manufacturers Dwelling & Safety, reported its first-ever quarterly report as a standalone firm in This autumn 2022. The corporate achieved 5.3% Y/Y income development within the quarter, bringing in $784.5 million. This development was primarily pushed by beforehand applied pricing methods and robust efficiency from chosen manufacturers like Mantra, an affordably priced full plywood development product that grew double digits Y/Y within the fourth quarter, outpacing different components of the enterprise.

MasterBrand Gross sales (Firm information, GS Analytics Analysis)

Trying forward, I imagine that income development for MBC could also be impacted by quantity declines because of softening demand within the housing market, because the order charge slowed on the builder channel. Moreover, the corporate’s backlog has normalized, and administration anticipates a $200 million Y/Y (or mid to excessive single digits share Y/Y) headwind as a result of normalized backlog stage. The combo shift of customers in the direction of lower-priced merchandise from higher-priced ones is one other headwind and will end in a discount of Common Promoting Value (ASP), adversely affecting revenues within the coming quarters. Whereas the carryover influence of pricing will increase applied by administration final 12 months, particularly within the again half, ought to assist year-over-year, a big decline in volumes and mix-shift in the direction of decrease priced merchandise ought to greater than offset it and end in a significant decline in gross sales within the present 12 months.

The longer-term outlook is barely higher, and the corporate has the potential to achieve market share. MBC is the most important residential cupboard producer within the U.S. with a 24% market share and has considerably expanded its near-shore manufacturing and sourcing capabilities during the last couple of years to extend benefits over Asian imports. Moreover, with 45% of the market remaining extremely fragmented, MBC presents a compelling alternative to develop and achieve market share on this $17 billion and rising business. Additionally, rates of interest are prone to peak across the center of this 12 months, and analysts predict a charge reduce across the finish of this 12 months and the following 12 months. So, the housing business may also backside out in 2023, and we will see some restoration in FY24 and past.

General, the corporate’s income outlook is detrimental within the close to time period, however the firm can see some restoration within the medium to long run.

Margin Evaluation And Outlook

The corporate reported a ~150 bps Y/Y enchancment in its adjusted EBITDA margin final 12 months, which elevated to 12.6%. For This autumn 2022, the adjusted EBITDA margin was up 350 bps Y/Y to 12.5%. This development was primarily pushed by value will increase and steady operational enchancment advantages, which greater than offset provide chain constraints, and materials, logistics, and wage inflation.

Trying forward, whereas provide chain constraints and inflationary headwinds are easing, the corporate’s margin is anticipated to face stress because of quantity deleverage, softening demand within the housing market, and lowering ASP because of a combination shift to lower-priced merchandise. The corporate sometimes sees 20% to 25% decremental margins, and given my expectation of a big income decline this 12 months, margins must also lower.

From the medium to long-term perspective, the corporate is taking a number of initiatives to drive value financial savings and enhance profitability. The “Lead by means of Lean” initiative has helped the corporate determine $80 million in addressable waste, and administration is engaged on lowering these prices. The corporate can be centered on simplifying and modernizing its know-how basis by means of the “Tech-Allow” initiative, which is anticipated to enhance stock accuracy and supply higher visibility into materials motion, leading to value financial savings in the long term. There are short-term prices associated to the investments in these initiatives, and administration expects an extra $5-$10 million of company bills in FY23 from them. Nonetheless, they need to profit the corporate’s margin in the long term.

Valuation And Conclusion

MBC inventory is presently buying and selling at a ahead P/E ratio of seven.69x based mostly on the FY23 consensus EPS estimate of $1.05, whereas its EV/EBITDA (FWD) is 6.33x. Whereas the inventory is cheap, the corporate is anticipated to face near-term headwinds as a result of softening housing market and normalizing backlog ranges. This could result in a significant decline in income in addition to margins this 12 months. Whereas the corporate has the potential to carry out nicely in the long term, I would favor for near-term headwinds to abate earlier than turning into extra constructive on the inventory. For now, I’ve a impartial score on MasterBrand.