Nexus choose belief REIT IPO Evaluation: Nexus choose belief REIT is developing with its Preliminary Public Providing. The IPO will open for subscription on Might 9, 2023, and shut on Might 11, 2023. The corporate is trying to increase Rs 3,200 Crores by means of the IPO out of which Rs 1,400 Crore might be a brand new challenge and the remaining Rs 1,800 Crore might be a proposal on the market.

On this article, we take a more in-depth have a look at the Nexus choose belief REIT IPO Evaluation and its attainable future prospects. Maintain Studying to seek out out!

In regards to the firm

Nexus Choose Belief is sponsored by world funding large Blackstone. This might be the fourth REIT to make its debut on the Indian inventory markets and the primary within the retail house for the reason that different three listed REITs are within the residential sector. Nexus Choose Belief has a portfolio of 17 operational procuring facilities all through 14 main cities, totaling 9.8 million sq. ft, with 96% of its properties underneath lease and a various tenant base of 983 home and worldwide manufacturers with 2,924. Purchasing facilities are positioned in main cities of India equivalent to Delhi, Navi Mumbai, Bengaluru, Pune, Hyderabad, and Chennai.

Firm Having a various tenant combine in industries equivalent to vogue & equipment, hypermarket, leisure, and meals and drinks which accounted for 30% of India’s complete discretionary retail spending in FY20 and had a inhabitants CAGR that was 226 foundation factors larger than the nationwide common from 2011 to 2021.

Monetary Highlights

In line with Nexus Choose Belief’s financials, their property have decreased from Rs.9,527.63 crore in March 2020 to Rs. 9,052.07 crore in March 2022.

Their income from operations has additionally decreased, from Rs. 1,621.97 crore in March 2020 to Rs. 1,318.21 crore in March 2022. Additional, its earnings turned unfavourable because it reported a lack of Rs 10.95 Crore in opposition to a revenue of Rs 2,06.7 Crore in March 2020.

It is usually notable that the corporate’s borrowing has risen from Rs. 5,955.67 crores in March 2020 to Rs. 6,311.20 crores on March 22.

The corporate is well-positioned for substantial natural development on account of contractual lease will increase, growing tenant gross sales, larger Turnover Leases, and re-leasing at larger market charges. Between FY23 and FY25, their Portfolio’s complete NOI is anticipated to increase organically by 26.8%, up from 15.9%.

The stability sheet of the corporate

(Supply: DRHP of the corporate)

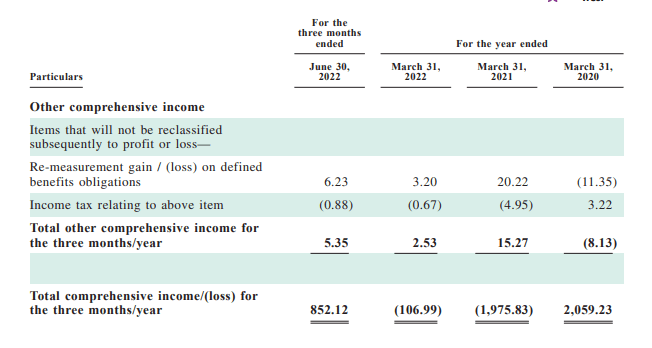

Revenue & Loss assertion

(Supply: DRHP of firm)

Rivals of the corporate

As per the DRHP of the corporate, there are not any direct rivals of the corporate. Nevertheless, there are three different REITs listed within the Indian inventory exchanges- Embassy Workplace Parks REIT, Mindspace Enterprise Parks REIT, and Brookfield India Actual Property Belief.

Strengths of the corporate

The corporate has Leased 3.5 msf, added 332 new manufacturers to the tenant base, and achieved common Re-leasing Spreads of 19.5% on roughly 2.2 msf of re-leased house.

The corporate’s pan-India presence helped drive portfolio-level leasing synergies, creating shut connections with tenants, and attracting and retaining high-quality tenants.

Extremely occupied by a diversified tenant base of famend nationwide and worldwide manufacturers.

The procuring facilities are rigorously positioned in excellent in-fill areas with sturdy entry limitations.

Has a extremely stabilized portfolio with dedicated occupancy of 93.5%.

Via industry-leading know-how initiatives, the corporate has proprietary insights and entry.

The corporate has elevated leased retail areas from 3.5 msf to five.0 msf by means of strategic acquisitions and accretive build-outs of city consumption facilities.

The corporate’s tenant leases present for Minimal Assured Leases with built-in contractual lease escalations of 12% to fifteen% over a interval of three to 5 years.

Sturdy natural development is estimated to contribute 87.0% of the projected rise in NOI over the Projections Interval. As well as, they’ve a confirmed monitor report of producing inorganic development by means of accretive acquisitions of secure property and turnaround of underperforming companies.

Weak spot of the Firm

The corporate is topic to in depth authorities laws which can be susceptible to vary. Any failure to adjust to these laws or the regulatory businesses can negatively have an effect on the enterprise.

The corporate could face a wide range of dangers and uncertainties regarding public well being emergencies, together with the persevering with worldwide COVID-19 outbreak. The longer term influence of COVID-19 is unsure and arduous to measure.

Elevated on-line buying and decreased footfalls could lead to decrease tenancy demand for firm property.

The leasing of house property drives a good portion of income.

Adjustments in native growth laws could have an effect on enterprise.

Tenant leases throughout our Portfolio are inclined to non-renewal, non-replacement, default, early termination, regulatory or authorized procedures, or modifications in related legal guidelines or laws, which might have an effect on leasing and different revenue..

Low occupancy and lease ranges could harm the enterprise

The highest ten clients account for 21.6% of the gross leases and 35.9% of its occupied space

If the Indian actual property market weakens, it adversely impacts working efficiency and money circulation outcomes.

Key IPO Info

Promotors: Arjun Sharma, Dalip Sehgal, Tuhin Parikh, Michael Holland and Jayesh Service provider, Sadashiv Rao.

E-book Working Lead Supervisor:

1. BOFA Securities India Restricted

2. Axis Capital Restricted

3. Citigroup International Markets India Personal Restricted

4. HSBC Securities & Capital Markets Pvt Ltd

5. IIFL Securities Ltd

6. JM Monetary Restricted

7. J.P. Morgan India Personal Restricted

8. Kotak Mahindra Capital Firm Restricted

9. Morgan Stanley India Firm Pvt Ltd

10. SBI Capital Markets Restricted

ParticularsDetails

IPO Measurement₹3200 cr

Recent challenge₹1400 cr

Provide on the market₹ 1800 cr

Opening dateMay 9,2023

Closing dateMay 11,2023

Face value-

Worth model₹95 to ₹100 per share

Lot size-

Minimal lot size150 ( ₹15,000)

Most lot size-

Itemizing dateMay 19, 2023(Prone to be)

The Goal of the Situation

Acquisition of holdings in sure asset SPVs and redemption of debt securities.

Reimbursement and redemption of some monetary money owed of asset SPVs and funding entities, in addition to for common functions.

In Closing

On this article, we appeared on the particulars of Nexus choose belief REIT IPO Evaluation 2023. Analysts stay divided on the IPO and its potential positive factors. It is a good alternative for buyers to look into the corporate and analyze its strengths and weaknesses. That’s it for this publish

Keep up to date on the newest Inventory Market Information and Company Actions NSE with Commerce Brains Portal, whereas additionally keeping track of the High Gainers In the present day in NSE with our Inventory Heatmap function

Begin Your Inventory Market Journey In the present day!

Need to be taught Inventory Market buying and selling and Investing? Be sure that to take a look at unique Inventory Market programs by FinGrad, the educational initiative by Commerce Brains. You may enroll in FREE programs and webinars obtainable on FinGrad in the present day and get forward in your buying and selling profession. Be part of now!!