Air fares are rising at greater than twice the speed of inflation, as carriers money in on hovering demand for journey that has defied broader financial headwinds.

Common ticket costs on greater than 600 of the world’s hottest routes rose at an annual fee of 27.4 per cent in February, the most recent month for which information is on the market, marking the fifteenth consecutive month of double-digit development, in response to a Monetary Instances evaluation of knowledge from aviation firm Cirium.

Against this, US inflation, a proxy for international inflation in developed economies, has grown at lower than half that over the identical interval.

The information analysed costs on standard routes flown the world over and used common one-way fares in economic system, excluding taxes and costs.

It discovered important worth rises throughout many routes this yr, in comparison with pre-pandemic ranges.

The typical one-way economic system class transatlantic flight from London Heathrow to New York’s JFK was $343 in February this yr, 23 per cent increased than in the identical month in 2019.

Fares between New York and Singapore had been 45 per cent increased at $887, whereas Dubai to Frankfurt tickets had been 51 per cent up at $360.

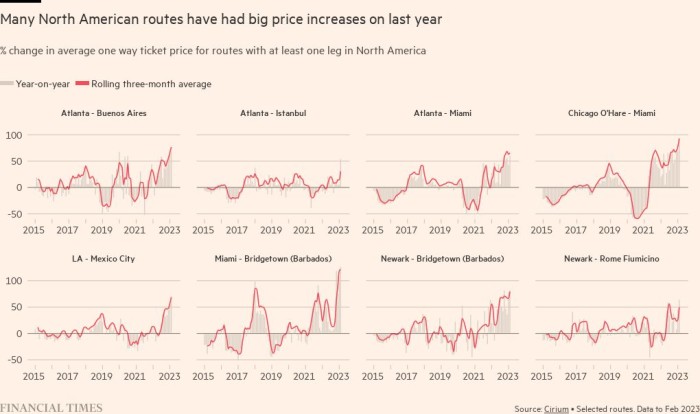

Sixty routes with not less than one leg in North America out of a complete of greater than 300 routes have set new highs previously 12-months, together with seven setting a brand new peak in February.

Fares between Miami and Bridgetown, Barbados grew 126 per cent within the yr to February and ticket costs between Los Angeles to Mexico Metropolis Worldwide virtually doubled — the best yr on yr adjustments in air fares since not less than 2014, the primary yr for which information is on the market.

Passengers’ willingness to pay excessive fares underlines the livid rebound in demand for flying over the previous yr, and the way airways are having fun with a pointy turnaround in fortunes following the pandemic.

“Airways are working out of hyperbole to explain demand power,” Bernstein analyst Alex Irving mentioned.

American Airways reported document first-quarter income in its most up-to-date outcomes, whereas Lufthansa mentioned it expects adjusted earnings to surpass 2019 ranges this spring. British Airways proprietor IAG and Air France each additionally predicted bumper summer season seasons this week.

The excessive demand for journey comes at a time when airways are passing on elevated prices to clients, together with gas, labour and the sturdy greenback for non-US carriers.

Costs have additionally risen as a result of many carriers have been sluggish in rebuilding their pre-pandemic flight schedules, partly due to a world scarcity of plane.

Analysts mentioned the comparatively restricted provide of seats at a time of excessive demand has helped assist costs, and stopped a glut of latest capability flooding the market and driving down fares.

Luis Gallego, chief govt of IAG, mentioned “it’s in our curiosity to supply aggressive pricing”. However he added that airways wanted to move on rising prices within the “excessive inflation” atmosphere.

Airways usually forecast demand with “unbelievable accuracy”, that means they know a yr prematurely which flights will probably be full, and might cost excessive fares from when tickets are first placed on sale in response, mentioned Oliver Ranson, managing director of consultancy Airline Income Economics.

However he mentioned the pandemic has difficult this mannequin as demand patterns are nonetheless in flux, that means airways have typically gone again to a cruder mannequin of elevating costs in keeping with gross sales, and elevating costs for folks reserving on the final minute.

Airways had been one of many worst hit sectors throughout the pandemic and are rebuilding their funds after dropping a mixed practically $200bn between 2020 and 2022, in response to trade physique Iata.

The excessive ticket costs come amid rising scrutiny of corporations utilizing excessive inflation as cowl to boost costs opportunistically, a phenomenon dubbed “greedflation”.

Rory Bolland, journey editor of UK shopper rights group Which?, mentioned passengers should not endure from a rerun of the widespread journey disruption seen final yr.

“Costs and earnings at many airways are hovering, so the least passengers ought to obtain in return is a reliable service,” he mentioned.

Nevertheless, Hugh Aitken, vice-president for strategic flights and trade partnerships at worth comparability web site Skyscanner, mentioned there have been nonetheless “offers” available, as fares should not rising uniformly.

“Even throughout busy journey durations like summer season, costs should not rising on all routes, nor on the similar fee,” he mentioned.