Introduction: Halifax exhibits annual home value development truly fizzling out

Good morning, and welcome to our rolling protection of enterprise, the monetary markets and the world economic system.

Annual home value inflation within the UK has slowed to its lowest in a decade, because the market stabilises after final autumn’s turmoil.

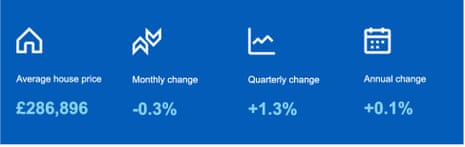

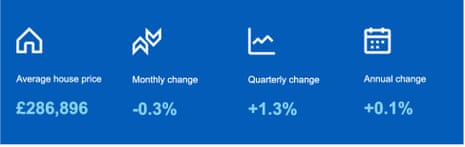

Lender Halifax has simply reported that costs in April have been 0.1% larger than a 12 months in the past – a slowdown on the 1.6% annual home value development recorded in March.

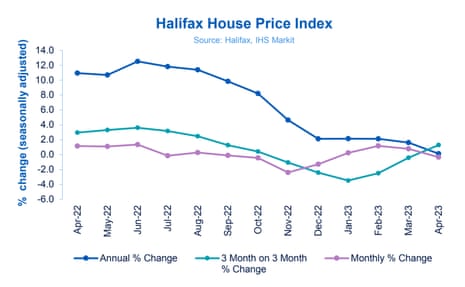

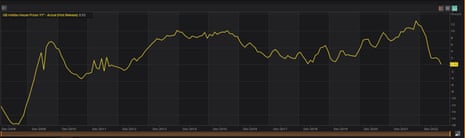

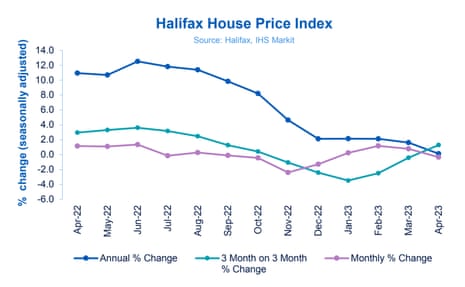

That’s the weakest improve since December 2012, as this chart exhibits:

On a month-to-month foundation, the common home value decreased by 0.3% in April, wiping out a bit of of the 0.8% rise reported in March.

This knocked the worth of the common property right down to £286,896, from £287,891 in March.

Common costs are nonetheless round £28,000 larger than two years in the past, however are round £7,000 beneath their peak set final summer time – earlier than rising mortgage prices and the turmoil brought on by the mini-budget.

Home value actions over current months have largely mirrored the short-term volatility seen in borrowing prices, says Kim Kinnaird, director of Halifax Mortgages, who explains:

The sharp fall in costs we noticed on the finish of final 12 months after September’s ‘mini-budget’ preceded one thing of a rebound within the first quarter of this 12 months as financial situations improved.

The economic system has confirmed to be resilient, with a strong labour market and shopper value inflation predicted to decelerate sharply within the coming months. Mortgage charges are actually stabilising, and although they continue to be nicely above the common of current years, this provides necessary certainty to would-be patrons.

Whereas the housing market as a complete stays subdued, the variety of properties on the market can be slowly rising, as sellers adapt to market situations.

Final week, rival lender Nationwide reported that the common home value rose by 0.5% in April after seven months of declines.

Halifax’s knowledge comes two days earlier than the Financial institution of England is anticipated to lift UK rates of interest for the twelfth time in a row, to 4.5%, because it battles inflation.

Increased curiosity funds are already hitting households, with an estimated 700,000 UK households missed or defaulted on a lease or mortgage fee final month, knowledge from Which? exhibits.

General, an estimated 2 million households missed or defaulted on at the least one mortgage, lease, mortgage, bank card or invoice fee in April, in line with the newest Which? month-to-month shopper perception tracker, based mostly on a web based ballot of about 2,000 folks.

Extra right here.

The agenda

7am BST: Halifax home value index for April

11am BST: NFIB index of US small enterprise optimism

3pm BST: IBD/TIPP index of US financial optimism

Key occasions

Insurer Direct Line mentioned its earnings outlook stays “difficult” because of the hovering value of claims – regardless of ramping up costs throughout its motor and residential insurance policies.

The group mentioned it was seeing an additional affect of the rising value of motor repairs as a consequence of inflation, which is anticipated to place stress on earnings this 12 months, PA Media experiences.

In response, it mentioned it was mountain climbing automobile cowl costs, which pushed up common motor renewal premiums by almost a fifth – 19% – year-on-year within the first quarter.

This led to a 2.5% fall in insurance policies within the quarter, however premium value rises helped the motor division’s gross written premium elevate 3.3% to £358.7 million.

The agency additionally mentioned it was seeing “vital value will increase” throughout the house insurance coverage market, with its gross written residence premium up by 2.1%.

Paving and landscaping agency Marshalls hit by housing slowdown

The slowdown within the UK housing market has hit Marshalls, the gardens, driveways and roofing merchandise firm.

Marshalls reported this morning that like-for-like gross sales have fallen by 14% up to now this 12 months, with buying and selling weaker than anticipated.

The corporate, which sells backyard paving and partitions, paths and driveways, and owns roofing agency Marley, says this falls displays the unsure macro-economic local weather, a discount in new home constructing and continued weak point in restore, maintainance and funding by residence homeowners.

Marshalls tells shareholders:

Within the first quarter of the 12 months, Nationwide Home Constructing Council new housing begins have been 27 per cent decrease than 2022, which had an affect on the efficiency of all of the Group’s reporting segments.

Marshalls now expects to overlook its earlier monetary expectations for this 12 months, citing the slowdown within the housing market.

It says:

The Board’s expectations for 2023 have been set close to the Development Merchandise Affiliation’s (‘CPA’) Winter forecast that was printed in January 2023. The CPA lowered its 2023 development output forecast earlier this month.

This was principally pushed by a six-percentage level deterioration in new construct housing to a year-on-year contraction of 17 per cent. The CPA cited lowered demand within the wake of the mini price range, the consequential sharp rise in mortgage charges and the top of Assist to Purchase as contributing elements for the downgrade.

Shares in Marshalls have dropped 15%, the most important faller on the FTSE 250 index.

Up to date at 04.01 EDT

Tesco chair accused of inappropriate behaviour by 4 girls

Anna Isaac

One of many UK’s most distinguished enterprise leaders, the Tesco chair John Allan, faces claims of inappropriate and unprofessional behaviour from 4 girls, the Guardian can reveal.

Allan allegedly touched the underside of a senior member of Tesco workers in June 2022, on the firm’s annual basic assembly (AGM). It is usually claimed that he touched the underside of a member of workers at enterprise lobbying group, the Confederation of British Trade (CBI), at its annual dinner in Could 2019, when he was the organisation’s president.

Sources allege that Allan, 74, made inappropriate remarks on these events in addition to separate, related feedback to 2 different feminine members of CBI workers in November 2019 and in 2021 respectively. A number of the girls mentioned they have been offended by the alleged actions and thought of his behaviour to be sexual harassment.

Right here’s the total story, by my colleague Anna Isaac:

Whereas the general UK housing market stays sluggish there are pockets of outperformance, factors out Victoria Scholar, head of funding at interactive investor.

New-build costs and first-time patrons are remaining resilient, partly due to hovering rental prices.

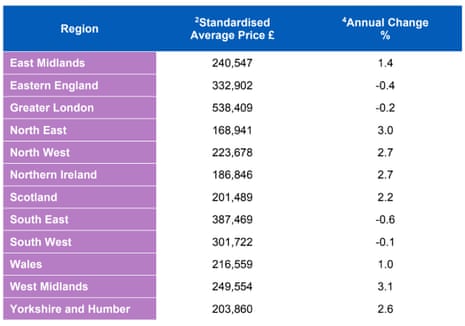

Geographically, the West Midlands loved the strongest annual development of three.1% whereas the South-East has seen property costs undergo.

Rising charges from the Financial institution of England and the cost-of-living disaster are squeezing people and households and are weighing on the UK property market, she provides:

Many potential patrons are holding off amid hopes that property costs will cool and mortgage charges will ease later this 12 months as inflation begins to lastly begins to come back down.

The housing market continues to be reeling from the fallout from the mini-budget fiscal fiasco final 12 months, which despatched mortgage charges hovering and plenty of mortgage merchandise quickly pulled from the market altogether. Whereas the macroeconomic backdrop stays difficult, final 12 months’s most dire forecasts have been wound again with the UK now anticipated to narrowly stave off a recession this 12 months.

However with Brexit, inflation above 10%, current political turmoil, and a sluggish economic system, the UK property market isn’t thought-about the funding it as soon as was by the worldwide neighborhood.”

Financial institution of England might have to lift charges to five% this summer time, says Goldman Sachs

Richard Partington

The Financial institution of England might be pressured to lift rates of interest to five% this summer time, Goldman Sachs has warned this week, as Britain struggles to carry down the best charges of inflation among the many G7 group of superior economies.

Threadneedle Avenue is broadly anticipated to extend the price of borrowing for households and companies on Thursday for a twelfth time in succession, with monetary markets anticipating a quarter-point rise to 4.5%.

Nevertheless, the US funding financial institution warned that households and companies might face additional will increase in the price of borrowing because the central financial institution struggles to carry down the best charges of inflation in 40 years to extra sustainable ranges.

Home costs: what the property brokers say

The slowdown in annual home value development to simply 0.1% in April exhibits that the cost-of-living and mortgage worries are weighing on demand, says Jeremy Leaf, north London property agent.

He provides:

‘Nevertheless, there is no such thing as a doubt that we’re a lot busier than we have been a number of months in the past and the underlying feeling is that we’re over the worst and can proceed on a comparatively even keel regardless of some ups and downs alongside the best way.’

Tom Invoice, head of UK residential analysis at Knight Frank, says the UK housing market is “regaining its footing after being knocked sideways” by final September’s mini-Finances.

The massive image, Invoice says, is that annual development is broadly flat and transactions clearly hit their low-point in January.

It ought to be a gradual 12 months, with the affect of a recovering economic system stored in verify by mortgage charges which are notably larger than 18 months in the past. It’ll even be probably the most predictable 12 months for the housing market since 2018.

Because the political temperature rises and a 2024 basic election strikes onto the radar, switched-on patrons and sellers are performing whereas the backdrop stays comparatively uneventful.”

First-time patrons pay extra, to flee rising rents

A newly constructed home would have value you 3.5% greater than a 12 months in the past in April, Halifax experiences, a lot bigger than the 0.1% rise in total costs throughout the market.

Costs of ‘current properties’ fell by 0.6% over the past 12 months.

The primary-time purchaser market can be proving to be “extra resilient”, with common property costs up +0.7% over the past 12 months, in comparison with a fall of -0.1% for residence movers.

Halifax says:

One issue behind this distinction could also be that with rents persevering with to rise sharply, it’s turning into more and more value efficient to buy a house, regardless of the problem of elevating a deposit and better mortgage borrowing prices.

Increased borrowing prices & elevating a deposit look like minor hurdles in comparison with the excessive bounce that’s renting. “The primary-time purchaser market proves to be extra resilient, with avg property costs up +0.7% over the past 12 months, in comparison with a fall of -0.1% for residence movers” @halifax pic.twitter.com/WRXNHtyk91

— Emma Fildes (@emmafildes) Could 9, 2023

Extra stress on home costs possible this 12 months

Halifax Mortgages director Kim Kinnaird additionally predicts that larger borrowing prices will weigh on costs this 12 months.

Kinnaird says:

“Alongside a market-wide uptick in mortgage approvals, these newest figures might point out a extra regular surroundings. Nevertheless, value of dwelling issues stay actual for a lot of households, which can possible proceed weigh on sentiment and exercise.

Mixed with the affect of upper rates of interest steadily feeding by to these re-mortgaging their present fixed-rate offers, we should always count on some additional downward stress on home costs over course of this 12 months.”

Home costs within the south of England below the best stress

Home costs within the south of England are below the best stress in the mean time, Halifax’s report exhibits.

The 4 areas of southern England have seen common home costs fall over the past 12 months, with the South East registering the most important dip, of -0.6%, pulling common home costs right down to £387,469.

Halifax says:

Sometimes, it’s these areas (together with Better London, Japanese England and the South West) the place patrons face the costliest common property costs, and subsequently the most important affect of upper borrowing prices.

In London, which has the most costly properties of wherever within the nation at a mean of £538,409, annual home value development slowed to -0.2%.

However different areas noticed development, led by the West Midlands which had the strongest annual development of +3.1%

Northern Eire (+2.7%, £186,846), Scotland (+2.2%, £201,489) and Wales (+1.0%, £216,559) have additionally seen common property costs improve year-on-year.

Introduction: Halifax exhibits annual home value development truly fizzling out

Good morning, and welcome to our rolling protection of enterprise, the monetary markets and the world economic system.

Annual home value inflation within the UK has slowed to its lowest in a decade, because the market stabilises after final autumn’s turmoil.

Lender Halifax has simply reported that costs in April have been 0.1% larger than a 12 months in the past – a slowdown on the 1.6% annual home value development recorded in March.

That’s the weakest improve since December 2012, as this chart exhibits:

On a month-to-month foundation, the common home value decreased by 0.3% in April, wiping out a bit of of the 0.8% rise reported in March.

This knocked the worth of the common property right down to £286,896, from £287,891 in March.

Common costs are nonetheless round £28,000 larger than two years in the past, however are round £7,000 beneath their peak set final summer time – earlier than rising mortgage prices and the turmoil brought on by the mini-budget.

Home value actions over current months have largely mirrored the short-term volatility seen in borrowing prices, says Kim Kinnaird, director of Halifax Mortgages, who explains:

The sharp fall in costs we noticed on the finish of final 12 months after September’s ‘mini-budget’ preceded one thing of a rebound within the first quarter of this 12 months as financial situations improved.

The economic system has confirmed to be resilient, with a strong labour market and shopper value inflation predicted to decelerate sharply within the coming months. Mortgage charges are actually stabilising, and although they continue to be nicely above the common of current years, this provides necessary certainty to would-be patrons.

Whereas the housing market as a complete stays subdued, the variety of properties on the market can be slowly rising, as sellers adapt to market situations.

Final week, rival lender Nationwide reported that the common home value rose by 0.5% in April after seven months of declines.

Halifax’s knowledge comes two days earlier than the Financial institution of England is anticipated to lift UK rates of interest for the twelfth time in a row, to 4.5%, because it battles inflation.

Increased curiosity funds are already hitting households, with an estimated 700,000 UK households missed or defaulted on a lease or mortgage fee final month, knowledge from Which? exhibits.

General, an estimated 2 million households missed or defaulted on at the least one mortgage, lease, mortgage, bank card or invoice fee in April, in line with the newest Which? month-to-month shopper perception tracker, based mostly on a web based ballot of about 2,000 folks.

Extra right here.

The agenda

7am BST: Halifax home value index for April

11am BST: NFIB index of US small enterprise optimism

3pm BST: IBD/TIPP index of US financial optimism