chinaface/E+ through Getty Photographs

China’s non-public sector is lastly catching a break this 12 months. Following a sequence of coverage crackdowns over the past 12 months or two and steep valuation de-ratings for main tech platforms like Tencent (OTCPK:TCEHY) and Alibaba (BABA), the coverage backdrop is now turning supportive. Additionally enjoying a key function is the better-aligned state/investor curiosity following the adoption of golden shares within the main tech corporations, in addition to the pending restructuring of their conglomerate-like companies. The buyer/tech rapprochement bodes effectively for funds centered on web platforms just like the China Fund (NYSE:CHN), having been punished for its focus right here in recent times. With earnings momentum additionally gathering tempo in 2023, led by final 12 months’s worst-performing sectors (property, tech, shopper discretionary), CHN may nonetheless outperform within the coming months. Whereas there are lower-cost methods to play China shopper/tech, the CHN fund stands out for its mid-teens % NAV low cost (even wider than once I final coated the fund). And with a performance-linked tender supply coverage (as much as 25% of excellent shares) now in place, there’s a clear catalyst for a narrower low cost going ahead.

China Fund

Fund Overview – Actively Managed China Fund Obese Tech/Shopper

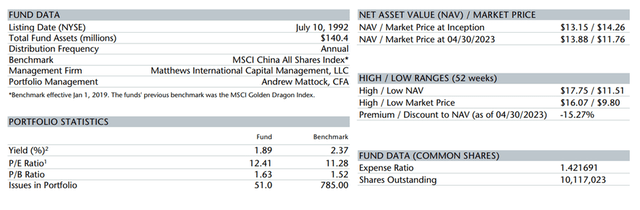

The US-listed China Fund, actively managed by Andrew Mattock from the Matthews Worldwide group, seeks to outperform the MSCI China All Shares Index, a >780-constituent index monitoring the massive and mid-cap segments of Chinese language equities listed domestically and overseas. According to the Matthews funding philosophy, the fund allocates capital with a long-term centered bottom-up inventory choice strategy. The closed-end fund held $140.4m of web property per its newest factsheet. It charged a 1.4% expense ratio (~70bps for administration charges and the rest allotted to different bills similar to fund administration, insurance coverage, and investor relations, and so on.). That is according to comparable energetic choices just like the Templeton Dragon Fund (TDF), although China ETF choices just like the Invesco Golden Dragon China ETF (PGJ) and the iShares China Giant-Cap ETF (FXI) sometimes preserve expense ratios within the 0.8% vary. A abstract of key info about CHN is listed within the graphic beneath:

China Fund

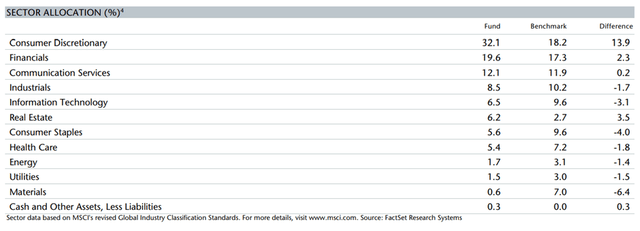

As mirrored within the chart beneath, the fund’s sector allocation stays closely skewed towards the Shopper Discretionary sector at 32.1% – whereas down from the ~38% pre-Q1, the 13.9percentpt delta to the benchmark remains to be large, highlighting the supervisor’s conviction right here. Financials is available in second on the record at 19.6% (up from ~16% prior), adopted by Communication Providers at 12.1% (up from ~8% prior) and Industrials at 8.5% (down from ~9% prior). CHN additionally has significant positions in Info Know-how (6.5%) and Actual Property (6.2%), whereas extra defensive sectors like Shopper Staples, Well being Care, and Utilities signify a few of the fund’s most notable underweight allocations. On a cumulative foundation, the highest 5 sectors accounted for a mixed 78.8% of the entire portfolio.

China Fund

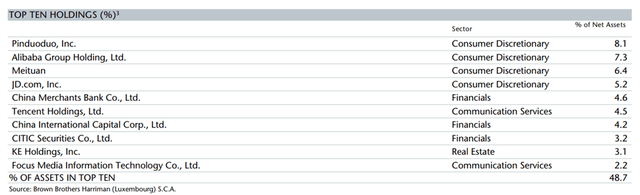

Per the fund’s April factsheet, CHN’s single-stock publicity is comparatively concentrated as effectively, most notably in China’s largest shopper/tech platforms. The most important single-stock publicity is e-commerce big Alibaba Group at 7.6% (down from ~8% prior), changing on-line retailer PDD Holdings (PDD) as the biggest place (the PDD holding is now right down to 4.8% from ~8% prior). Tencent has moved up the record at 6.6% (up from <5% prior), whereas purchasing platform Meituan (OTCPK:MPNGF) stays the third-largest holding at 5.4% (albeit down from ~6% prior). Different notable holdings embrace China Retailers Financial institution (OTCPK:CIHKY) at 4.5% (unchanged) and one other e-commerce participant, JD.com (JD), at 4.5% (barely down). With 5 of the six largest holdings in shopper tech and the highest ten holdings accounting for ~46% of the general portfolio, the supervisor definitely does not shrink back from focus.

China Fund

Fund Efficiency – Underwhelming Latest Efficiency, however There Are Silver Linings

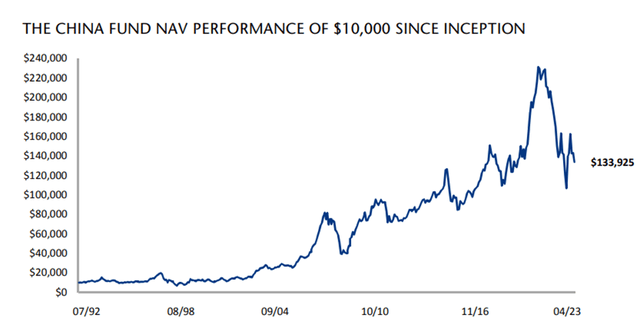

Per the newest factsheet, the fund was down by -6.0% in NAV phrases and a steeper -9.0% in market value phrases because of the widening NAV low cost. The underwhelming begin to 2023 comes on the heels of consecutive years of drawdowns – 2021 and 2022 noticed the fund decline by 24.1% and 12.9%, respectively. And on a relative foundation (vs. its benchmark MSCI China All Shares Index), returns have not been nice lately, both. The place the fund has excelled, nevertheless, is over longer timelines. Since its inception in 1992, CHN has compounded within the high-single-digits % (NAV and market value phrases), whereas over a five-year interval (the longest comparable timeline for the MSCI China All Shares Index), the fund has outperformed as effectively.

China Fund

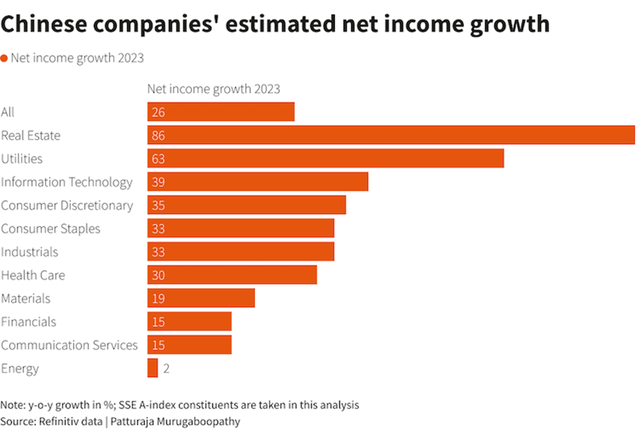

A key contributor is the portfolio’s greatest overweights in Chinese language tech/shopper platforms, which have undergone turbulence in recent times. The fund’s focus did not assist, with the portfolio composition staying largely constant via the cycles. If the month-to-month commentary is something to go by, count on extra of the identical going ahead, with the supervisor nonetheless firmly bullish on the main Chinese language tech platforms, given their low cost valuations and secular progress potential. Up to now, the tempo of web revenue progress and upward revisions in CHN’s chubby sectors point out they could simply be heading in the right direction.

Refinitiv

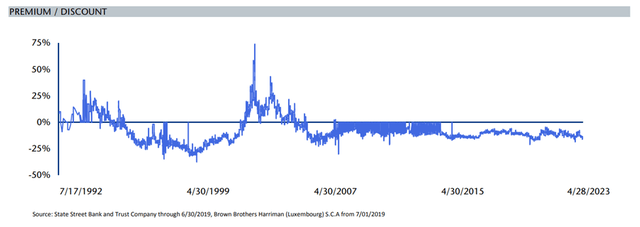

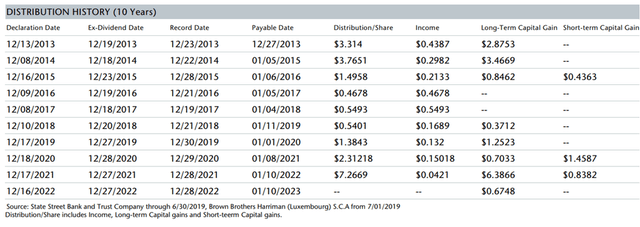

This is not a fund buyers will need to personal for the distribution, although. Whereas the $0.67/share distribution final 12 months equates to a strong ~6% yield, most of this was right down to the belief of prior capital positive factors. The recurring revenue portion tends to run <1% and might be inconsistent, so income-focused buyers ought to most likely look elsewhere. Alternatively, the fund’s wider-than-usual NAV low cost stands out – the present mid-teens % low cost is a multi-year low, seemingly reflecting worsening investor sentiment following a number of years of underperformance. The tender supply introduced in January (as much as 25% of CHN’s excellent shares) has completed little to alleviate issues both. However the performance-linked nature of the supply is a step in the best path, for my part, and presents some draw back safety ought to the fund’s relative efficiency (vs. the benchmark MSCI China All Shares) disappoint over the following 5 years.

China Fund

Put money into China’s Main Platforms at a Steeper Than Regular Low cost

After the ‘zero-COVID’ U-turn final 12 months, Chinese language policymakers seem to have completed one other about-face on its stance towards the non-public sector. Specifically, commentary in regards to the function of main tech platforms similar to Alibaba as an engine of progress and job creation has been encouraging. With a streamlining of the tech conglomerate construction (see BABA’s current split-up announcement) set to enhance regulatory oversight and unlock shareholder worth down the road, beaten-down shopper/tech funds like CHN ought to profit. With earnings momentum solely simply starting to assemble tempo in China, led by price and policy-sensitive sectors like property, tech, and shopper discretionary, count on the CHN portfolio to outperform as effectively. The catch with CHN is the expense ratio at 1.4%, which appears unwarranted given its below-par monitor document in recent times vs. its benchmark and the various low-cost passive choices out there to buyers. However CHN’s traditionally extensive NAV low cost is compelling, significantly with a point of draw back safety now in place through a efficiency tender supply (<25% of excellent shares). Therefore, buyers in search of a higher-beta China play might discover CHN value a glance.