wildpixel

By Suvi Platerink Kosonen, Senior Sector Strategist, Financials

The US’s financial institution troubles have been concentrated amongst smaller-sized banks, whereas the bigger establishments have weathered the storm comparatively properly to date. The influence on banks within the European Union has remained average. European banks carry substantial liquidity buffers that they will faucet into in instances of stress.

US financial institution troubles stay restricted to smaller banks to date

US financial institution worries have considerably eased after the substantial deposit instability within the regional banks in March and April resulted in 4 mid-sized banks collapsing.

The mix of a excessive perceived influence from larger rates of interest on these banks’ steadiness sheets and their comparatively massive uninsured deposit bases made them susceptible to quick and in depth deposit outflows, probably exaggerated by social media and the benefit of cellular banking.

The issues have been concentrated amongst smaller lenders. Bigger US banks have remained extra steady all through the disaster and have, to an extent, been a part of the answer.

Discovering a big and robust sufficient acquirer for a failing financial institution could get harder if there are extra decision circumstances. Lack of transparency on the potential remedy of uninsured depositors is an element conserving monetary markets (and depositors) on their toes relating to US financial institution dangers.

At the moment, depositors could depend on deposit insurance coverage of as much as US$250k. In a report detailing three alternative routes to vary the deposit assure system, the Federal Deposit Insurance coverage Company (FDIC) suggests {that a} focused vital enhance in deposit insurance coverage protection for enterprise fee accounts might greatest meet the target of monetary stability and depositor safety relative to its prices.

Focused modifications to the present framework might present stability to the entire system however would include a value for the trade as an entire. As additionally identified by the FDIC, nevertheless, limitless protection would threat eliminating depositor self-discipline and end result available in the market self-discipline being pushed by debtholders and stockholders.

In our view, stabilisation of deposit swings stays key for the sector worries to subside. The JPMorgan (JPM)-First Republic (OTCPK:FRCB) transaction eliminated one threat issue offering uncertainty to monetary markets.

A focused change to the deposit assure scheme might grow to be a part of a wider resolution in the long run however is unlikely to be a fast treatment because it requires Congressional motion for some components.

Greater protection would additionally end in larger deposit insurance coverage prices for the trade. In our opinion, rising protection may benefit smaller and riskier banks over stronger ones, because the latter have already got higher entry to funding markets at extra engaging ranges. A limiteless deposit assure would pose a threat of an ethical hazard.

The issues have been concentrated amongst smaller regional US banks, and we’d not rule out additional issues arising within the sector as a result of tough mixture of comparatively massive unrealised losses and uninsured deposits.

Our base case is that bigger banks stay higher positioned, with their systemic significance and stronger buffers supporting market confidence. In a extra damaging situation, smaller names may need a wider resolution than dealing with points on the go as they floor.

In Europe, banks weathered US financial institution stresses properly

US financial institution troubles have had restricted repercussions on the European banking sector. Massive European banks have sturdy capital and liquidity buffers, which permit them to climate a considerable quantity of uncertainty in instances of stress.

Regardless of some stress on deposit balances, now we have not seen main liquidity occasions in European banks exterior of Credit score Suisse (CS). In reality, European financial institution earnings within the first quarter have been comparatively sturdy.

European banks have to satisfy a Liquidity Protection Ratio (LCR) of 100% to organize for liquidity outflows. The primary concept of the LCR is to drive banks to carry enough liquid belongings to satisfy potential internet liquidity outflows over a 30-day stress interval. European banking sectors exceed the requirement with massive margins.

We have now seen financial institution deposit bases contract within the first quarter this 12 months. In an surroundings of upper rates of interest, purchasers could begin to search for better-yielding alternate options to financial institution deposits, which can mirror as deposit outflows and end in upside pressures on deposit pricing.

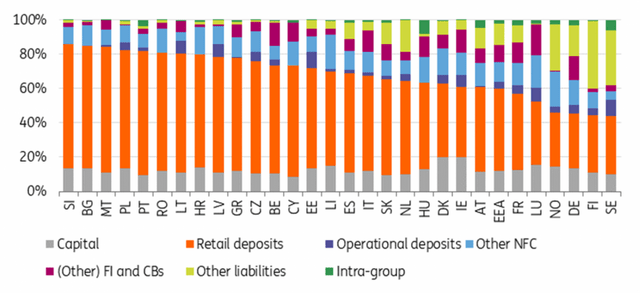

When assessing banks’ liquidity dangers, retail deposits are usually seen as stickier and fewer liable to fast outflows. The majority is supported by deposit assure schemes defending deposit balances of as much as €100k.

Southern European banks rely extra on retail deposits of their funding combine, whereas Nordic, German and French banks have a smaller share of retail deposits of their funding palette.

German and French banks have attracted a bigger share of operational and different non-financial buyer deposits than their Belgian or Dutch friends. These deposits could also be extra value delicate and extra risky in instances of stress.

Accessible steady funding cut up by nation (after weighting) as of end-2022

ING, EBA

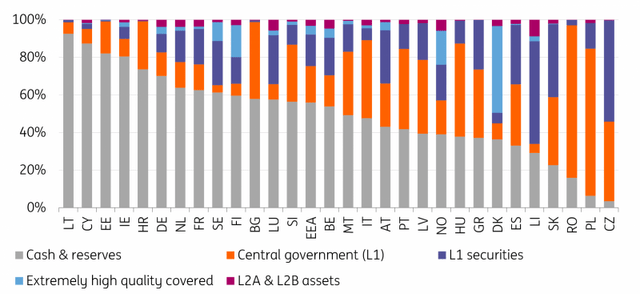

In case of liquidity outflows, banks depend on their liquidity buffers. Money will be simply deployed. Debt securities could also be used as collateral for central financial institution funding or in repo markets. Promoting down securities portfolios could as an alternative have an effect on earnings and capital metrics if the bonds weren’t being marked to market.

The majority of liquidity buffers in nations equivalent to Germany, the Netherlands and France depend on money and reserves. In Southern European nations together with Portugal, Italy, Greece and Spain, the share of central authorities exposures of liquidity buffers is as an alternative larger.

Banking sector liquid belongings by nation (after weighting)

ING, EBA

In our current publication, Scrutiny of Liquidity Metrics has Elevated, we calculated that the majority European banks might take in substantial outflows of their much less steady deposit bases (together with deposits exterior deposit assure schemes) with their current liquidity buffers.

Massive banks with the least room for careworn deposit outflows included names much less geared in direction of steady (retail) deposit funding, together with chosen Swiss, UK and Spanish banks. Banks with the strongest headroom for these kinds of liquidity shocks included primarily chosen Benelux and Nordic names in our collection of banks.

Depositor safety can be on the radar in Europe, as it’s within the US. One issue that might probably assist deposit stability in European banks is the Disaster Administration and Deposit Insurance coverage (CMDI) framework that’s at present being assessed for modifications.

The European Fee proposals present for a normal depositor desire with a single-tiered rating. Because of this all deposits, together with uncovered company deposits, will rank above bizarre unsecured claims in insolvency.

Furthermore, the relative rating between the totally different classes of deposits would get replaced by a single-tier depositor desire, the place all deposits rank pari-passu with no tremendous desire for coated deposits.

These proposals counsel higher safety for depositors, which might make deposits stickier and fewer liable to deposit runs. A normal depositor desire would make the layer together with most well-liked senior unsecured debt thinner in most EU nations.

This may doubtless push up the prices of issuing most well-liked senior unsecured debt and end in a tightening of the unfold of non-preferred senior over most well-liked senior debt. A part of the influence may very well be mitigated by rising loss-absorption buffers, pushing up financial institution wholesale funding prices.

Conclusion

The US’s financial institution troubles have been concentrated amongst smaller-sized banks, whereas the bigger establishments have weathered the storm comparatively properly to date. The impacts on banks within the European Union have remained average.

European banks carry substantial liquidity buffers that they will faucet into in instances of stress. On either side of the pond, authorities are wanting into potential modifications that might end in higher safety for depositors and as such maybe extra stability for the event of deposits in instances of stress.

A rise in depositor safety will push up prices from the assure schemes that can ultimately be borne by the banking system. Higher safety for depositors could enhance the prices of issuing most well-liked senior unsecured debt in chosen EU nations attributable to the next potential burden sharing in instances of stress.

Content material Disclaimer

This publication has been ready by ING solely for info functions no matter a selected consumer’s means, monetary state of affairs or funding targets. The knowledge doesn’t represent funding advice, and neither is it funding, authorized or tax recommendation or a suggestion or solicitation to buy or promote any monetary instrument. Learn extra

Unique Put up

Editor’s Notice: The abstract bullets for this text have been chosen by Looking for Alpha editors.