Cavan Photos

Fulgent Genetics (NASDAQ:FLGT) is a expertise firm based in 2011. Since then, it has continued to actively develop its enterprise by rising the variety of oncology checks and the vary of companies provided, turning into one of many leaders in the sphere of scientific diagnostics in america.

On Might 5, 2023, the corporate launched its monetary outcomes for the primary quarter of 2023, which confirmed that because the COVID-19 pandemic subsides and the corresponding drop in COVID-19 testing income, demand for complete anatomic pathology companies, molecular diagnostic, and genetic testing continues to point out optimistic dynamics in latest months.

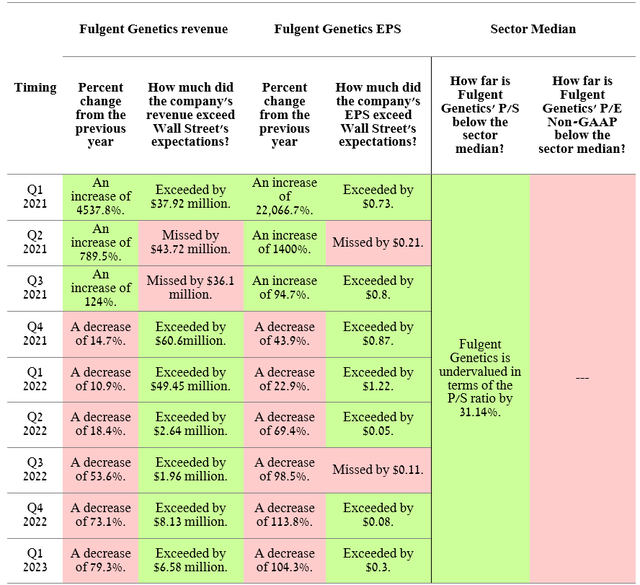

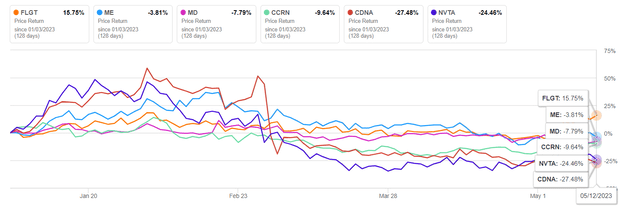

Writer’s elaboration, based mostly on Investing.com

Consequently, Fulgent Genetics’ web earnings and income proceed to shock Wall Avenue analysts’ expectations, which is mirrored in its share worth development in 2023, in contrast to main opponents like 23andMe (ME), CareDx (CDNA), and Invitae (NVTA).

Writer’s elaboration, based mostly on Searching for Alpha

We provoke our protection of Fulgent Genetics with an “outperform” ranking and a $42 goal worth for the following 12 months.

Fulgent Genetics’ Monetary Place

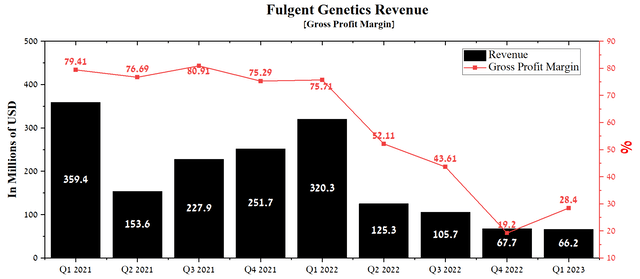

The enterprise mannequin constructed beneath Ming Hsieh’s management, which incorporates buying promising belongings geared toward growing medication towards most cancers and its diagnostics, will permit administration to show the genomic diagnostics enterprise right into a precision drugs firm. Fulgent Genetics’ income for the primary three months of 2023 was $66.2 million, down barely from the earlier quarter however exhibiting a extra vital decline from the prior yr.

Writer’s elaboration, based mostly on Searching for Alpha

The principle motive for the sharp decline in income is the discount in cooperation with public colleges and numerous public well being companies within the subject of testing for COVID-19. Fulgent Genetics, together with such business mastodons as Quest Diagnostics (DGX), Labcorp (LH), and OPKO’s BioReference Well being (OPK), has been one of many key gamers within the battle towards the pandemic from 2020 to 2022. The corporate shipped about 19.3 million COVID-19 checks, incomes about $1.7 billion, which allowed for a extra aggressive R&D and M&A coverage.

From This fall 2022, the corporate’s gross margin started to point out optimistic dynamics once more, because of lowered reagents and provides prices and a rise in Fulgent Genetics’ core income to $62.7 million within the first three months of 2023. We predict that by 2023 the corporate’s gross margin will attain 35.5%, and by 2024 this worth will enhance to 42.5%.

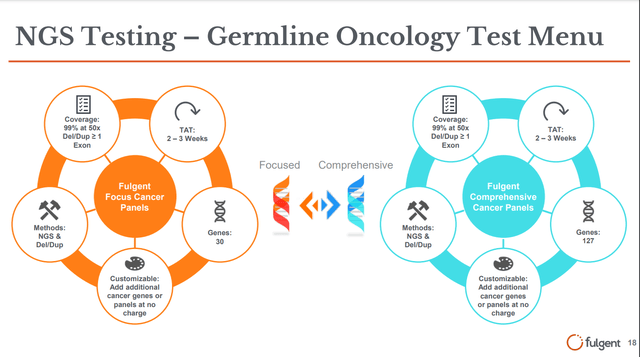

This consequence might be achieved as a result of development in demand for the corporate’s genetic checks in China and the acceleration of the combination of Inform Diagnostics, which was acquired in April 2022 and is without doubt one of the main pathology laboratories. We consider that this acquisition has enabled Fulgent Genetics to strengthen its place within the quickly rising marketplace for pathological checks and develop its portfolio of next-generation sequencing (NGS) checks, which offer physicians and sufferers with many advantages. These benefits over conventional strategies equivalent to Sanger sequencing are extra genomic data for physicians, quicker information processing, and extra correct genome sequencing.

Fulgent Investor Presentation

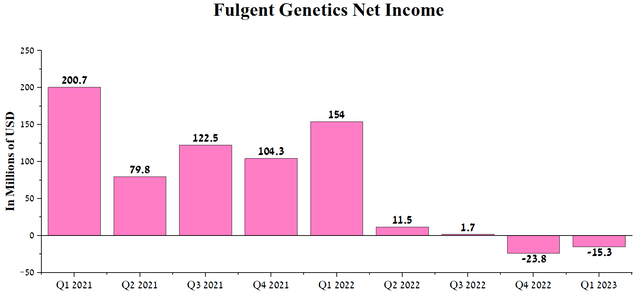

The corporate’s web loss continued to say no and stood at $15.3 million in Q1 2023, beating Wall Avenue analysts’ expectations.

Writer’s elaboration, based mostly on Searching for Alpha

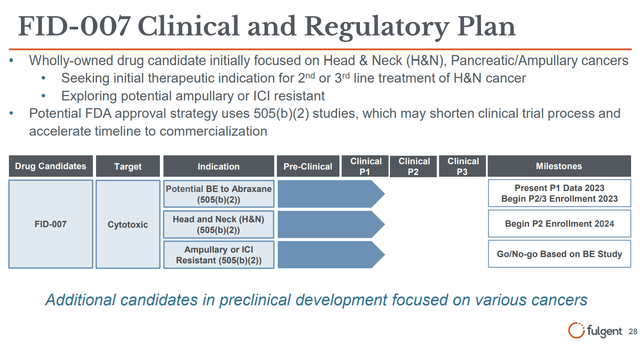

2023 might be one other yr of vital transformation and excessive spending on growing the corporate’s pharmaceutical phase initiatives. On account of the acquisition of Fulgent Pharma in 2022, the corporate acquired promising applied sciences for delivering small-molecule medication with low solubility in aqueous options.

Because of the nanoencapsulation of experimental drugs, its solubility improves, in the end positively affecting its absorption contained in the affected person’s physique. The corporate is constant its Section 1 scientific trial evaluating the efficacy of FID-007, a nano-encapsulated paclitaxel, in treating numerous varieties of most cancers. We estimate that the primary outcomes of this scientific examine are anticipated in June 2023 and might be a necessary milestone in growing the corporate’s enterprise.

Fulgent Investor Presentation

Below our DCF mannequin, we count on the corporate to have a web lack of $65 million in 2023. Nonetheless, from the primary half of 2025, the corporate will start to point out a revenue, together with as a result of geographic enlargement and elevated entry to Beacon787, one of the superior provider checks. We consider this product is a useful instrument for hundreds of thousands of ladies planning to develop into pregnant to make higher choices about household planning and scale back the danger of passing on genetic and chromosomal situations to their kids.

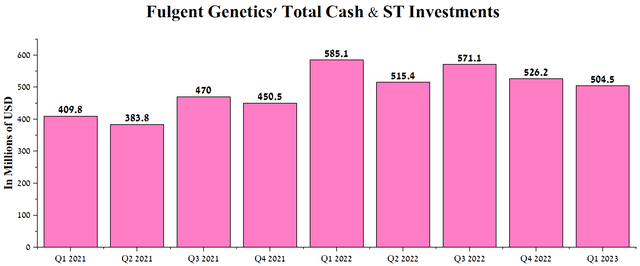

On the finish of March 2023, complete money and short-term investments had been $504.4 million, or about 48% of Fulgent Genetics’ present market capitalization.

Writer’s elaboration, based mostly on Searching for Alpha

Fulgent’s present money stream is adequate to take care of excessive R&D exercise, and we see no have to take motion to extend the corporate’s liquidity by means of a secondary public providing.

Conclusion

We provoke our protection of Fulgent Genetics with an “outperform” ranking and a $42 goal worth for the following 12 months. Fulgent Genetics is a expertise firm based 12 years in the past and, since then, has continued to actively develop its enterprise by rising the variety of oncological and genetic checks and the vary of companies provided, turning into one of many leaders within the subject of scientific diagnostics in america. As well as, the corporate is constant its Section 1 scientific trial evaluating the efficacy and security profile of FID-007, a nano-encapsulated paclitaxel, in treating intractable cancers.

Within the subsequent three months, we count on the corporate’s share worth to drop to $29 per share as a result of continued macroeconomic volatility in some European nations as a result of struggle between Russia and Ukraine and an elevated threat of default as a result of US authorities debt ceiling being reached. If this worth is reached, we plan to start out buying Fulgent Genetics shares as a long-term funding.