Torsten Asmus

Thesis

The Simplify Excessive Yield PLUS Credit score Hedge ETF (NYSEARCA:CDX) is a set earnings change traded fund. The fund is a reasonably new addition to the ETF house, having its IPO in February 2022. The car is a U.S. excessive yield fund with embedded hedges. This fund takes a holistic portfolio method thought, with the goal to supply an investor with publicity to the excessive yield house however with a extra muted drawdown than a pure lengthy place. The ETF is ready to doubtlessly hedge a few of the draw back through just a few devices:

Credit score hedging could be very costly, so it’s paramount to be versatile in our method to hedging throughout the house. CDX will opportunistically make investments, primarily based on cost-to-payout ratios, in CDX calls, High quality-Junk factor-based hedges, and fairness places.

At present, the fund solely holds S&P 500 places with Might and June maturity dates, which we assume are going to be rolled in a single type or one other.

Conceptually, what the fund is attempting to realize is a extra ‘smoothed-out’ excessive yield whole return. The thought course of right here is that an lively supervisor can hedge out a few of the draw back through the outlined devices above, and thus present an investor with a complete return profile that has much less volatility than an outright lengthy place.

The fund presently has whole return swaps that give it publicity to the iShares iBoxx Excessive Yield Company Bond ETF (HYG) and in addition comprises just a few small positions in S&P 500 places. A lot of the money is held in T-Payments. As a reminder whole return swaps are artificial lengthy positions (i.e. a by-product) thus the fund is ready to sit on a major amount of money whereas holding an artificial lengthy in HYG.

When taking a look at its historic efficiency although we fail to notice the good thing about hedges. We’re trying right here on the September/October 2022 drawdown, which noticed a considerably detrimental market efficiency throughout asset courses. A ‘hedged’ instrument ought to exhibit a greater return than its most important element, specifically HYG. Within the ‘Efficiency’ part under we outlined the graphical illustration of the efficiency, and we don’t see CDX outperforming, fairly the alternative truly.

We discover the overall thought behind CDX as one, executed with a small administration price of solely 25 bps, however we don’t assume the layered hedges are important sufficient to truly buffer the draw back. If we have a look at the present collateral and hedges we discover the next:

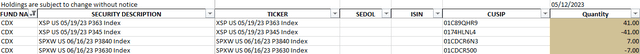

Hedging (Fund Web site)

These are put unfold hedges on the SPY. For instance, the primary two traces are a 363/345 put unfold on the SPY. If the index falls in worth under 363 by Might 19, these hedges can pay out. Irrespective of the particular incidence, please be aware that the market worth may be very small: 41 contracts x 100 x 363 = $1.5 mm market worth. That may be very small for a $44 million fund.

The take-away right here is that the hedges are very small and insignificant to make a distinction for the fund, though the intent in there. The ETF’s historic efficiency additionally outlines the truth that within the September/October 2022 market sell-off the car failed to guard an investor greater than an outright place in HYG. Whereas the chance is there to do some attention-grabbing safety shopping for, we now have not seen that but. Count on this fund to carry out very equally to HYG till the supervisor proves us completely different.

Analytics

AUM: $0.04 billion Sharpe Ratio: n/a (3Y) Std. Deviation: n/a (3Y) Yield: 5.45% Premium/Low cost to NAV: n/a Z-Stat: n/a Leverage Ratio: 0% Composition: Mounted Revenue – U.S. HY (hedged) Length: 4 yrs Expense Ratio: 0.25%

Efficiency

CDX has a efficiency which is in step with the iShares iBoxx $ Excessive Yield Company Bond ETF:

Complete Return (Searching for Alpha)

As a ‘hedged’ instrument we might count on a greater efficiency, particularly throughout market sell-off occasions. If we now have a more in-depth have a look at the October/November 2022 efficiency for the 2 devices we will see that shockingly, HYG outperforms. This tells us that the ‘hedging’ executed by CDX is insufficient and it solely ends in a portfolio carry drag. By taking a look at this graph, an investor is best off by simply investing in HYG outright.

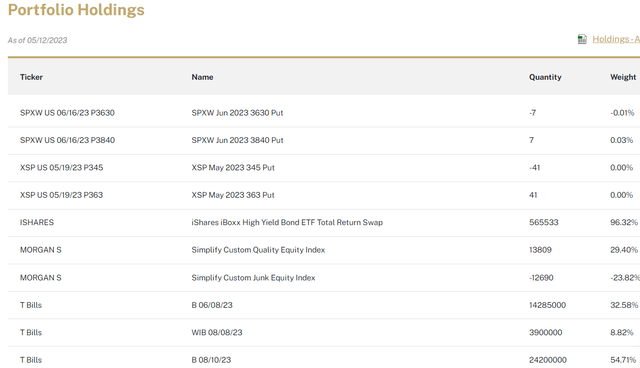

Holdings

The fund holds an artificial place in HYG through swaps, put spreads on the SPY and T-Payments:

Holdings (Fund Truth Sheet)

As a reminder, whole return swaps are a type of a by-product that may cross to a fund like CDX the online proceeds from a sure funding (on this case HYG) in return for a price. Funds interact in TRSs as a way to keep away from having to purchase on their very own stability sheet a whole lot of bonds and consistently adjusting positions and managing them. Within the detailed collateral view we will see the fund paying Fed Funds minus 90 bps for the construction:

TRS Value (Fund Web site)

Conclusion

CDX is a set earnings change traded fund. The car mirrors the iShares iBoxx $ Excessive Yield Company Bond ETF through a TRS construction, and in addition layers in S&P 500 put spreads to mitigate the draw back. The fund additionally has the mandate to put money into CDX calls or quality-junk factor-based hedges. Theoretically that is an attention-grabbing construction since it would lead to much less of a drawdown in a market downturn, all else equal. Nevertheless, CDX appears to be chronically under-hedged, with its September/October 2022 efficiency very a lot in step with HYG. In different phrases, the fund doesn’t do sufficient hedging to make a distinction in its return profile. It’s the case presently as effectively, with its S&P 500 put unfold hedges amounting to a really small notional when in comparison with the fund measurement. Until the portfolio supervisor modifications one thing in its composition, do count on CDX to carry out in step with HYG, regardless of its attention-grabbing said mandate.