William Thomas Cain/Getty Photographs Information

Again in January we mentioned why we favored Sinclair Broadcast Group (NASDAQ:SBGI) and the way it appeared that the market is perhaps undervaluing the corporate because the sum-of-the-parts gave the impression to be value way more than the market worth of the corporate. Administration believed that their funding portfolio alone was value $1.2 billion, or near $17/share, and whereas that was an estimate it appeared cheap us. Since our final article, Sinclair has determined to endure a reorganization which can see a brand new father or mother firm with two principal subsidiaries; Sinclair Broadcast Group and Sinclair Ventures (which can maintain all the non-broadcast belongings) – which is defined in a bit of extra element right here.

Sinclair’s most up-to-date convention name, the place administration mentioned the reorganization plan and quarterly outcomes, was informative and make clear the truth that the bulk shareholders need to shut the hole between what they imagine the corporate is value and the place it’s buying and selling available on the market presently.

Reorganization

On the convention name, administration defined that they believed this reorganization will present the market with extra transparency which can create a better to grasp entity for the market. Administration believes that with a clearer image of the corporate, buyers will be capable of assign it a better valuation – a minimum of that’s the hope.

We thought it was fairly telling that a part of the dialogue centered across the regulatory surroundings, which seems to be one of many principal drivers of this plan. It appears that evidently administration believes that with the FCC’s current actions pertaining to the TEGNA (TGNA) takeover by Commonplace Normal that there won’t be far more M&A exercise for the massive broadcasters to do shifting ahead; together with transactions out on the margin. Splitting into two segments, one being the boring, money cow broadcast belongings and the opposite showing to deal with progress initiatives throughout the media business (together with all the personal fairness holdings), seems to be to be setting the desk for a possible future break up between what can be the brand new holding firm’s new subsidiaries.

Structuring these in order that they might each subject their very own debt, and stand on their very own additionally creates “silos” – which isn’t probably the most environment friendly strategy to run a enterprise with interrelated elements however does allow one to make clear breaks if the debt paperwork comprise the right language and the corporate has self-sustaining money flows (and administration said they believed this that every would be capable of generate sufficient FCF for their very own funding wants). Whereas administration shouldn’t be presently discussing this situation, it seems clear to us that they perceive that they must be investing in progress initiatives and that sometime we would see many of those broadcasters do what the newspaper firms beforehand did – break up no progress and progress as much as maximize shareholder worth and create pureplays.

Share Repurchases

Lucy Rutishauser, Sinclair’s CFO, mentioned share buybacks that the corporate did in the course of the quarter, in addition to subsequent repurchases after quarter-end:

Through the quarter, we repurchased roughly 3.6 million frequent shares underneath a 10b5-1 inventory buyback program, and an extra 5.2 million shares since March 31, representing roughly 13% of the entire shares excellent in the beginning of the 12 months. Our whole share rely on the finish of the quarter was 68 million.

Whereas the share rely could have been 68 million on the finish of the quarter, on Might fifth it stood at 63,038,970 shares excellent (Class A and Class B, mixed) because of the extra 5.2 million shares repurchased after the quarter ended.

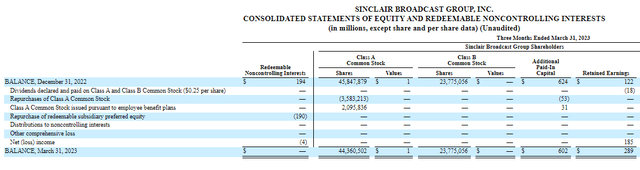

The corporate continues to repurchase the Class A Frequent Inventory. (Sinclair 10-Q SEC Submitting)

Whereas the mathematics is fairly shut from quarter finish to Might fifth, we might level out that there are some reconciling points from the corporate’s annual submitting to this quarterly submitting. Whereas the corporate ended the 12 months with 69,564,683 shares excellent (Class A and Class B, mixed), the worker retirement plan noticed 2,095,836 shares issued (which was over 1 million greater than final 12 months on this identical quarter). That determine ought to assist those that sustain with this type of factor go from the 69 million+ from year-end determine to the present shares excellent determine factoring within the buybacks.

Why does all of that matter? Effectively first, it exhibits that even with a big debt load that the administration crew feels that the shares are undervalued. It additionally exhibits that they imagine that the corporate’s skill to generate FCF shifting ahead continues to be sturdy as they’re directing these funds to share buybacks and never repurchasing their debt (which trades beneath par). Lastly, it exhibits that the controlling household is excited by persevering with to solidify their grip on the corporate by specializing in Class A share repurchases once they already managed 80%+ of the voting rights.

Sinclair repurchased a good quantity of shares within the quarter, however in addition they issued over 2 million shares for the worker profit plan. (Sinclair 10-Q SEC Submitting)

Huge 12 months For Investments

Sinclair has not supplied full-year steering presently, however we do know that Q2 adjusted EBITDA “is predicted to be between $84 million and $104 million,” as said by Lucy Rutishauser – which might be down $100 million from final 12 months’s $184 million in the event that they hit the underside of the vary. Ms. Rutishauser additionally stated that adjusted FCF for Q2 “is predicted to be damaging $6 million to optimistic $16 million.” In order that steering, coupled with the corporate’s deal with share repurchases and main investments ought to see money on the stability sheet shrink.

Sinclair can be spending $75 million on “infrastructure” this 12 months, which incorporates shifting to the cloud, their NextGen tech rollout and their proprietary advertising and marketing providers platform (which may very well be a hidden gem sooner or later). Whereas this outflow for infrastructure will probably be a drag over the subsequent few quarters as the corporate builds out and revamps, the spending will cease and will present an extra tailwind together with political spending in 2024.

Even with the spending and what seems to be decrease spending within the advert market, Sinclair expects to be FCF optimistic in FY 2023.

Hold An Eye On Diamond’s Chapter

Credit score buyers may be ruthless, particularly on the subject of gaining management of an asset or searching for to make themselves entire. With Diamond’s chapter and the poor state of affairs for the regional sports activities networks, or RSNs, there may be rising hypothesis that the collectors may look to Sinclair to extract worth for themselves. We’ve got not seen numerous particulars on this, however the considering is that Sinclair offloaded the danger by making some maneuvers to keep away from any recourse on the debt if Diamond did need to undergo the chapter course of and that collectors could view that as a possible level of assault to get some money. Sinclair is a ripe goal because of the money on their stability sheet and huge funding portfolio, so we do suppose that that is one thing to maintain one’s eye on.

Our Present Positioning

We’re presently lengthy the inventory, nonetheless we have now a ‘Maintain’ on it. We don’t need to be massive consumers of the shares proper now as we principally have equal weightings to our targets. Nevertheless, we’re consumers to take care of that concentrate on allocation on new inflows when the variance has gotten exterior of our allocations between rebalancing dates. We like the truth that the corporate has taken a multi-pronged method to returning capital to shareholders and imagine that elevated dividends and share buybacks create probably the most worth for all shareholders.

We’d transfer to a ‘Purchase’ if we obtained readability on the Diamond Chapter publicity and will quantify that any doubtlessly liabilities can be minimal.