mihailomilovanovic/E+ through Getty Photos

Dropping costs trigger greenback gross sales to drop even when unit gross sales rise. Residence Depot (HD) blamed a part of its income decline on decrease costs.

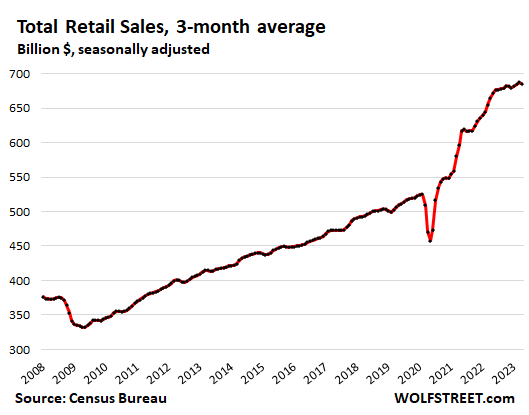

Whole retail gross sales, seasonally adjusted, rose 0.4% in April from March, and 1.6% from a 12 months in the past, regardless that most of the classes of products that retailers promote have dropped in worth, some on a month-to-month foundation, others already on a year-over-year foundation, as inflation has shifted to companies.

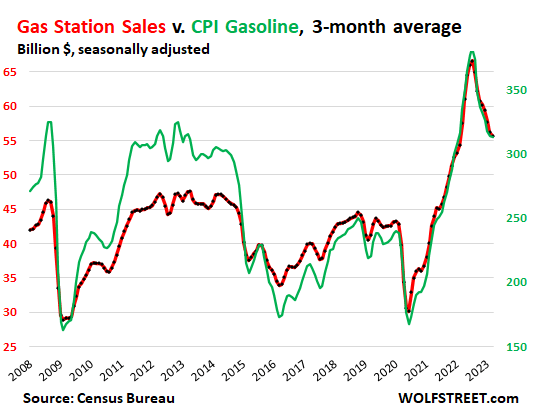

Gasoline costs have plunged by over 12% from a 12 months in the past, at the same time as the value ticked up in April from March. Gross sales at gasoline stations have plunged in lockstep with the value of gasoline (green-red chart beneath).

The meals CPI dropped for the second month in a row, however remains to be up 7% from a 12 months in the past.

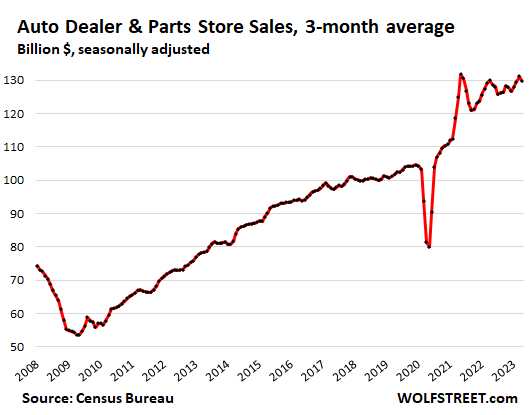

Used automobile costs have dropped almost 7% from a 12 months in the past, regardless of the bounce in April. New automobile costs are nonetheless up 5.4% year-over-year, however fell in April from March.

These three classes – gross sales at meals & beverage shops, motorized vehicle & components sellers, and gasoline stations – account for about 40% of complete retail gross sales. Dropping costs translate into dropping gross sales, even when the retailer sells the identical quantity of products.

The charts beneath present the three-month shifting common to dodge the ineffective drama of the month-to-month ups and downs that obscure the developments. The three-month shifting common dipped a hair for April as the large improve in January moved out of it, however was up 3.1% year-over-year.

The development reveals normal-ish gross sales development in latest months, after the large stimulus-induced spike in 2020 and early 2021 that was then additional boosted by mid-2022 by the raging worth will increase which have now abated, with inflation having largely shifted to companies, which retailers don’t promote.

Retail gross sales by class, 3-month shifting common, seasonally adjusted.

New and Used Car and Elements Sellers (19% of complete retail gross sales):

Gross sales: $130 billion From prior month: -1.0% 12 months-over-year: unchanged CPI used automobiles: +4.4% for the month, -6.6% year-over-year CPI new automobiles: -02% for the month, +5.4% year-over-year.

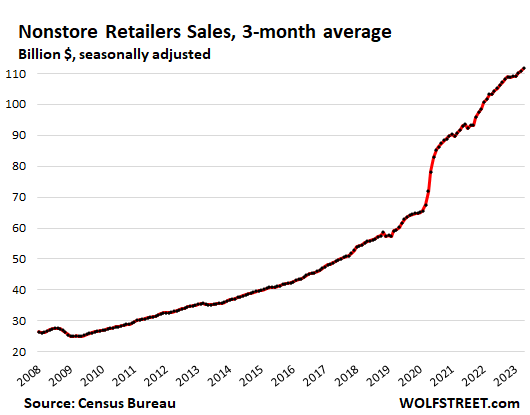

Ecommerce and different “nonstore retailers” (16% of complete retail gross sales), ecommerce retailers, ecommerce operations of brick-and-mortar retailers, and stalls and markets:

Gross sales: $112 billion From prior month: +0.8% 12 months-over-year: +8.0%

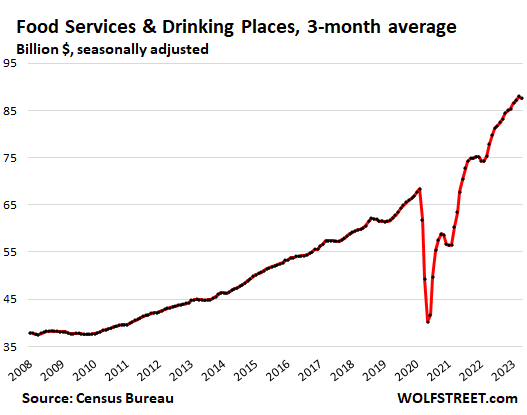

Meals companies and ingesting locations (13% of complete retail), consists of eating places, cafeterias, bars, and so on.

Gross sales: $88 billion From prior month: -0.5% 12 months-over-year: +12.4% CPI for “meals away from dwelling”: +0.4% for the month, +8.6% 12 months over 12 months:

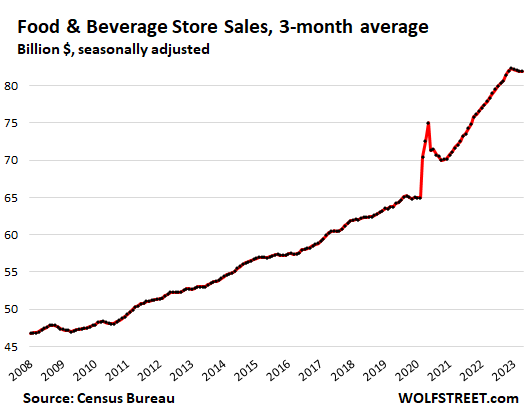

Meals and Beverage Shops (12% of complete retail):

Gross sales: $82 billion From prior month: un modified% 12 months-over-year: +4.6% CPI for “meals at dwelling”: -0.2% month-to-month, +7.1% 12 months over 12 months:

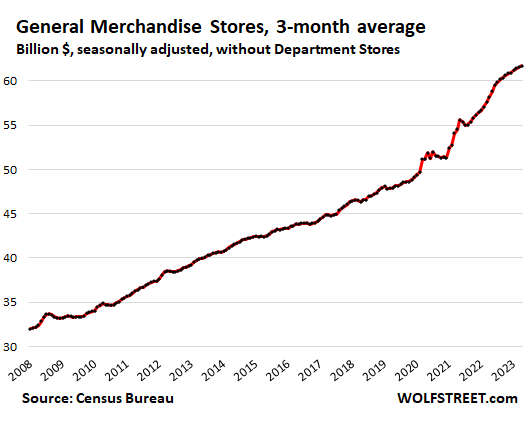

Basic merchandise shops, with out malls (9% of complete retail):

Gross sales: $62 billion From prior month: +0.2% 12 months-over-year: +6.0%

Fuel stations (8% of complete retail):

Gross sales: $55 billion From prior month: -1.1% 12 months-over-year: -9.9% CPI for gasoline: +3.0% for the month, -12.2% 12 months over 12 months:

This chart reveals the connection between the CPI for gasoline (inexperienced, proper axis) and gross sales in billions of {dollars} at gasoline stations, together with different merchandise gasoline stations promote (purple, left axis):

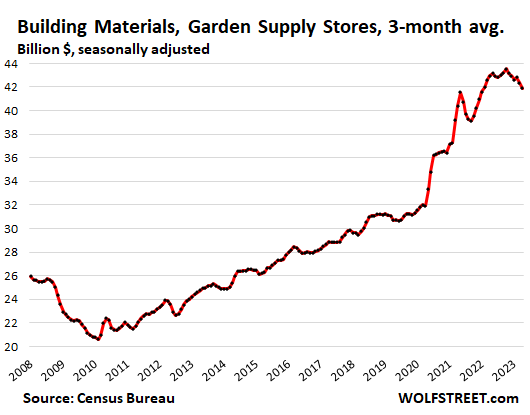

Constructing supplies, backyard provide and gear shops (6% of complete retail). Residence Depot falls into that class. It reported a 4.2% drop in revenues, and blamed a part of it on falling costs, resembling lumber.

And for normal readers of this month-to-month retail gross sales column, Residence Depot’s income state of affairs doesn’t come as a shock. Within the chart, this development has been growing since late final 12 months:

Gross sales: $42 billion From prior month: -1.0% 12 months-over-year: -2.4%

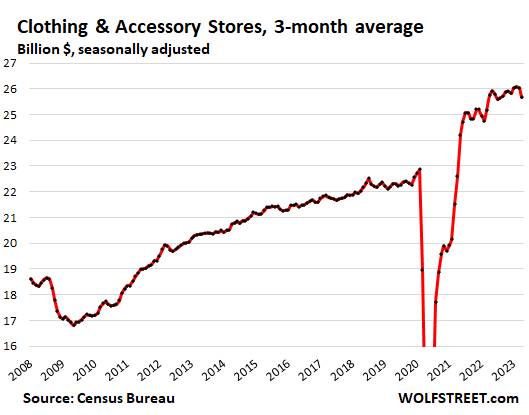

Clothes and accent shops (4% of complete retail):

Gross sales: $26 billion From prior month: -1.4% 12 months-over-year: -0.4% CPI attire: +0.3% for the month, +3.6% year-over-year.

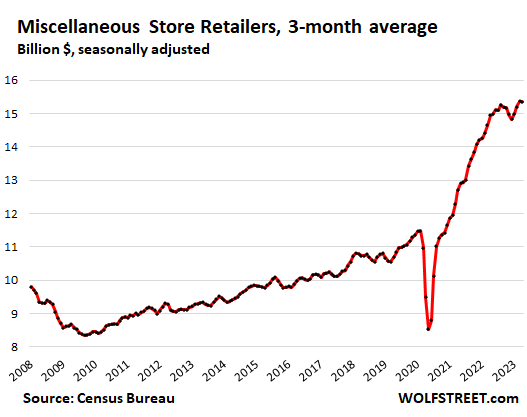

Miscellaneous retailer retailers, consists of hashish shops (2.3% of complete retail): Specialty shops, from artwork provide shops to wine-making provide shops. Hashish shops are the expansion driver.

Gross sales: $15 billion, seasonally adjusted Month over month: unchanged. 12 months-over-year: +2.7%

There isn’t any CPI for hashish. Hashish Benchmarks U.S. Spot Index reported that the common worth within the US ticked up in latest weeks from the March low, however remains to be down by 16% year-over-year.

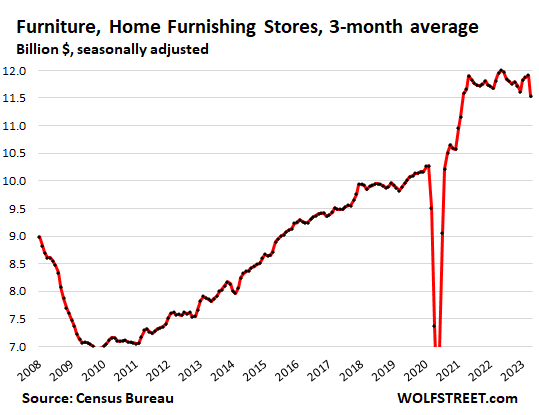

Furnishings and residential furnishing shops (1.7% of complete retail):

Gross sales: $11 billion, seasonally adjusted From prior month: -3.2% 12 months-over-year: 3.6% CPI Family furnishings: -0.4% for the month, +4.8% year-over-year.

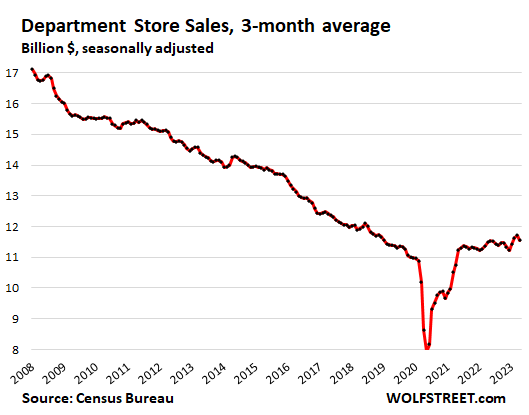

Department shops (now right down to 1.3% of complete retail, from the 8% to 13% vary within the Nineties, as customers found out the way to purchase the very same stuff on-line, together with on the ecommerce websites of the few surviving division retailer chains:

Gross sales: $11 billion From prior month: -1.4% 12 months-over-year: +0.6% From peak in 2001: -40% regardless of 21 years of inflation.

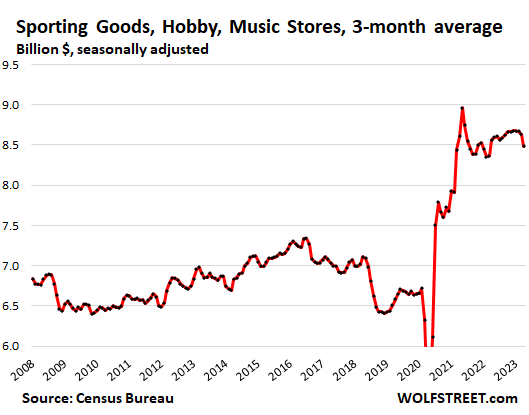

Sporting items, interest, guide and music shops (1.3% of complete retail);

Gross sales: $8.5 billion Month over month: -1.8% 12 months-over-year: -1.0%.

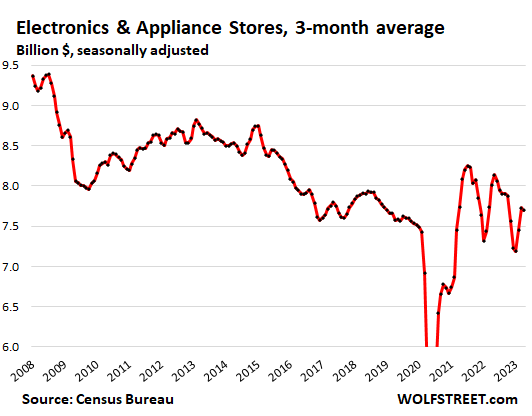

Electronics and equipment shops: Specialty electronics and equipment shops (Finest Purchase, Apple shops, and so on.), not together with electronics and equipment gross sales on-line and at different retailers.

Gross sales: $7.7 billion, seasonally adjusted Month over month: -0.4% 12 months over 12 months: -3.9% CPI client electronics: -0.1% for the month, -9.4% 12 months over 12 months. CPI home equipment: -1.9% for the month, -0.4% 12 months over 12 months.

Unique Put up

Editor’s Notice: The abstract bullets for this text had been chosen by Looking for Alpha editors.