jetcityimage

In my current work on Charles Schwab (NYSE:SCHW) — Charles Schwab Q1 Earnings: A Prime Restoration Guess For 2023 — I indicated that the agency is seeing sturdy asset inflows which I felt contradicted adverse investor sentiment in regards to the brokerage firm. Actually, property continued to stream to Charles Schwab in the course of the March craziness within the monetary sector… indicating that traders noticed (and nonetheless see) Charles Schwab as a vacation spot for funding capital. In keeping with Charles Schwab’s newest exercise report for the month of April, the brokerage firm has seen $13.6B in whole internet new property final month. I consider this exercise report strongly helps my bullish funding case for Charles Schwab and since shares of the monetary brokerage firm have didn’t rebound (and are nonetheless low cost), I consider traders have much more causes to purchase SCHW inventory!

Newest exercise report signifies Charles Schwab stays a magnet for investor capital

One of many key issues about Charles Schwab within the context of the monetary disaster in March was that the dealer was shedding deposits. Within the first-quarter, Charles Schwab did certainly lose deposits within the quantity of $41B because of main money sorting efforts in a higher-interest world. Nonetheless, and this will not be totally understood, for my part, Charles Schwab additionally noticed $53.9B in core internet new property flowing to the corporate in March. This was a 16% 12 months over 12 months improve and strongly indicated that traders are snug with handing over their property to Charles Schwab.

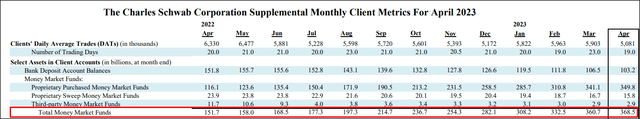

In keeping with Charles Schwab’s newest exercise report, the brokerage noticed whole internet new property of $13.6B within the month of April. Core new property declined $2.3B which, in keeping with the corporate, was associated mainly to money realignment exercise within the context of the present tax season. The $13.6B in whole new property which were moved to the platform by present shoppers in April proves that Charles Schwab’s stays a magnet for traders capital, regardless of a significant disaster taking part in out within the U.S. regional banking market. Charles Schwab had $7.63T in whole shopper property on the finish of April, displaying a 1% improve 12 months over 12 months.

The market misprices Charles Schwab’s earnings potential

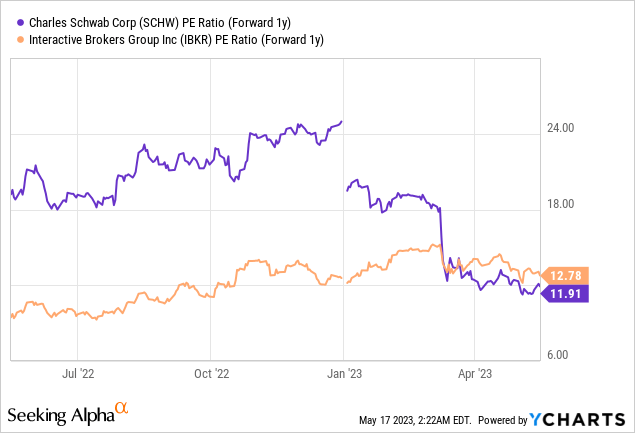

Charles Schwab’s valuation has didn’t rebound from the March sell-off up to now and shares are down about 7% since I final labored on Charles Schwab. Regional banks have additionally seen a frequently excessive degree of volatility and haven’t but recovered from the trade turmoil which began again in March when Silicon Valley Financial institution failed. Nonetheless, I consider that Charles Schwab’s valuation is so engaging at this level, that the monetary brokerage firm has a really low threat profile, for my part. Charles Schwab is presently buying and selling at a P/E ratio of 11.9X which is barely decrease than the P/E ratio of Interactive Brokers Group (IBKR)… which has a 12.8X multiplier sitting on its earnings potential.

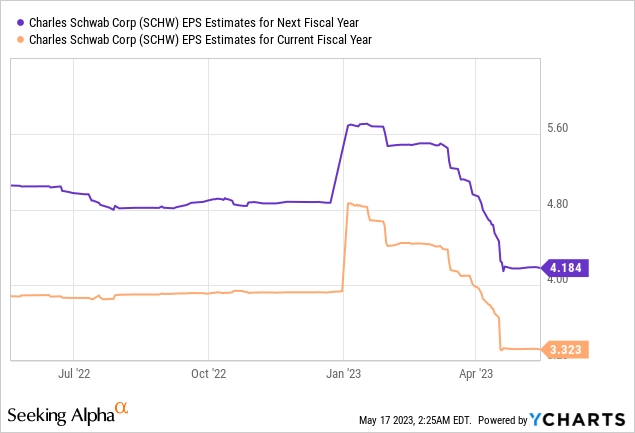

FY 2023 has up to now been a difficult 12 months for the monetary sector and analysts count on a 15% decline in EPS for Charles Schwab this 12 months as money sorting efforts proceed after the Fed has proven no indicators of slowing down with its price will increase. Nonetheless, the broad notion is that Charles Schwab will see a restoration of its earnings in FY 2024 with common consensus estimates implying a 26% rebound in EPS in subsequent 12 months and 27% progress in FY 2025.

EPS estimates have reset sharply decrease this 12 months within the wake of the monetary disaster, however I consider estimates are actually very bearish, particularly if Charles Schwab’s posts constructive core internet new asset progress once more within the coming months. Even with lowered EPS estimates, Charles Schwab’s shares are fairly low cost, for my part, with a P/E ratio of 12X.

Dangers with Charles Schwab

I have to say, contemplating Charles Schwab’s sturdy weekly exercise report for April, dangers for the monetary dealer have decreased recently, not elevated. The most important threat for Charles Schwab is that the Fed continues to lift rates of interest which provides stress on the monetary sector basically and sure forces traders to proceed to withdraw financial institution deposits and make investments them into higher-yielding cash market funds, a development that already had an enormous impact on Charles Schwab: between April 2022 and April 2023, a complete of $216.8B flowed into Charles Schwab’s cash market funds as traders chased greater yields.

Supply: Charles Schwab

What would change my thoughts about Charles Schwab is that if the agency noticed constant declines in core internet new property going ahead or noticed an enormous down-grade in EPS estimates.

Closing ideas

I consider the market total doesn’t get Charles Schwab and particularly doesn’t get the monetary brokerage’s energy in attracting investor capital regardless of uncertainty lingering within the U.S. monetary system. Latest updates from U.S. regional banks present that the deposit state of affairs has broadly stabilized which is solely the accomplishment of the Fed’s emergency liquidity facility made accessible to the monetary sector in March. Investor capital, nevertheless, remains to be gravitating to Charles Schwab… which makes, for my part, a powerful case for the monetary brokerage. Contemplating that Charles Schwab’s earnings potential is probably going undervalued at 11.9X (FY 2024) earnings, regardless of resetting EPS estimates, I consider the danger profile stays terribly engaging right here. Shares of Charles Schwab stay a powerful purchase!