NicoElNino

ServiceNow (NYSE:NOW) is a kind of enterprise tech corporations doing the unimaginable on this present robust financial system: exhibiting resilient progress charges alongside sturdy money move margins. Traders have rewarded the enticing fundamentals with a wealthy premium in relation to friends, although that has come together with greater expectations. The corporate delivered a powerful earnings report whilst I used to be projecting some disappointment – illustrating clearly the facility of its product platform. At its most up-to-date investor day, administration reiterated sturdy confidence of their long run outlook whereas authorizing the corporate’s first ever share repurchase program. Given the sturdy monetary image, I’m upgrading my view of the inventory however notice the valuation premium relative to cheaper friends.

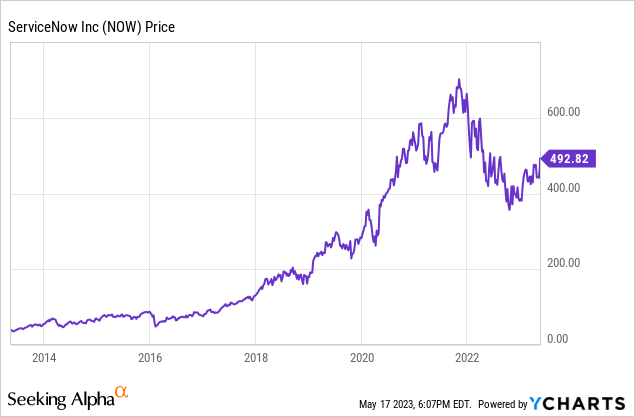

NOW Inventory Value

NOW has managed to flee the worst of the tech crash, seemingly as a result of firm’s sturdy money move era.

I final lined the inventory in April the place I defined why I used to be shifting to the sidelines on account of expectations for a lower to steerage. Administration ended up rising full yr steerage, and with the announcement of a share repurchase program, it’s clear that my concern was unwarranted. Even with the inventory value greater than my final report, I have to improve my score to purchase.

NOW Inventory Key Metrics

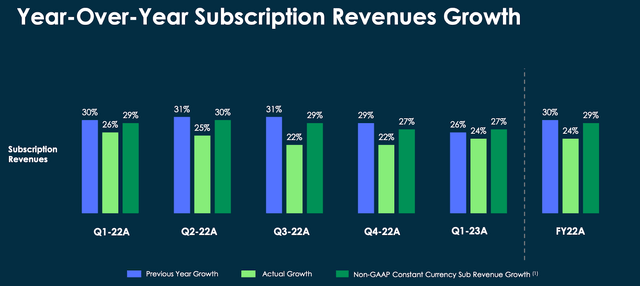

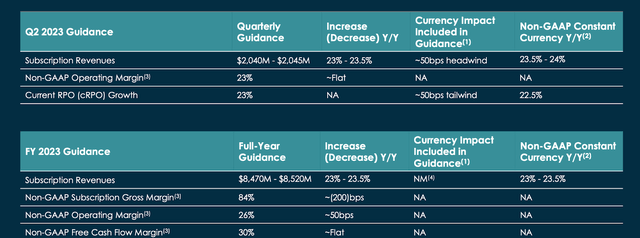

The latest quarter noticed NOW ship 24% YOY income progress (27% fixed foreign money), simply forward of steerage for 22.5% progress. That progress fee is according to years previous which in itself is outstanding given the robust macro setting.

2023 Q1 Slides

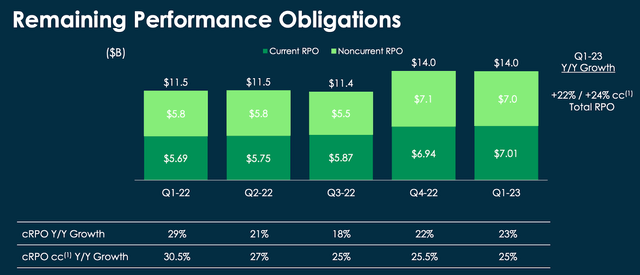

NOW additionally grew remaining efficiency obligations at a 22% clip, serving to to provide confidence that the corporate can maintain an identical progress fee at the very least within the close to time period.

2023 Q1 Slides

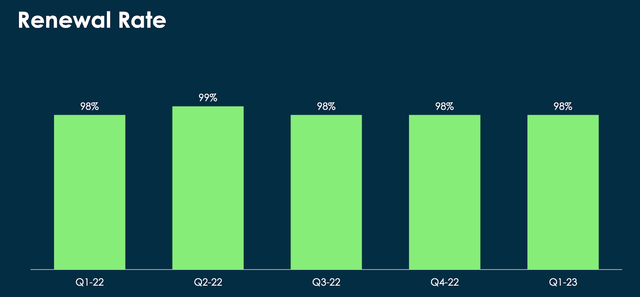

Whereas sentiment stays less-than-rosy within the tech sector, I ought to notice that enterprise tech companies are exhibiting their stickiness amidst the robust macro setting. NOW demonstrated a best-in-class 98% renewal fee.

2023 Q1 Slides

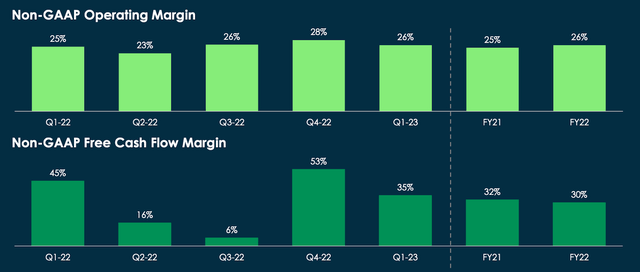

A part of what makes NOW such a preferred inventory is their money move era. The corporate delivered gentle working margin growth to 26%, whereas producing an outstanding 35% free money move margin.

2023 Q1 Slides

NOW ended the quarter with $7.2 billion of money and investments versus $1.5 billion of debt, with its money stability boosted by $4.7 billion of deferred income. These favorable money assortment cycles are notably advantageous given the upper rate of interest earned on money balances.

NOW barely elevated full yr income steerage to as much as 23.5% fixed foreign money.

2023 Q1 Slides

On the convention name, administration exuded confidence of their pipeline, noting that they even noticed progress within the monetary companies sector regardless of the macro headwinds posed by the regional banking turmoil. Administration additionally famous that they’ve seen materials influence by way of seat compression attributable to reductions in headcount, primarily due to the corporate’s potential to upsell further workflows to present clients. Administration got here simply in need of reiterating their 2026 monetary targets however given the impact that macro has had on lots of its friends, these outcomes are nothing in need of spectacular. A pair weeks later, on their investor day, administration ended up barely decreasing their monetary targets (the prior steerage was for $11 billion of income by 2024 and $16 billion by 2026) however the extent of the lower appeared modest.

2023 Investor Day

The inventory is rising quickly, seemingly partially attributable to administration additionally saying a $1.5 billion share repurchase program to be able to handle dilution. Whereas the share repurchase program is an efficient show of monetary power, I’m of the view that their {dollars} is perhaps higher used in the direction of M&A given the decrease valuations elsewhere within the tech sector. Managing dilution by way of the share repurchase program might really feel good on paper as a result of fixed share depend, nevertheless it may not be essentially the most accretive to the bottom-line. That mentioned, the share repurchase might assist play an necessary position in driving a number of growth as top quality corporations sometimes return free money move to shareholders.

Is NOW Inventory A Purchase, Promote, or Maintain?

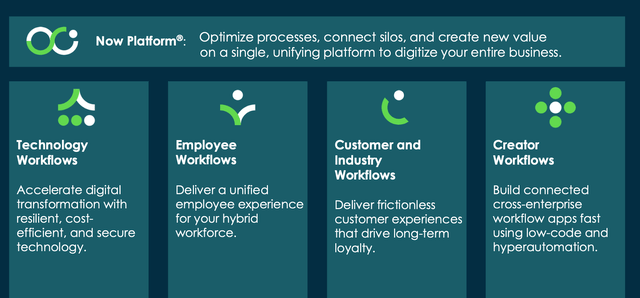

NOW stays a compelling funding based mostly on the digital transformation progress story. NOW allows digital workflows which apply throughout a wide range of use instances.

2023 Q1 Slides

If it’s not totally clear what a “digital workflow” is, an instance worker workflow is perhaps to deal with what occurs when an worker is onboarded at a tech firm. They could have to request varied tools like laptops in addition to varied technical trainings. With out NOW, an organization might have an additional division simply to pre-process these requests earlier than routing them to the best division. NOW helps to automate that course of in order that such requests are immediately despatched to the best level of contact.

Whereas it’s so far unclear how the newest developments in synthetic intelligence will influence NOW, administration famous that AI can improve the effectiveness of their merchandise and make implementing their digital workflows even simpler. On the aforementioned investor day, administration appeared very bullish relating to how AI can enhance their merchandise, stating that they intend to implement generative AI throughout their complete product suite. Administration believes that generative AI might finally allow additional pricing energy over the long run.

2023 Investor Day

As of latest costs, NOW was buying and selling at premium albeit cheap valuations.

In search of Alpha

A lot of that premium comes from the corporate’s non-GAAP profitability, although it takes a number of years earlier than the inventory appears to be like low-cost on that metric.

In search of Alpha

Based mostly on 20% progress, 40% long run internet margins, and a 1.5x value to earnings progress ratio (‘PEG ratio’), I see honest worth hovering round 12x gross sales, implying some upside.

What are the important thing dangers? Valuation stays the obvious threat right here. NOW is much from “dust low-cost” and a compression in progress charges might have a big influence on valuation multiples. Whereas I’m assured within the firm’s positioning within the enterprise tech stack, it’s attainable that the corporate finally faces the identical speedy deceleration in progress that e-commerce operators confronted following the pandemic. It’s also attainable that generative AI finally ends up having a unfavorable somewhat than constructive profit on the enterprise, however I’m merely expressing unknowns than any identified issues. I’m upgrading my score from “maintain” to “purchase” as the basics proved extra resilient than anticipated. I have to once more reiterate that NOW trades at a relative premium to tech friends and my purchase score primarily displays a top quality commerce, with cheaper friends seemingly providing superior potential upside.