DNY59

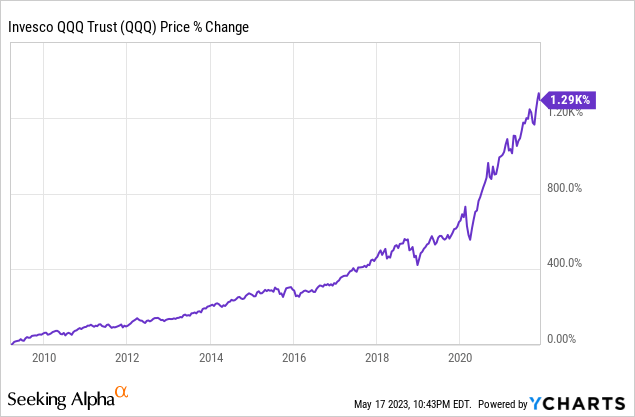

From 2009 to 2021, we skilled one of the vital highly effective bull markets in trendy historical past. That is very true for Nasdaq (NASDAQ:QQQ) because it elevated its worth by 1290% (nearly 13 bagger) throughout this era till it topped in November of 2021 as you’ll be able to see under.

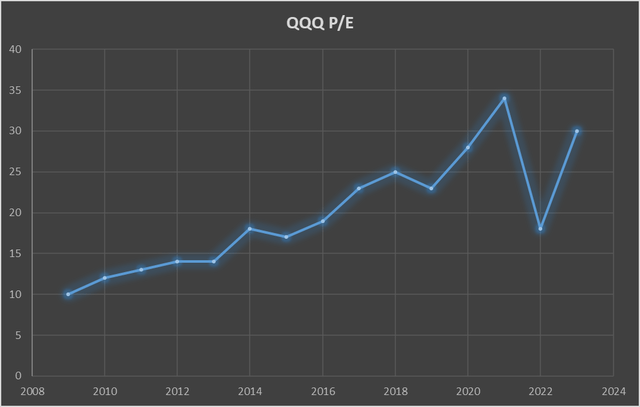

The humorous factor is throughout this era Nasdaq has by no means been as costly as it’s in the present day regardless of rallying relentlessly for 12 years. Under you will note QQQ’s P/E historical past since 2009 and spot that it is P/E worth had been increasing from 10 to 35 from 2009 to 2021 which implies we noticed a 250% a number of growth throughout this era however nonetheless QQQ was by no means as costly as it’s in the present day. Within the graph under you’ll discover that there was a time on the peak of 2021 the place QQQ traded for a P/E of 35 and that it’s at present buying and selling for a P/E of 30 so that you could be inclined to suppose that it’s cheaper in the present day than it was in 2021 however this is not so. You would possibly marvel how come a P/E of 30 is dearer than a P/E of 35 and I’ll attempt to clarify this within the the rest of this text.

Created on Excel by Writer

To begin with, there is no such thing as a good option to worth shares. Neither is there a technique on which all buyers agree. If this was the case markets would not be so risky everyday. There are various completely different fashions and theories as to the right way to calculate a inventory’s good worth. Some of the widespread and most accepted strategies is Discounted Money Circulation methodology which additionally occurs for use by legendary buyers like Warren Buffett, Benjamin Graham and Peter Lynch. Once more, even inside this system there are completely different colleges of thought and completely different nuances however the common thought is identical. You’re taking an organization’s present earnings, its development fee, value of money (bond yields) and attempt to calculate its honest a number of worth with a purpose to see its honest worth.

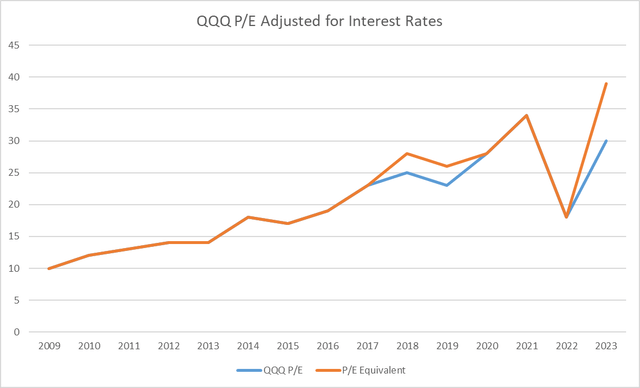

Irrespective of which mannequin you utilize, two issues are crucial for calculations. First is the low cost fee which is principally the prevalent bond yield. The honest P/E worth for shares will likely be considerably completely different when rates of interest are at 0%, 5%, 10% and so forth. This is the reason markets crashed exhausting in Eighties when Fed was aggressively mountain climbing charges as a result of honest P/E values dropped like a rock. In 2021, Nasdaq’s when P/E ratio was 35, Fed’s funds fee was 0.25%. At the moment when Nasdaq’s P/E ratio is 30, Fed’s funds fee is at 5.25%. When Fed’s funds fee jumps from 0.25% to five.25%, honest worth of P/E multiples drop from 10% to 50% relying on which mannequin you utilize to run your calculations. Let’s take mid-point and apply a 30% low cost fee which implies in the present day’s P/E ratio of 30 is equal of 2021’s P/E ratio of 39 (30% increased). Now our graph under seems to be a bit completely different (discover that it additionally seems to be barely completely different for 2018 and 2019 when Fed was mountain climbing charges briefly).

Created on Excel by Writer

There’s extra although. One other vital issue for calculating a good a number of of shares is their development fee. In any case there’s a motive why some shares commerce for a P/E of 10 whereas others commerce for a P/E of 100 as a result of buyers try to guess an organization’s future earnings and value it in accordingly. Once more, there is no such thing as a agreed-upon method of calculating what honest P/E a number of relies on development charges however everybody agrees that increased development charges justify increased multiples. Between 2009 and 2016, Nasdaq corporations grew their earnings by about 15% on common. From 2016 to 2021, the common development fee accelerated to 22% partly due to the enhance throughout COVID interval the place folks spent their money and time at residence on technological units, apps and companies. When tech corporations have been rising their earnings at 15-20% fee, a P/E of 25-30 could be justified however how about when their development has utterly stalled and in lots of circumstances really reversed? At the moment Nasdaq corporations are anticipated to see their earnings really shrink by 5-10% and that is the primary time since 2008 that that is occurring.

At the moment Nasdaq’s P/E of 30 whereas its elements are seeing their earnings shrink seems to be dearer than when Nasdaq’s P/E was 35 however tech corporations have been rising 20% 12 months over 12 months. The final time Nasdaq corporations noticed their earnings shrink, the index had a P/E in low 10s not 30.

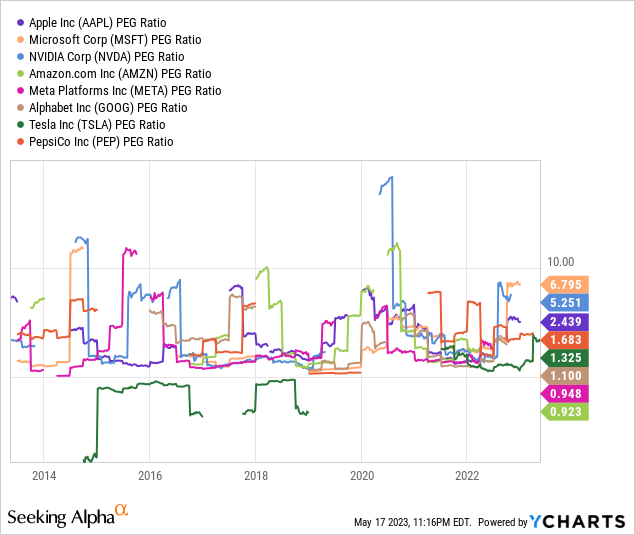

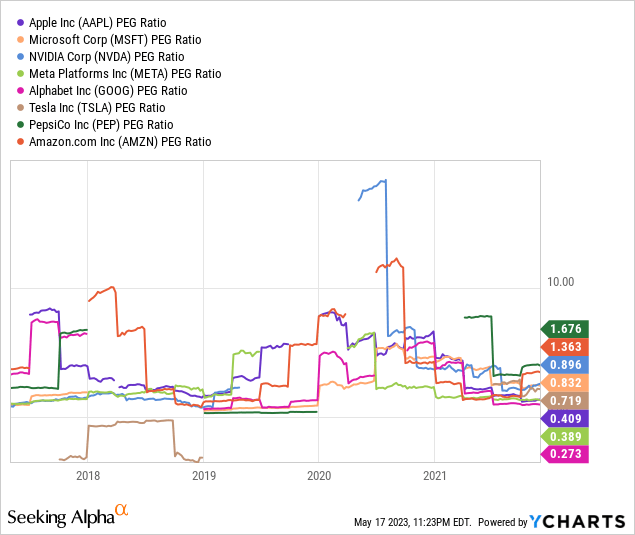

There’s a less-known metric that’s generally utilized in lieu of P/E ratio which is PEG. This metric takes an organization’s P/E ratio and divides it by the corporate’s development fee with a purpose to calculate its honest worth based mostly on its development. PEG ratios under 1.0 are thought-about low-cost, PEGs round 1.0 to 1.5 are thought-about pretty valued and PEGs above 1.5 are thought-about costly. Under are the highest 8 corporations in QQQ which account for 54% of the full weight of the index. Discover that corporations like Microsoft (MSFT), Apple (AAPL) and Nvidia (NVDA) are seeing their PEG values at sky excessive ranges. There are solely 2 corporations with PEG values under 1.0 however they aren’t a lot under with one being at 0.948 and the opposite being 0.923.

Under you will note PEG values loved by the identical corporations a pair years in the past when Nasdaq’s P/E was as excessive as 35. You may discover that again in November of 2021, PEG ratios of the identical corporations ranged from 0.27 to 1.67. For instance Microsoft had a PEG ratio of 0.83 versus in the present day’s 6.7 so despite the fact that Microsoft now has the identical P/E because it did in 2021, it is about 8 instances dearer in the present day than it was in 2021. One other instance is Apple whose PEG jumped from 0.40 to 2.43 since QQQ’s final prime in 2021. Again in 2021, even Nvidia had a PEG ratio under 0.9. At the moment the identical firm’s PEG is at 5.2. Additionally, you will discover that Tesla (TSLA) had a PEG of 0.71 versus in the present day’s 1.32.

Again then Nasdaq’s P/E of 35 was effectively justified contemplating 0% fee atmosphere and 20-25% development fee. At the moment’s P/E of 30 is just not justified given 5.25% rates of interest and complete lack of development. To ensure that Nasdaq to turn out to be cheaper than it’s proper now, both company earnings have to leap considerably or costs should fall. At the moment many indicators present that the financial system is slowing down and though most tech corporations beat analyst estimates, their ahead steerage requires additional drops of their income. It may very well be 2-3 years earlier than company income return to the place they have been on the peak of 2021.

I did not even point out different elements equivalent to declining liquidity ranges, ongoing quantitative tightening, rising prices, dropping margins, attainable credit score crunch, risk of a recession and plenty of different elements that might end in even decrease honest multiples for valuations.

For the reason that starting of the 12 months, QQQ is up 25% with none pullbacks, corrections or significant dips. There hasn’t even been any profit-taking but. It has been going up in a straight line and we aren’t even achieved with half of the 12 months but. As a lot as Nasdaq is anxious markets are all greed and no worry proper now.

All in all, when you think about rates of interest and declining development charges, QQQ is now dearer than it was at any interval since 2009. At the moment Nasdaq nonetheless trades as if Fed’s rate of interest is at 0% and tech income are rising 15-20% per 12 months however neither is the case. We are able to maintain taking part in this “fake” sport and maintain rallying on a number of growth alone whereas company income proceed to fall and rates of interest stay excessive however nobody is aware of how sustainable that may be in the long term.